-

The crypto markets bleed as BNB prices take a dip.

Stablecoin inflow and trading volume are dwindling.

As a seasoned crypto investor with over five years of experience under my belt, I’ve witnessed market fluctuations like this before. The current downturn, with BNB prices taking a dip and stablecoin inflow and trading volume dwindling, is reminiscent of the bear market in 2018. However, the difference between then and now is that we have more resilient projects and better technology in place.

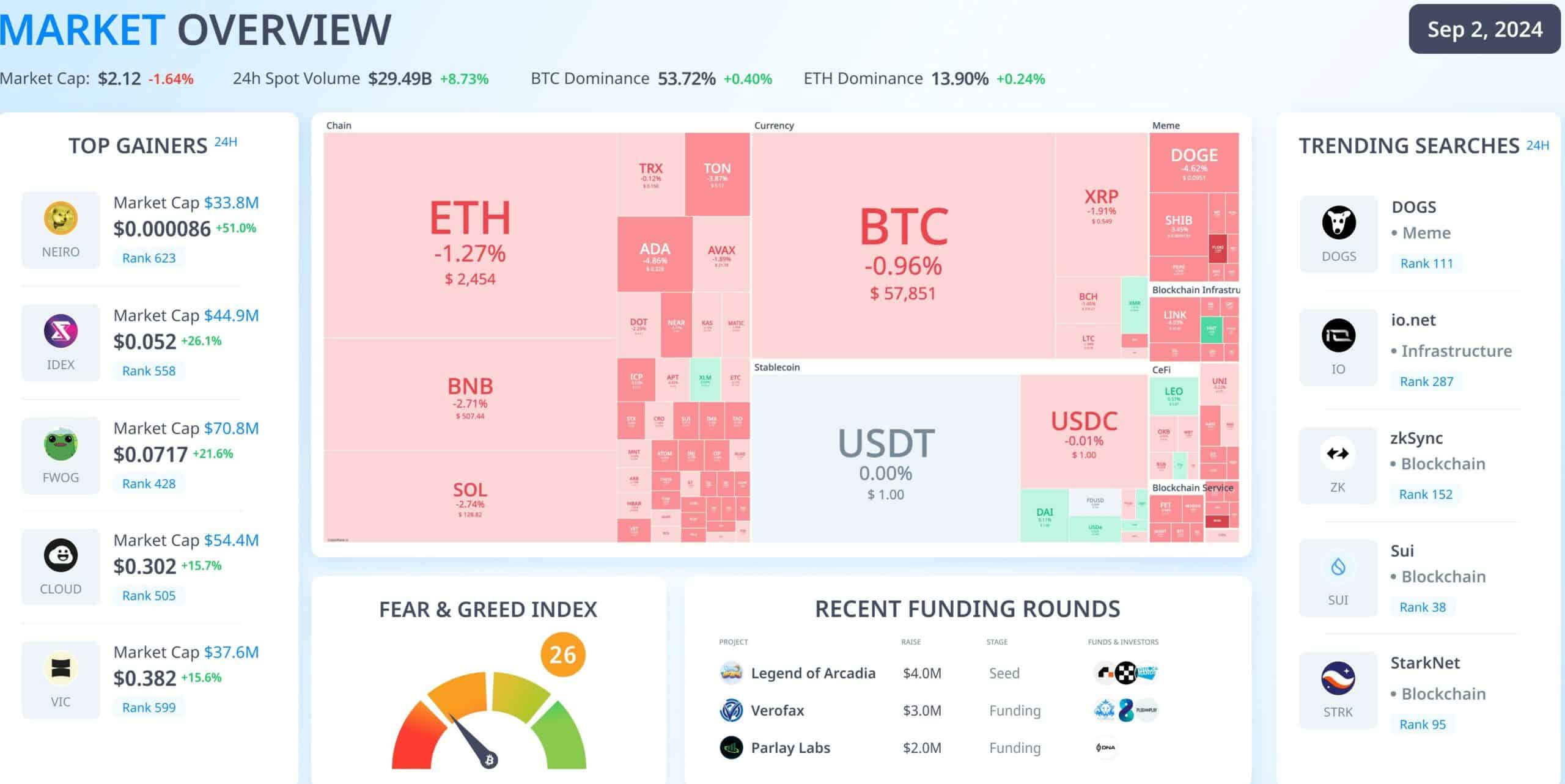

As a crypto investor, I’m currently navigating through some turbulent market conditions, where most cryptocurrencies are taking a significant dive in value. The leading coins are no exception, with their prices plummeting dramatically. The overall vibe among investors is apprehensive, as mirrored by the Fear & Greed index registering a low score of 26, indicating that fear seems to dominate the market at present.

At that time, Bitcoin‘s value was dipping below $58,000. All of the top 10 cryptocurrencies were experiencing losses, with Dogecoin leading the way at a decrease of 4.00%, followed closely by Binance Coin and Solana, each down by approximately 2.22% and 2.11% respectively.

