- Are Bitcoin whales really accumulating? We explore on-chain data to find some answers.

- Bitcoin longs could be at risk of liquidations if the bears assume dominance.

As a seasoned Bitcoin investor with over a decade of experience under my belt, I can confidently say that the idea of whales accumulating BTC is not as straightforward as it seems.

On September 2nd, Bitcoin (BTC) experienced a jump of more than 3% in its trading session. This uptick can be partly attributed to enthusiasm generated by news that large-scale Bitcoin holders, often referred to as “whales”, were buying more BTC.

However, its inability to maintain strong momentum calls into question those reports.

As a cryptocurrency investor, I’ve noticed something interesting according to Lookonchain. Despite the fact that Bitcoin has been consistently flowing out of wallets into exchanges, indicating health among crypto holders, it seems that some whales have been transferring Bitcoin onto these same exchanges. This could be an attempt to stir up more market volatility, given their substantial influence on the price movements.

Even though these reports suggest otherwise, AMBCrypto too noticed outflows (withdrawals) from Bitcoin ETFs, a situation that doesn’t necessarily boost investor confidence.

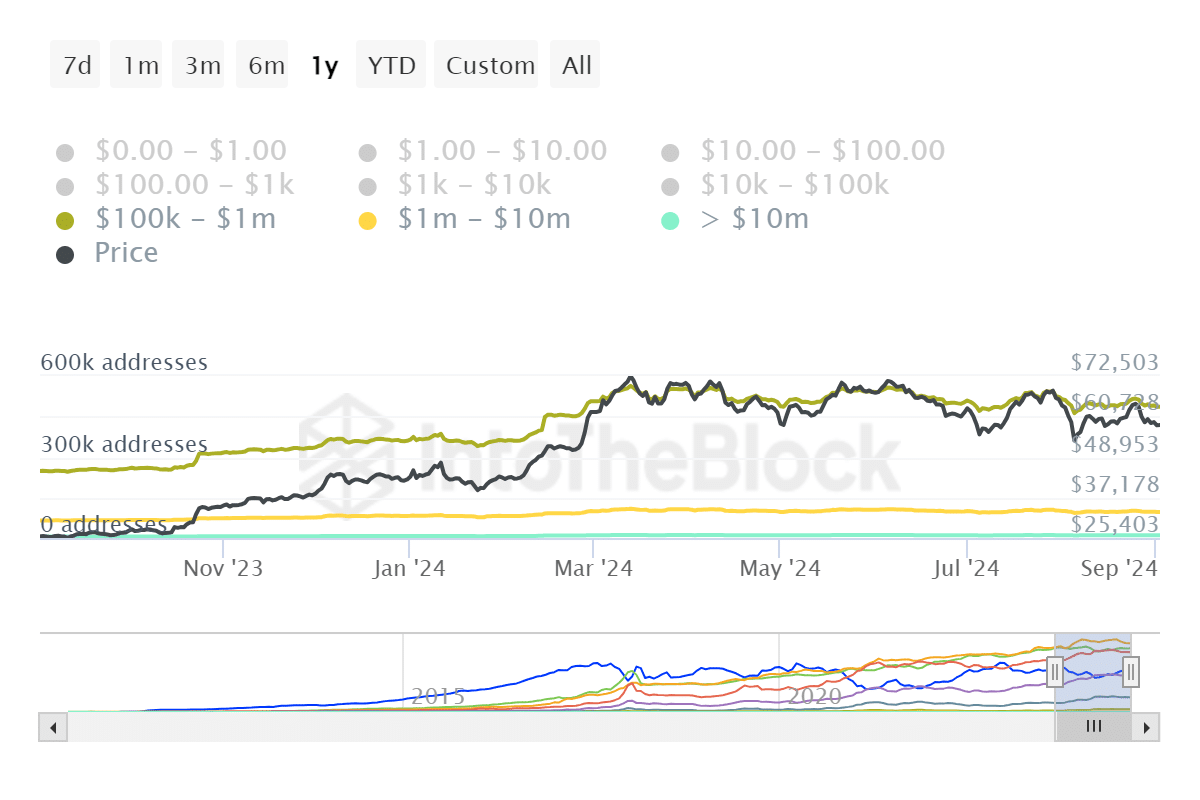

These findings warranted an assessment of Bitcoin addresses to establish the level of accumulation.

