-

Increased liquidity and a prevailing bullish pattern contribute to the anticipated upward movement.

If buying pressure persists, NEAR could climb to $5.2 and potentially extend to $8.

As a seasoned market analyst with over two decades of trading under my belt, I find myself drawn to NEAR Protocol [NEAR] due to its resilience amidst recent market downturns. Despite the 16.48% drop over the past week and the 10.61% decline over the last four weeks, the token’s potential shift towards bullish control is evident in its 0.43% decrease in the last 24 hours.

Despite bearing the brunt of recent market downturns—with a 16.48% drop over the past week and a 10.61% decline over the last four weeks— NEAR Protocol [NEAR] has shown signs of resilience. A modest 0.43% decrease in the last 24 hours signals a potential shift towards bullish control.

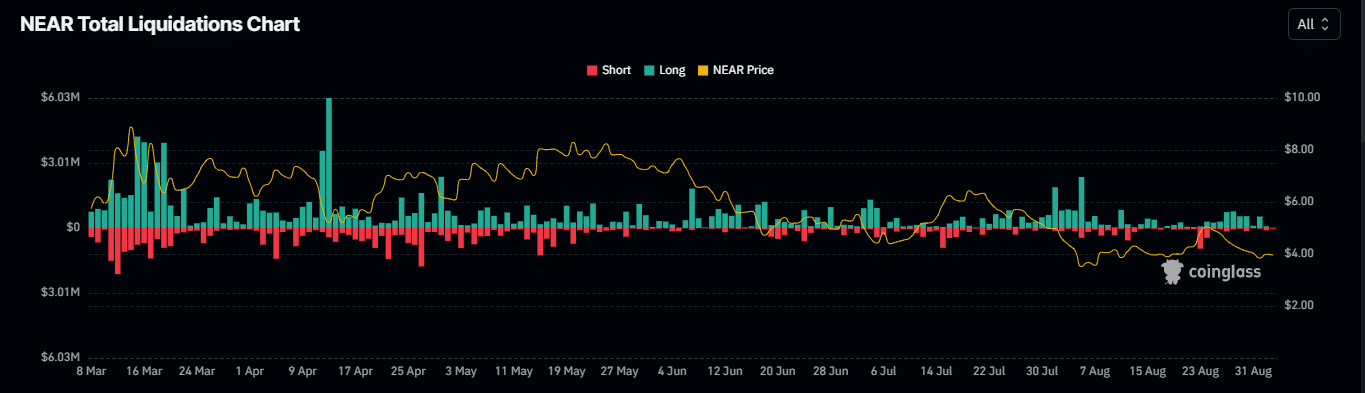

Short traders misjudge market dynamics

1. The rephrased object is thepriceshouldbeexpectedtofall for:

Over the past day, positions that were betted on a decrease in value for NEAR amounting to $114,860 have been closed, indicating an increasing number of traders anticipating a price rise.

Currently, AMBCrypto has delved into the topic of where NEAR might be heading next, given the rising trend in buying interest.

