As a seasoned crypto investor with over a decade of experience in this wild, rollercoaster ride of digital assets, I’ve seen my fair share of market highs and lows, bull runs and bear markets. Monero (XMR) has always been an intriguing coin for me due to its focus on privacy and security, which resonates with the hacker in me who values the importance of anonymity in this increasingly transparent world.

Monero (XMR) was designed with a strong emphasis on security and confidentiality. Since it hides the specifics of transactions, it has become a popular choice among individuals who value privacy.

It’s crucial for those intrigued by Monero (XMR) to grasp its price fluctuations since it exhibits unique market characteristics. Lately, Monero has shown resilience, managing to maintain a steady price level even when there have been overall negative trends in the broader market.

Monero XMR Price Trends and Market Performance

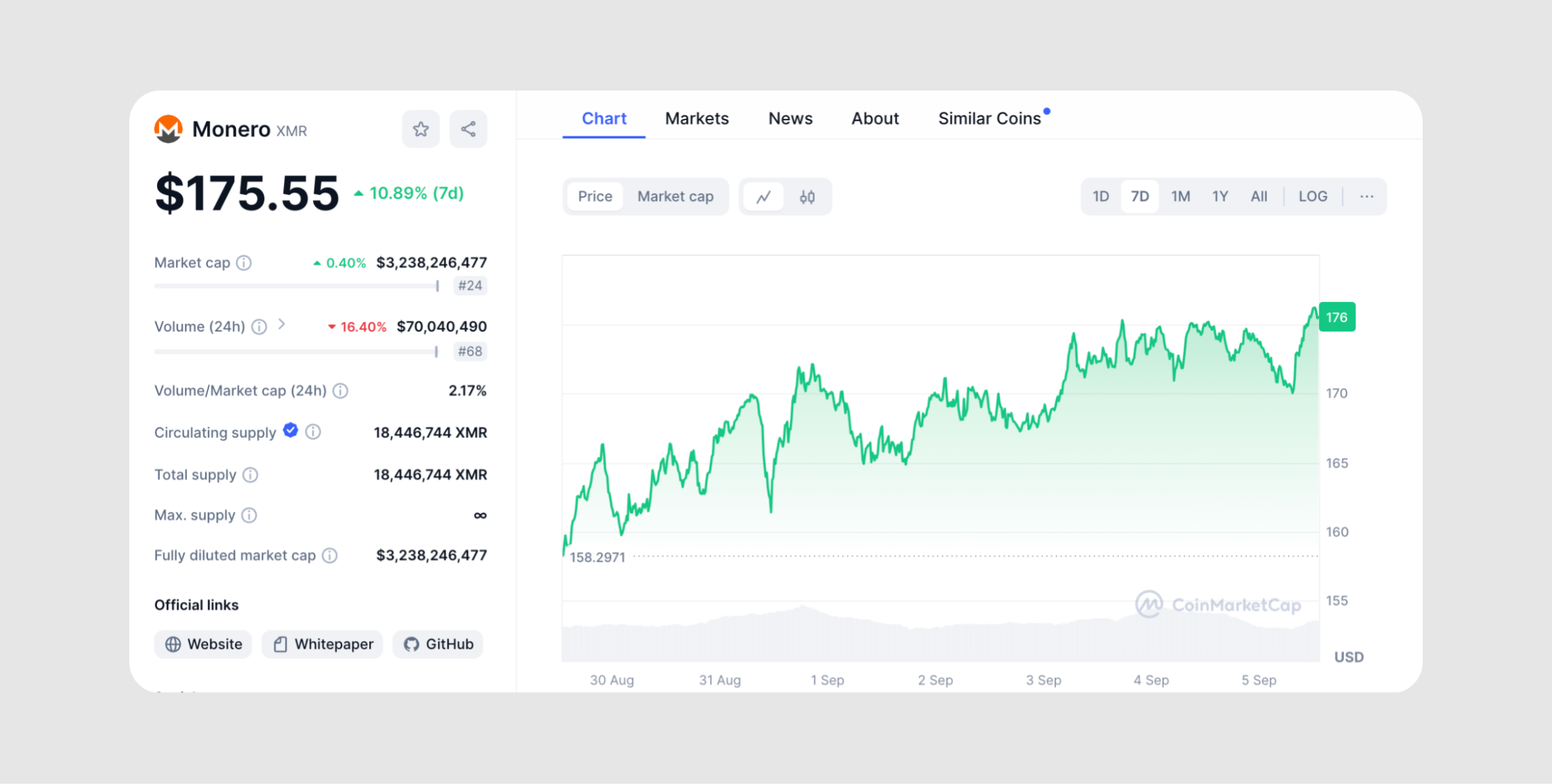

The present cost of Monero stands at $175.57. Interestingly, over the past seven days, Monero (XMR) has seen a surge of 10.9%, bucking the overall gloomy sentiment that’s been prevailing in the crypto market.

Yesterday, there was a trading volume of approximately 67 million units of XMR. Key market metrics include a market cap of around 3.24 billion dollars and a circulating supply of about 18 million XMR tokens.

Resistance Levels and the Near Forecast

From May 2022 onwards, the price of Monero has consistently hit a barrier at around $181 without managing to consistently surpass it. This specific price point is closely monitored by traders because if Monero manages to break through, it could be an indication of an upcoming price increase.

If the current downward trend continues, there’s a possibility that XMR could drop back to around $164. This level has historically provided support during previous market downturns.

Based on temporary predictions, XMR could potentially climb to around $190 or perhaps reach $200 if it builds enough strength. This ascent would require a continued increase in buying demand if the broader market conditions remain favorable.

As a crypto investor, I find myself treading with caution at the moment due to the volatile nature of the market. Swings in trading volume and overall market sentiments can have a substantial effect on external factors, making it essential for me to closely monitor the market trends and adjust my investment strategy accordingly.

Monero Coin Price Prediction

According to market experts, it’s expected that Monero (XMR) will experience a period of significant growth, or a bull run, by the year 2025. This optimistic outlook is due in part to the ongoing fascination with cryptocurrencies and the increasing demand for privacy-centric digital assets among traders.

As a seasoned crypto investor, I find Monero (XMR) an attractive pick for those seeking lasting profits due to its proven ability to stand strong amidst market turbulence and its impressive historical performance.

As we approach 2025, experts forecast that the value of Monero may experience fluctuations. However, these changes are expected to be temporary. Despite this, Monero is still projected to see an overall increase in value. It’s possible for Monero to surmount notable resistance levels, thereby solidifying its position as a prominent Layer 1 digital asset.

The historical and present patterns of Monero’s price suggest a substantial increase in value in the upcoming years. By 2026, it is expected to rise from its current $407.79 to approximately $476.02. Predictions for 2027 point towards a potential range of $580.76 to $709.53. These forecasts imply that Monero will experience a notable upward trend in value over the years.

Conclusion

Over the past few months, I’ve noticed that the real-time value of Monero has experienced considerable fluctuations. It’s crucial to closely monitor a few key resistance levels as they could significantly impact its trajectory. From a long-term perspective, the outlook remains optimistic. However, traders should be prepared for potential downturns and short-term market turbulence. Factors such as shifts in the broader market, new regulations, and technological advancements may influence Monero’s future price movements. Staying abreast of these variables can help traders make informed decisions about managing risks and capitalizing on opportunities.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-09-06 14:13