-

BTC adoption by businesses has surged by more than 30% over the past year.

How is this massive adoption changing the financial landscape?

As a seasoned analyst with over two decades of experience in the financial sector, I have witnessed numerous transformations in the global economic landscape. The recent surge in Bitcoin adoption by businesses is one such transformation that has piqued my interest.

For the past three days, the value of Bitcoin (BTC) has remained stable within a specific price band that extends from approximately $56,000 to $59,000.

As some experts predict BTC might dip below its current $51K level, a fresh pattern seems to be arising, which may heighten the chances of a price adjustment.

Is it possible that the business sector could serve as an unseen spark igniting another surge in popularity for Bitcoin? That’s what AMBCrypto is looking into.

Businesses are increasing BTC accumulation

On the platform now known as X (previously Twitter), a recent investigation disclosed a remarkable 30% increase in Bitcoin usage among businesses within just one year.

As an analyst, I’ve recently discovered an intriguing trend: The number of public companies holding Bitcoins has grown significantly, with a staggering 40% increase observed over the past year. This growth has swelled our initial list to 52 companies.

According to AMBCrypto’ analysis of the report, a quieter yet significant trend is emerging.

Source : X

As a humble crypto investor, I’ve noticed that while the limelight often falls on big names like individual investors, investment firms, and massive corporations splashing out millions on Bitcoin, it’s the quiet strength of small-scale businesses that’s steadily expanding the Bitcoin landscape behind the scenes.

