-

Ripple unlocked 1 billion XRP tokens worth $559.9 million

XRP has depreciated significantly over the last 30 days

As a seasoned crypto investor who has weathered multiple market cycles, I can say with some degree of caution that the latest Ripple token unlock of 1 billion XRP tokens is not exactly music to my ears. While I’ve learned not to predict market movements with absolute certainty, history does seem to repeat itself in this space.

Throughout the month of August, the value of XRP significantly decreased in the price graphs. Currently, at the point of this writing, the cryptocurrency is experiencing a 8.16% drop compared to the monthly rate and is being traded for approximately $0.5569.

In August, XRP underwent significant price fluctuations, plunging to a temporary minimum of $0.43. But it swiftly rebounded, reaching a peak of $0.64. Unfortunately, the surge in value was short-lived as XRP gave back its gains once more.

Today, Ripple is making headlines due to recent releases of its XRP tokens from a lockup period.

Ripple’s 1 billion XRP Token Unlock

As per a widely used whale transaction tracker on platform X, Ripple executed three successive releases of XRP tokens amounting to a total of 1 billion units. Given the market value at that time, these tokens were equivalent to approximately $559.9 million as shown in the price charts.

In this recent update, a set of three distinct transactions were processed, with one transaction valued at 500,000 XRP and the remaining two transactions valued at 300,000 XRP and 200,000 XRP respectively.

“500,000,000 #XRP (280,008,999 USD) unlocked from escrow at unknown wallet.”

Recently, the latest release has caused concern among investors due to potential future price decreases. Historically, such releases tend to have a negative impact on XRP‘s value. For example, in June, Ripple sold 200 million tokens, which led to an 9.25% drop in the altcoin, causing it to trade at $0.475.

XRP’s price also fell during August’s unlocks, with the altcoin falling to $0.56 from $0.65.

Starting from January 2024, Ripple has distributed approximately 2.02 billion XRP tokens valued at around $1.15 billion from its reserves.

Over the past several months following each reopening, prices have fallen in four instances instead of rising, as they typically do in seven out of these eight periods. However, XRP bucked this trend by registering gains only in February and July after reopenings. In two other instances, its market response was rather subdued.

Consequently, considering past trends, it seems that the release of XRP tokens isn’t consistently linked with price increases.

What do the charts say?

According to AMBCrypto’s examination, XRP has been on a continuous decline for the past seven days.

For starters, the altcoin’s Chaikin Money Flow (CMF) had a reading of -0.02.

It appeared as though this indicated a potential increase in selling among XRP, possibly due to a pessimistic outlook from investors who are choosing to cash out their holdings.

