-

The TON blockchain touted a record-breaking milestone, reaching 1 billion transactional volume.

Does this signal an impending price correction?

As a seasoned analyst with over two decades of experience in the ever-evolving world of cryptocurrencies, I’ve witnessed bull runs and bear markets more times than I care to remember. The recent surge in transaction volume on the TON blockchain is indeed impressive, but it seems the market remains skeptical.

Since the end of August, Toncoin [TON] has been on a decline, falling by approximately 28% to reach $4.884. This decrease is believed to be influenced by the ongoing controversies regarding Telegram and the recent dip in Bitcoin‘s [BTC] value

Recently, the massive influx of over a billion transactions on the Toncoin blockchain has halted any attempt to test the $4.5 support level I was hoping for. As AMBCrypto pointed out, this surge could potentially push Toncoin back down to its February low of $2.06

After the pullback, TON rallied close to the $9 resistance.

As TON approaches $4.5 once more, AMBCrypto delves into the possibility that bulls might thwart a reoccurrence of the downturn witnessed in February, or whether Bitcoin could drive TON towards a bear market instead

BTC volatility limits TON rebound

In the face of broader market turbulence, triggered by Bitcoin falling below its $57 support point, advocates of TON might have to exert more effort to spark a recovery

The TON blockchain recorded approximately 1.02 billion transactions, with around half taking place over the past three months. This clearly demonstrates an increase in user interaction and activity on the platform

Nevertheless, though this was a significant historical achievement, the day-to-day purchasing volume fell short of overly optimistic forecasts