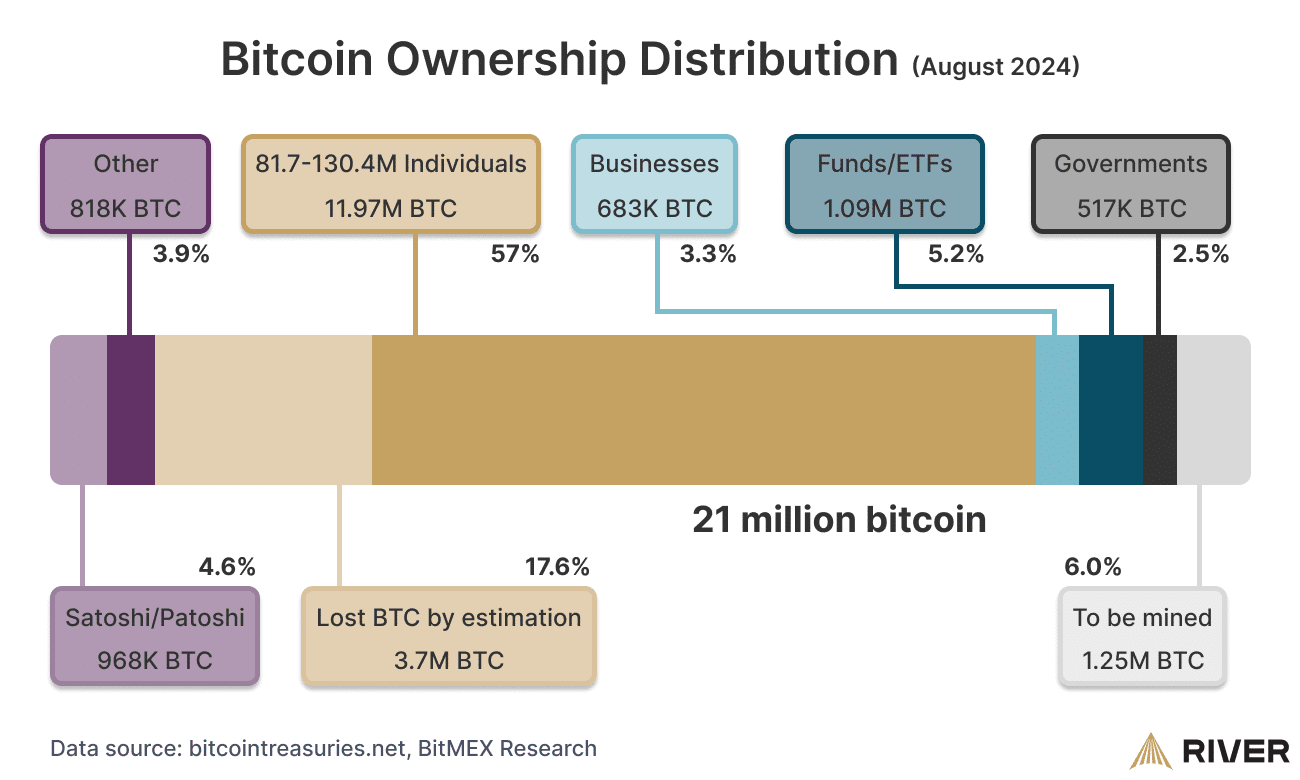

Today, businesses collectively hold more than 3% of all Bitcoin in circulation – a remarkable 500% increase over the past few years.

Interestingly, businesses have swiftly surpassed governments in Bitcoin accumulation.

If this trend continues, businesses could soon rival ETFs in Bitcoin holdings, boosting Bitcoin’s financial significance.

It seems that many companies consider Bitcoin as a means to hold value much like traditional wealth reserves, aiming for long-term preservation. The question remains: Can Bitcoin withstand fluctuation and maintain its worth?

Corporations have immense faith that it can

It’s worth noting that the study found a significant pattern: The majority of Bitcoin holdings among businesses are controlled by the top five entities.

Approximately five major entities, namely MicroStrategy, Block.one, Tether, BitMEX, and Xapo, collectively control about 82% of all existing Bitcoin (BTC) reserves, amounting to approximately 559,000 BTC in total.

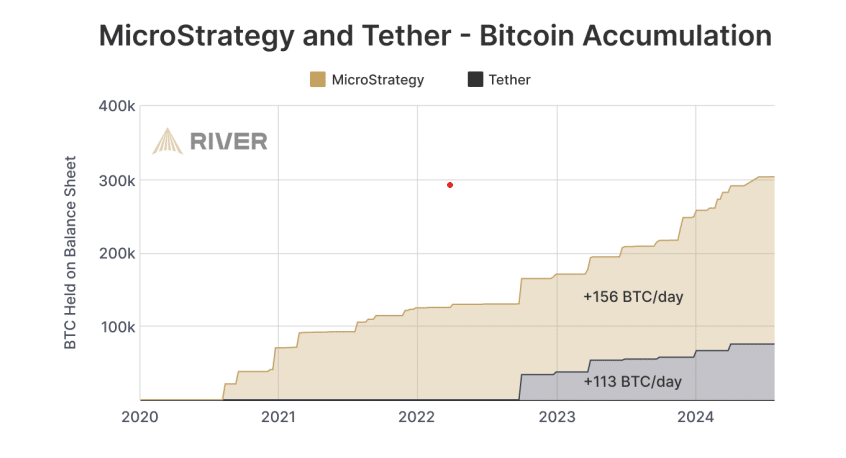

In early 2024, it was observed that MicroStrategy and Tether were responsible for approximately 85% of daily Bitcoin purchases, with an average purchase of around 269 Bitcoins each day, starting from late 2022.

Source : X

To put it simply, significant investments by businesses have played a crucial role in increasing the worth of Bitcoin, causing its price to continually rise even amidst economic turmoil on a larger scale.

To put it simply, Bitcoin started off September showing bearish tendencies, as short positions were prevalent in the futures market, causing Bitcoin’s value to stay below the $60,000 mark.

Could it be that the large corporations holding significant amounts of Bitcoin are contributing to the recent market downturns?

