-

Attempted price action below $58k could set up an opposing move

BTC’s movement across Monday – Tuesday could be key to crypto’s next move

As a seasoned researcher with years of experience navigating the crypto markets, I find myself closely watching Bitcoin’s movements, especially on significant days like Mondays. The price action we saw in August has left some interesting targets that I believe we might revisit soon.

Currently, Bitcoin (BTC) is showing a downward trend on extended timeframes. The significant volatility experienced in early August has set potential price levels on the chart that could be revisited in the near future.

Starting from August 25th, Bitcoin has experienced a 10.6% decline as shown on the charts. A potential dip below $60k might lead to a temporary price correction. So, what could traders anticipate in the upcoming trading week? (This version aims to simplify the language and make it more conversational while still maintaining the original meaning.)

Dreaded Monday volatility could be full of opportunities

In conventional as well as cryptocurrency markets, Mondays carry significant weight due to their potential impact on the trading week ahead. The opening highs or lows established on Monday can often influence the trends that unfold during the rest of the week.

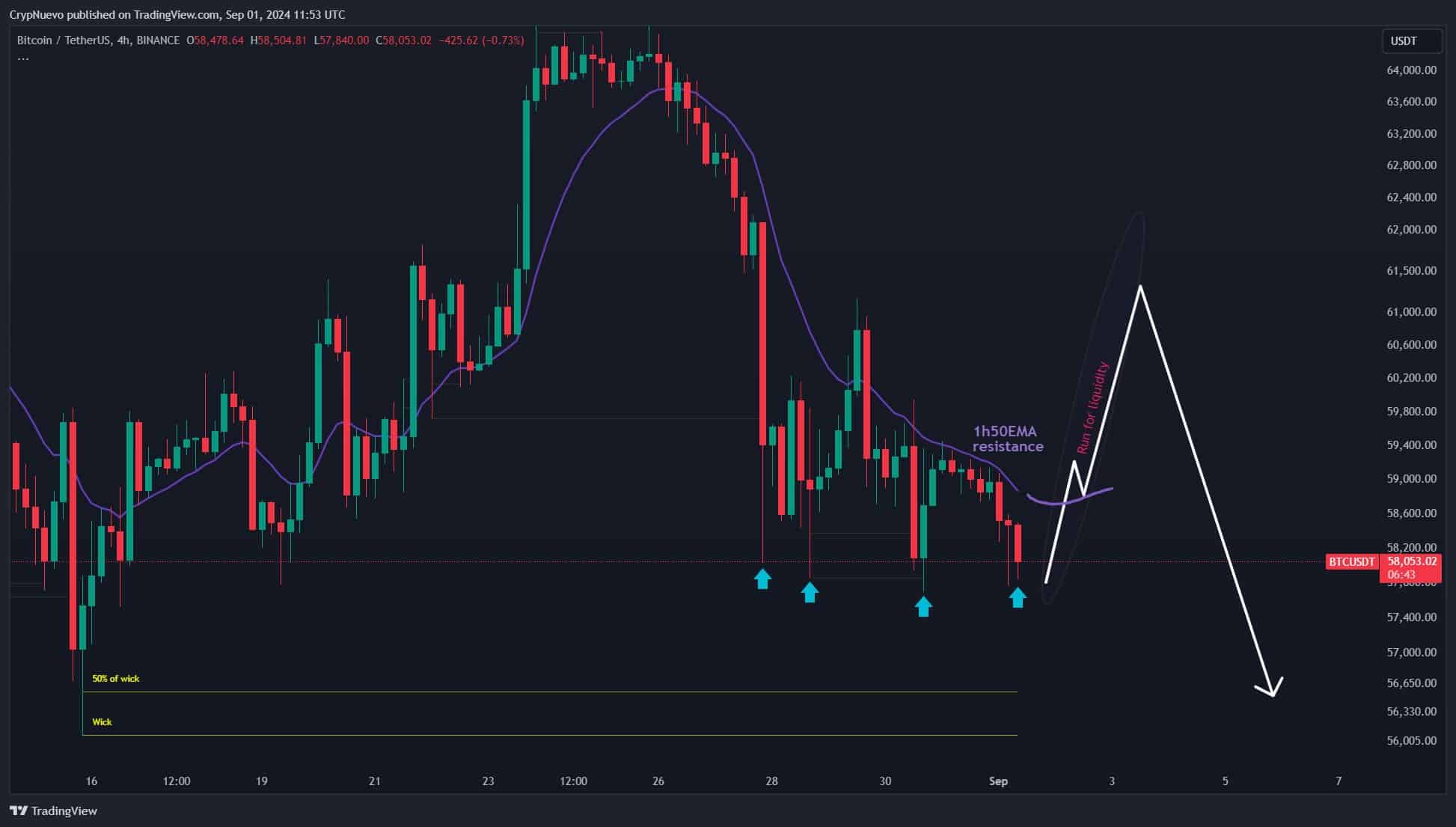

CrypNuevo, a crypto analyst, pointed out in a recent post about X that potential liquidity points for Bitcoin (BTC) may emerge within the next 24-48 hours. The $56.3k area, which was marked by a significant wick on August 15th, could be an appealing target to watch moving forward.