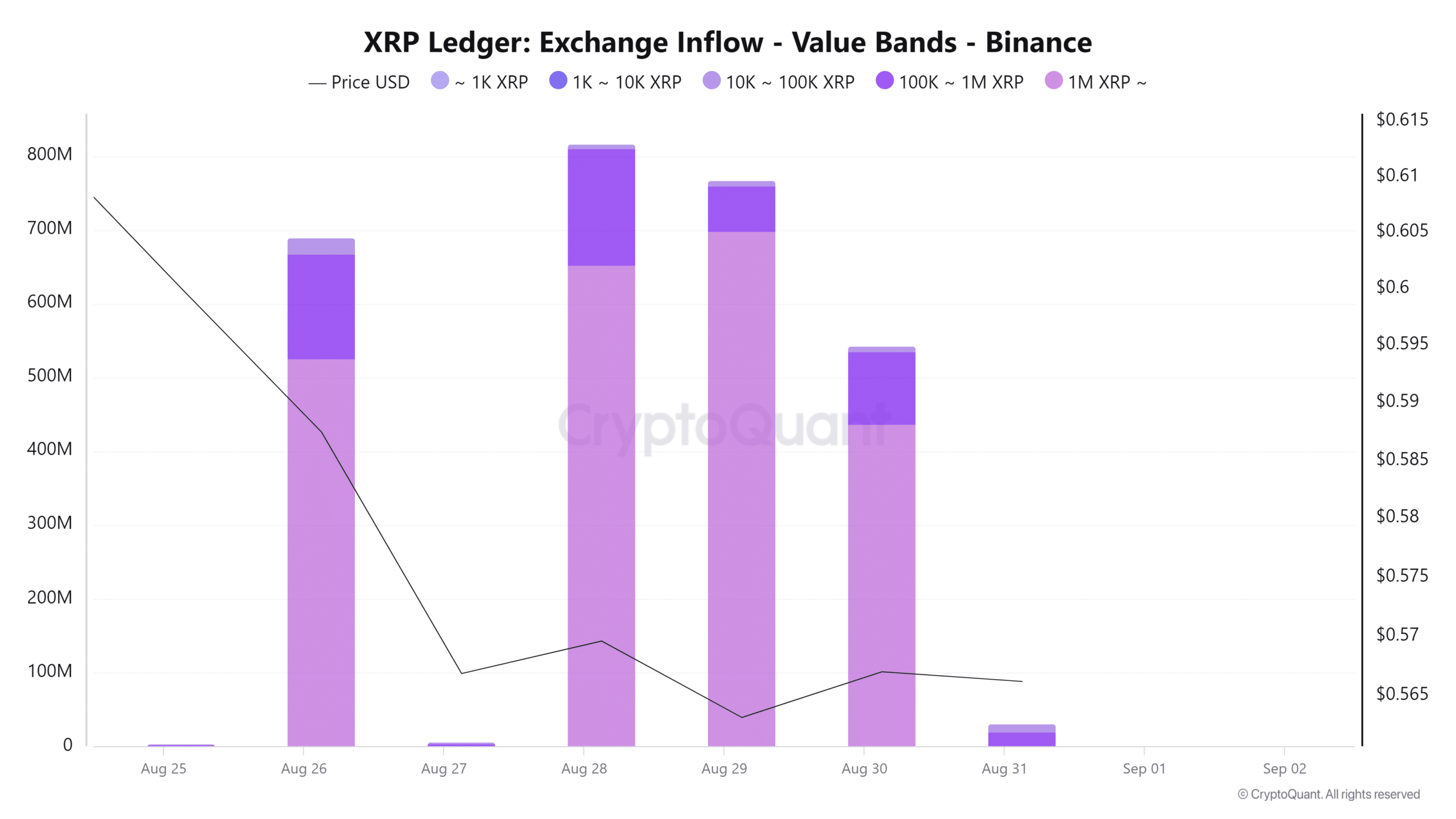

Furthermore, our examination of Cryptoquant revealed that the exchange inflow values predominantly fell within the high inflow categories.

It appears that XRP has been subject to substantial activity by ‘whale’ investors recently. The increased deposits into exchanges suggest these whales might be planning to offload their holdings, potentially causing a drop in the price due to increased supply.

