- Bitcoin mining may help bulls start another major rally, according to this analysis.

- Miner reserves soared to 6-week highs despite recent market FUD.

As a seasoned researcher with years of experience analyzing Bitcoin and its ecosystem, I find myself increasingly intrigued by recent developments. The hash price analysis by Woominkyu seems to be pointing towards a potential bullish trend for BTC. Given my past experiences, I’ve learned to never underestimate the power of miner sentiment and reserves.

With Bitcoin [BTC] trading under $60,000 again, people may be questioning if this could be a good opportunity for purchase, given its previous show of vulnerability at this significant price level.

Right now, it appears that Bitcoin could be a good investment opportunity, as suggested by the analysis of CryptoQuant’s expert, Woominkyu. This conclusion was drawn based on a positive outlook for Bitcoin, supported by the Bitcoin hash price, which underscored the profitability of miners.

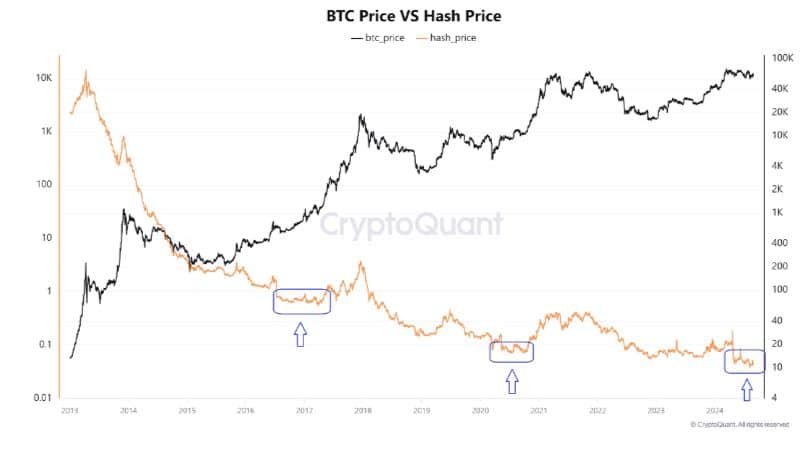

Based on Woominkyu’s findings, it appears that the hash price may serve as an indicator of potential bullish trends. Comparing it to Bitcoin’s low points indicates that when the hash price reaches its lowest point in a trend, it might signal profitable buying opportunities on the horizon.

The Bitcoin hash price recently dropped to its lowest historic levels. This coincided with BTC’s recent downside, especially at the start of August.

If this analysis holds true, then it suggests that Bitcoin may already be in the beginning stages of its next major rally. It also suggests that the recent pullbacks might be the best accumulation opportunities at discounted levels.

In the meantime, Loka Mining, an operator specializing in decentralized mining pools, intends to implement novel strategies aimed at either preventing or alleviating the issue of miners leaving their operations.

As per its CEO, Andy Fajar Handika, the company plans to fund its expansion and immediate requirements through advance mining agreements.

The aim, it seems, is to alleviate some of the stresses experienced by miners resulting from reduced block rewards and escalating operational expenses.

How Bitcoin mining affects demand

So far, Bitcoin’s demand appears robust even below the $60,000 price mark. Additionally, mining-related indicators suggest a positive outlook, possibly hinting at an upcoming bullish trend.

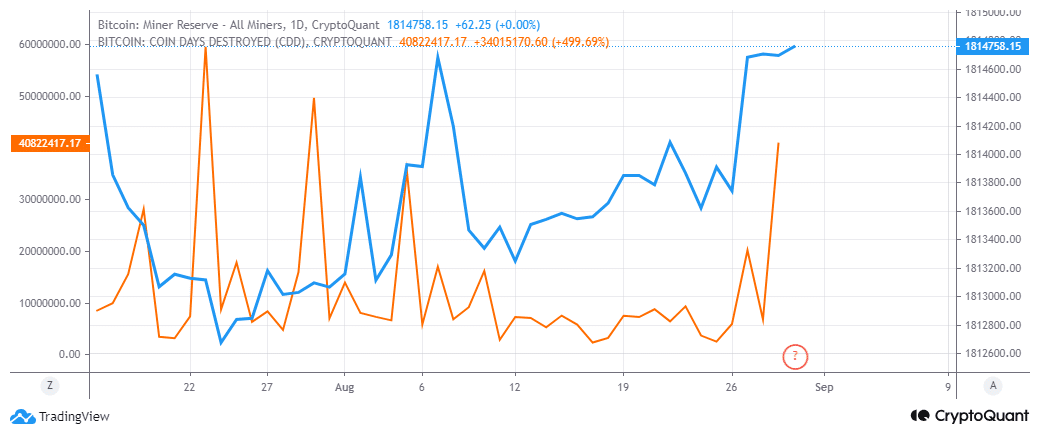

For example, miner reserves were at their highest levels in the last six weeks.

The surging miner reserves suggests that miners have been HODLing their coins in anticipation of higher prices. We also observed the highest spike in coin days destroyed in August.

The second-largest increase within the month happened right after the initial drop that took place at the beginning of the month.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

In the past, significant increases in the coin days destroyed (CDD) indicator have preceded substantial price changes for Bitcoin. Consequently, it seems plausible that we might be approaching another period of high volatility, potentially leading to a significant increase or decrease in price.

Based on the findings, it seems the data points towards a more likely bullish trend. Yet, it’s crucial for traders to proceed with caution as there remains a significant degree of uncertainty within the market.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

2024-08-31 02:15