-

U.S inflation was steady in July, raising Fed rate cut odds

However, BTC’s price remained subdued and could stay range-bound

As a seasoned crypto investor with a knack for deciphering market trends, I must admit that the July inflation data has left me with mixed feelings. On one hand, the steady numbers have increased the likelihood of a September Fed rate cut, which historically has been beneficial for Bitcoin and other risk assets. However, the cryptocurrency market seems to be in a state of limbo, with BTC‘s price remaining subdued despite these positive macroeconomic indicators.

The consistent inflation rate in the U.S. supports predictions that the Federal Reserve might lower interest rates in September, which could potentially stimulate Bitcoin [BTC] and other high-risk investments. As reported by the U.S Bureau of Economic Analysis (BEA), the annual growth rate for the Core PCE Price Index in July was 2.5%. This index reflects personal spending patterns and is a key factor considered by the Federal Reserve when determining monetary policy.

As an analyst, I observed that the Personal Consumption Expenditures (PCE) Price Index increased by 0.2% in the previous month, mirroring the rate seen in June. This figure was in line with what analysts had anticipated. This index measures fluctuations in prices for a broad range of goods and services, except for food and energy, making it the Federal Reserve’s preferred indicator for monitoring inflation and formulating monetary policy decisions.

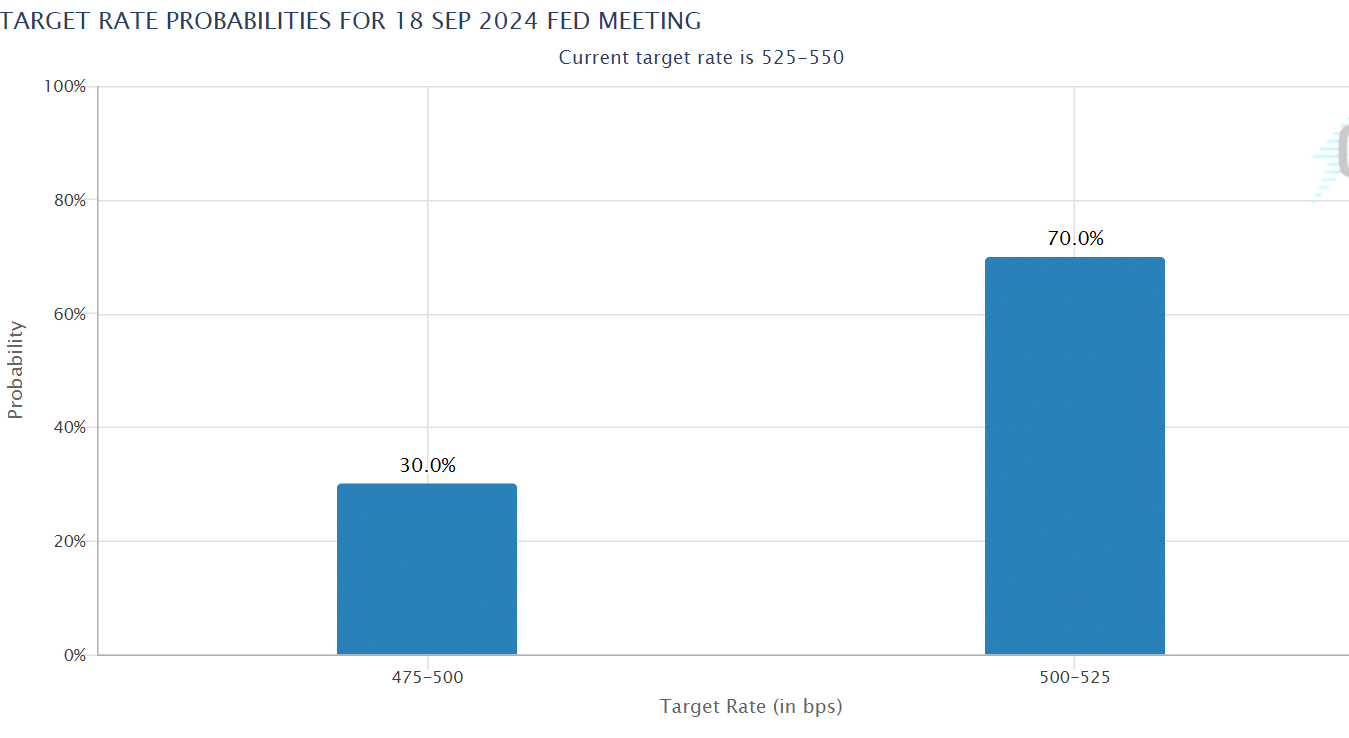

September Fed rate cuts jump to 70%

In summary, the consistent inflation figures for July have strengthened investors’ beliefs that the Federal Reserve will probably reduce interest rates by 0.25% in September. As per the CME FedWatch tool, traders are currently assigning a 70% probability to a rate cut happening in September.

