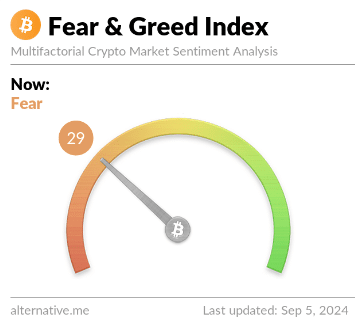

- The Fear and Greed Index reached lows not seen in a year.

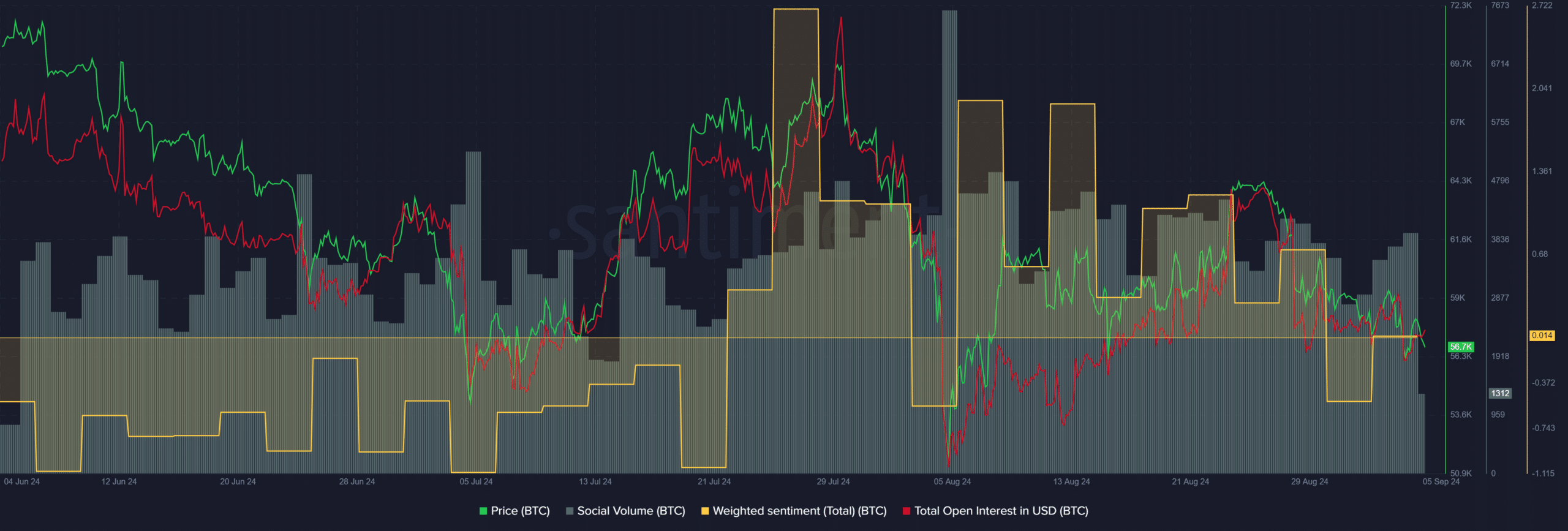

- The decline in Social Volume and positive engagement outlined the market despondence.

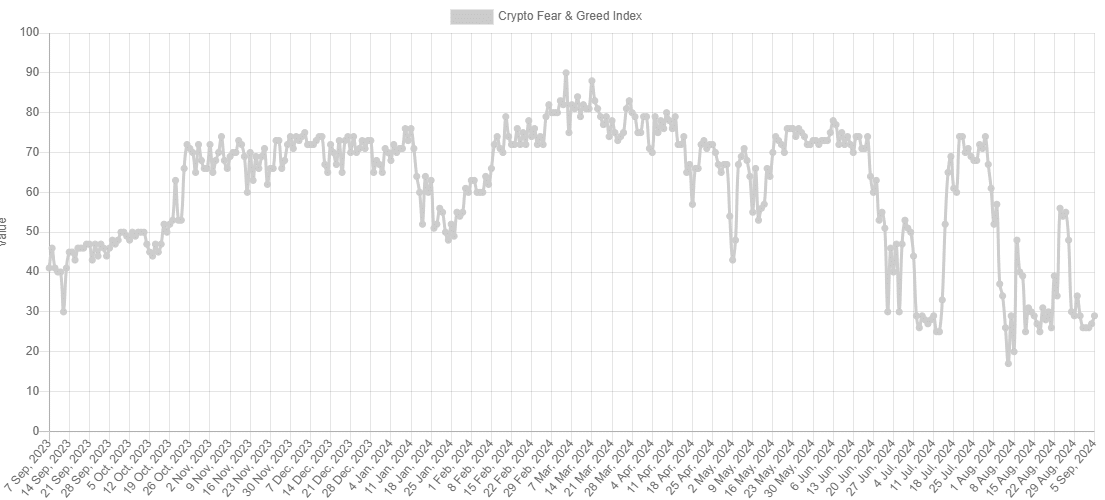

As a seasoned analyst with over two decades of experience in financial markets under my belt, I’ve seen bull runs and bear markets come and go, and I must say that the current state of the crypto market has me feeling a bit like a lone wolf on Wall Street amidst a blizzard. The Fear and Greed Index, a tool I often rely on for insights, is showing readings not seen in a year. The despondence in the market is palpable, with social volume and positive engagement taking a nosedive.

The Crypto Fear and Greed index stood at 29 at press time.

It showed fear was prevalent in the market, but was still better than the previous month when heavy price corrections affected the market-wide sentiment, worse than the recent drop below $60k.

The overwhelmingly negative sentiment in the market saw a week-long, hefty torrent of outflows from the Bitcoin [BTC] spot ETFs. On the other hand, El Salvador continued to buy 1 BTC a day.

The weakest sentiment in a year

The Fear and Greed Index serves as a valuable resource for investors, helping them determine when it’s best to purchase or offload assets. When the index indicates extreme fear within the cryptocurrency market, it often signifies a good buying opportunity. Conversely, markets displaying euphoria usually signal peak prices.

The Index values are calculated based on the behavior of Bitcoin, since the king coin largely dictates the crypto market behavior. This includes volatility, market momentum, and social media engagement.

In simpler terms, the Crypto Fear and Greed Index was quite optimistic in May, but it has become more cautious or pessimistic since then.

Instead of an immediate surge following the halving event in April, as anticipated, the cryptocurrency market has instead witnessed a persistent downtrend since March, causing considerable concern among investors.

During July and the start of August, the index dipped down to levels under 30, which hadn’t been observed for about a year.

Currently, the value of 29 is quite low compared to other periods. This could present a promising investment opportunity over the next 6-12 months.

Examining Bitcoin’s metrics

Read Bitcoin’s [BTC] Price Prediction 2024-25

Over the last month, Bitcoin’s social activity has gradually decreased. The sentiment score, which was favorable after Bitcoin surpassed the $60k mark in mid-August, has been on an upward trend of negativity over the past three weeks.

As Bitcoin hit the resistance zone at $64k, the Open Interest dropped rapidly, reflecting a general pessimism in the market. Few traders were interested in buying during this time as the overall sentiment leaned towards bearishness.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-06 06:15