-

A PEPE whale took a +$3 million hit following a sell-off of 330 billion tokens

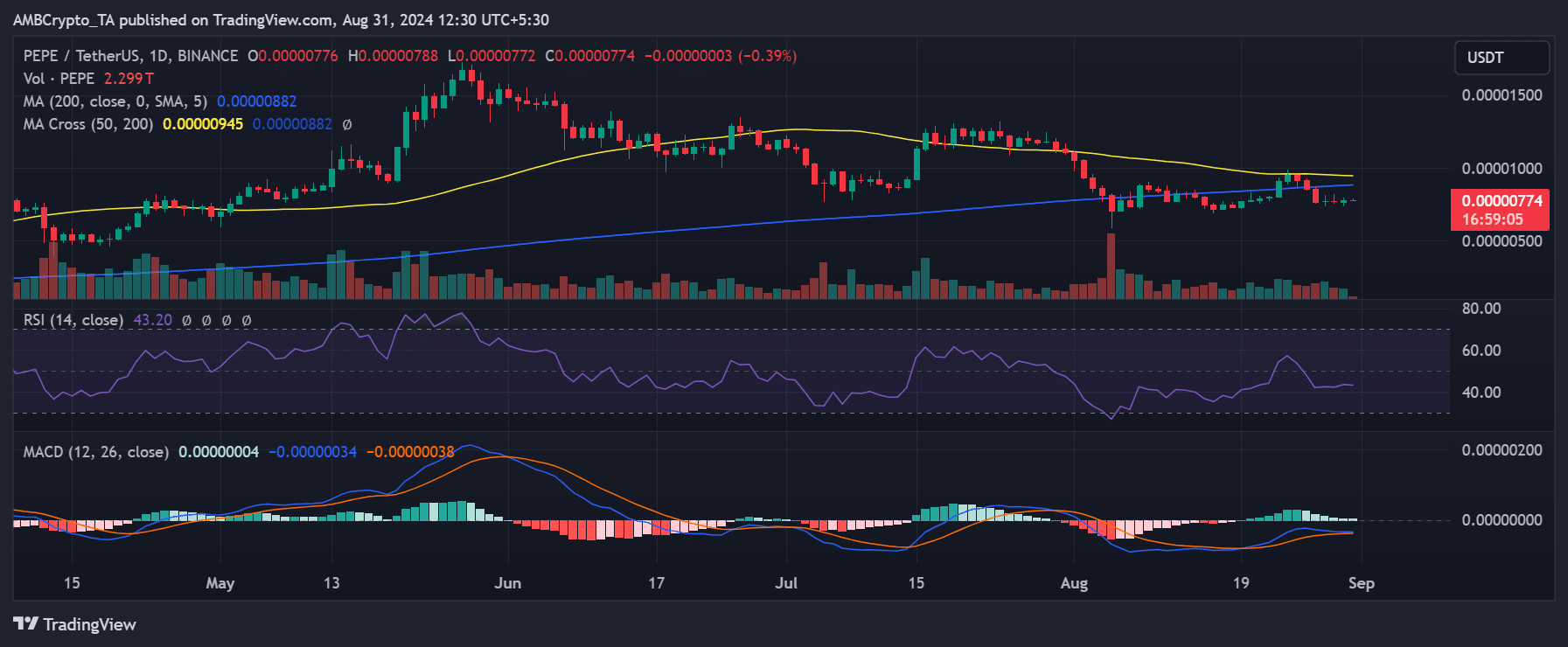

PEPE, at press time, remained below the neutral line of its RSI

As a seasoned analyst with years of experience navigating the cryptocurrency market, I find the recent events surrounding PEPE to be both intriguing and cautionary. The whale’s decision to sell off 330 billion tokens at a loss serves as a stark reminder that even the most astute investors can sometimes misjudge market movements.

A PEPE whale’s major move has sparked curiosity and prompted a closer examination of the memecoin’s on-chain data. An analysis of these on-chain metrics can give us insights into the market’s true trend and the prevailing sentiment among holders and traders. Including the whale in question.

What did the whale do?

Data from Lookonchain shows that a major PEPE holder transferred 330 billion tokens worth around $2.53 million to Kraken within the last day. Such a large transaction often indicates an intention to sell, and it’s usually profitable. But in this scenario, the data hints that the whale might be selling at a loss, estimated to be over $3 million.

The whale’s recent dealings offer insight into this choice. Earlier in the month, the whale took advantage of market volatility by selling when prices were high and buying when they were low. Yet, despite these earlier profits, the current investments have not yielded a profit, prompting the decision to dispose of some tokens. This could be an attempt to minimize potential future losses.

