-

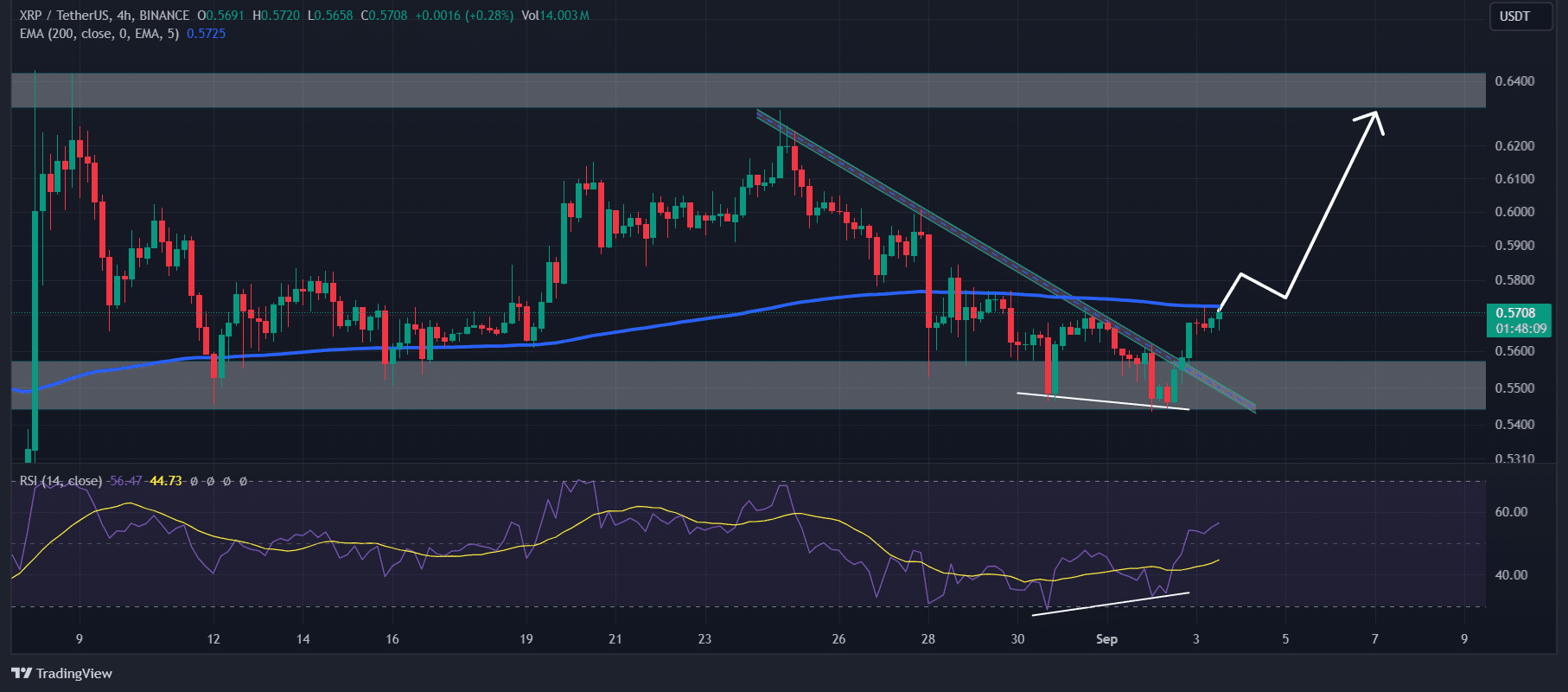

XRP’s Relative Strength Index (RSI) formed a bullish divergence, signaling a bullish trend.

Following the breakout of the descending trendline there is a high possibility that XRP could soar by 15%.

As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I can confidently say that the recent bullish signs for XRP are hard to ignore. The trendline breakout and the bullish divergence on its Relative Strength Index (RSI) indicate a strong possibility of XRP soaring by up to 15% in the near future.

Despite the overall pessimistic outlook in the current financial climate, Ripple (XRP) appears optimistic. Its internal data suggests a significant increase in its value, hinting at an imminent surge.

Beginning from August 2024 onwards, XRP, among other prominent digital currencies, faced a steep fall in their values. This decline might be attributed to the substantial decrease in the value of Bitcoin [BTC].

XRP could rise by 15%

Examining the crucial on-chain statistics of XRP, a recent breakdown of its trendline and a positive divergence on the graph indicate a favorable perspective for the digital token, hinting at potential price increases.

However, there is a high possibility that it could soar by 15% in the coming days.