The total market capitalization has dropped to $2.12 trillion, marking a decrease of -1.64%.

It’s worth mentioning that advancements related to Binance Smart Chain (BSC) could potentially influence the larger crypto market substantially, given that BNB is one of the leading cryptocurrencies by market capitalization, with a value of approximately $73.95 billion at the moment.

Binance price analysis shows…

Looking closely at the fluctuations in Binance Coin’s (BNB) value against Tether (USDT), it appears there’s a troubling pattern emerging. The general drop in the cryptocurrency market hasn’t left BNB untouched, as its rate of decrease is causing some unease among investors.

Despite some initial indications of improvement as suggested by the long wicks on the daily candles, Binance’s forecasts for the next few months hint at possible additional drops in value.

Having recently touched the $500 level, BNB appears to be on the verge of breaking down further.

Dropping below $500 may suggest a significant adjustment phase is approaching, whereas consistently rising above $550 might hint at a change in investor attitudes and possibly reinitiate the bullish trend.

However, the entire crypto market currently remains in a correction phase.

An encouraging sign, the recurring bullish divergence noticed in the Relative Strength Index (RSI) for the BNB/USDT pair using the Divergent indicator, provides a hint of optimism, though it’s still too early to draw definite conclusions.

BNB trading volume and market impact

Among cryptocurrencies with significant market values, BNB holds the fourth highest trading volume, accounting for a sizable share of the overall volume traded in the crypto market.

The leading role of Binance and BNB in the market implies that unfavorable information about them might cause widespread impacts across the industry. While BNB boasts a large trading volume, its growth seems to have plateaued, which raises some concerns.

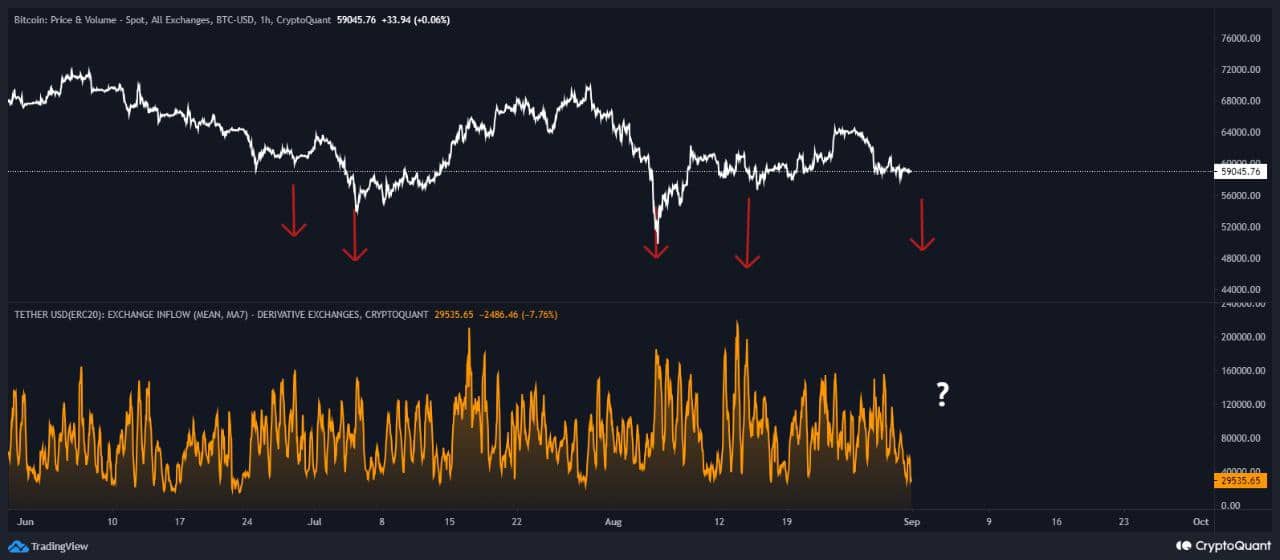

As a crypto investor, it appears that the flow of stablecoins into Binance Coin (BNB) exchanges is dwindling noticeably. This downward trend suggests that the trading volume might be remaining steady or even decreasing, which could indicate potential challenges ahead for BNB.

Read Binance (BNB) Price Prediction 2024-25

Despite Bitcoin dropping to $59,000, the inflow of stablecoins into exchanges is decreasing, indicating that investors may be uncertain that the market downturn has ended.

Refraining from using stablecoins to buy BNB at its present value intensifies my reservations about the token’s future trajectory, as I find myself questioning whether this could be a missed opportunity for potential growth.

Read More

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Solana – Long or short? Here’s the position SOL traders are taking

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Lilo & Stitch & Mission: Impossible 8 Set to Break Major Box Office Record

2024-09-03 12:08