- Ethereum experienced a notable price surge, testing the crucial $2,500 resistance level.

- Will the bulls maintain momentum, or will the bears reclaim control?

As a seasoned researcher with years of experience in the cryptocurrency market, I must admit that predicting the short-term price movements of Ethereum [ETH] is like trying to catch a greased pig in a dark room. However, based on the available data and my own observations, it seems that we’re at a crucial juncture for ETH.

During the final week of August, Ethereum [ETH] underwent a substantial drop, erasing nearly all the progress it had made in the first week of the month. Remarkably, during this initial phase, ETH approached the resistance level of $2,700.

Conversely, the pessimistic stance from earlier in September was reversed, as ETH experienced a 3% increase in the last 24 hours, reaching $2,521 at the time of reporting.

It’s interesting to note that even with rising prices, the Altcoin Season Index decreased, implying a lack of confidence among investors about the continued upward momentum.

Underpinned by growing ETH exchange reserves

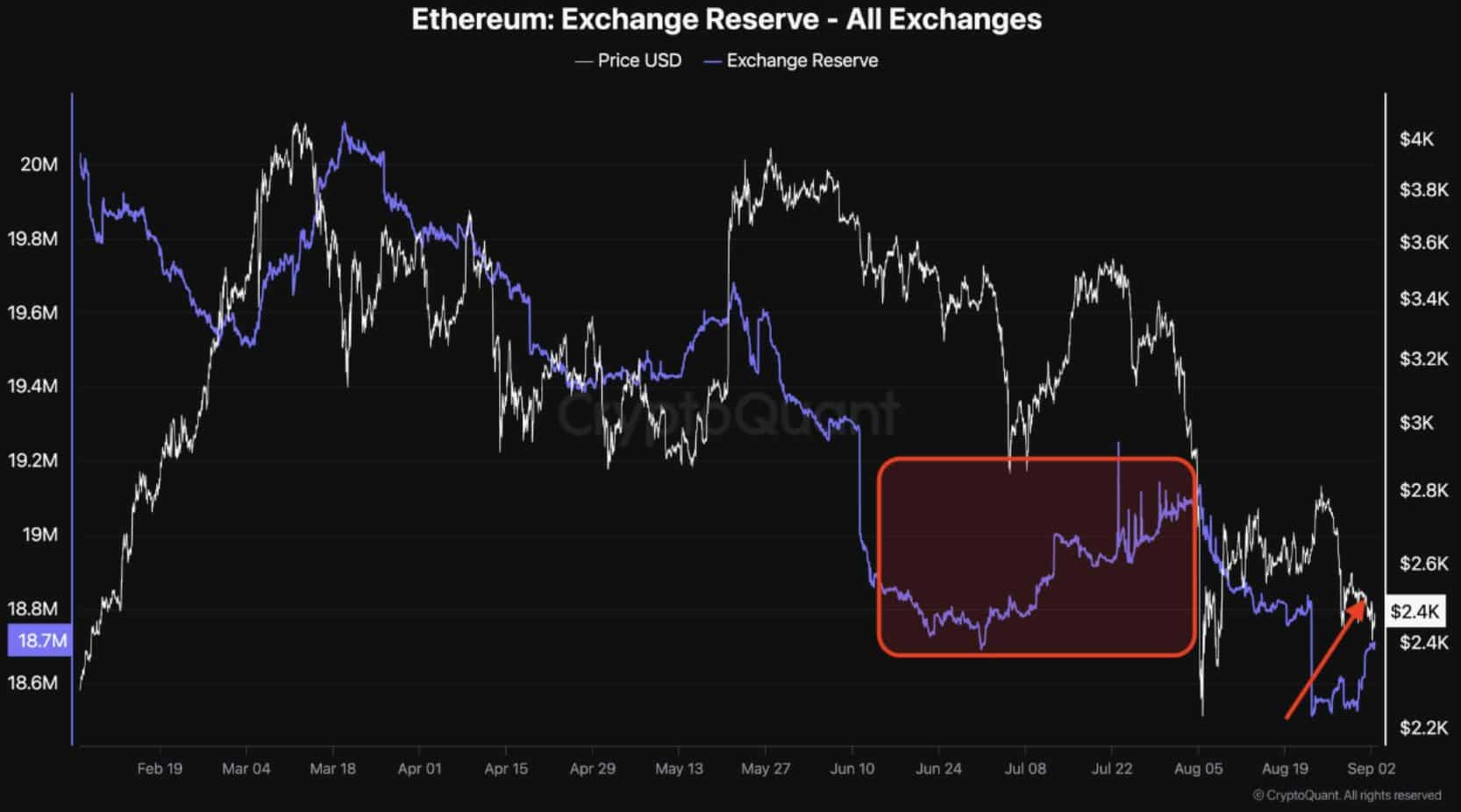

In a post, a prominent crypto analyst highlighted a significant development, suggesting the start of a distribution phase.

Essentially, the significant increase in Ethereum (ETH) exchange reserves suggests that many traders are taking advantage of the current price rise by transferring their earnings to exchanges, anticipating that the excitement might soon subside.

Based on AMBCrypto’s interpretation of the graph, every instance when Ether (ETH) has ended close to its resistance level, there’s usually a rise in the amount of Ether held in exchange reserves.

For instance, when ETH tested the $4,050 resistance earlier in March, the exchange reserves spiked from $19.5 million to $20.8 million.

In a similar fashion, as Ethereum’s (ETH) price surpassed the $2,800 barrier last month, an increase in exchange reserves created sturdy opposition, making it difficult for the bulls to drive the price further upwards.

Consequently, the price retraced to the $2,390 support level.

Since then, as a crypto investor, I’ve been anxiously waiting for a price dip, hoping it would be the start of a significant market rally. Now, with this latest 3% surge, I can’t help but wonder if this could indeed be the catalyst we’ve all been anticipating.

No assurance for a bullish upsurge

It’s not surprising that the graph indicates a substantial increase in exchange reserves, from $18.5 million to $18.7 million, on the day following the significant rise in ETH value on September 2nd.

This supports the traditional approach of securing profits when the price indicates even a minor uptick.

Instead, to combat this tendency in the algorithm, fresh traders should enter the market without selling, whereas established investors should refrain from unloading their holdings.

