-

Solana behaved like a more of a volatile version of Ethereum until press time.

Pump.Fun and institutions impacted price of SOL.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of volatility and market cycles. Looking at Solana [SOL], it’s reminiscent of Ethereum [ETH] on steroids – volatile but with immense potential.

In an upcoming bull run, it’s predicted that Solana (SOL) could outshine many other altcoins, especially if there’s a significant increase in the value of Bitcoin (BTC)

As a crypto investor, I’ve noticed that Solana is earning a notable reputation for being highly user-friendly, which puts it in the running as a promising candidate for growth. However, even with its great potential, the price of SOL seems to be encountering some resistance from its previously established bull market support level

Technical expert, Benjamin Cowen, pointed out on his platform (previously known as Twitter), that Solana’s price action seems to resemble Ethereum’s [ETH]. If the current trend persists, he predicts that Solana (SOL) might retreat into its previous ascending wedge pattern

Indications point towards Solana reaching a significant turning point in the near future. October is generally considered an auspicious month not just for SOL, but also for the entire cryptocurrency market, given its historical strength since the birth of digital currencies

Even though there are occasional fluctuations, the general trend leans towards holding long positions for SOL, offering potential profits; however, be aware that this trading approach involves certain risks

Should Support-Resistance Line (SOL) persistently stay within the consolidation area of its ascending triangle over a prolonged timeframe, there’s a possibility that the price might dip prior to experiencing a substantial uptick

Volatility index of Solana

Beyond these technical understandings, the introduction of the Solana Volmex Implied Volatility Index (SVIV) provides an additional tool for examination. Specifically, this index estimates the potential volatility of SOL over a 14-day period, and as of the current press time, it stands at 87

This high-volatility indicator indicates that the market is likely to experience substantial fluctuations in prices, whether they trend upward or downward

Such fluctuations may entice traders seeking profits from the shifts, but they also heighten the likelihood of sudden and substantial losses that might not have been anticipated

With Bitcoin’s price climbing, there might be advantages for Solana within this market trend. However, it’s crucial to exercise caution

On-chain data analysis

The information stored on the blockchain, according to Artemis, added complexity to the perspective of Solana. While SOL maintains a significant lead in daily active addresses, suggesting a high level of network activity, there’s little indication that institutions are bullish about it

