-

XRP presents a good risk-to-reward buying opportunity.

Sentiment is bearish and traders might have to cut their losses quickly if the price trends the other way.

As a seasoned analyst with over two decades of experience in the crypto markets, I’ve seen my fair share of bull and bear cycles. From the dot-com bubble to the crypto winter, I’ve learned that every downturn is an opportunity for growth if you know where to look.

In simpler terms, Ripple (XRP) has been moving in a limited price band. Currently, the bears seem to be driving the prices downwards, but don’t fret, the bulls are still very much in the game.

On days when the market falls below its lower range limits, it often signals a potential short-term turnaround. Particularly if this happens on Mondays, more aggressive investors or swing traders may find it advantageous to adopt a bullish stance near the range’s lower levels.

Do the indicators support a reversal?

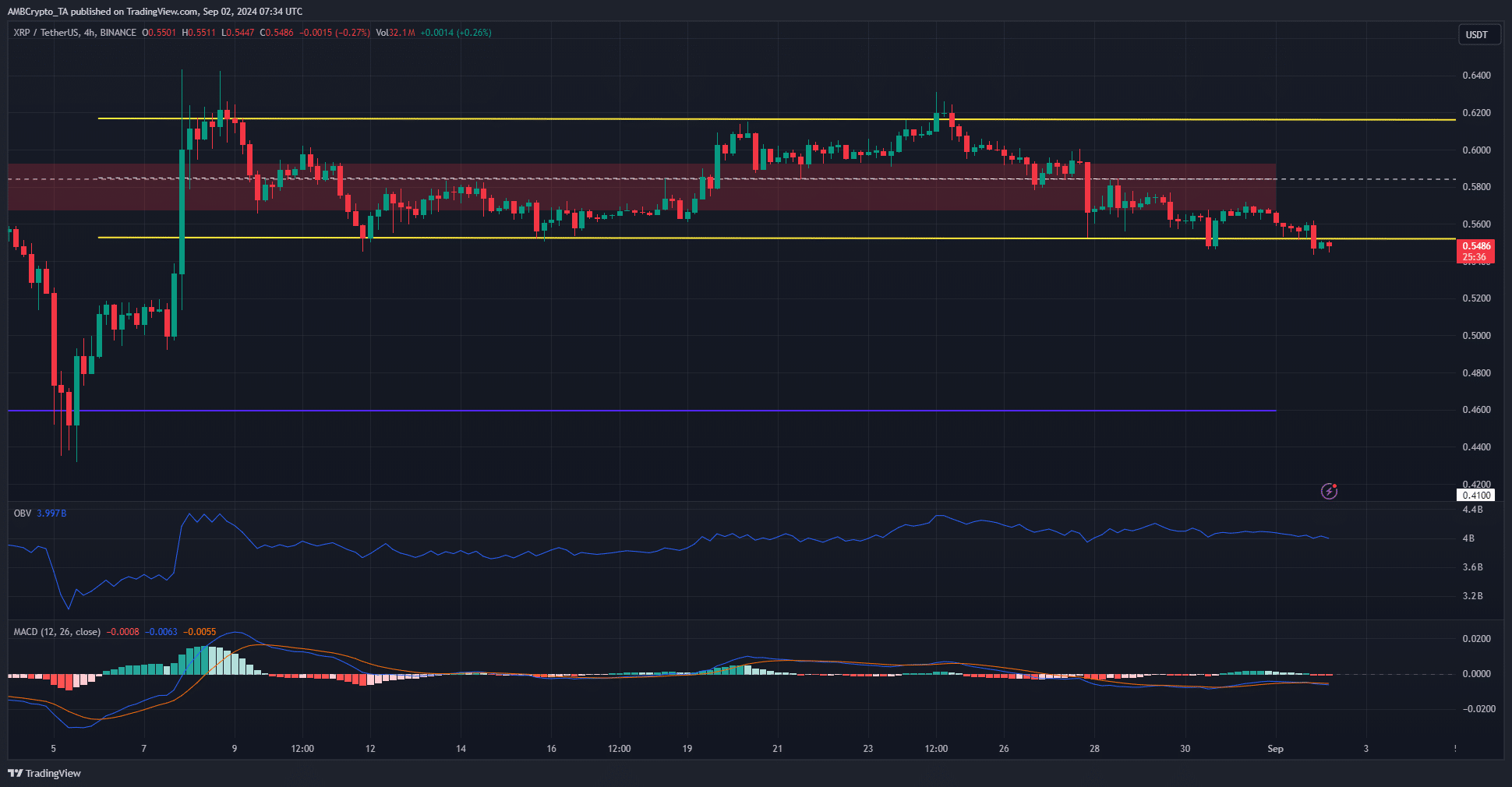

Over the last eight days, the On-Balance Volume (OBV) on the 4-hour chart has remained relatively stable. Despite this, XRP saw a decrease of 13.5%. Remarkably, the OBV’s behavior suggests optimism as the significant price drop didn’t seem to trigger excessive selling.