On August 25th, there were approximately 516,000 addresses holding Bitcoin valued between $100,000 and $1 million. By September 2nd, that number had decreased to over 486,500 addresses.

The number of Bitcoin addresses holding between $1 million and $10 million in value decreased from 100,540 to 96,150 over the specified timeframe.

The number of wallets containing over $10 million in Bitcoin decreased from 100,440 to 100,000 wallets.

A Bitcoin price inducement set-up?

It appears that numerous whales were selling off their holdings, thereby increasing selling pressure. This could suggest that the recent excitement might have been an intentional manipulation, as the market was inflated to create a favorable environment for sellers, allowing them to exit with ease.

This would explain Bitcoin’s limited upside and its struggle to sustain recovery above $60,000.

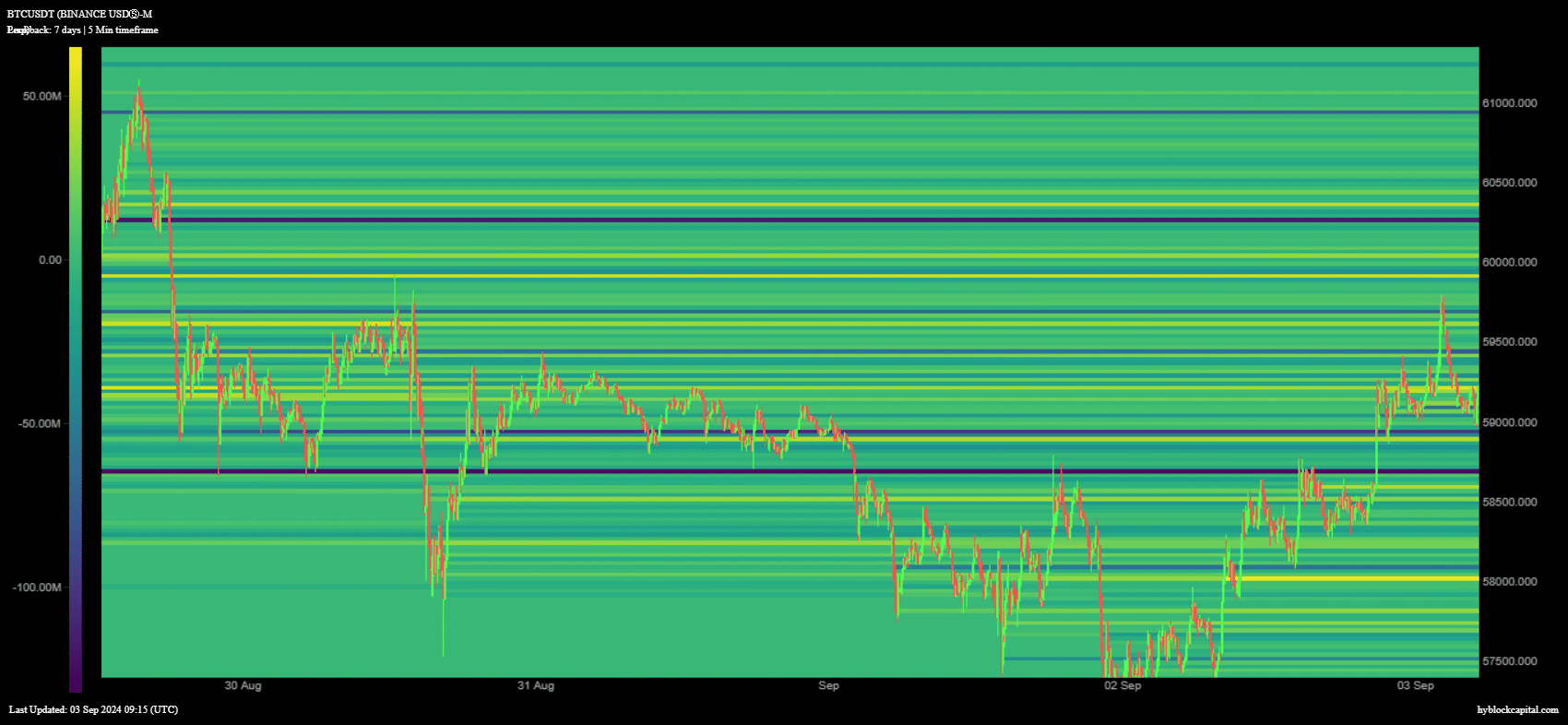

As a researcher, I’ve noticed an interesting pattern: Increased incentive often translates into a heightened desire for leveraged investments. On the 2nd of August, we observed a significant accumulation of approximately 25.582 million net long positions, which appeared to cluster near the market bottom.

The figure was higher at 52.82 million net longs at the $58,000 price level.

