-

Arthur Hayes believes BTC could slip below $50k into the weekend

Bitget’s Gracy Chen maintains a long-term bullish outlook though

As a seasoned analyst with years of experience navigating the volatile cryptocurrency market, I find myself cautiously optimistic when considering the opinions of Arthur Hayes and Gracy Chen regarding Bitcoin’s future price movements.

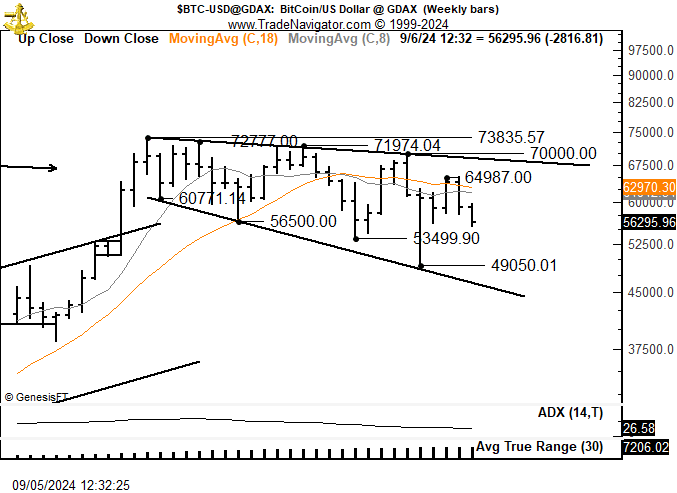

Bitcoin‘s [BTC] vulnerability increased in September as the leading digital currency battled to stay above $60k on the graphs. Notably, Arthur Hayes, Co-Founder of BitMEX and Chief Investment Officer at VC fund Maelstrom, predicted that BTC might fall even more and potentially dip below $50k over the weekend.

“$BTC is heavy, I’m gunning for sub $50k this weekend. I took a cheeky short.”

More BTC losses in the short term?

Previously this week, Hayes predicted a bearish outlook for Bitcoin in the near future, contending that anticipated Federal Reserve rate reductions would not stimulate cryptocurrency markets. However, prior to the release of the U.S job report on Friday, interest rate speculators began to heavily wager on a 0.25% and 0.50% reduction in Fed interest rates.

Based on the executive’s reasoning, U.S. financial institutions are preferring to participate in the Fed’s Reverse Repurchase Agreement (RRP) over investing in risky assets like Bitcoin for higher returns. This trend may lead to a decrease in liquidity, potentially causing Bitcoin prices to fall, even with anticipated Federal Reserve interest rate reductions.