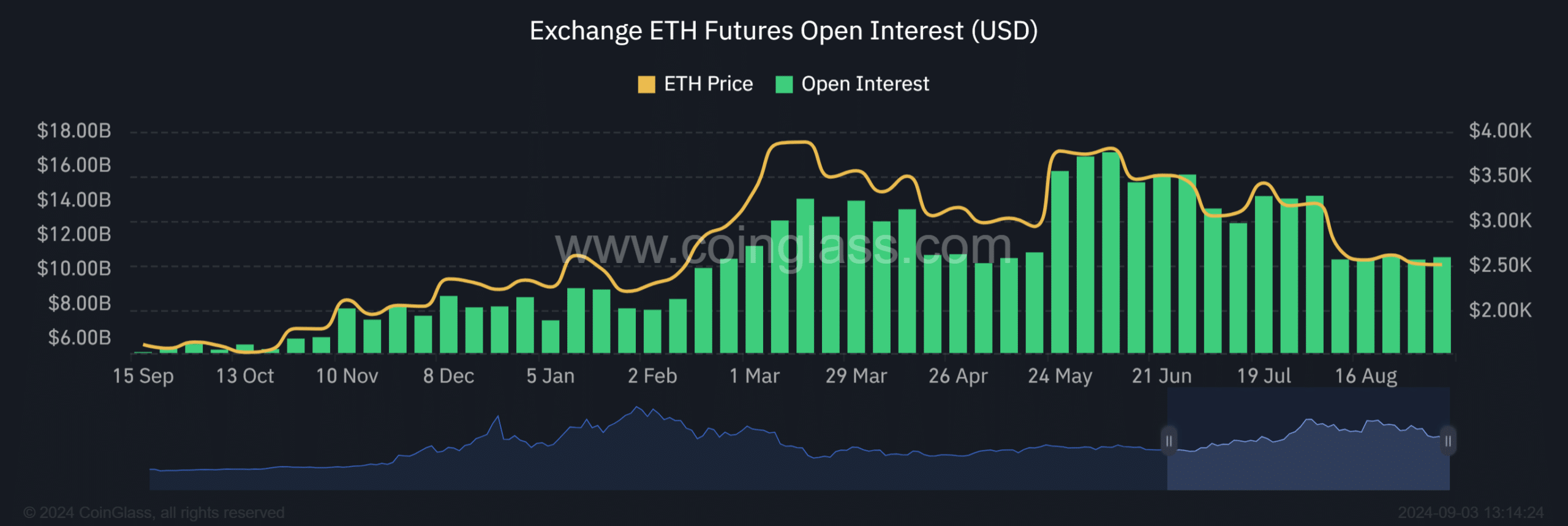

To the bulls’ relief, AMBCrypto noted an increase in Open Interest among Futures traders.

Based on the diagram, Open Interest (OI) rose to approximately 10.72 billion USD, representing a 0.37% growth compared to the 10.68 billion USD recorded the day before.

Even though there’s an increase now, a significantly larger surge in Open Interest is required to assure a prolonged upward trend.

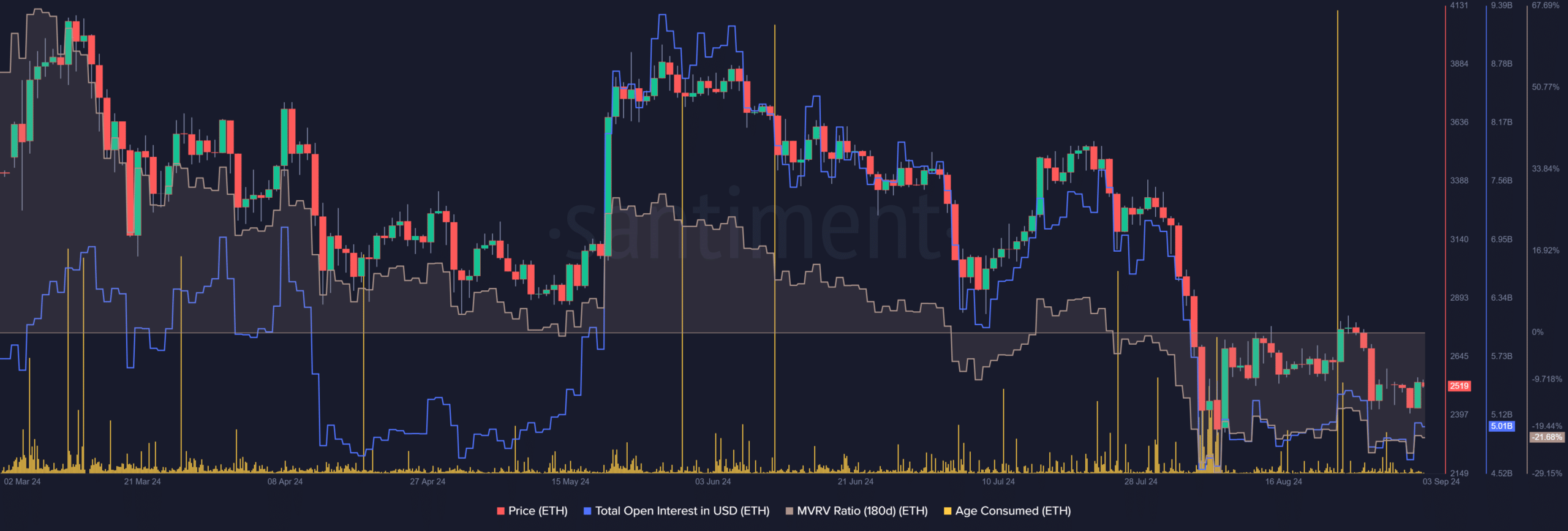

Although futures traders exhibit restrained hope about an immediate Ethereum price spike, long-term investors frequently sell a segment of their mature tokens, suggesting a downward market trend.

On August 23rd, the value skyrocketed to an astonishing $629 million, causing a subsequent drop in price.