The increase in long positions suggests a rising optimism about further price increases. At the same time, there’s been a renewed interest in using borrowed funds (leverage).

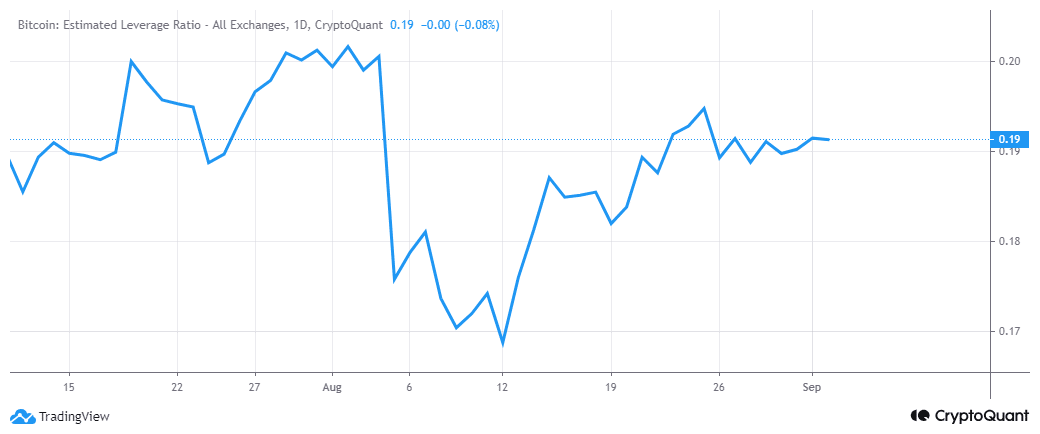

Bitcoin’s estimated leverage ratio bottomed out on the 12th of August, followed by a pivot.

As a researcher, I’ve noticed an intriguing trend in the market. It appears that the market is increasingly adopting higher levels of leverage. This could indicate that we might be moving towards a situation where heavy liquidations could become a possibility if another financial crash were to occur.

Bitcoin exchanged hands at $58,861 at press time, after a 0.47% discount in the last 24 hours.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This suggests that the market is finding it difficult to continue its upward trend, and this correlates with the selling force from large investors or ‘whales’ as previously noticed. Furthermore, it indicates a potential for more sell-offs if the price falls even further, possibly leading to liquidations.

Over the coming day, Bitcoin could experience significant developments because the financial world is on edge, waiting for the upcoming Federal Reserve (FED) announcement about changes to interest rates. This situation might lead to increased market volatility during the remainder of the week.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-04 02:16