-

Bitcoin could rally up to the $62,000 level, based on historical price momentum.

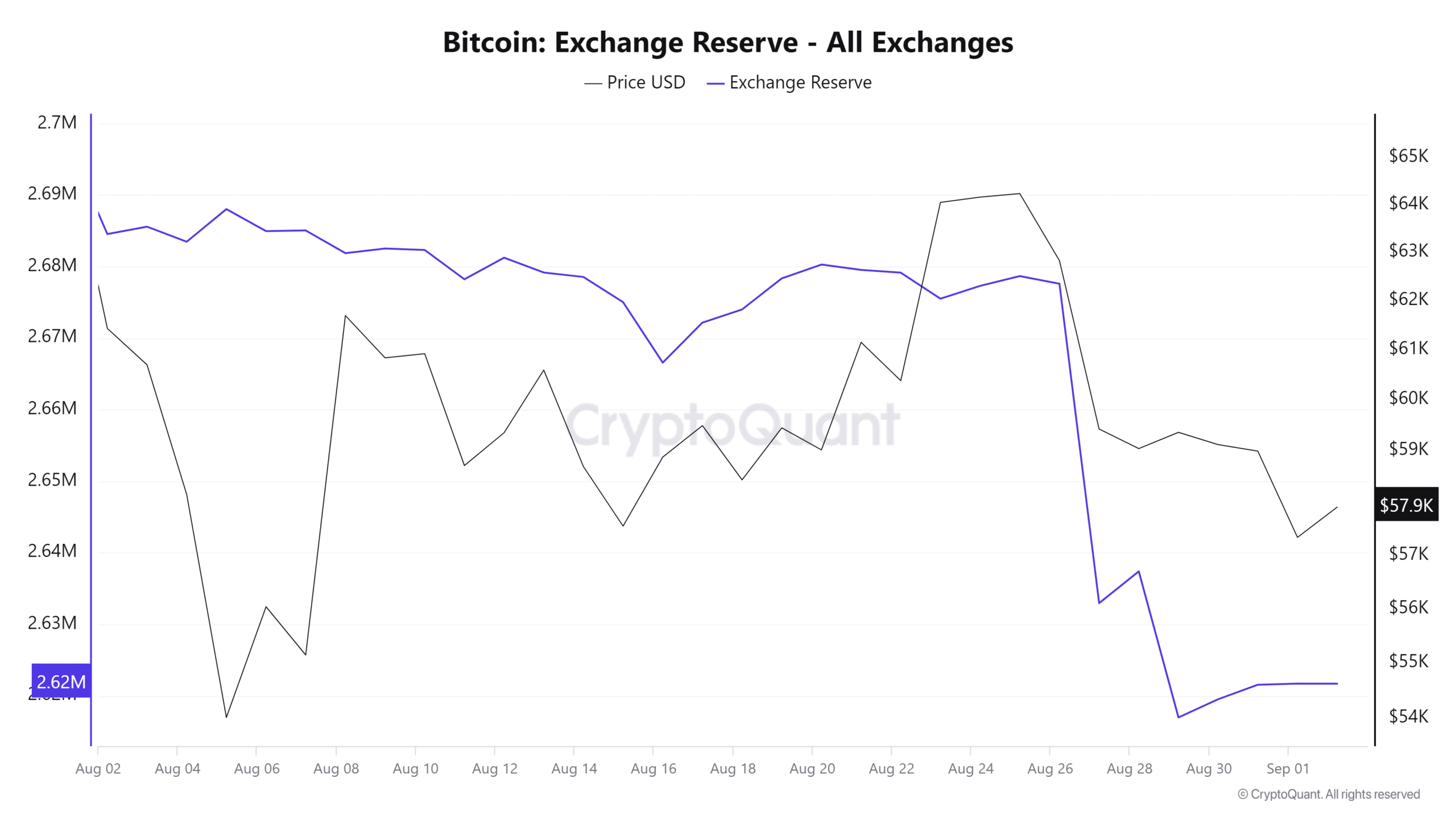

BTC exchange reserve data showed potential buying pressure from investors, as it has significantly fallen in recent days.

As a seasoned analyst with over two decades of market analysis under my belt, I can confidently say that the recent buying spree by Bitcoin whales is a clear sign of their bullish sentiment towards the market. Having witnessed numerous market cycles, it’s not hard to spot these patterns.

Amid a pessimistic outlook on the market, large-scale crypto investors (referred to as ‘whales’) were actively purchasing at reduced prices, as prominent cryptocurrencies like Bitcoin [BTC] and Ethereum [ETH] experienced substantial drops in value.

