-

The Ethereum Foundation has sold over 1,000 ETH again

Its previous selling spree was received by much criticism from the community

As a seasoned researcher with years of experience navigating the cryptocurrency landscape, I must say that the recent actions by the Ethereum Foundation have sparked a familiar sense of intrigue and curiosity among us crypto enthusiasts. The Foundation’s decision to sell ETH yet again, despite facing criticism in the past, is a move that warrants careful observation.

In the past day, the Ethereum Foundation has conducted two transactions, converting some of its ETH into DAI. This action was taken even after encountering substantial criticism during a prior massive sale of its ETH holdings.

The Foundation’s decision to convert ETH into stablecoins like DAI could be a move towards managing their assets. However, it may also raise concerns about the potential impact on market sentiment and ETH’s price stability.

Ethereum Foundation on the move again!

Based on figures provided by Spot on Chain, it’s reported that the Ethereum Foundation exchanged approximately 100 Ether for more than 241,000 units of DAI on the 5th of September.

Previously, the first transaction didn’t cause much notice, but the latest one has caught some eyes. On September 6th, the Foundation moved 1,000 ETH, roughly equivalent to $2.38 million, into a multi-signature wallet. Given past transaction behaviors, it is anticipated that this ETH will be transferred again and probably exchanged for DAI.

In spite of the attention being paid to these transactions, the Ethereum Foundation continues to possess a significant quantity of Ether – approximately 274,000 ETH, which amounts to over $652 million. The recent sale of 1,000 ETH has sparked some debate, but another transaction from 13 days ago has also caught attention. This transaction reveals that the Foundation transferred more than 35,000 ETH to Kraken, causing onlookers to wonder about the reasons for these transactions.

As an analyst, I’ve noticed recent speculations concerning Ethereum’s Foundation allegedly selling off assets. However, neither Vitalik Buterin nor the Foundation have issued any official statements clarifying these recent transactions publicly.

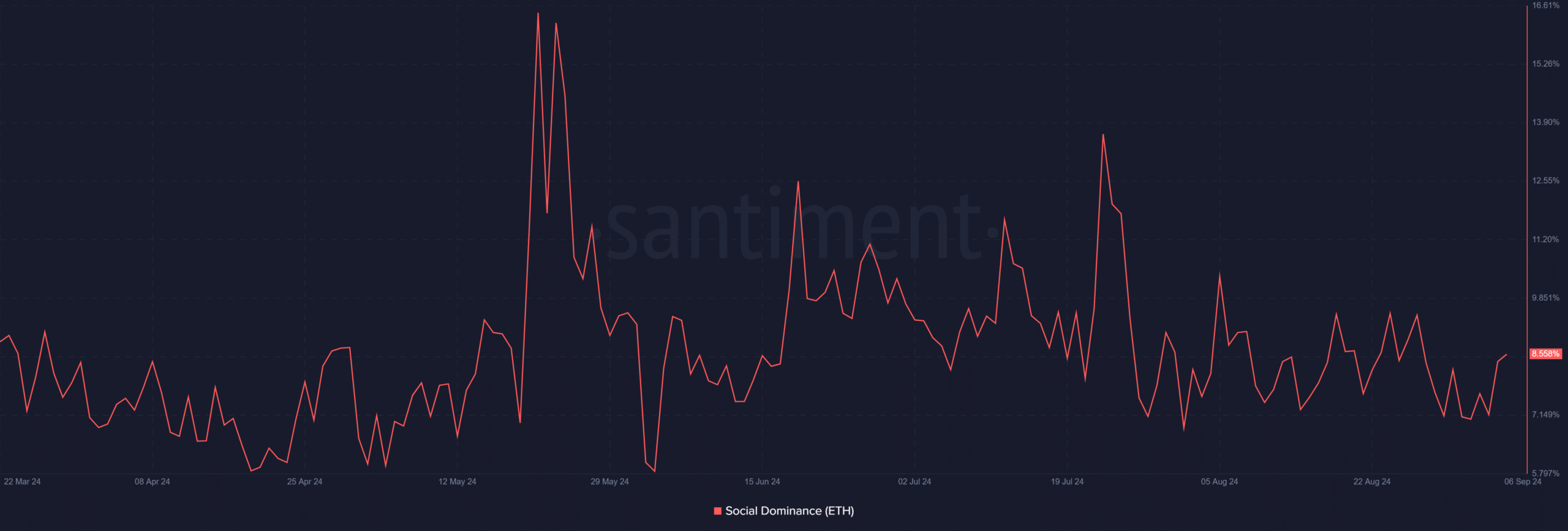

Ethereum’s social metrics show a lack of impact

A recent analysis of Ethereum’s social dominance showed a slight hike, with Ethereum taking up over 8% of the overall crypto discussions.

On Santiment, it appears that the Ethereum Foundation’s recent ETH sale hasn’t sparked much discussion or become a hot topic among the wider cryptocurrency community yet. Regardless of the Foundation’s transaction, the overall discourse in the crypto sphere remains relatively unaffected by this event.