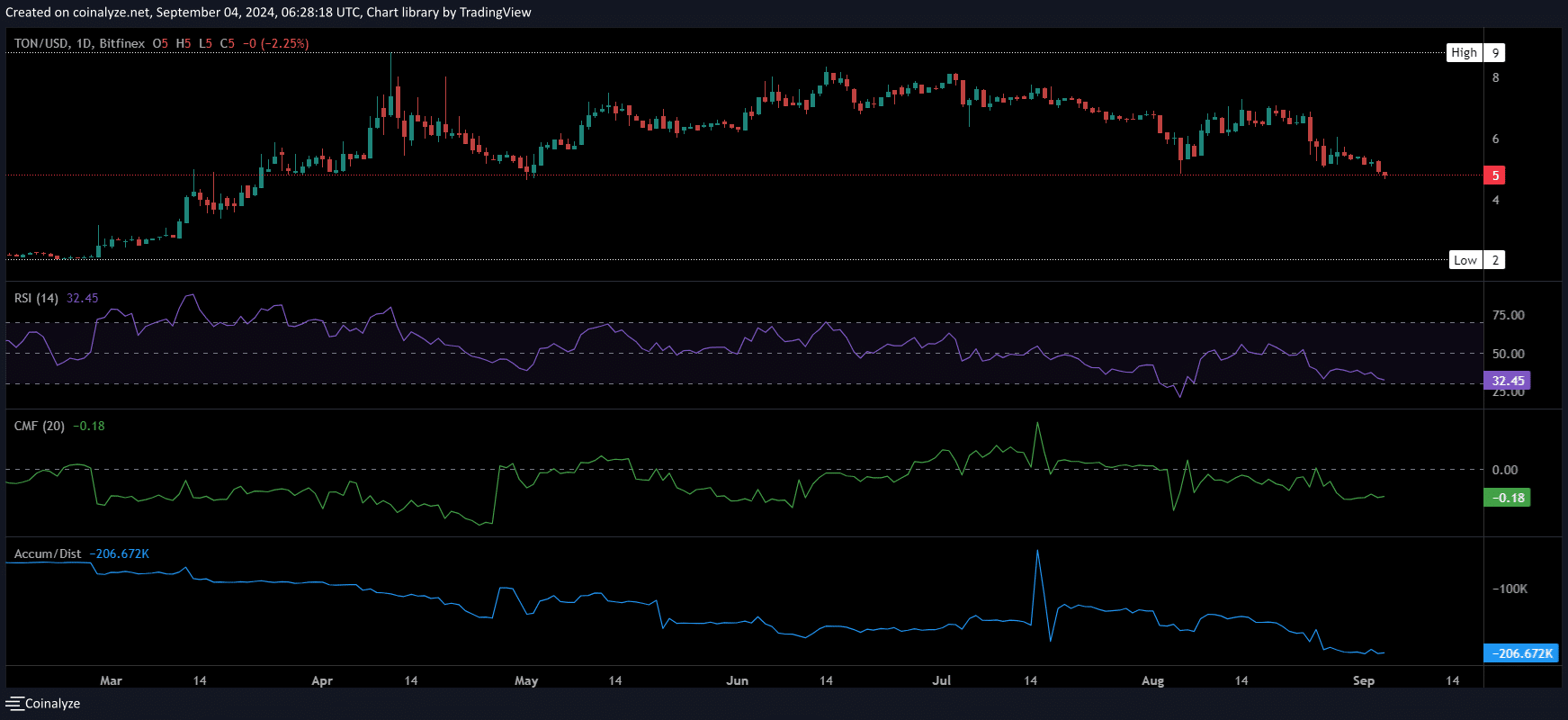

Source : Coinalyze

In simple terms, the graph indicated a significant increase in TON‘s price starting late February, peaking at around $9 by mid-April. The On-Balance Volume (OBV) increased from 80,000 to 216,000 during this period, suggesting a strong upward trend. Additionally, the Relative Strength Index (RSI) reached 80, indicating that TON was in an overbought state, meaning it had risen too quickly and might be due for a correction

Beginning in early August, an increase in OBV and CMF propelled a significant two-week rise in TON, but this upward trend was interrupted by the influence of BTC

Essentially, there have been repeated attempts by bulls (market buyers) to drive up the price of TON, which is being reinforced by substantial trading volume and heavy transaction activity on the TON blockchain

Despite bullish attempts, AMBCrypto observes that high market volatility due to Bitcoin has left investors wary. This wariness is reflected in an oversold Relative Strength Index (RSI), causing a decrease in capital inflow even with these positive efforts. In other words, there’s a question as to whether we might see a price recovery based on current chart trends

Recent whale activity

Interestingly, whales hold 68.88% of the large TON holdings, totaling approximately $3.24 billion.

The remainder is split between retail and institutional investors, with the latter holding 26.53% of the remaining large TON holdings.

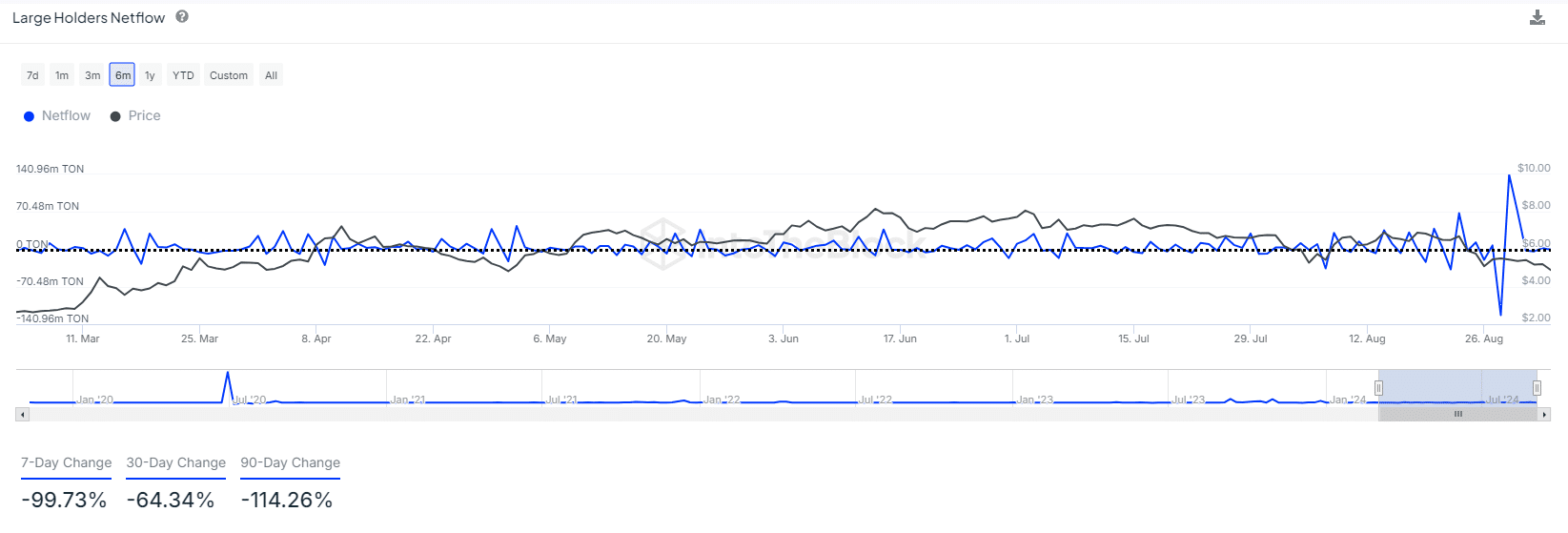

Over the past five months, I’ve noticed that big players in the crypto market have been mostly holding onto their investments, making fewer transactions than usual

Source : IntoTheBlock

However, the chart revealed striking activity on the TON blockchain in the last few days of August.

