-

U.S. Bitcoin ETF outflows continued into the new week.

BTC price has remained muted amid weak demand from U.S. investors.

As a seasoned analyst with extensive knowledge of the crypto market, I find myself intrigued by the current state of affairs regarding Bitcoin [BTC]. Here’s the rest of Q4 might just be the strongest bullish seasonality we’ve ever seen, according to a crypto trading firm.

=pro_r_q=pro_r_p_r_r_q_=pro_r_p_r_q=pro_r_q_r_p_r_p_r_pro_r_=pro_q_r_pro_r_p_r_pro_=pro_r_x_x_pro_r_pr_r_pro_r_q_r_r_pro_r_pro_r_pro_r_pro_r_pro_r_pro_r_pro_r_pro_r_pro_r_pro_r_pro_r_pro_r_pro_r_pro_pro_pro_r_pro_r_pro_r_pro_r_pro_r_=pro_r_pro_pro_r_pro_r_pro_r_pro_r_pro_pro_r_pro_r_pro_pro_pr_pro_r_pro_pro_pro_r_pro_pro_r_pro_pro_pro_r_pro_pro_=pro_r_pro_r_pro_r_pro_pro_pro_pro_r_pro_pro_r_pro_r_pro_r_pro_r_pro_r_pro_pro_r_pro_r_pro_=pro_pro_r_pro_r_pro_r_pro_pro_r_pro_r_pro_pro_r_pro_r_pro_r_pro_r_pro_pro_pro_r_pro_r_pro_r_pro_r_pro_r_pro_r_pro_r_pro_r_pro_r_pro_r_pro_r_pro_r_pro_r

function0:

