- Bitcoin struggled below $60k as critics highlighted its recent underperformance.

- Despite bearish signals, 79% of Bitcoin holders were “in the money,” suggesting potential bullishness.

As a seasoned crypto investor who has weathered countless market cycles, I find myself intrigued by Bitcoin’s current situation. On one hand, the bearish signals are hard to ignore – Bitcoin’s struggle to break the $60k mark, Peter Schiff’s relentless criticism, and the technical indicators that suggest a shift towards the bears. However, as a pragmatic investor, I always strive to balance these short-term trends with long-term fundamentals.

The month of September sees Bitcoin [BTC] struggling to surpass the $60,000 mark.

Based on data from CoinMarketCap, Bitcoin experienced a minor daily rise of 0.51%, but its weekly performance has been disappointing, with a substantial decrease of 8.65%. This decline dropped its current trading value to approximately $58,401.

Peter Schiff has a warning

Despite the ongoing fight, long-standing Bitcoin critic Peter Schiff recently expressed his views on a platform previously known as Twitter, emphasizing the underwhelming results of the cryptocurrency and voicing his worries about its future direction in the market.

“As we’ve reached the eighth month of 2024, it’s worth noting that all of Bitcoin’s annual growth happened in the initial two months of the year.”

He also added,

“In the past two months following February’s end, even though 11 Bitcoin exchange-traded funds have been introduced, Bitcoin itself has dropped by 8%. Conversely, during the same period of six months, the price of gold has risen by 23%. It appears that the trend has shifted.”

Bitcoin gives mixed signals

Responding to the criticism, AMBCrypto examined TradingView data and found that the Relative Strength Index (RSI) had fallen below the neutral threshold, currently reading 44.

This implies a weakening of the positive trend, as the bullish energy seems to be losing steam. Furthermore, notice that the Moving Average Convergence Divergence (MACD) line, which is blue, lies below the Signal line, a yellow color, suggesting that at present, negative forces are more dominant than the positive ones.

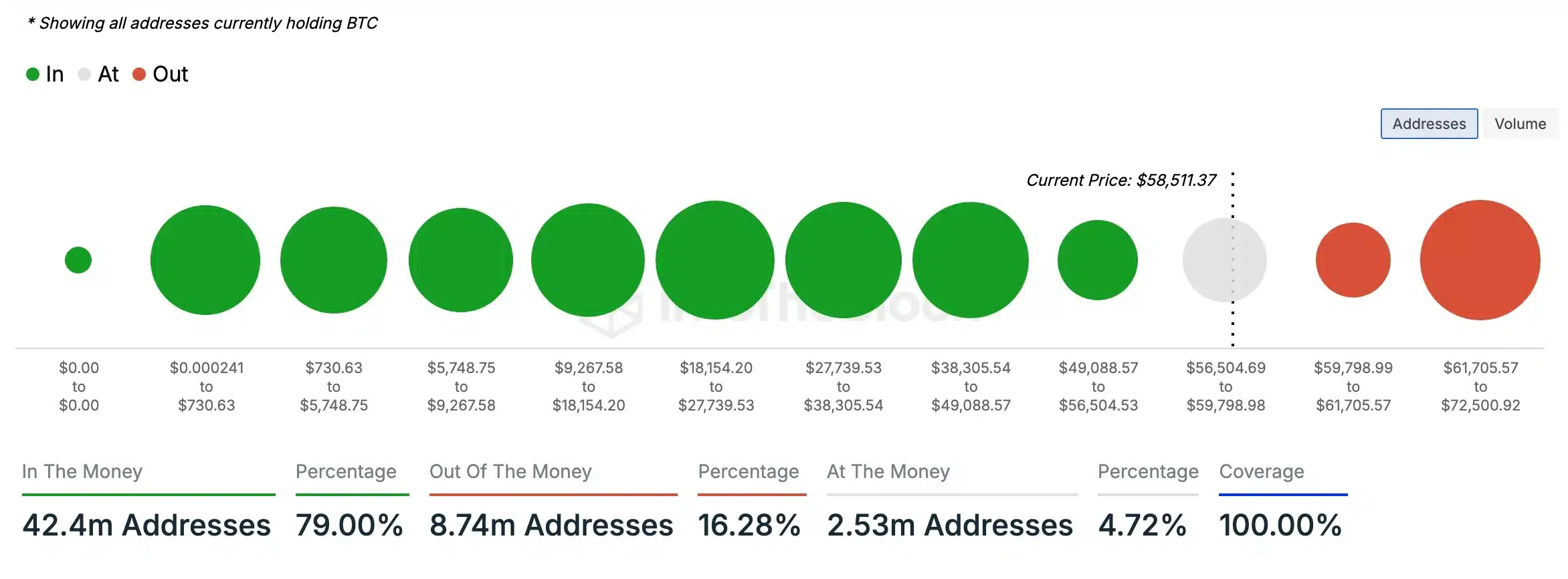

However, despite recent criticisms and technical indicators suggesting bearish pressure, IntoTheBlock data provided a more optimistic outlook for Bitcoin.

At the given moment, approximately 79% of Bitcoin owners found themselves in profit, as the current value of their coins exceeded what they initially paid for them.

Conversely, it was found that just about 16.28% of bitcoin owners were “underwater,” meaning they paid more for their bitcoins than what those bitcoins are currently worth.

This difference suggests a significant possibility that Bitcoin may soon undergo a bullish trend.

The crypto community remains positive about Bitcoin

Agreeing with the sentiment and noting similarities to past trends, user Elja suggested that…

“Similar fractal, different timeframe. Elites are playing the same game again.”

However, it was Sensei who put it best when he said,

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-09-02 22:16