- Pepe has not rid itself of the bearish price momentum of the past week.

- The metrics showed a wave of selling toward the end of August.

As a seasoned researcher with years of experience in analyzing cryptocurrency markets, I must say that Pepe [PEPE] seems to be navigating choppy waters at the moment. The bearish momentum from last week has yet to completely dissipate and it’s evident in the trading activity over the past few days.

As a researcher observing the PEPE token, I’ve noticed it’s moving within a bullish flag pattern on the larger timeframes, suggesting a potential consolidation phase that might continue for another one to three weeks.

On a daily basis, the downward momentum of the market (or the bearish trend) has begun to decelerate, but it hasn’t been taken over by an upward momentum (or bullish trend) just yet.

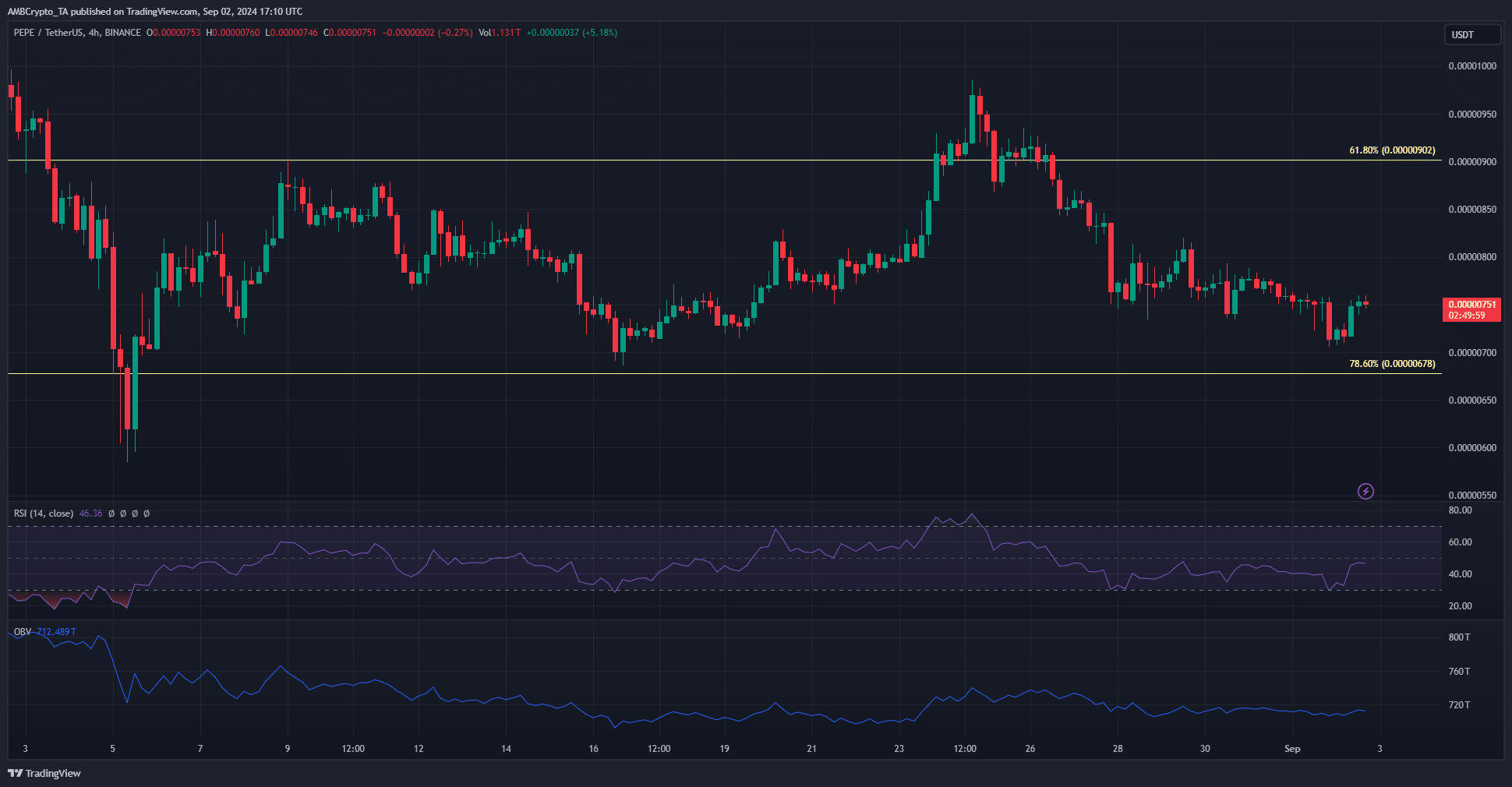

On the 4-hour timeframe, the trend appeared to be getting increasingly bullish as momentum drew near to a reversal. For a clear sign of robust purchasing power, we’d want to see the On-Balance Volume (OBV) reaching new peaks.

AMBCrypto examined some on-chain metrics to gauge the crowd engagement and what could come next.

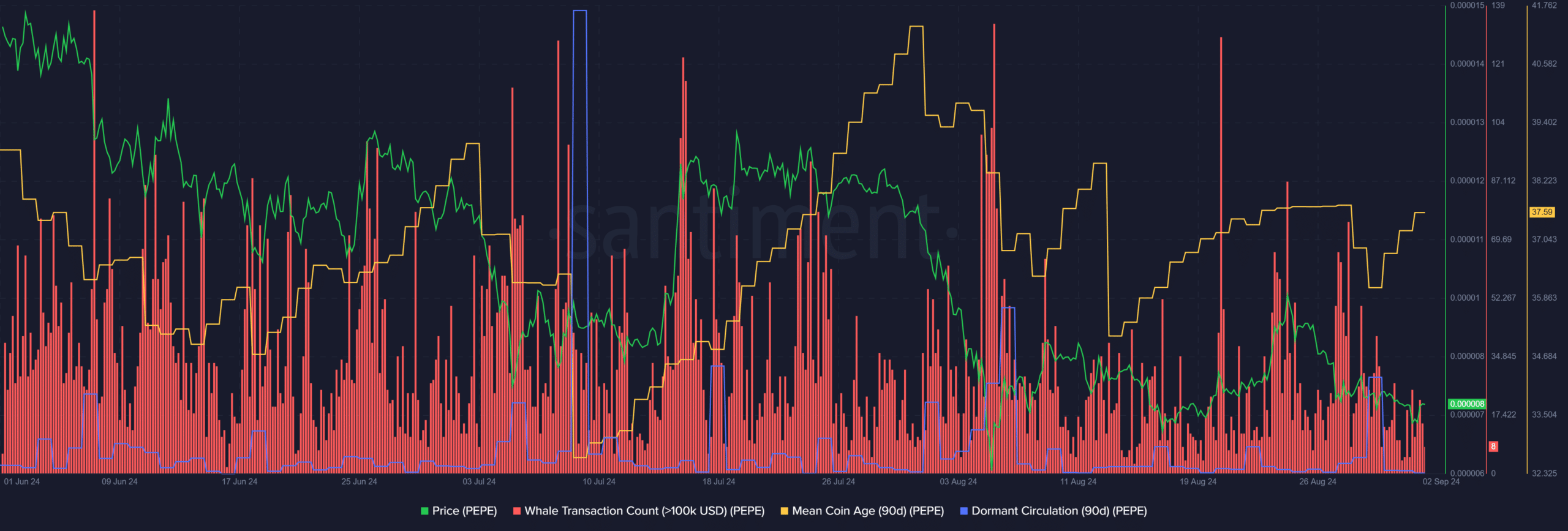

Pepe whale transactions indicated some panic in recent days

Towards the latter part of July, the average age of coins in circulation for the meme coin was on an upward trajectory, suggesting a widespread accumulation across the network. It was also observed that there was an increase in significant Pepe transactions, which may point towards increased accumulation by large investors or whales.