It appears that he’s pointing out that efforts to lower the price below $58,000 didn’t occur, suggesting it’s possible that the market maker might be accumulating assets.

In simpler terms, this suggests that there might be a rise in prices to attract or “hunt” the temporary liquidity that’s accumulated recently. This is more likely considering the general expectation of a prolonged downtrend in the market. The potential increase in price could offer a trading opportunity.

What are the chances of a short squeeze?

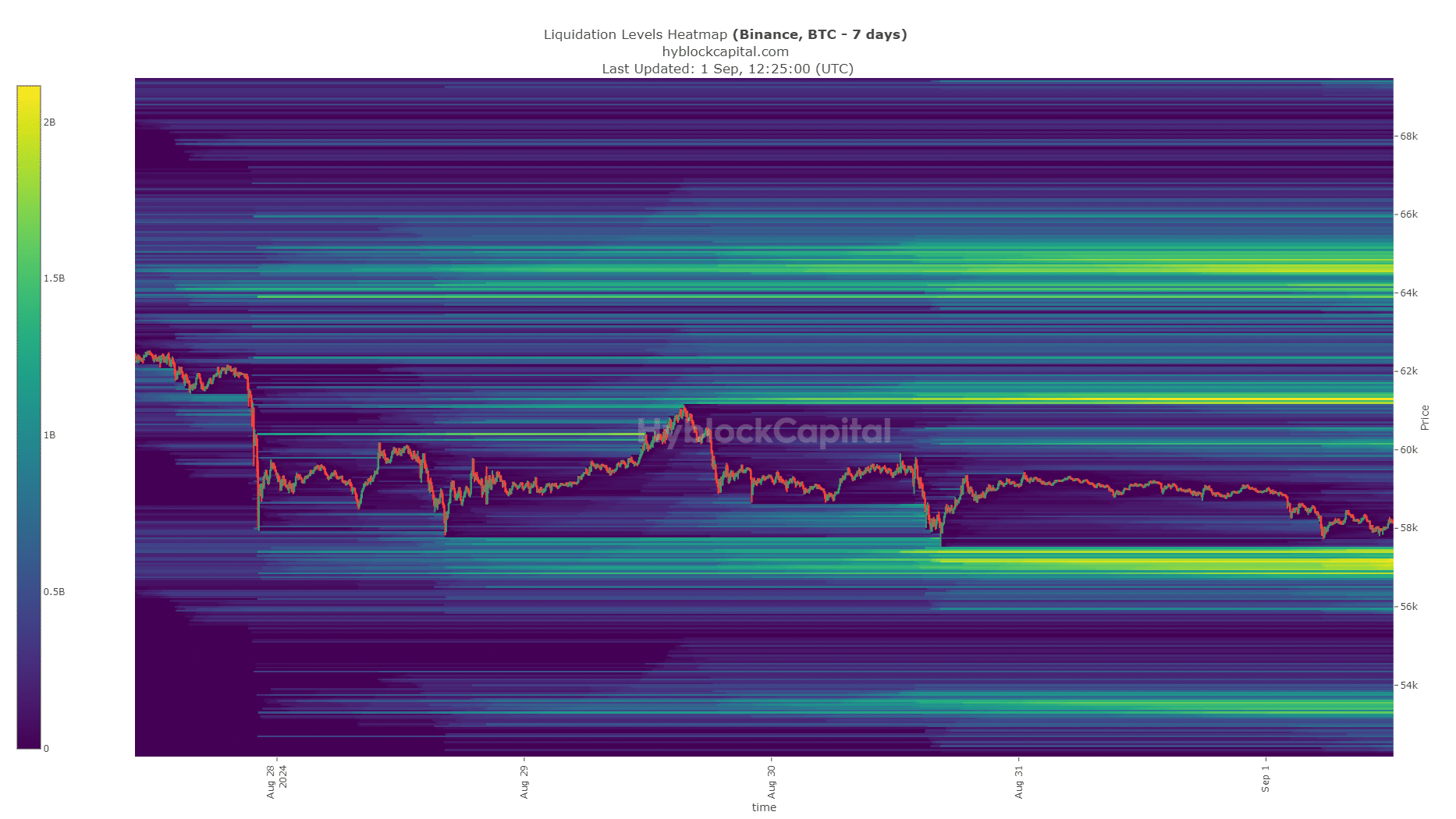

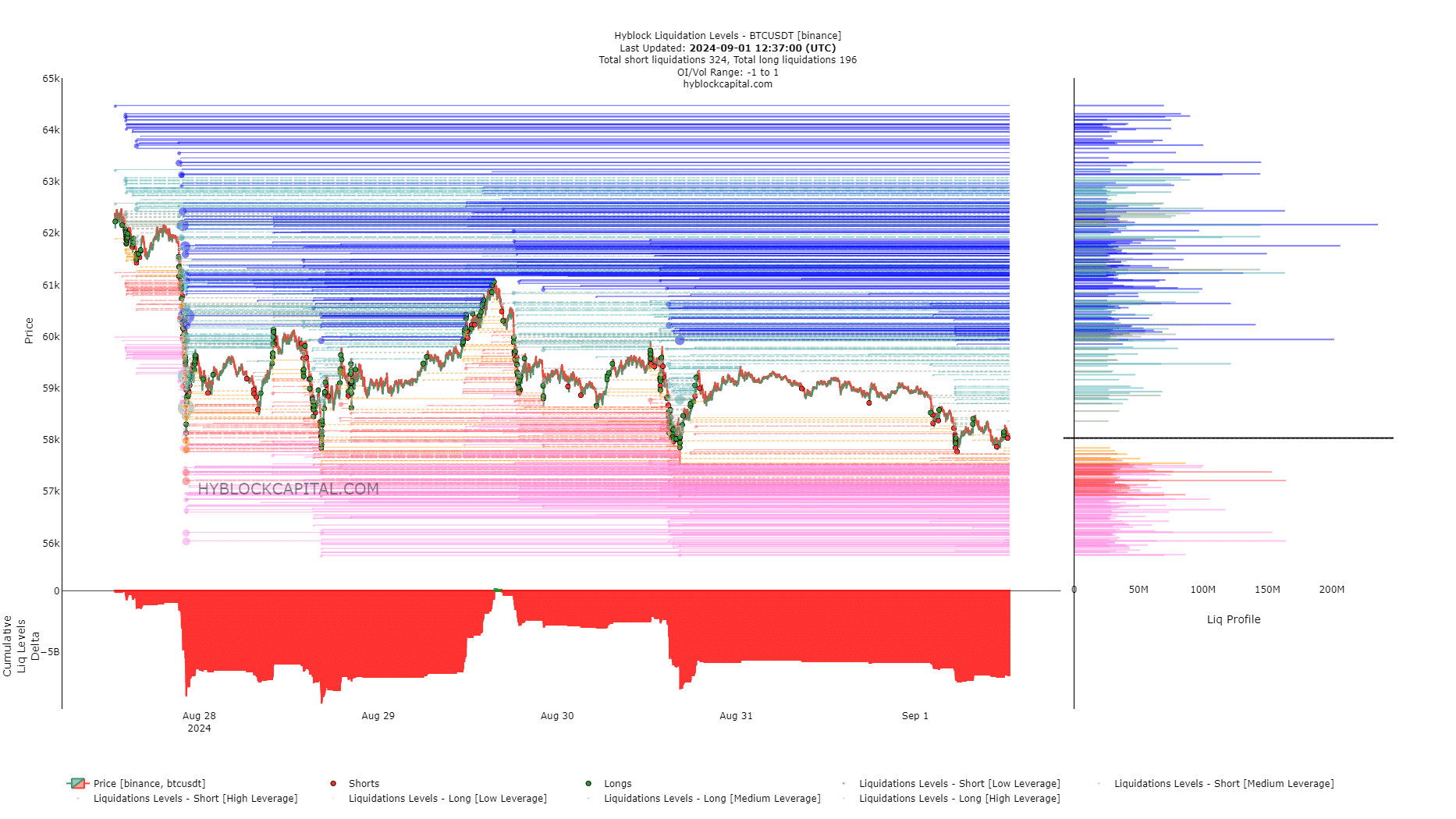

According to AMBCrypto’s analysis, the temporary points for forced selling, or liquidation levels, were mostly located near the $57,100 and $61,300 range. Since the current market price is close to $57,100, traders anticipate a potential drop in prices.

However, this expectation has built liquidity overhead, as covered previously.

In simpler terms, the total amount of positions being closed (delta) indicated a large number of shorts being closed more than longs, which suggests the prices might rise due to a demand for liquidity. This could potentially adjust the Futures market’s predictions to better balance out.

Is your portfolio green? Check the Bitcoin Profit Calculator

The liquidity points showed a significant concentration around $59,900 and $61,700, suggesting possible short-term objectives. Those entering long positions ahead of Monday should be prepared for potential market turbulence if they aim to secure returns.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-09-02 06:15