After the release of the July inflation data, there was a significant increase in likelihood, amounting to a 4% rise from the initial 66% probability. Concurrently, some traders have been calculating a 30% possibility for a 50 basis point interest rate reduction at the upcoming Federal Reserve meeting next month.

Bitcoin’s price remains muted

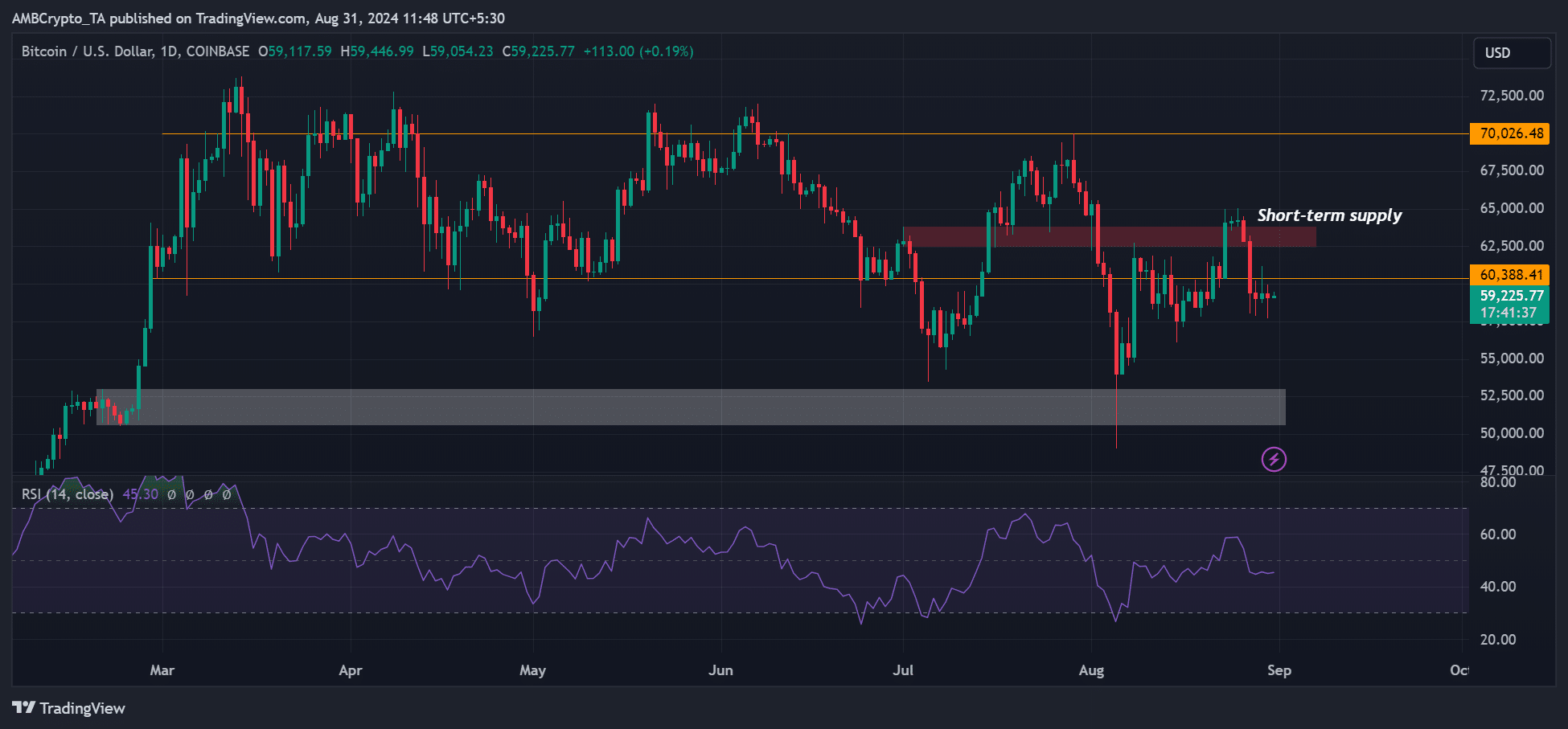

The data tipped U.S equities to edge higher while BTC and the crypto markets tanked and consolidated. BTC moved slightly to $59.9k, before dropping to $57k on Friday after the inflation data was first released.

