-

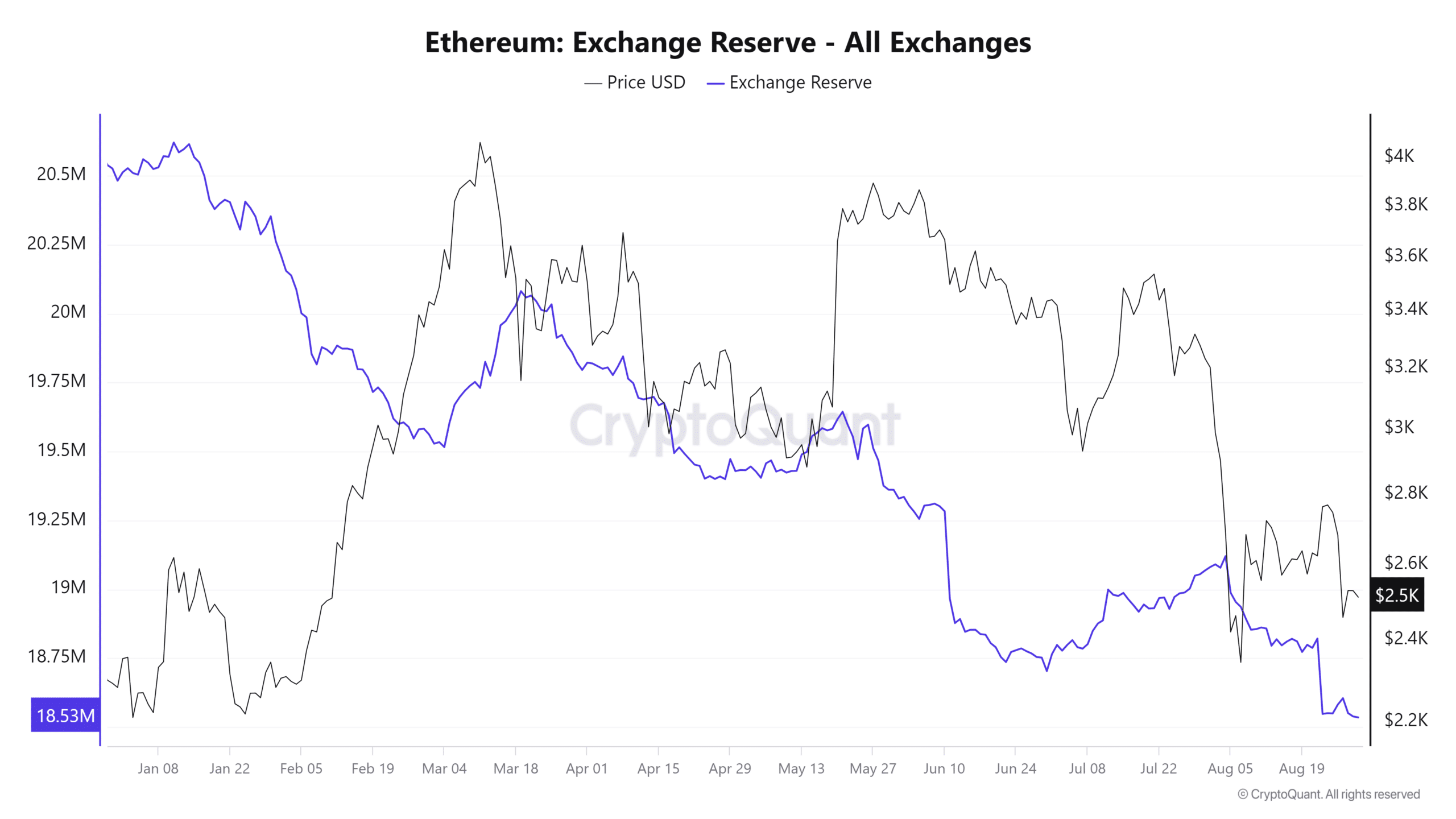

ETH exchange reserves declined to around 18.5 million ETH

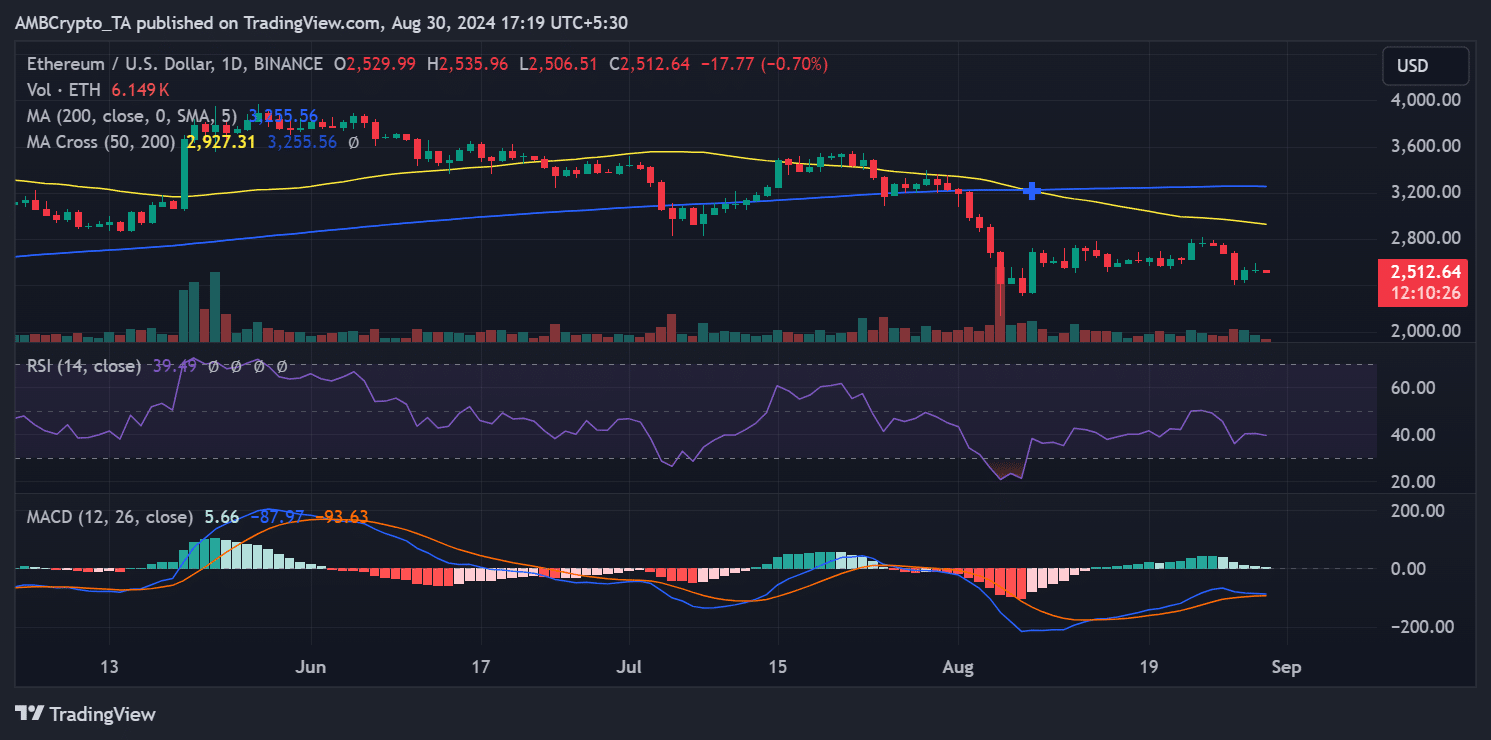

ETH, at press time, remained below key price levels

As a seasoned analyst with over two decades of experience in the cryptocurrency market, I find myself constantly intrigued by the dance between bulls and bears in this dynamic space. The recent developments with Ethereum (ETH) have caught my attention, and I believe it’s worth sharing my insights.

Over the past few weeks, Ethereum has encountered obstacles at significant price points. This resistance might have influenced some major investors, often referred to as “whales,” to dispose of parts of their holdings. Yet, remarkably, the decrease in Ethereum held on exchanges persists even with this selling action.

Ethereum faces sell-offs

Recent data from Lookonchain revealed that an Ethereum whale sold 6,900 ETH, valued at approximately $17.87 million.

Starting from July, a significant change in behavior was observed in the whale, who had been amassing Ethereum (ETH) from January to May. During this period, it accumulated approximately 65,000 ETH, which is equivalent to around $196 million. But since July, this whale has started liquidating its holdings, selling off more than 21,000 ETH.

Despite the substantial drop in prices, the netflow metric for Ethereum on CryptoQuant did not clearly indicate more coins flowing into exchanges (suggesting increased selling pressure). Instead, the netflow seemed to show a nearly equal balance between coins entering and leaving exchanges – A sign that there hasn’t been a significant increase in either inflow or outflow activity.

