-

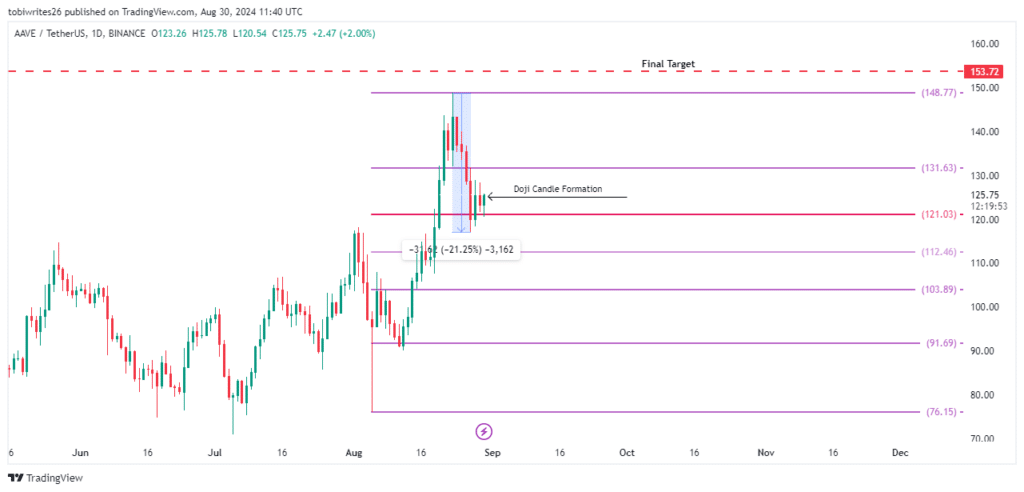

AAVE’s pause may be a retracement, setting the stage for a higher low before a potential rally to $153.

The altcoin was backed by a strong investor base in the $121 support region at press time.

As a seasoned researcher with years of experience tracking cryptocurrency markets, I have to admit that Aave [AAVE] has piqued my interest lately. The recent surge past $148 was nothing short of impressive, and it’s clear that this altcoin has captured the attention of many investors.

After a remarkable ascent past $148, Aave [AAVE] has caught the attention of numerous investors.

An earlier forecast by AMBCrypto accurately anticipated that the value of AAVE would reach $121, which it did surpass. Yet, this milestone now serves as a significant level of support for AAVE.

As a crypto investor, I’ve noticed a significant drop of 21.25% in AAVE, which has prompted me to consider it as a potential buying opportunity. Currently, the $121 level is crucial and must be sustained for AAVE to make further progress.

AAVE’s rally hinges on 121 support level

By drawing Fibonacci Retracement lines based on the highest peak and lowest valley in an upward trend, the price of AAVE is currently found to be at a vital point of potential support around $121.03.

Should this level hold, AAVE is set to reach $153.

Upon closer inspection of the market trends, it’s clear that the price of AAVE has neared a support point, showing strong signs of increased buying activity.

Moreover, a Doji candle is shaping up in the daily candlestick chart, indicating potentially robust purchasing activity if it completes its formation.

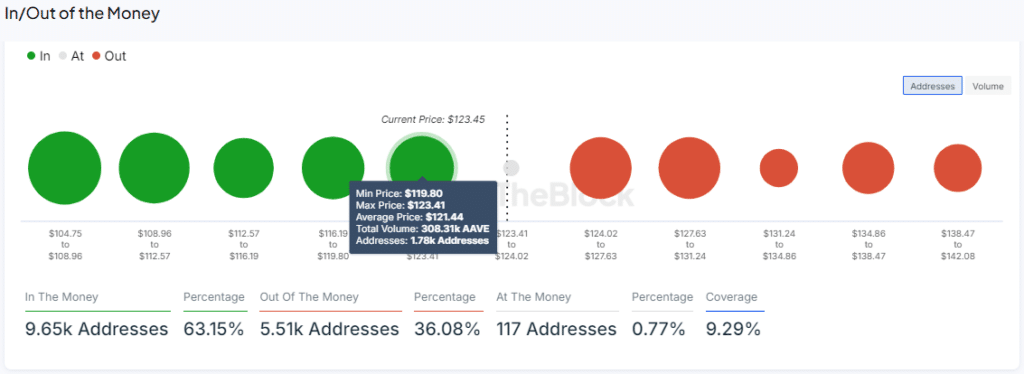

Through additional examination by AMBCrypto, we’ve uncovered potential reasons for the increased demand around this specific price point.

Bulls charge ahead

According to IntoTheBlock’s IOMAP analysis, there is significant buying interest concentrated in the vicinity of approximately $121, with a more specific focus at roughly $121.44, suggesting strong demand in that price range.

More than 1,780 locations have AAVE currently in the money, totaling around $308,310. This figure is nearly identical to the Fibonacci retracement level at approximately $121.03.

As a crypto investor, I find IOMAP incredibly valuable. It visualizes the distribution of wallets that own a particular asset at distinct price points, allowing me to quickly identify crucial support and resistance zones. This way, I can make informed decisions about buying or selling based on where other investors are likely to step in or out.

The emphasis was placed on regions with numerous addresses being “In the Money,” implying possible support zones since holders might be hesitant to part with their assets.

Gaining more understanding from the Chaikin Money Flow (CMF), which evaluates the buying and selling of an asset based on its price and volume, showed a favorable change or trend.

According to the CMF, there’s been a substantial increase in funds flowing into AAVE, which might lead to an uptick in its price.

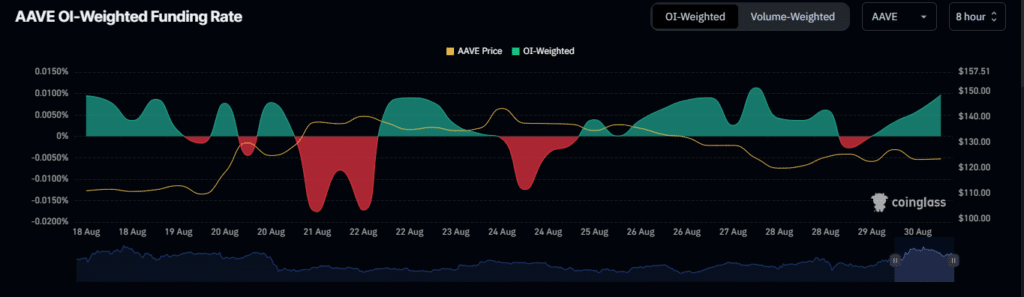

Bullish narrative gains momentum

Based on data from Coinglass, it appears that the Funding Rate and the Open Interest Weighted Funding Rate are both increasing. This trend could indicate that investors who anticipate prices to rise, often referred to as “bulls,” are gradually preparing for a potential market surge.

In simpler terms, a favorable Funding Rate acts as a charge that keeps the prices of continuous future contracts aligned with the current market value. Long positions (investors who hold a contract expecting its price to rise) are required to pay short positions (investors who hold a contract expecting its price to fall).

Read Aave’s [AAVE] Price Prediction 2024–2025

This perspective is additionally reinforced by the Optimized Interest (OI)-Weighted Funding Rate. This rate improves upon the standard Funding Rate by providing a more precise measurement of the broader market’s status.

Its positive status shows the likelihood of a bull market.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- ANKR PREDICTION. ANKR cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- DOOM: The Dark Ages Debuts on Top of Weekly Retail UK Charts

- Badminton’s Huang Yaqiong Wins Olympic Gold Moments Before Engagement

- 2 Astronauts Stuck in Space After 8-Day Mission Goes Awry

2024-08-30 18:48