From my perspective as a crypto investor, when the Market Value to Realized Value (MVRV) ratio for Ethereum dips below the mark, it suggests that the current market price of ETH is lower than its intrinsic value. This could imply that the asset might be undervalued, potentially opening up an opportunity for buying.

Yet, if we don’t see a substantial increase in Open Interest, it might suggest that the real worth of ETH has yet to be fully recognized.

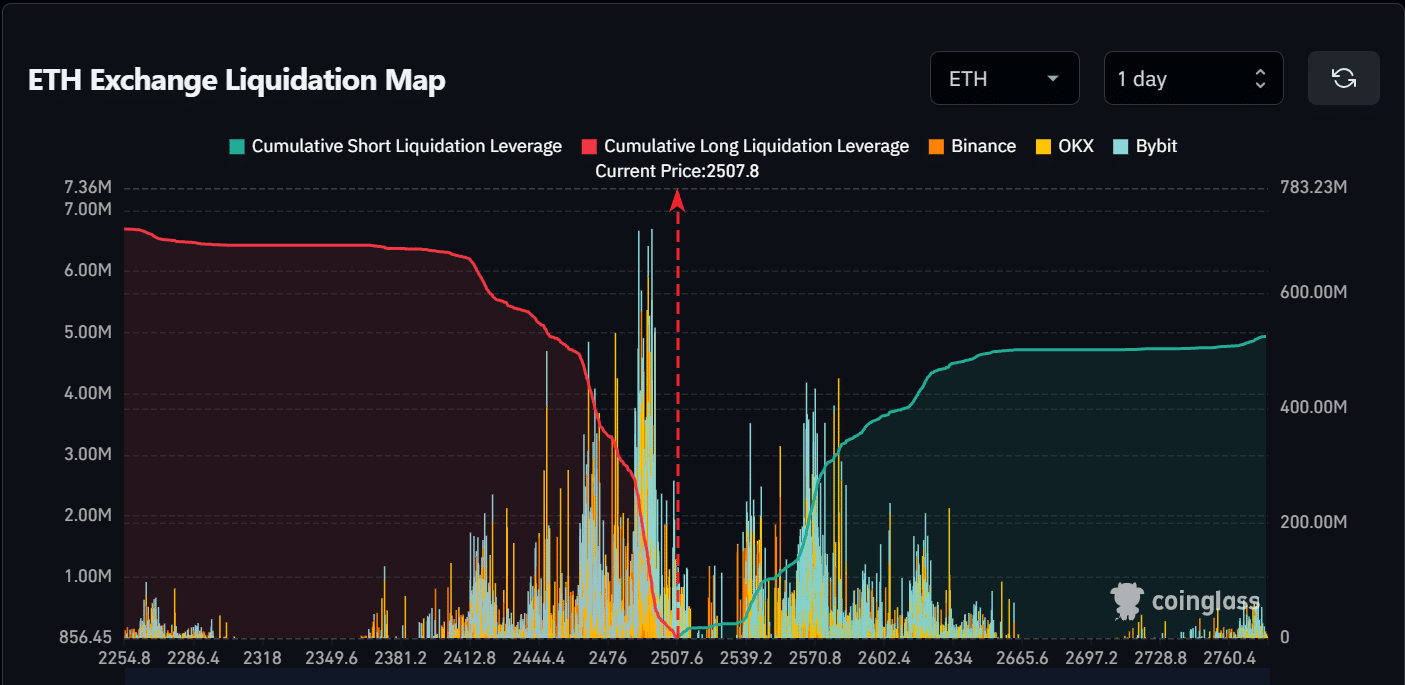

In addition, AMBCrypto pointed out that the latest 3% increase could potentially be misleading, resulting in around $34 million worth of short positions being liquidated and causing ETH to challenge the significant resistance at $2,500.

Read Ethereum’s [ETH] Price Prediction 2024–2025

According to AMBCrypto’s analysis, weak buying interest has made it less likely for a breakout to occur.

Essentially, should there be no rise in purchasing, Ethereum (ETH) might encounter approximately $40 million worth of liquidation orders if its value drops below the $2,500 support level, causing it to revert back to $2,300.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-03 18:38