Revisiting the price dips, I recognized an opportune moment for purchasing. Concurrently, the Moving Average Convergence Divergence (MACD) suggested a mildly bearish trend aligning with the recent trading activities.

For brief investors, the potential gain versus possible loss is substantial in the short term, and a significant event could occur soon. On the other hand, more conservative investors might prefer to hold off until the New York trading session starts, allowing for increased market volatility to settle down, before making an investment decision.

Assessing the sentiment behind XRP

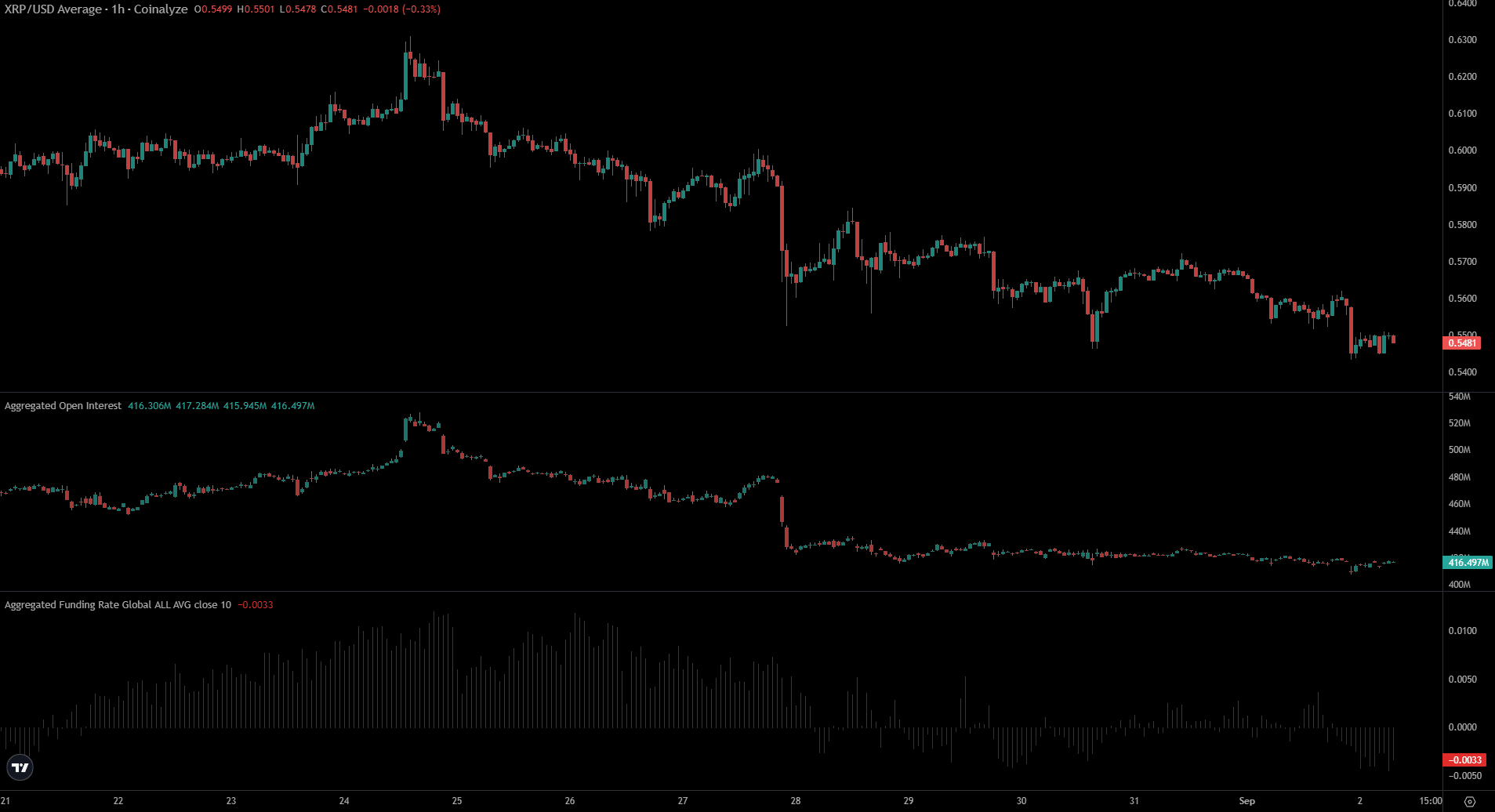

In simpler terms, when the Funding Rate went below zero and the Open Interest didn’t increase significantly, it showed that futures traders were cautious about buying and instead chose to sell or stay out of the market.