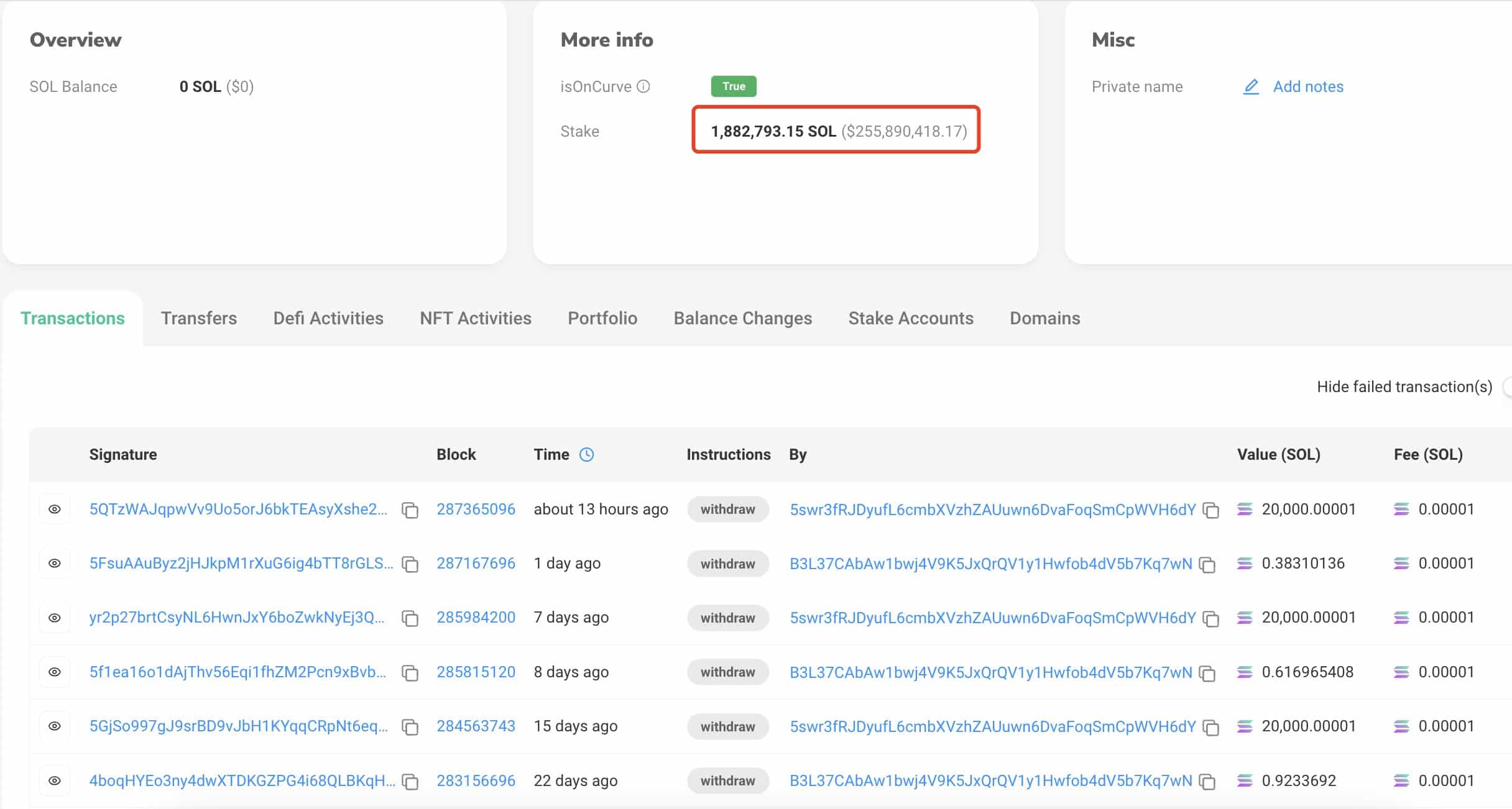

As reported by Lookonchain, a certain institution disposed of about 695,000 Solana (SOL) tokens this year, which is roughly equivalent to $99.5 million. On average, this institution has been selling approximately $100 million worth of SOL, or around 19,306 tokens, every week

As a financial analyst, I can confirm that despite our recent sales, our institution continues to hold approximately 1.88 million SOL, valued at roughly $255.89 million, which are currently staked. The liquidation of these assets undoubtedly exerts pressure on Solana’s market, potentially influencing the recent challenges we’ve observed in its price movement