This equilibrium in inflows and outflows suggests that while certain big investors (such as this ‘whale’) are offloading their assets, there have also been considerable withdrawals from trading platforms. The absence of a clear direction in the flow indicates a market that is relatively steady, where temporary selling by some players is offset by buying or holding by others.

Ethereum reserves continue to decline

An analysis of Ethereum’s exchange reserves indicated that the recent sell-off had minimal impact on halting its overall decline. According to data, after a brief hike to approximately 18.6 million ETH on 27 August, the same declined again – Hitting 18.5 million ETH.

The continuous decrease in Ethereum held on exchanges implies a large portion of the cryptocurrency is yet to be taken out from these platforms.

The continuous decrease in available ETH for immediate trade, reflected by dwindling exchange reserves, is often interpreted as a positive signal, or bullish sign. This is because it implies that the quantity of ETH up for grabs is diminishing. If demand remains consistent or increases, this supply reduction could potentially boost prices or at least keep the market steady.

ETH remains bearish

Currently, Ethereum is being traded around $2,512, representing a nearly 1% drop as observed on the price charts. Furthermore, a review of its Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) indicates that, at this moment, Ethereum is trending bearishly.

– Read Ethereum (ETH) Price Prediction 2024-25

The RSI was below 40 – A sign that the asset was in a strong bearish phase.

Even though the MACD’s histogram showed positive values, its signal lines remained below zero, possibly signaling a change in momentum direction. Nevertheless, the signal lines’ placement indicated that bears might still have some power over the market.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-08-31 03:03