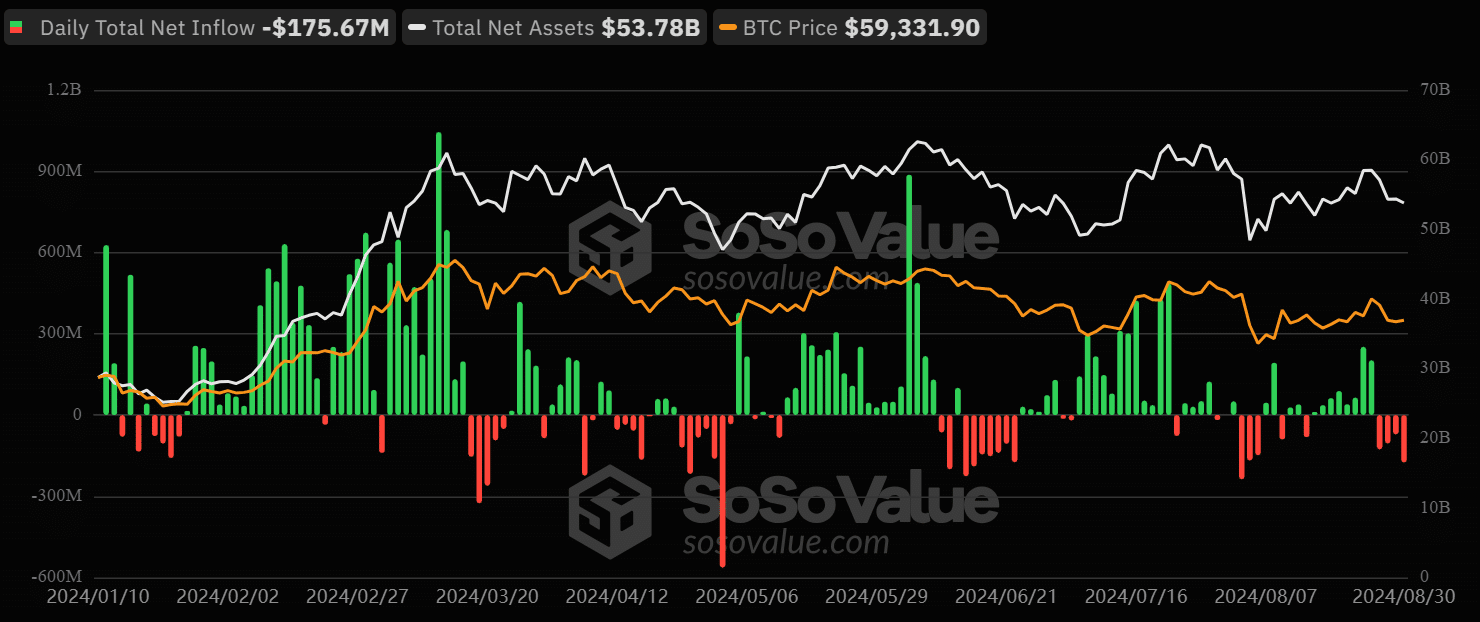

Currently, as I write this, the value of the cryptocurrency stands at approximately $59,200. This is the fourth consecutive day it’s been trading below $60,000. The general mood in the market and the cautious approach taken by risk-averse investors are also reflected in U.S spot Bitcoin ETFs.

For the past five days (since Tuesday), there has been a total withdrawal of approximately $277 million from our products. This indicates that the consistent increase in prices during July didn’t manage to reverse the downward trend we’ve been experiencing.

Meanwhile, crypto trading firm QCP Capital has suggested that a potentially less robust U.S job market report due next week might bolster the argument for a Federal Reserve interest rate reduction in September. For now, they anticipate Bitcoin’s price to stay within a specific range.

Given the latest economic headlines showing minimal impact on the cryptocurrency sector, our analysis suggests Bitcoin will probably stay within a specific range of $58,000 to $65,000 in the immediate future. The market is currently looking for positive triggers that can help it break free from this price range.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- BLUR PREDICTION. BLUR cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- Apple Watch Series 10 UK release date, price and when you’ll be able to pre-order

- Pauly Shore Honors “One of a Kind” Richard Simmons After His Death

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

2024-08-31 13:12