On the 29th of August, significant amounts of around $140 million in TON were transferred to exchanges by major stakeholders. This action led to a drop in the TON’s value exceeding 2%, observed the next day

According to AMBCrypto, these net outflows occurred during Bitcoin’s recent price drop, and it seems that many people consider September as a typically unpredictable and turbulent month in the cryptocurrency market

Essentially, the significant number of transactions (about 1 billion) on the TON blockchain got overshadowed due to the general market instability, compelling major stakeholders to sell off their assets prematurely in order to avoid potential losses

Additionally, should the market continue to fluctuate, it could be the bulls who lose ground, potentially allowing bears to strengthen their grip and drive TON‘s price below the $4.5 resistance level – Who appears to have the advantage in this situation?

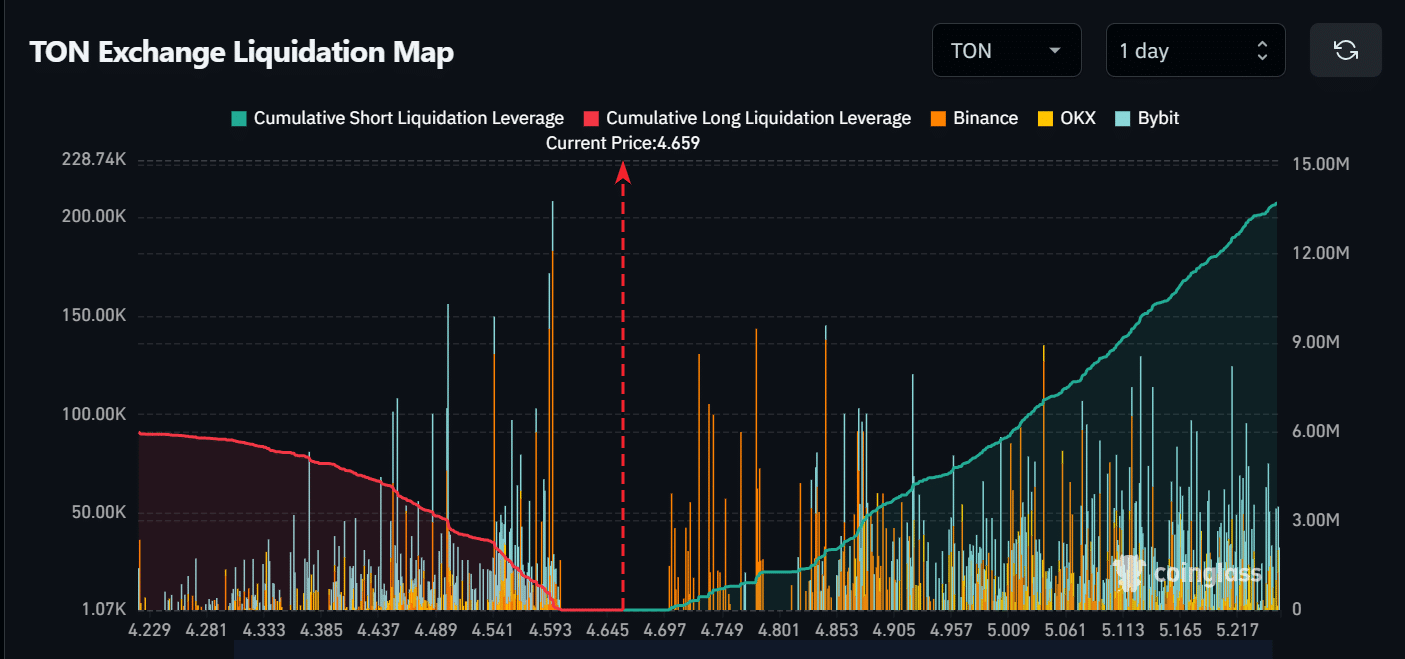

TON blockchain volatility favors short positions

According to AMBCrypto’s study, if the price trend of TON keeps going downward, even with a significant number of transactions on the TON blockchain reaching new records, potential long liquidations worth approximately $332,000 might take place when it approaches the $4.5 support level

Source : Coinglass

Realistic or not, here’s TON market cap in BTC’s terms

Essentially, if market fluctuations continue in the long run, recovering TON could prove difficult. If the bulls are victorious, TON may potentially scale up to the $5.2 barrier; however, should they fail, TON might slide back down towards the $4.2 level instead

Currently, the odds seem to favor short position holders.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Here’s What the Dance Moms Cast Is Up to Now

2024-09-04 18:17