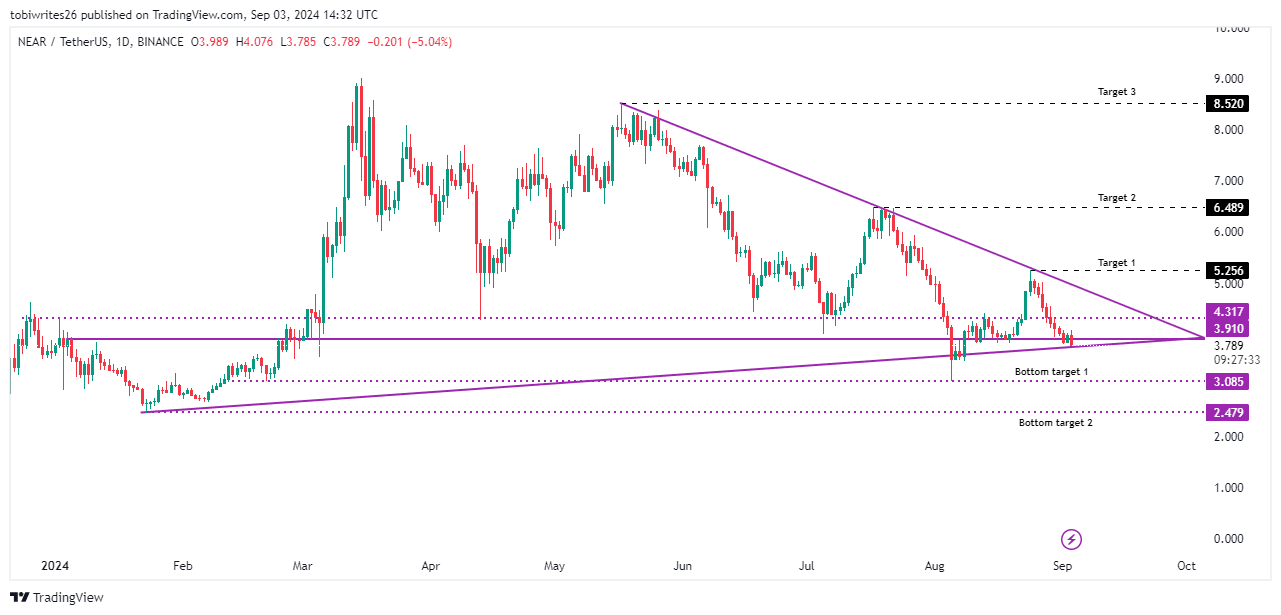

NEAR set for a rally to $5.2, with more gains on the horizon

According to the technical analysis provided by AMBCrypto, there seems to be a growing optimism among traders due to the presence of a symmetrical triangle and other positive chart formations.

In one scenario, the original investor’s roleiss assumedtobeasinvestor’srolecouldbeinvestedat$6.628,whilstthenewonewouldbeexpectedtoarriveat$7.58,assumingthatitscatedtobeexpectedtomighto,enjoyasut to make:

If the demand continues to grow more vigorously, it might push NEAR‘s price upwards, potentially reaching future milestones of around $6.489 and $8.520, as these levels hold substantial market activity.

Instead, if market conditions change and there’s a higher number of sellers, the token might pull back to potential support areas around $3.085 or even down to $2.479.

Buyers recognize NEAR as undervalued

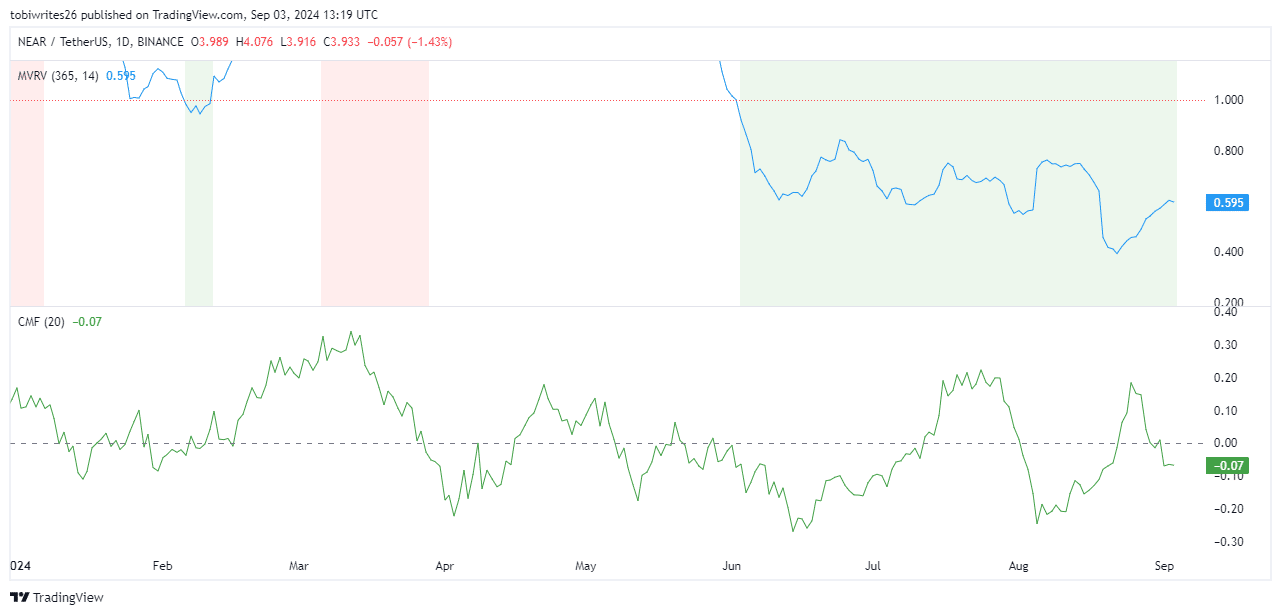

According to AMBCrypto’s assessment, utilizing the Chaikin Money Flow (CMF) and Market Value to Realized Value (MVRV) metrics, it appears that the cryptocurrency NEAR might be trading below its true worth at present.

The MVRV ratio, which compares market capitalization to realized capitalization, indicates undervaluation when below 1. This suggests a potential reversal in the asset’s price direction, which is currently the case with NEAR as it reads at 0.595.

Realistic or not, here’s NEAR’s market cap in BTC’s terms

Currently, the Capital Movement Fund (CMF) – a gauge for accumulation and distribution – is below zero, yet it’s showing signs of stabilizing, suggesting that buying and selling forces are roughly equal at this time.

Typically, these circumstances set the stage for either a market surge (breakout) or a market drop (breakdown). A breakout might strengthen investor optimism, whereas a breakdown may trigger a downward trend in prices.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Solo Leveling Arise Tawata Kanae Guide

2024-09-04 11:04