-

FLOKI has plunged by nearly 17% after a team wallet deposited $2M to Binance.

FLOKI’s Open Interest has reached a multi-month high, but negative Funding Rates suggested further bearish pressure.

As a seasoned crypto investor with a penchant for the more eccentric coins in the market, I’ve seen my fair share of rollercoaster rides. Today, Floki [FLOKI] has taken a nosedive that would make even the most hardened investors cringe – down nearly 17% and trading at a weekly low of $0.000127.

Today, most of the leading cryptocurrencies, excluding Tron [TRX], experienced a drop in value, as they traded in the negative.

The losses were minimized across the board, apart from Floki [FLOKI], which iwas down nearly 17% in the last 24 hours until press time.

At the moment of writing, FLOKI‘s price had reached its lowest point for the week at $0.000127. This decline is due in part to worries about increased selling from a wallet associated with the Floki Inu team.

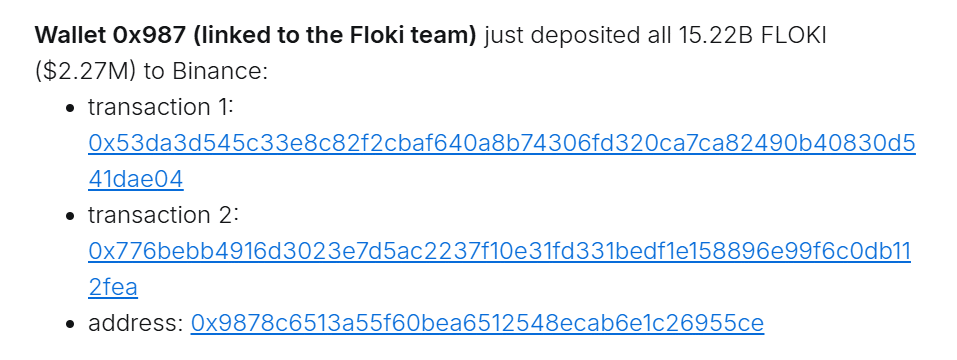

According to SpotOnChain’s records, the wallet had been inactive for over two years, but it became active again recently. Just before the FLOKI meme coin took a sharp dive, this wallet deposited approximately $2.27 million worth of FLOKI tokens into Binance.

The wallet had received these tokens in early 2022 from the Floki deployer. At the time, the stash was worth $468,000.

The wallet’s activity has now stirred concerns among FLOKI holders about a looming sell-off.

FLOKI bears seize control

At the moment, bears seem to be driving the price movement of FLOKI. Due to heavy selling, the Relative Strength Index (RSI) has fallen to 22, indicating that the coin is currently in the oversold region.

It seems that the falling Relative Strength Index (RSI) implies that the token FLOKI is being underestimated. This undervaluation might present a chance for purchasing, and if FLOKI recovers after testing its crucial support at $0.000126, it may stabilize or even consolidate in price.

As an analyst, I’ve noticed that the Bollinger bands have expanded, pushing the price down to the lower band. This expansion indicates a surge in market volatility, heightened uncertainty, and a sense of stress within the market.

As a crypto investor, I’m seeing signs that could indicate the end of this downtrend, such as oversold conditions and the Bollinger bands. However, I believe it’s crucial to wait for further confirmation before making any moves, just to ensure we’re not jumping the gun on a potential market reversal.

In simpler terms, for FLOKI to potentially correct positively, we need to see the Relative Strength Index (RSI) create higher lows above 30 and cross over its signal line. If these conditions are met and the price moves up to the midpoint of the 20-day Simple Moving Average, FLOKI might experience a favorable correction.

Open Interest hits multi-month high

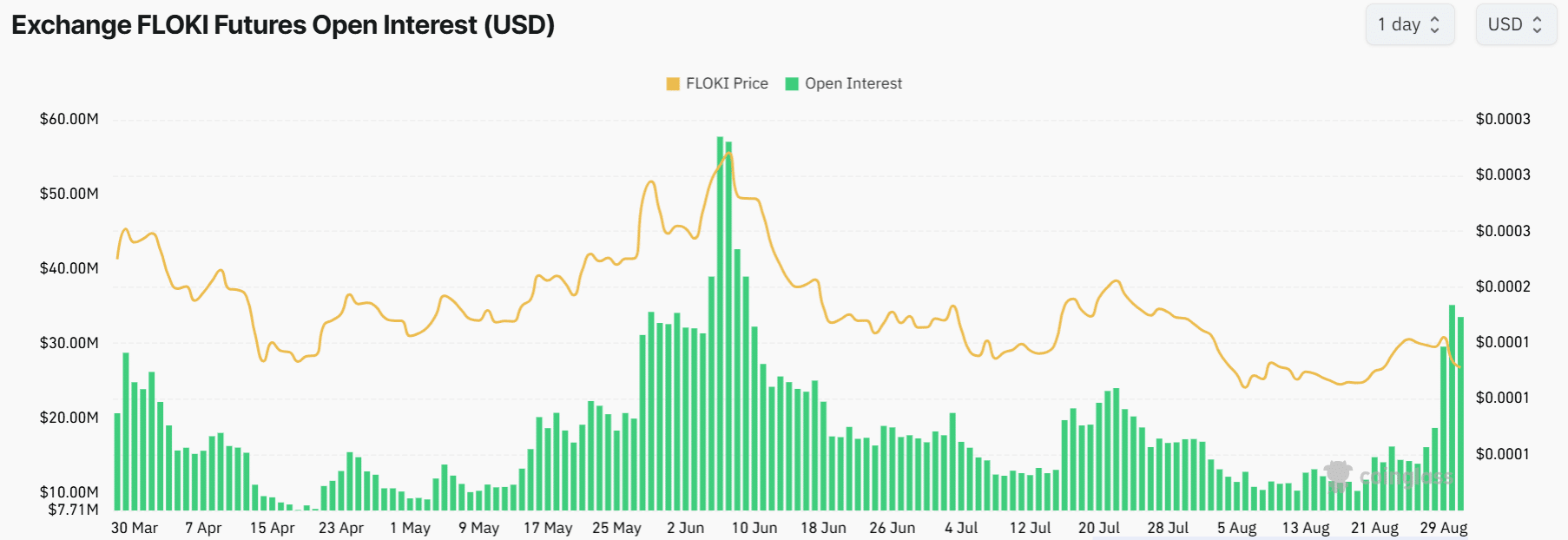

Based on data from Coinglass, the Open Interest for FLOKI has reached an all-time high of $33 million, marking the highest point since June. This significant increase in Open Interest has been steadily climbing since August 26th.

For FLOKI, an increase in Open Interest (OI) along with a significant decrease in price might indicate that traders are predicting a continued price fall, rather than the typical bullish sign it usually is.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

Additionally, Funding Rates have fallen significantly into the negative range, suggesting an increase in traders taking on short positions.

In the past day, more than $408,000 worth of FLOKI positions were closed due to a recent price decrease, and most of these closures occurred among traders who had previously bought (long positions).

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Superman Rumor Teases “Major Casting Surprise” (Is It Tom Cruise or Chris Pratt?)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

2024-08-30 11:36