10 Great Netflix Dramas That Nobody Talks About

Check out these 10 less-discussed yet exceptional dramas on Netflix that truly warrant your attention!

Check out these 10 less-discussed yet exceptional dramas on Netflix that truly warrant your attention!

In a recent tweet, Ubisoft acknowledged a vulnerability in the game mechanism known as Castle, which can prematurely end a match. They are currently working on a solution. As a precautionary measure, they will temporarily disable the selection of Castle in Ranked, Unranked, and Siege Cup games. Once the fix is implemented, Castle will be reinstated in these game modes.

In the enchanted, medieval land of Faerieland, populated by mystical beings and a group of humans gifted with magic known as Homo Magi, reside. These people harness their power from earthly gemstones, and the realm is governed by twelve houses, each symbolized by distinct birthstones. House Amethyst was once the most powerful but faced turmoil when the malevolent Dark Opal attacked their castle, killing the royal family. The protective sorceress Citrina then secreted Princess Amethyst to our world, where she was brought up by ordinary human parents and named Amy Winston.

Spoilers for Mobile Suit Gundam GQuuuuuuX

Horror movies can provide an exhilarating experience for those who enjoy them, with slasher films often featuring excessive gore. If you prefer a more suspenseful approach, British horror miniseries might be the better choice. These series are known for their slow-paced storytelling, allowing tension and mysteries to gradually accumulate. The list provided includes original stories, adaptations from books, as well as shows claimed to be based on real events.

In a refreshing turn of events, And Just Like That has put an end to a grim fan theory about a season 3 demise, bringing relief to one of the original Sex and the City characters. As Sarah Jessica Parker brought back the timeless Carrie Bradshaw for HBO’s reboot, several original Sex and the City cast members rejoined her, including Kristin Davis portraying Charlotte and Cynthia Nixon as Miranda.

The ongoing struggle against the Injustice Society has put the Justice Society to its most severe test yet, dividing them into two groups: their strongest members were secluded in Surtur’s Realm, while the rest faced an internal traitor. Longtime member Wildcat sadly lost his life during combat, but eventually, they managed to reunite as an organization. Meanwhile, Johnny Sorrow has been causing discord from within the team. However, it seems that the Injustice Society’s schemes have crumbled, and the real danger to both the JSA and the world has finally surfaced.

Warning: Spoilers ahead for Black Clover‘s manga up to chapter 380.

Pascal expressed that “Game of Thrones” was a pivotal moment. He believes it’s the reason he’s where he is today. He can hardly believe that David Benioff and D.B. Weiss, with all their options, noticed him. With his extensive background in regional theater, off-Broadway work, and television episodes, he never expected to land such a significant role during their peak popularity. To this day, he feels grateful to them for kick-starting his career.

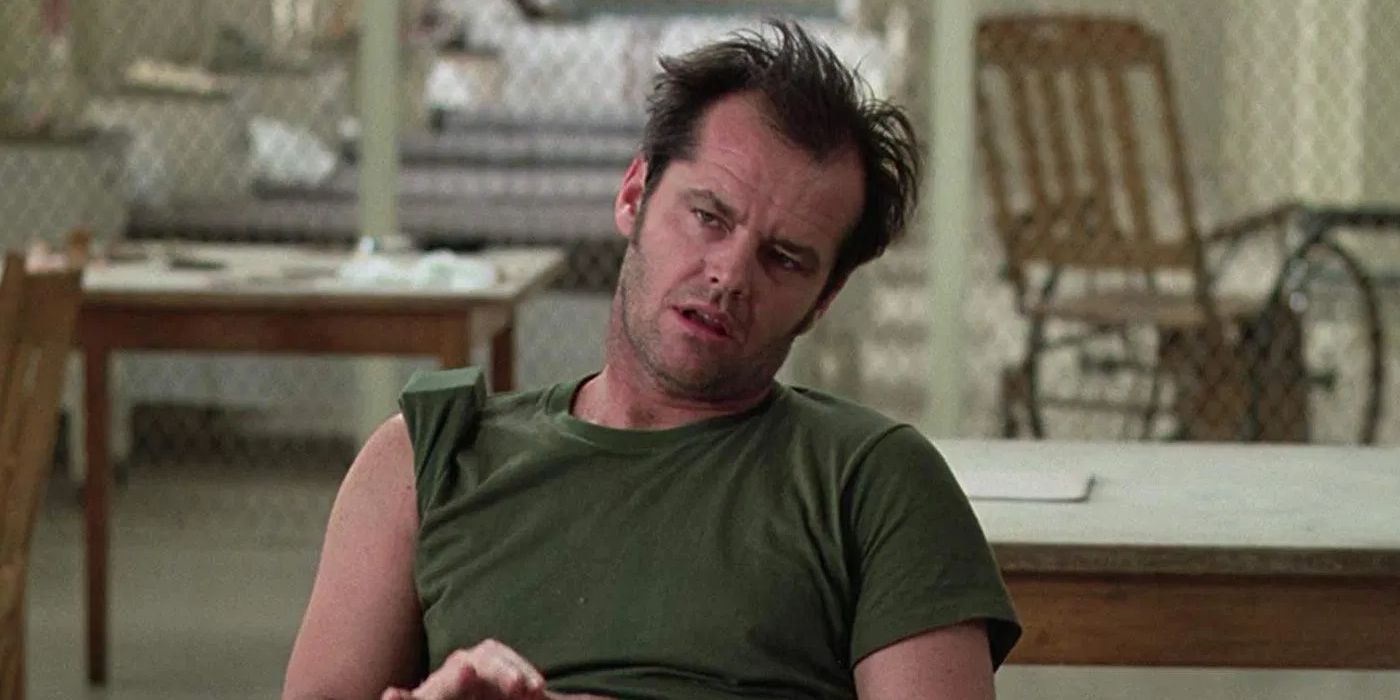

According to reports, Paul Zaentz, who is Saul Zaentz’s nephew and the original producer of “One Flew Over the Cuckoo’s Nest,” has secured the rights to the story. Now, he aims to adapt it for television, focusing this time on Chief Bromden’s perspective, as expressed by Will Sampson’s character in the novel. In his statement, Zaentz mentioned that he recently signed an agreement with Ken Kesey’s widow, Faye Kesey, and family to develop a TV series. He continued, “For the first season, we will tell the story from Chief Bromden’s point of view. Afterward, we will explore what happens to him following his escape from the hospital.