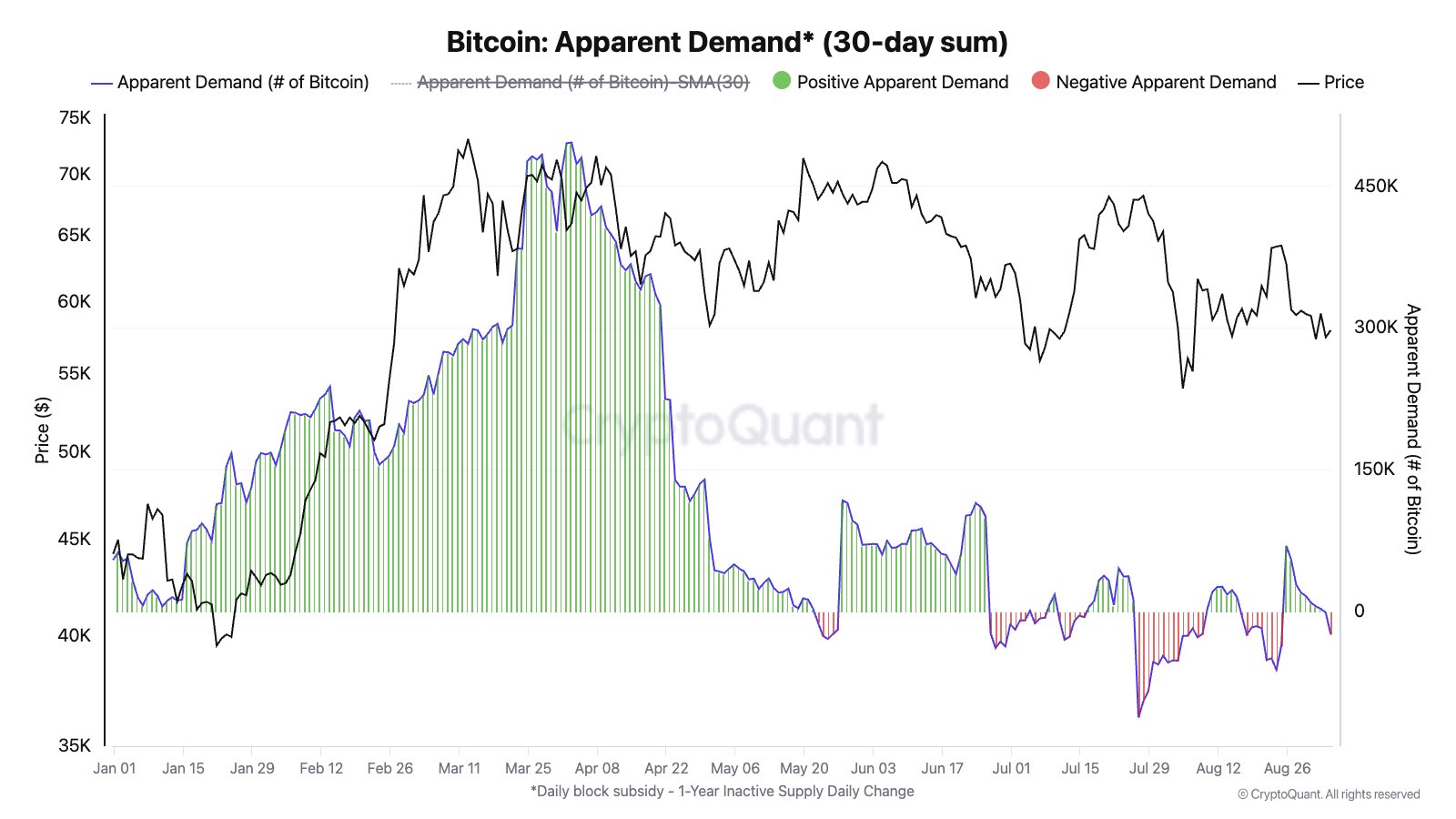

It’s important to note that the interest in the cryptocurrency has dropped noticeably since the first quarter of the year. As per the latest figures from CryptoQuant, investor appetite is currently at an all-time low, which may potentially lead to a continued decrease in the crypto’s value.

According to Peter Brandt’s perspective, the trend for Bitcoin might involve more selling over buying due to its present megaphone chart formation. Under unfavorable circumstances, Brandt anticipates that Bitcoin could plummet down to approximately $46,000.

Contrarily, certain industry experts maintain an optimistic outlook for the future, believing that Bitcoin may experience a significant rise in the upcoming quarters of this year and into 2025. For instance, Gracy Chen, CEO of crypto exchange Bitget, recently stated to AMBCrypto that the recent declines in September could be seen as “a major dip” preceding this potential rally.

“At the start of September, the market experienced a significant dip that some call the ‘final fall.’ However, experts are hopeful that prices will reach new peaks by year-end. In fact, many financial analysts continue to express optimism about Bitcoin’s price forecast for the last quarter of 2024.”

Given the long-term bullish outlook, Chen projected that BTC could climb above $100k by November.

“Given no unforeseen dramatic occurrences (referred to as ‘black swan’ events), it’s possible that Bitcoin could surge past the $100,000 mark by November. Following this rise, a dip might occur, and then Bitcoin may gradually trend towards the $200,000 price range.”

BTC was valued at $56.4k at press time as traders and investors waited for the U.S Jobs report.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-09-06 18:15