MicroStrategy data signals…

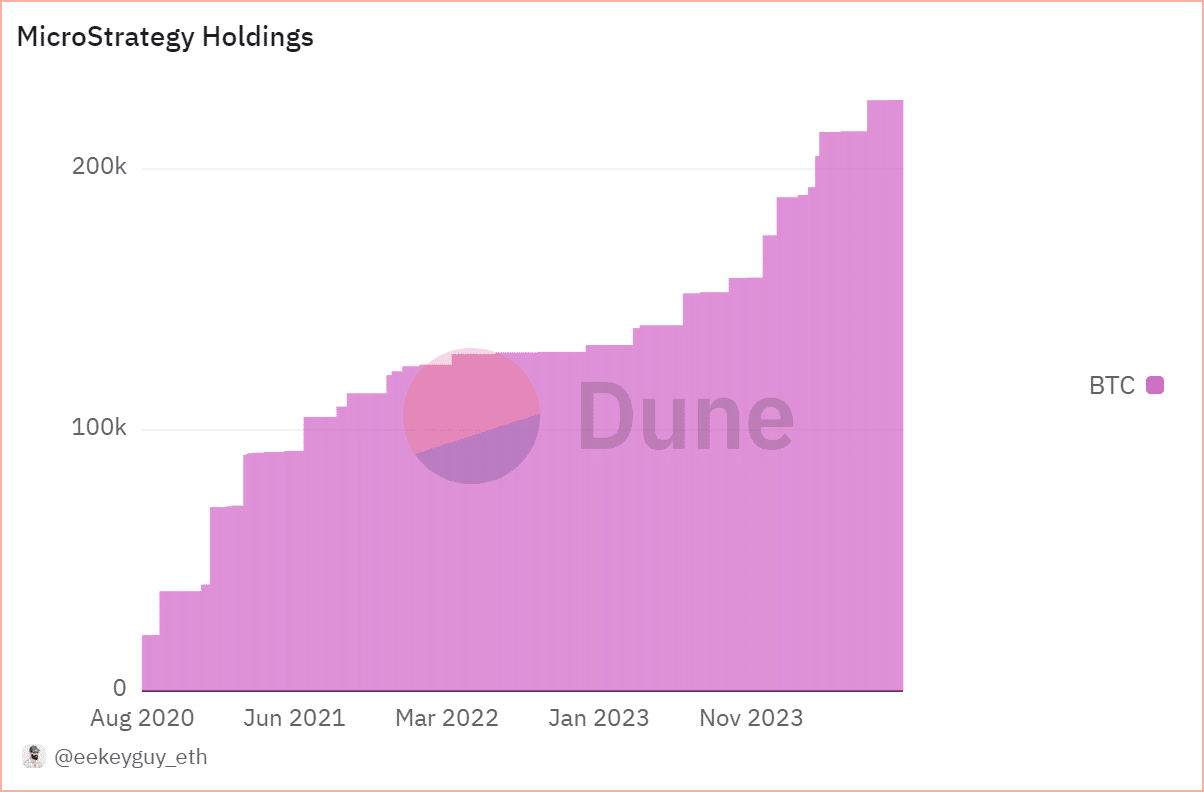

On April 29th, MicroStrategy disclosed its first-quarter financial report, indicating they now own approximately 214,400 Bitcoins. The firm purchased an extra 25,250 Bitcoin at a combined expense of $1.65 billion, with each coin averaging around $65,232.

Source : Dune

As per the given chart, MicroStrategy’s Bitcoin holdings have significantly increased more than ten times in the last four years. They were initially at 21,000 in early 2020 and have now grown to 216,000 as of the current press time.

Simultaneously, the U.S. government keeps a close tab on its Bitcoin holdings, routinely transferring BTC to digital exchanges for safekeeping.

Essentially, large companies have maintained their hold on Bitcoin even during temporary market fluctuations, suggesting a strong positive sentiment towards the cryptocurrency.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Moreover, reinforcing this positivity, the report underlined the increasing perception of Bitcoin as a form of value storage. It forecasted that business adoption might reach close to one million by the year 2026.

Consequently, AMBCrypto suggests that Bitcoin might experience a drop in price, but this is subject to the moves made by institutional investors and shrewd traders.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-09-06 05:12