-

More traders have taken short positions in BNB

BNB, at press time, had declined by over 2% in the last 24 hours

As an analyst with over two decades of experience in the financial markets, I find myself constantly intrigued by the ebb and flow of the cryptocurrency market. The recent decline in Binance Coin (BNB) has caught my attention, not just because it’s the third-largest cryptocurrency, but also due to its resilience amidst a broader market downturn.

Just like other cryptocurrencies, Binance Coin (BNB) has experienced a dip due to the recent slump in the overall crypto market during the last couple of weeks. Nevertheless, it’s worth noting that despite this drop, BNB has managed to preserve a substantial market value.

Despite outperforming numerous other assets in terms of market worth, the level of BNB trading has remained relatively low, as suggested by its minimal funding rate.

Binance maintains top spot

As I’m typing this, Binance Coin (BNB) has a market value of around $75.8 billion, placing it as the third-largest cryptocurrency globally, just after Bitcoin and Ethereum, but before Tether USDT. This is striking when considering the overall drop in the crypto market over the last week.

Indeed, as per CoinMarketCap’s latest data, the leading ten cryptocurrencies such as BNB have all experienced substantial drops over the last week, losing more than 5% each. Remarkably, despite these declines, BNB managed to maintain its rank on the market charts.

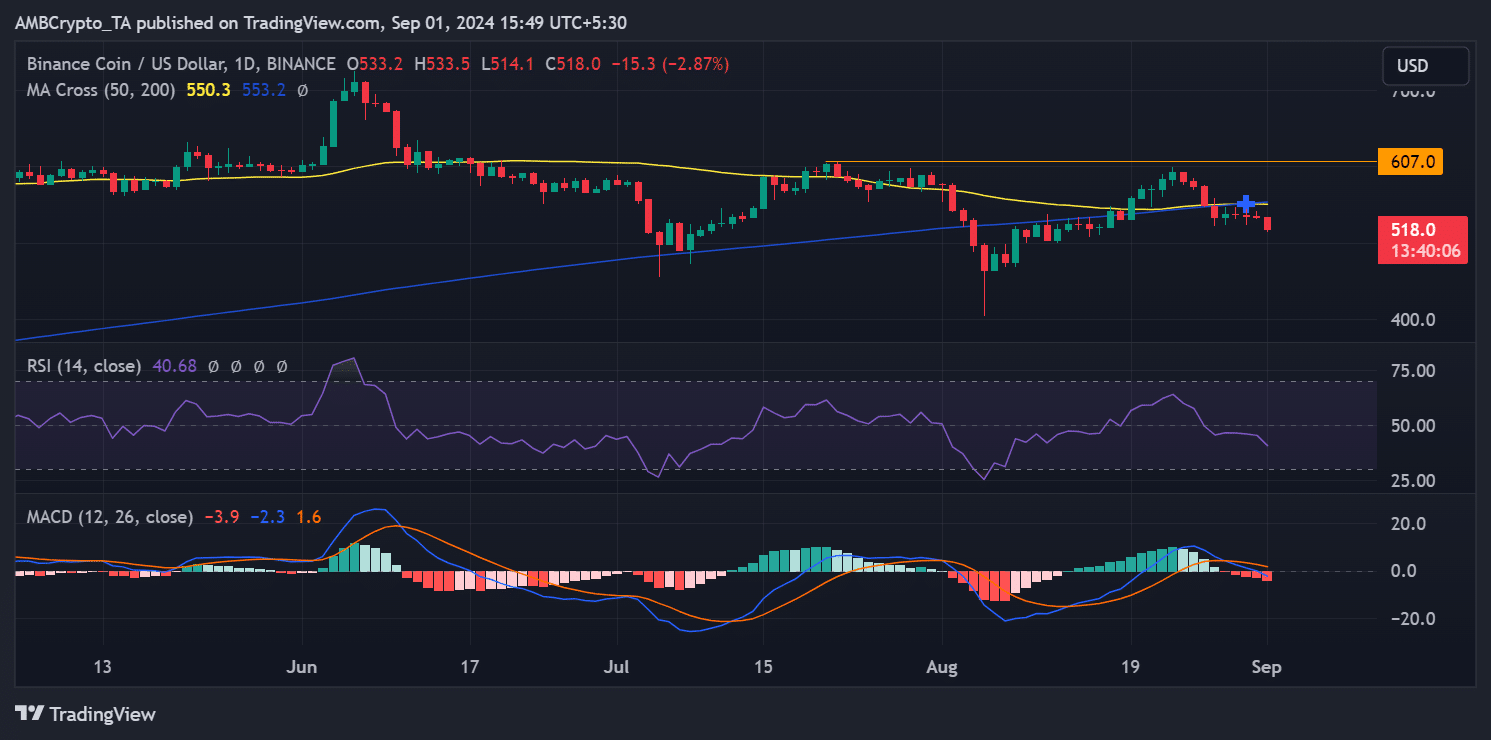

A look at the price charts

In simpler terms, the graph of Binance Coin (BNB) over a day’s time has shown a ‘death cross.’ This technical indicator suggests a negative trend as it happens when a quick-moving average line falls beneath a longer-term moving average line.

Yet, at the point when I penned this, the death cross wasn’t completely manifested yet. It initially emerged on August 30th as the price of BNB fell approximately to $535, marking a minor decrease of 0.24%.

Ever since the “death cross” formation occurred, the price of BNB has persisted in going down. Currently, it is being traded around $517, having dropped almost 3% more.

Currently, the moving averages function as potential barriers for price increase, appearing approximately at $550. However, it’s worth noting that a stronger resistance area exists between $590 and $600.

Based on additional examination with the help of the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) technical indicators, there appears to be a growing pessimism towards BNB, suggesting it may continue to decline.

According to the RSI, Binance Coin (BNB) is moving towards an oversold state, which supports its continuing decline. Additionally, the MACD’s alignment and conduct appear to align with a bear market, suggesting that the downward pressure on BNB may continue.

Sellers take charge of a subdued trade

To summarize, an examination of Binance Coin’s (BNB) funding rate found that trading activities have been rather quiet for the last several weeks, with only a few significant peaks. At present, the funding rate has dropped slightly below zero, standing around -0.0020%.

– Read Binance (BNB) Price Prediction 2024-25

As I delve into the market dynamics of BNB, a high unfunded ratio indicates that there are more traders opting for selling positions compared to buying ones. Essentially, this means that many traders are expecting the value of BNB to further decline as they take short positions on it.

A consistently low return on investment, or negative funding rate, often signifies pessimistic feelings among market participants who believe that prices will continue falling. Consequently, these traders are ready to compensate others (by paying) in order to hold onto their short positions.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-09-02 07:04