,270,281,292

7

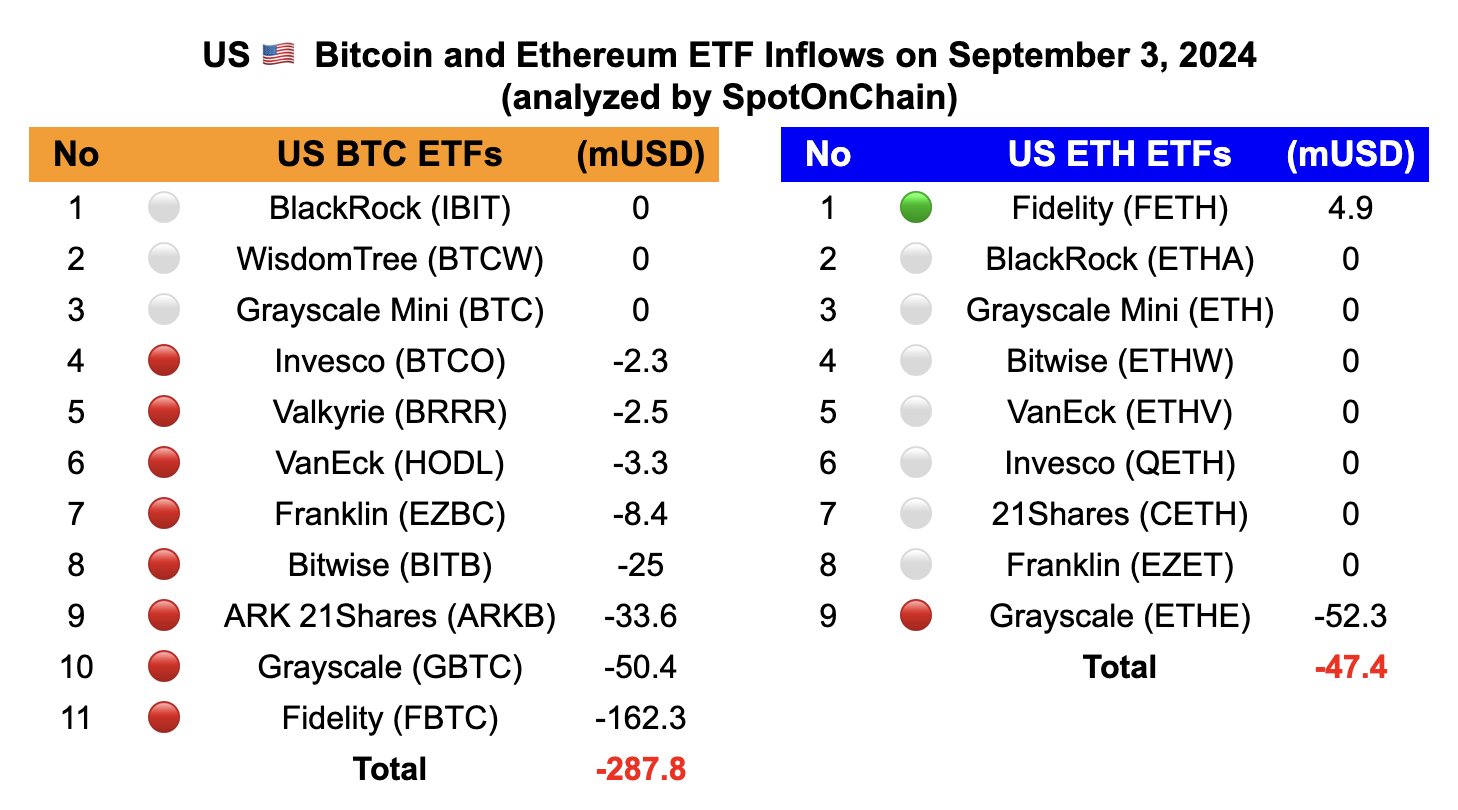

BTC ETF investors’ risk-off mode persist

6273568910

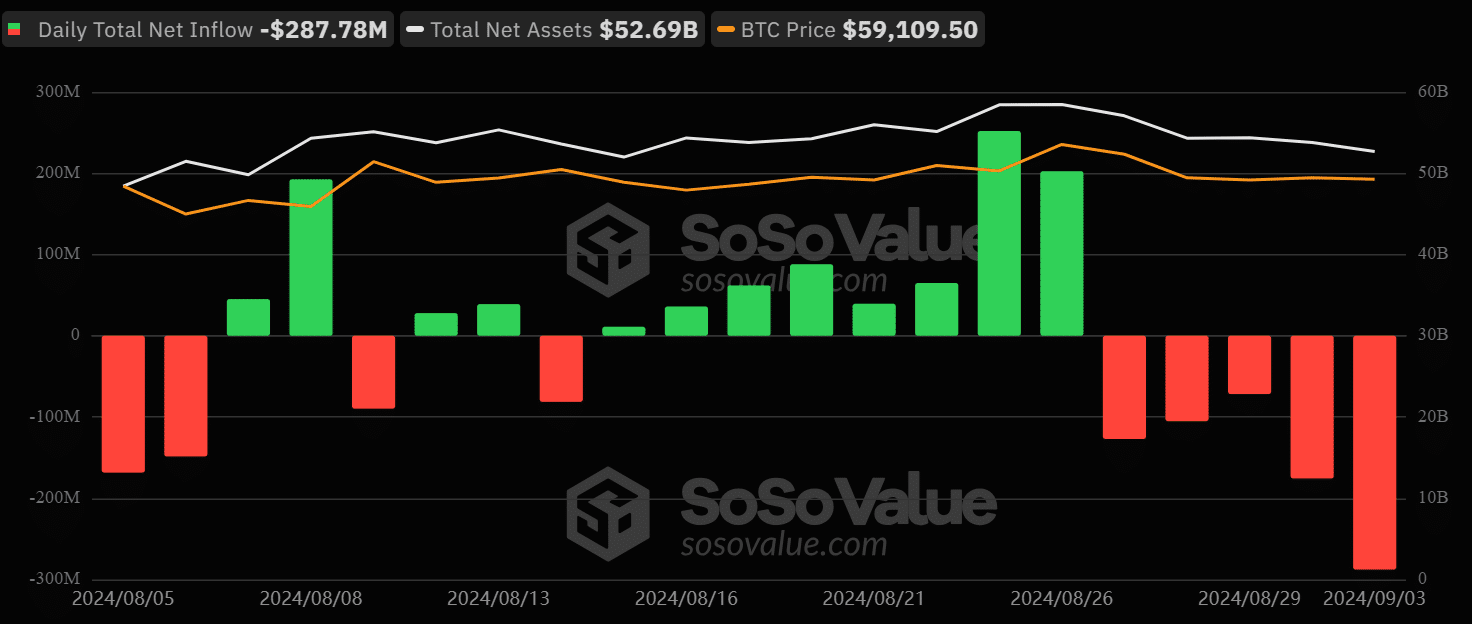

Investor behavior towards ETFs remained cautious as they continued to adopt a risk-averse stance into this current week. Previous data shows that last week, these investment products collectively experienced an inflow decrease of approximately $277 million

BTC’s price has remained muted amidst sustained BTC ETF outflows.

Since last week, the digital asset has dropped below $60K and weakened further as the risk-off mode persists across the market. BTC was valued at $56.6K at press time, down over 12% from a recent high of $64K.