Based on AMBCrypto’s examination, XRP has found recent support at the significant level of approximately $0.55 and has aligned with the 200 Exponential Moving Average (EMA) on a day-to-day chart perspective.

Starting from July 2024, I’ve observed that the XRP market consistently bounces back at a specific support level. Each time it does so, there’s a noticeable increase in its price, often amounting to approximately 14%.

On this occasion, it seems quite likely that history may reoccur, potentially propelling XRP to surpass $0.65 and possibly climb higher.

Over the past four hours, Ripple (XRP) has breached its trendline, indicating a potential increase in value. Furthermore, its Relative Strength Index (RSI) displayed a bullish pattern, suggesting an upward trend.

In the midst of the latest market slump, I’ve noticed an intriguing pattern with XRP. Unlike its falling price, which reached a new low (referred to as a “lower low”), its Relative Strength Index (RSI) has been creating higher bottoms (or “higher lows”). This discrepancy between the two trends is known as a bullish divergence, and it’s often seen as a potential buy signal by seasoned traders and investors.

On-chain metrics

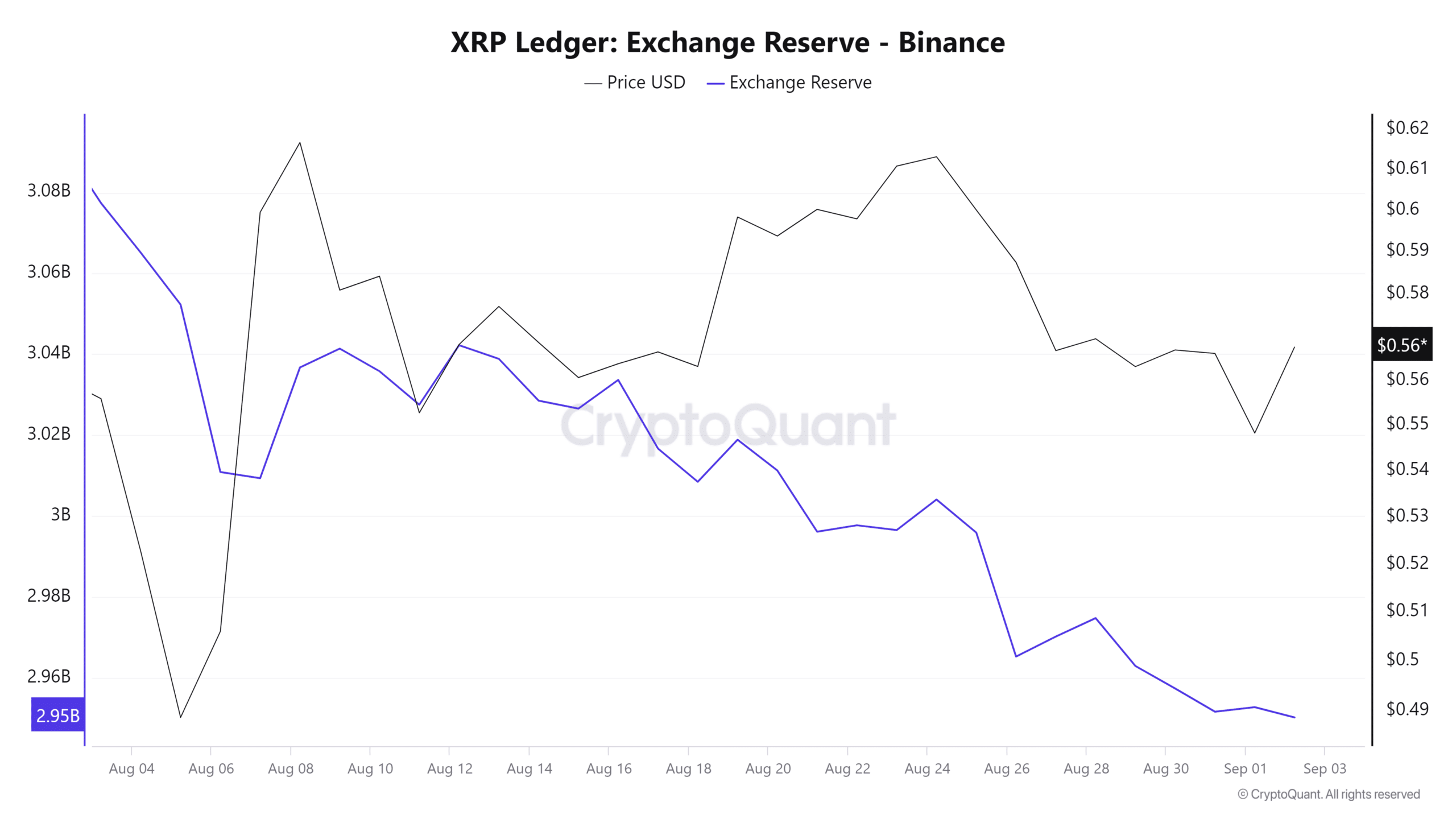

As an analyst, I’ve noticed that, based on recent data from CryptoQuant, the reserve of XRP held by exchanges has reached a record low. This decrease might suggest a bullish outlook for XRP, as lower exchange reserves could indicate increased holder activity and potential demand growth.

