Bitcoin (BTC) had a little dance over the weekend, hitting two all-time highs between Saturday and Sunday. But, before we get too excited, there are four US economic signals this week that will have their say in where Bitcoin’s wild ride is headed.

Sure, the institutional big players can pull the strings, but it’s those pesky US economic indicators that really get to decide if Bitcoin’s rocket will keep soaring or burn out mid-flight.

US Economic Signals To Watch This Week

Traders, time to sharpen those skills! This week’s market movements will be a game of macro-specific volatility, and these events are your golden opportunities to either ride the wave or get caught under it.

CPI

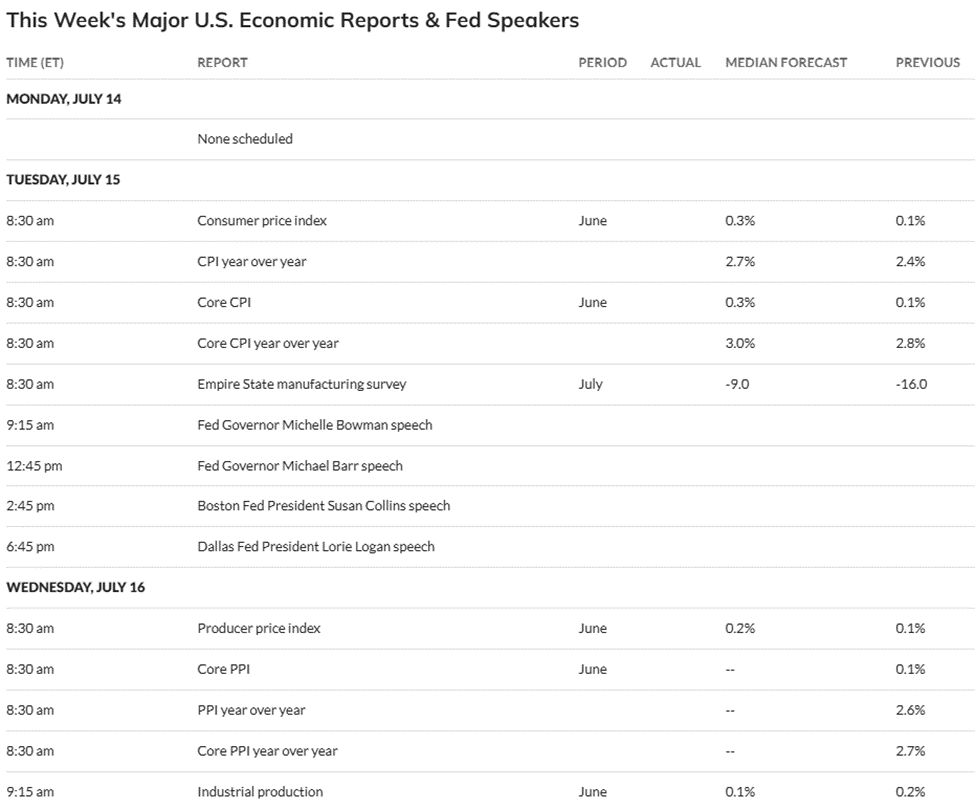

Ah yes, the mighty US CPI (Consumer Price Index) – the heavyweight of the week. Due on Tuesday, July 15, this number could make or break things. Economists are calling for inflation to come in at 2.7% for June, up from 2.4% in May. A small rise, but enough to stir the pot.

As BeInCrypto reported, the May reading was the first CPI increase since February, so anything above 2.4% will show inflation isn’t backing down. But don’t fret, if it falls below 2.4%, BTC might just pop its champagne in celebration.

US inflation leading indicator sees CPI starting to grind higher from here

— Markets & Mayhem (@Mayhem4Markets) July 11, 2025

In case you were wondering, if the June CPI hits above 2.4%, the Fed might just tighten its grip, which could leave Bitcoin gasping for air. But if it dips below? Expect Bitcoin to ride high on the waves of rate cuts and looser liquidity.

And, for the cherry on top, a squad of Fed speakers will be chatting on the same day, likely making volatility even juicier. Investors will be all ears, hanging on every word for clues about the Fed’s next move.

PPI

Not to be overshadowed by CPI, the Producer Price Index (PPI) is also on deck. This number tracks the price change producers receive for their goods and services – because, you know, the middleman is always curious about his cut.

In May, PPI saw an annual increase of 2.6%, and economists are expecting a modest rise in the June PPI, due Wednesday, July 16. Spoiler alert: A bigger rise could send fears of inflation spiking, shaking up Bitcoin’s value.

*US MAY PRODUCER PRICES RISE 0.1% M/M; EST. +0.2%

*US MAY PRODUCER PRICES RISE 2.6% Y/Y; EST. +2.6%*US MAY CORE PPI RISES 0.1% M/M; EST. +0.3%

*US MAY CORE PPI RISES 3% Y/Y; EST. +3.1%— *Walter Bloomberg (@DeItaone) June 12, 2025

If June’s PPI decides to be a rebel and climb higher, it could signal inflation on the rise, giving the Fed reason to tighten things up. This would cramp Bitcoin’s style, but if it falls? Expect Bitcoin’s party to keep going, with more liquidity and risk appetite to spare.

Initial Jobless Claims

Thursday brings the eagerly awaited initial jobless claims report. This is the “tell me how the economy is doing” moment, as it gives us insight into the health of the job market. After all, a shaky job market is like a sponge soaking up Bitcoin’s bullish vibes.

In the week ending July 5, 227,000 people filed for unemployment insurance. Now, experts predict that number will rise to 233,000. Oh, the suspense!

Initial jobless claims dropped to a two-month low of 227k last week. Continuing claims ticked up.

— Kathy Jones (@KathyJones) July 10, 2025

Should jobless claims rise, it means the labor market is starting to feel the heat, and the Fed might jump in with rate cuts to stimulate the economy. A lower rate environment? That’s a recipe for Bitcoin’s growth as the dollar weakens and risk assets get a makeover.

Consumer Sentiment

Finally, Friday’s consumer sentiment report, or as we like to call it, the “how optimistic are the people?” report. This metric shows whether consumers are feeling like millionaires or barely scraping by. A higher reading means confidence, which can give the dollar a boost and send Bitcoin into a downward spiral.

For July, economists are projecting a score of 62.0, up from June’s 60.7. Not a huge jump, but hey, it’s still something. If sentiment falls below expectations, expect Bitcoin to get a boost, as a pessimistic outlook means rate cuts might just be on the horizon.

Read More

- Best Controller Settings for ARC Raiders

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- 🚀 DOGE to $5.76? Elliott Wave or Wishful Barking? 🐶💰

- Pokémon Legends: Z-A’s Mega Dimension Offers Level 100+ Threats, Launches on December 10th for $30

- Beyond Gaussian Beams: A New Testbed for Quantum Advantage

- Kylie Jenner Makes Acting Debut in Charli XCX’s The Moment Trailer

2025-07-14 10:37