2nd of September update: Spot On Chain, an analytics firm, shared on their platform (previously known as Twitter), that a significant Bitcoin holder (referred to as a whale) bought approximately 1,000 BTC valued at about $57.4 million from Binance‘s platform (BNB).

Bitcoin whales buy the dip

Furthermore, it’s been reported that this particular whale made a purchase of approximately 2,000 Bitcoins, valued at around $117 million, over the past four days, with an average cost per Bitcoin of roughly $58,525 from Binance.

With the recent purchase, the whales’ Bitcoin holding increased to 8,559 BTC worth $494 million.

Back in July 2024, a whale (a large Bitcoin holder) disposed of approximately 7,790 Bitcoins, equivalent to around $467 million at that time. This sale occurred prior to the market’s overall negative sentiment shift.

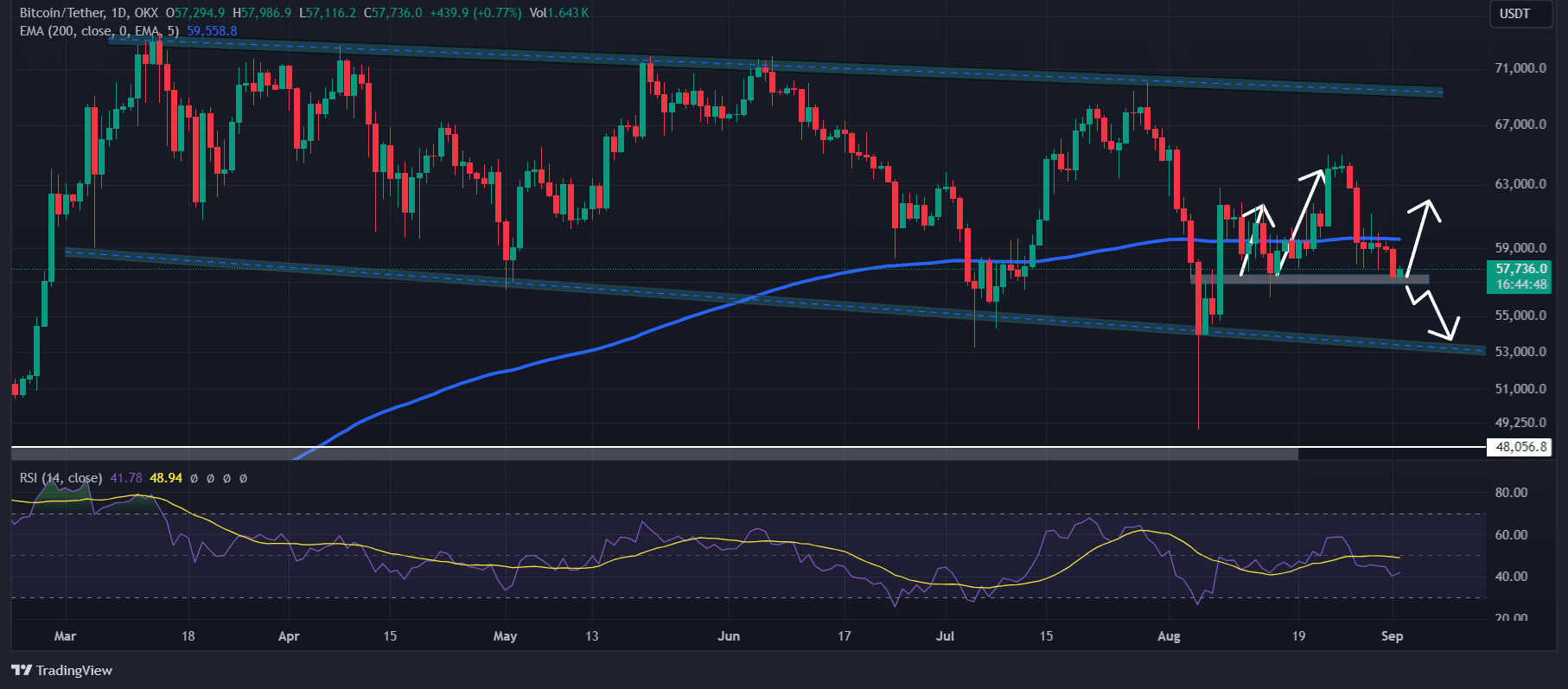

Upcoming levels

According to AMBCrypto’s analysis using TradingView, Bitcoin was holding steady at a significant support point of approximately $57,300 as we speak. On a larger, day-to-day time scale, it appeared to be trading below its 200 Exponential Moving Average (EMA).

The price below the 200 EMA indicated that it was in a downtrend at this time.