A drop in available exchange tokens suggests that investors or large players might be buying these tokens off the exchanges, causing the reserve amount to steadily diminish.

Moreover, the inflow of XRP trades on CryptoQuant was relatively smaller compared to usual trading days, suggesting potential for buying opportunities.

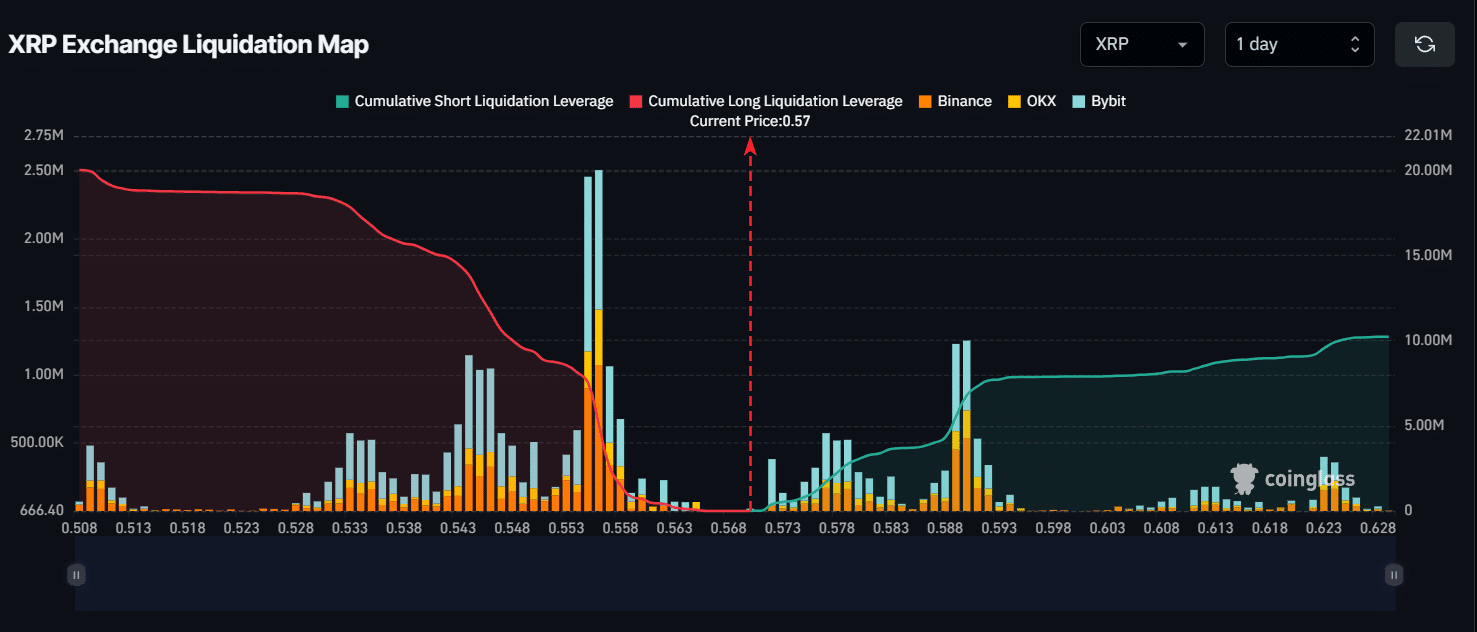

As an analyst, I’m observing that the key liquidation points currently hover around the $0.555 mark on the downside and $0.59 on the upside. The trading activity suggests that traders are heavily leveraged at these levels based on the data from CoinGlass. This information might be useful for your strategy considering the current market dynamics.

If the market mood shifts and the XRP value reaches approximately $0.59, many near $6.8 million-valued short positions will be closed down.

Read Ripple’s [XRP] Price Prediction 2024–2025

If the market continues to be bearish and the price dips down to around $0.555, it’s likely that roughly $7.6 million in long positions will get closed out. As a crypto investor, I always keep an eye on such situations to manage my own risks effectively.

Therefore, at the current moment, bulls are controlling the market, potentially offering an opportunity for those with long positions to profit by liquidating any existing short positions.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-09-04 04:09