On August 5th, a significant price drop was followed by an escalation in whale transactions, suggesting widespread market anxiety.

A similar scenario but much smaller in magnitude played out on the 28th and 29th of August.

1) The average age of circulating coins decreased while the number of whale transactions increased, suggesting that bigger investors were putting more coins up for sale. On the 30th of August, there was an unexpected surge in coin circulation, hinting at a selling trend related to Pepe.

Bearish weighted sentiment and network participation

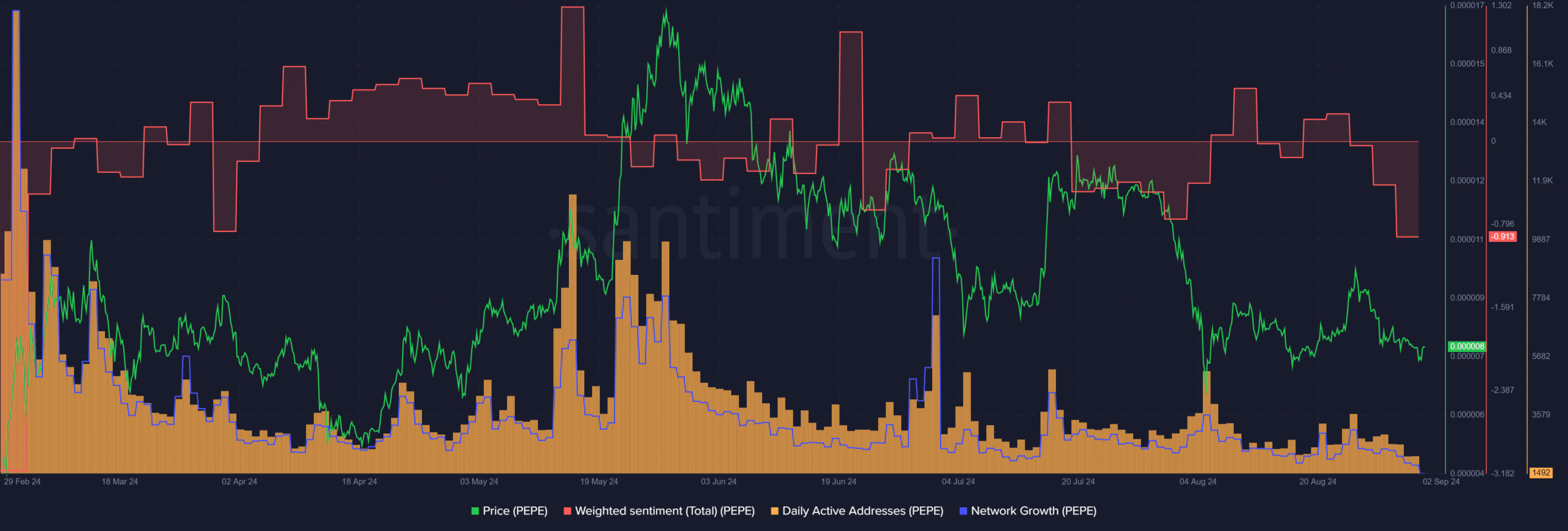

Investors may be expecting that the current bout of selling could mark a temporary end. If prices hold steady near the $0.0000071 support level, however, the level of network activity remains disappointing.

Over the past week, both the number of daily active addresses and the expansion of the network decreased simultaneously with the drop in price.

Is your portfolio green? Check the Pepe Profit Calculator

This showed reduced market participation and shrinking PEPE adoption.

1. The strongly negative feelings expressed (sentiment) increased significantly, indicating a pessimistic outlook (bearish sentiment) in online interactions. In summary, while the short-term price movement may be changing direction, the network statistics showed little enthusiasm.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-03 07:35