Read Ripple’s [XRP] Price Prediction 2024-25

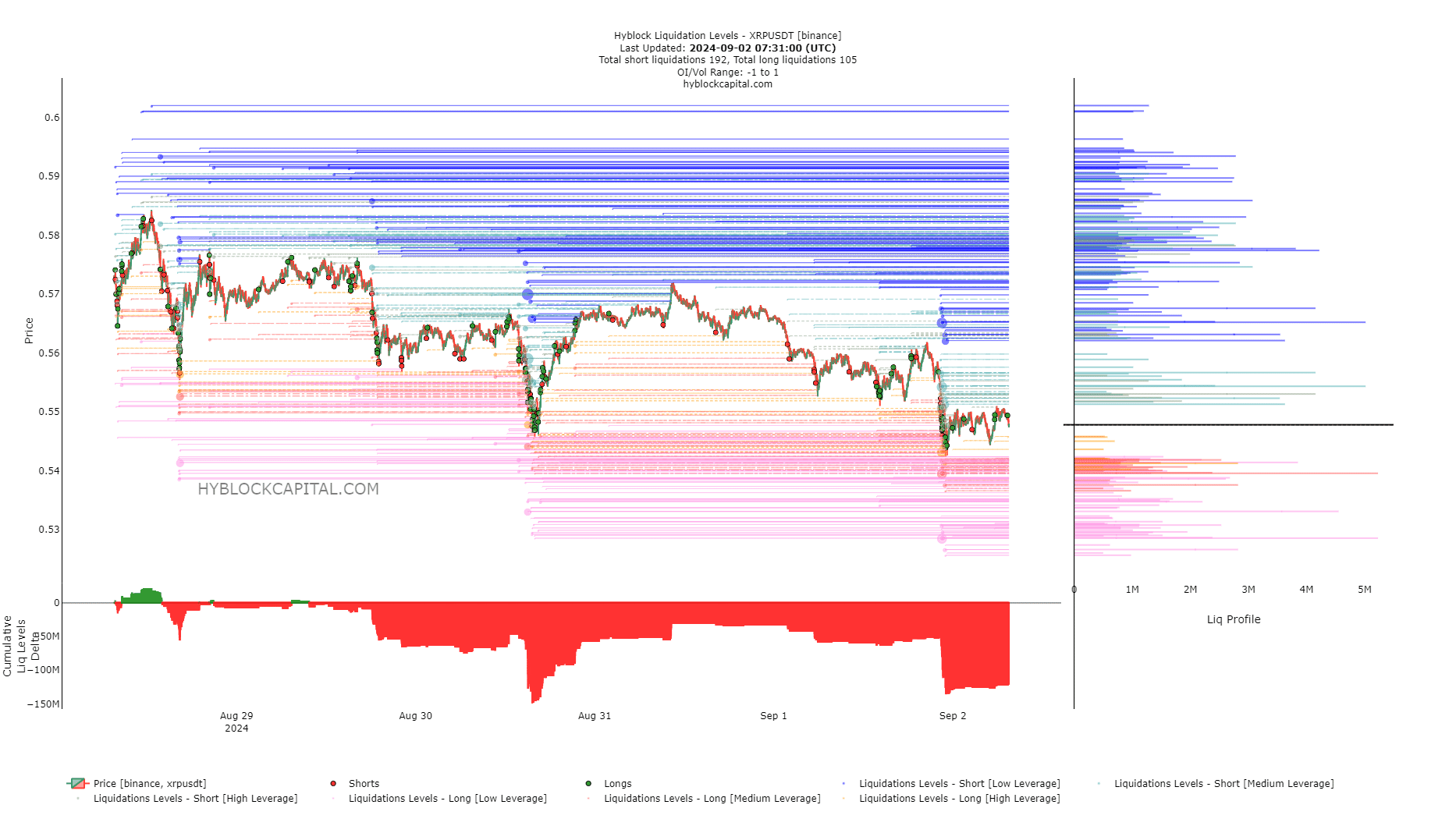

As an analyst, I observed a bearish trend in the market sentiment, as evidenced by the liquidation levels data. The cumulative liquidation levels delta dipped significantly, approaching the levels seen on the 30th of August. Despite this, XRP demonstrated resilience, managing to rise by 4.7% from the lower end of its range.

In all probability, a situation comparable to this one might play out, so traders need to exercise caution. The price of Bitcoin [BTC] may potentially drop down to or even beneath $56k, which could pull the entire altcoin market along.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-09-02 16:07