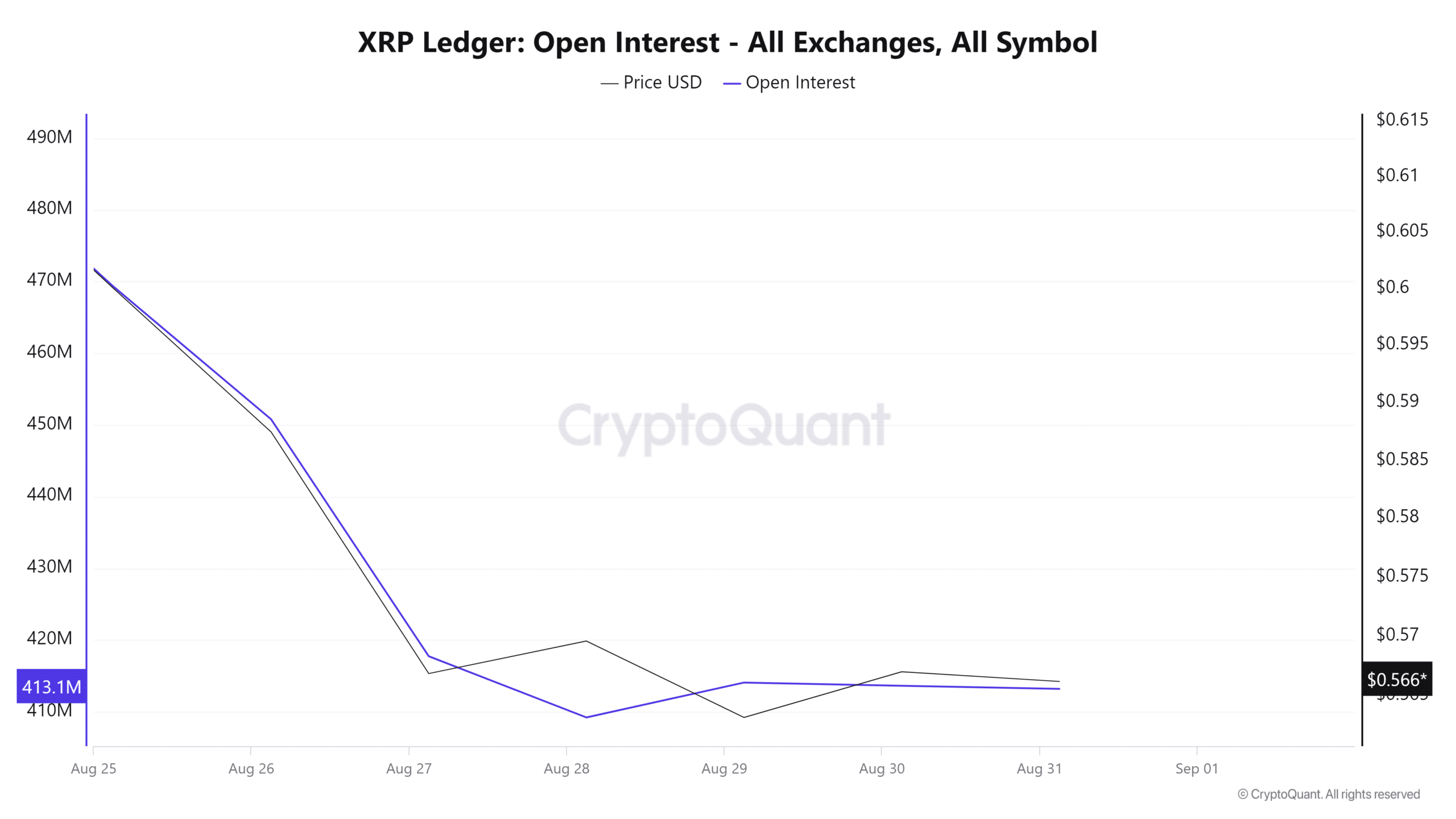

Equally, Open Interest fell over the last 7 days.

OI declined from $469 million to $413 million, meaning that investors are closing their positions. When investors close their positions without opening new ones, it is a sign of negative market sentiment.

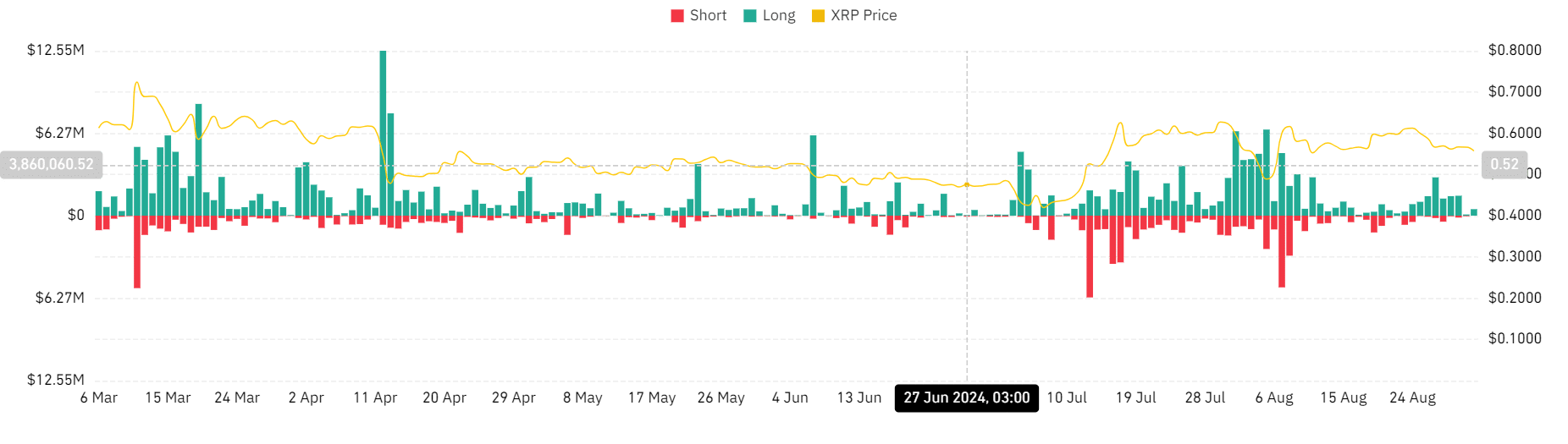

Over the recent week, I’ve noticed a significant number of long position liquidations, with Coinglass reporting approximately $494,000 in these liquidations at this moment. On the other hand, short position liquidations amounted to just $10,980. To put it simply, it appears that investors who were anticipating market growth are experiencing a forced exit from their positions due to these high liquidation figures.

As a crypto investor, I’m finding myself in a cautious mood. I’m not keen on paying an elevated price to maintain my positions, which leads to liquidations when the market doesn’t cooperate.

Given historical trends and considering the current pessimistic market atmosphere, there’s a possibility that the value of this altcoin could drop down to its nearby support price of around $0.43.

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Grammys Pay Emotional Tribute to Liam Payne in First Honorary Performance

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

2024-09-02 01:12