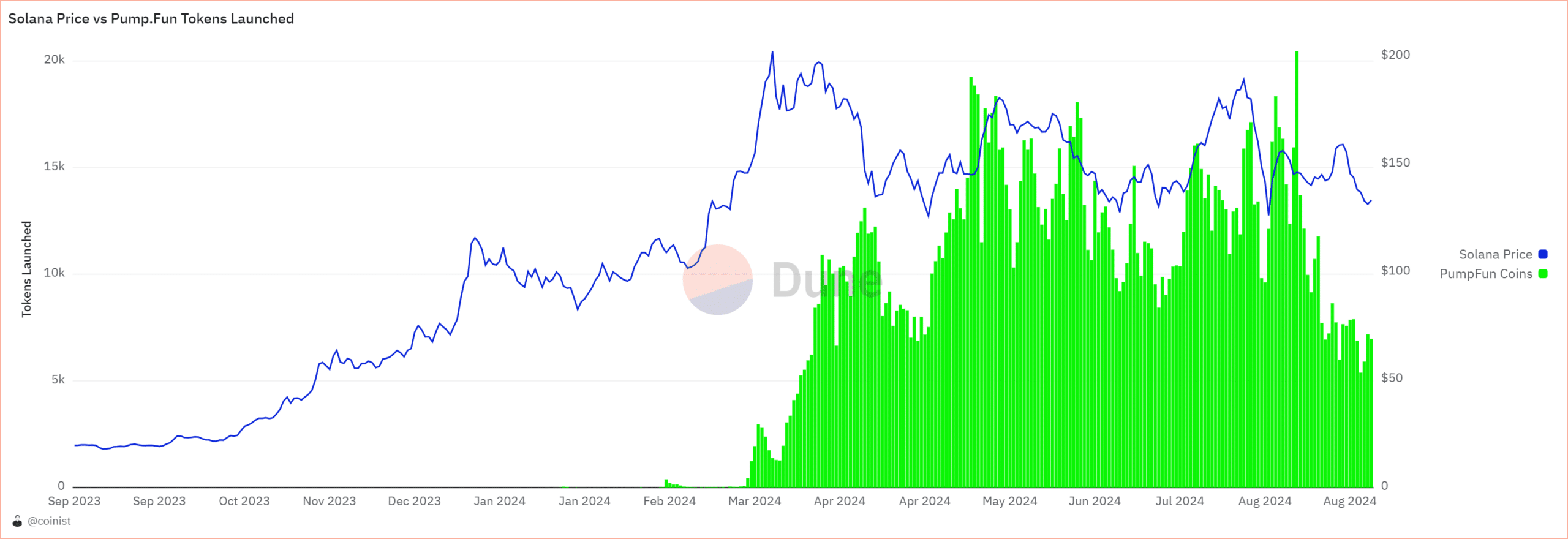

Solana price vs. Pump.Fun tokens launch

Additionally, the introduction of Pump.Fun tokens appears to have significantly affected Solana’s (SOL) price. Upon examination of the price graph, it’s clear that SOL’s growth trend seems to have slowed down approximately when these meme coins were released

Pump.Fun disposed of a large chunk of its earnings, specifically 264,373 Solana tokens at an average cost of $157.5 per token. This action had a considerable impact on the market value of Solana, causing its price to drop significantly

This situation has sparked worry among investors because the increased selling of these tokens is putting significant downward pressure on Solana

Solana-staking products

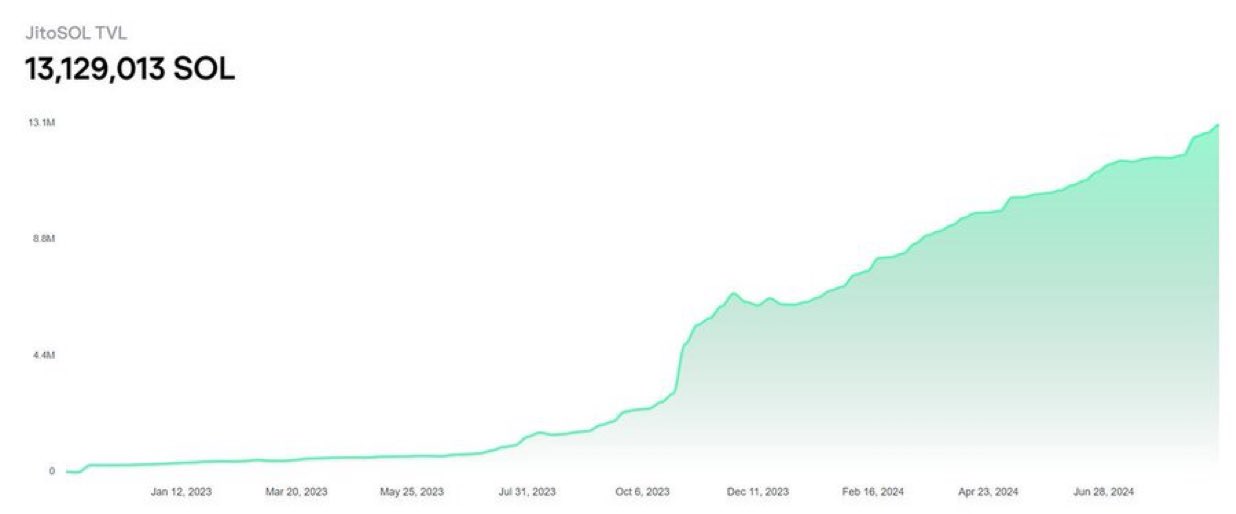

Nevertheless, there’s optimism for Solana since Binance unveiled its upcoming Solana Staking product, BNSOL, scheduled for release in late September 2024. Additionally, the Total Value Locked (TVL) in JitoSOL has reached over 13 million SOL for the first time

Read Solana’s [SOL] Price Prediction 2024–2025

Using this product, users can deposit SOL tokens, collect variable returns, and keep custody of their holdings. This action might boost the potential value of Solana in the long run

As a crypto investor, I’m keeping a close eye on Solana. With its promising staking opportunities and the possibility of a wider market rebound, I believe this digital coin could see a significant comeback in the near future

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-05 00:08