-

BNB jumped by more than 5%, but technical indicators were hinting at a possible bearish divergence.

Transaction volumes on the BNB Chain have plunged by more than 33% in the last week, showing declining network activity.

As a seasoned analyst with a decade of experience in the crypto market under my belt, I must say that the recent surge in BNB is intriguing but also raises some red flags. The 5% jump is impressive, no doubt, but the technical indicators suggest a possible bearish divergence. It’s like watching a high-stakes poker game where the player keeps bluffing, and while I’d love to see them win, I can’t help but feel that the house might have something up its sleeve.

Among the ten leading cryptocurrencies based on market capitalization, Binance Coin (BNB) saw the most significant increase, climbing over 5% within the past 24 hours.

At the point of this writing, BNB was priced at $533, marking a substantial increase from its 24-hour low of $503. However, these gains could potentially be undone by a bearish reversal if the bullish momentum in the wider market doesn’t sustain.

Will BNB’s bullish momentum hold?

The price of BNB has been mirroring that of Bitcoin [BTC]. Therefore, the likelihood of this token sustaining gains depends on whether the broader market maintains the positive sentiment.

On BNB‘s daily chart, there appeared to be a potential sign of a downward trend (bearish divergence). Despite an increase in price, the technical indicators suggested that the upward momentum might be insufficient, following BNB’s formation of a double-top structure on the same daily chart. In simpler terms, while the price was rising, the strength of the uptrend seemed questionable due to the appearance of a double-top pattern on the daily chart.

Initially, BNB reached its initial high in late July as it surged upward from a starting point under $500, challenging a significant barrier at $600. Subsequently, a descending trend took hold, resulting in the formation of a support line around $464.

The uptrend resumed before failing again after hitting $600.

If BNB drops below $464, it might signal a downward trend (bearish breakout). But if the present upward movement continues and BNB manages to surpass the resistance level beyond its second high peak, the bearish assumption could be disproved.

47 on the Relative Strength Index indicates that while there have been gains, the upper hand still lies with the sellers. For a bullish momentum to be confirmed and the double-top pattern disproved, the RSI line should cross above its signal line.

A significant signal suggesting a decline in the upward trend was the Directional Movement Index, or DMI for short. In this case, the positive DI (represented by blue) consistently stayed lower than the negative DI (represented by orange). This could be an early sign of a possible price reversal towards a downturn.

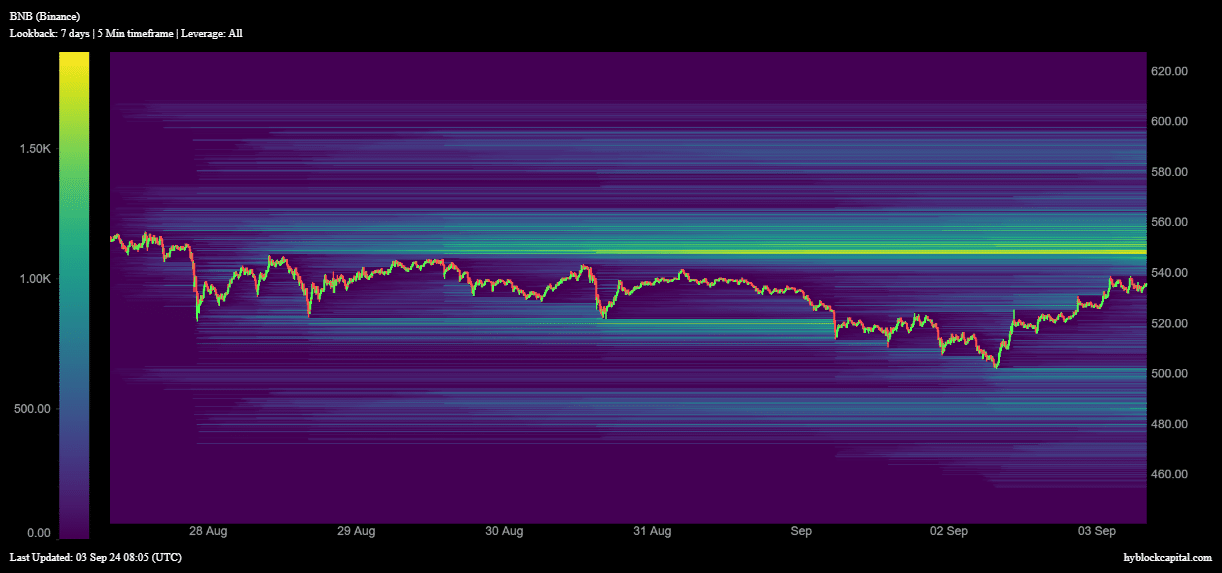

According to data from Hyblock Capital, there was a significant number of sell-offs occurring around the price point of $548. As a result, this price level may serve as a formidable resistance point if traders decide to cash out their profits when BNB nears $548 in an attempt to minimize potential losses during the rally.

BNB Chain sees declining usage

The BNB Chain has also seen reduced usage, which could further hamper BNB’s ability to rally.

According to data from DappRadar, there’s been a 25% decrease in the number of unique active wallets on the network over the past week. Furthermore, trading volumes have plummeted by more than 30%, dropping from approximately $850 million to $350 million.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

This declining network usage could show reduced market interest in BNB.

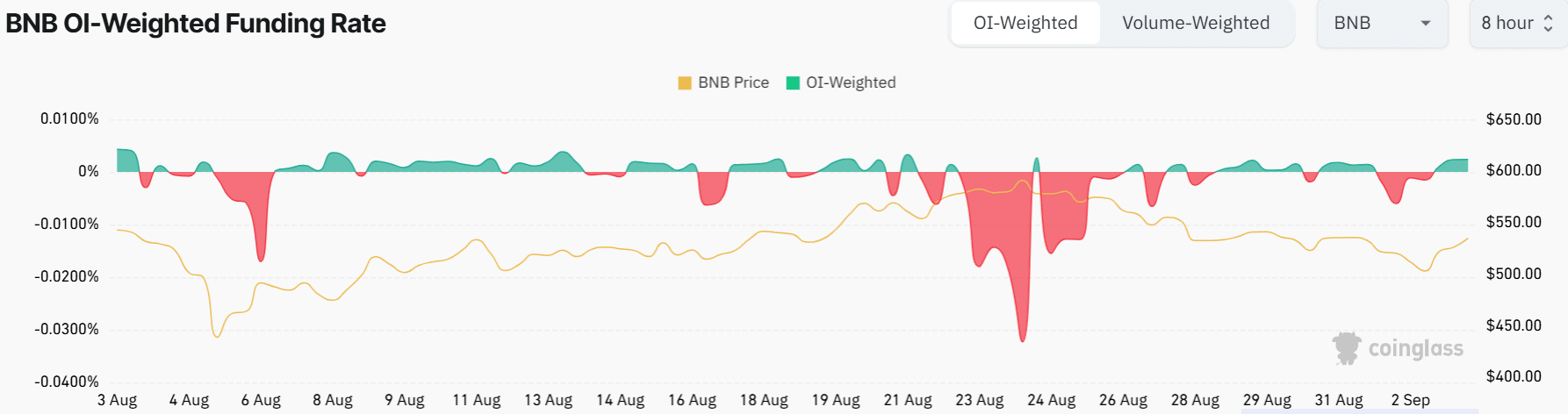

Data from Coinglass showed that BNB’s Funding Rates have been predominantly negative over the past month, showing a general bearish sentiment among traders.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-04 01:15