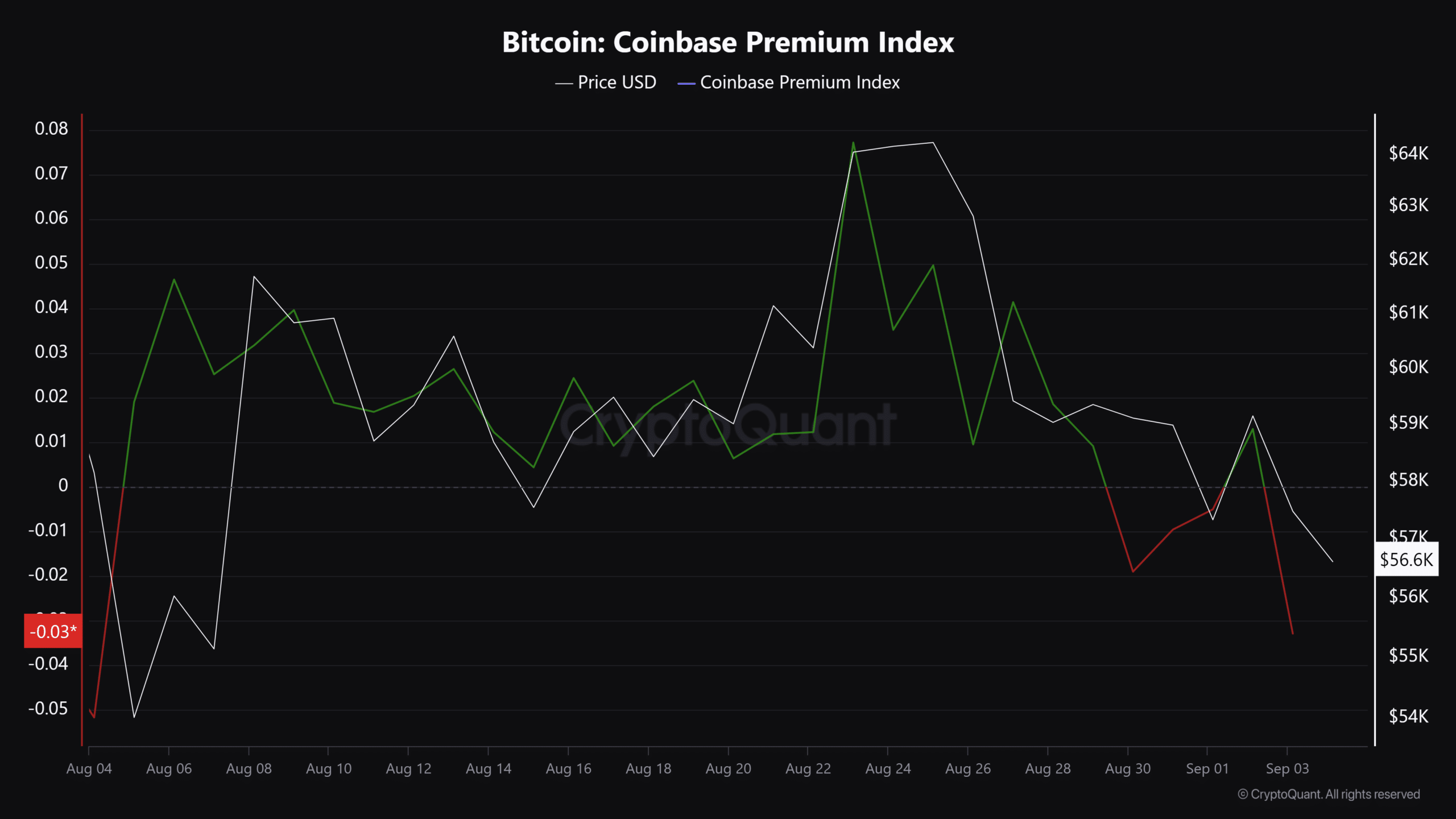

In simpler terms, a decrease in interest from American investors might temporarily affect the value of cryptocurrencies

According to the Coinbase Premium Index, a measure that follows investor interest in Bitcoin (BTC), the price of BTC tends to rise significantly when there’s high demand coming from the United States

However, the weak demand (marked by red) has exposed BTC to downward pressure since late August. A substantial reversal could only happen if demand from U.S. investors showed a remarkable recovery.

For now, many experts like QCP Capital have forecasted that Bitcoin might show a subpar performance in September, considering past patterns

Based on information from a cryptocurrency trading company, it’s possible that Bitcoin might initiate a significant surge during October and continue through the end of Q4, as suggested by historical trends and insights from the options market

‘While other months may have less, October tends to show the most bullish trends… This pattern in the market could be behind the frequent purchases of call options, as we’ve seen another 150 times worth of 80,000 December calls being bought in the Asian morning.’

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

2024-09-04 22:16