Notably, despite having sold a substantial portion of their PEPE tokens following this major transaction, the whale remains in possession of approximately 1 trillion PEPE tokens, currently worth more than $7 million. Consequently, while they’ve lessened their exposure on certain investments, the whale continues to hold a notable stake in PEPE. This could be due to the whale’s expectation for future growth or price escalation in the PEPE market.

On-chain data points to massive sales

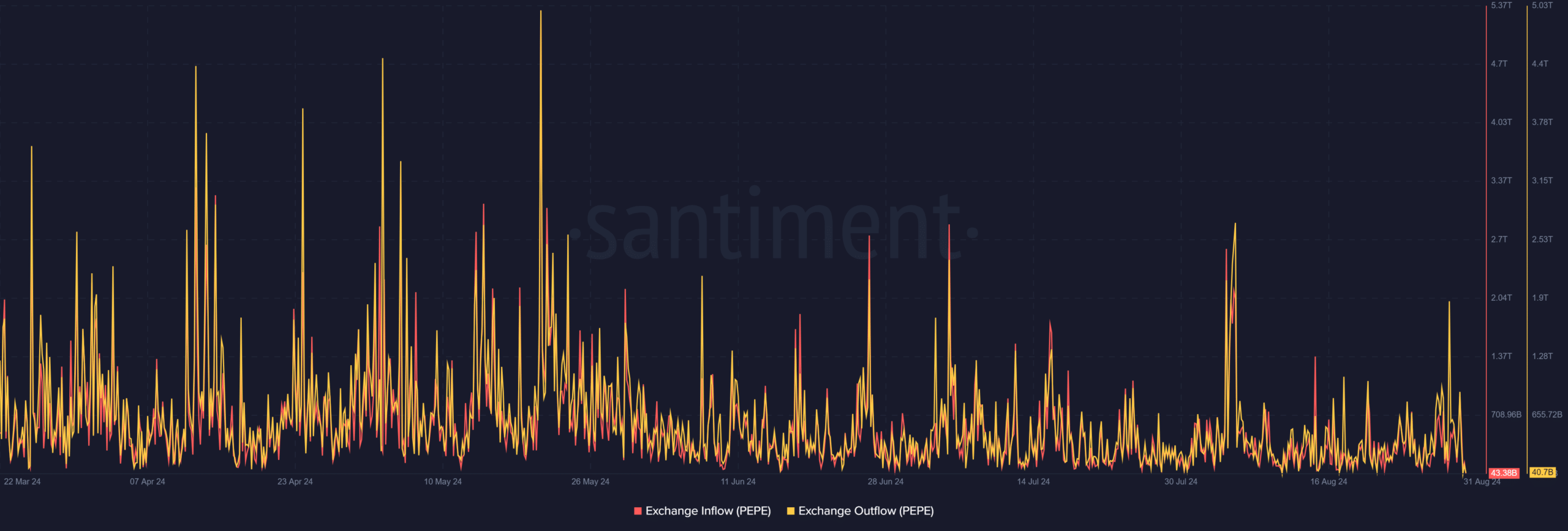

Examining PEPE‘s transaction data on Santiment showed a notable imbalance between incoming and outgoing transactions.

In simpler terms, when PEPE tokens are transferred into an exchange (inflows), it often suggests a possible intention to sell. Conversely, when tokens are moved out of an exchange (outflows) and stored elsewhere (like wallets), it generally shows signs of accumulation or holding.

By the close of trading on August 30th, data revealed that more than 76 billion PEPE tokens had been brought in (inflows). In comparison, approximately 23 billion tokens were taken out (outflows).

During that trading session, it appeared that a larger number of tokens were put into exchanges rather than taken out, which suggests there was increased selling pressure at the time.

The substantial increase in incoming funds coincides with the earlier finding of a major deposit by a whale, suggesting that this particular whale’s actions were not unique. In fact, it appears that several investors have been eager to dispose of their tokens, collectively boosting the overall rise in inflows.

Bear trend continues…

A review of PEPE‘s daily chart showed it ended the previous trading day with a modest increase of 1.57%. Yet, greater growth is necessary to offset the persistent selling pressure, especially from the identified whale accounts.

A closer examination found that the market was largely pessimistic, with a single bullish phase for the memecoin lasting just three days throughout the month. This downward trend was also visible in the Relative Strength Index (RSI), which stood at approximately 40 as of the current report.

The proposed idea indicates that the token might be moving through an area with a weak or negative sentiment, but it hasn’t quite reached the point of being overly sold.

Currently, PEPE is being traded around $0.00000773, after experiencing a minor dip of about 0.3%.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-09-01 03:03