During periods of market decline, when Bitcoin hits that particular price point, it tends to encounter strong buying interest and a subsequent price surge. There’s considerable anticipation that this time, the upward trend could extend as high as $62,000.

Moreover, the Relative Strength Index (RSI), a common technical tool, suggested that the market was overbought, potentially hinting at a price turnaround. This could be a promising signal for both investors and traders.

Bullish outlook emerges

Additionally, other indicators suggest a bullish perspective too. For instance, CryptoQuant’s Bitcoin exchange reserve data indicates that investors could be preparing to buy, given that the Bitcoin exchange reserves have noticeably decreased over the past few days, hinting at potential buying pressure.

Currently, the BTC Long/Short Ratio chart on CoinGlass is showing a value of 1.0043, which is its highest point since August 26th. This suggests that there’s a strong bullish attitude among traders at the moment.

At that moment, Bitcoin (BTC) was hovering around $57,730, with a minor decrease of 0.8% over the past 24 hours. Simultaneously, the Open Interest saw a drop of 1% within the same timeframe.

Key liquidation levels

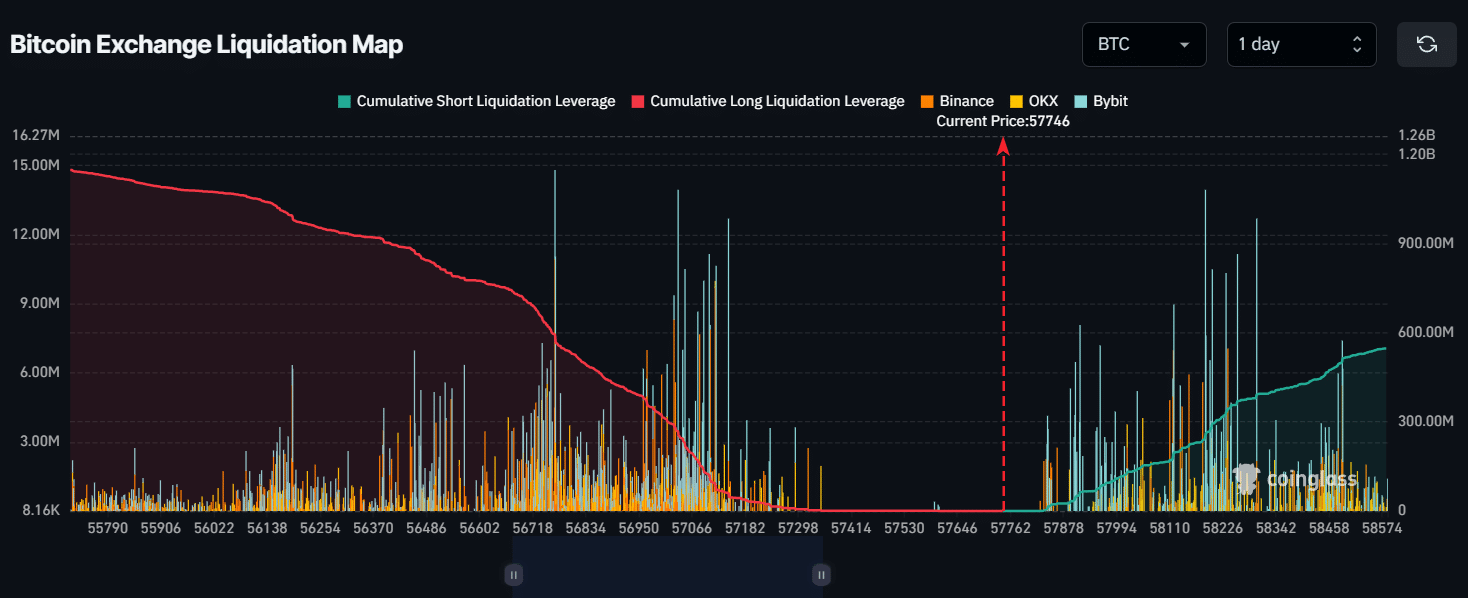

According to AMBCrypto’s analysis, the Bitcoin exchange liquidation map provided by CoinGlass suggested that the bulls were in control and might be closing out short positions as we speak.

significant liquidation points were close to $56,760 on the downside and $58,300 on the upside, as traders have taken on excessive leverage at these price points.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As an analyst, if the overall sentiment continues to lean bearish and Bitcoin’s price drops to approximately $56,760, it’s estimated that a staggering $600 million in long positions could potentially be liquidated.

If the vibe flips and the price soars up to around $58,300, it’s estimated that about $390 million worth of short positions will get wiped out.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-09-02 11:36