Since the sale hasn’t attracted much notice, this suggests that it didn’t significantly influence the overall market opinion or mood.

For the moment, it seems that the sale won’t significantly impact Ethereum’s current price. The community’s muted reaction suggests a market response that is generally neutral or balanced, indicating little immediate anticipation of dramatic price decreases due to the Foundation’s activities.

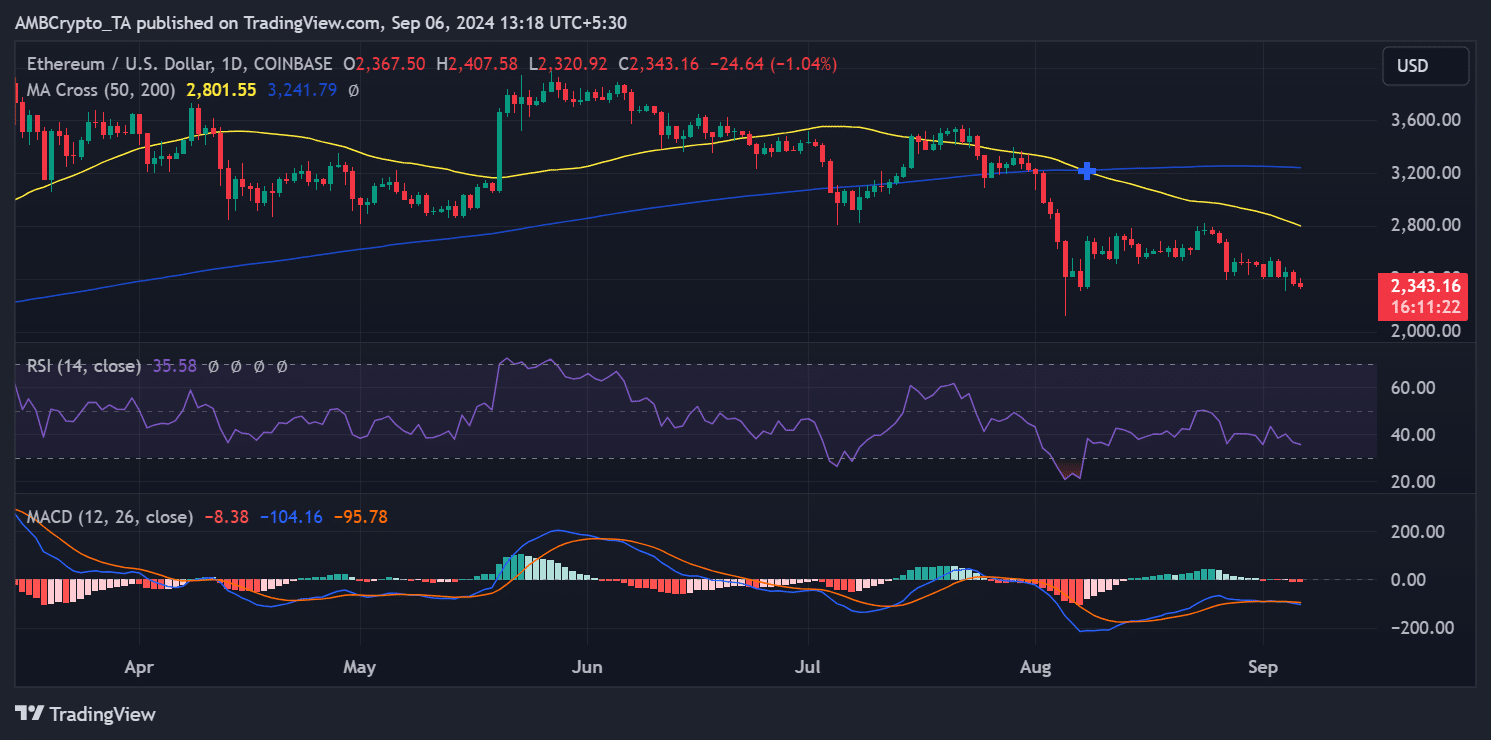

ETH continues its downward trajectory

As a researcher, by the close of trades on September 5th, I observed Ethereum (ETH) was approximately valued at $2,367, representing a 3% drop in value from previous charts. This downward trend continued into the subsequent trading session, with ETH being traded around $2,343 shortly thereafter.

Regarding Ethereum’s price, even though it may keep falling, it’s important to note that recent sales by the Ethereum Foundation are not responsible for this trend. Instead, the current price fluctuations appear to be influenced more by overall market conditions, as these sell-offs have yet to significantly alter investor sentiment.

– Read Ethereum (ETH) Price Prediction 2024-25

Furthermore, Ethereum, currently, is persistently moving downwards, suggesting a bear market, based on its Relative Strength Indicator (RSI). As long as the RSI doesn’t suggest a reversal of momentum or other technical indicators don’t show improvement, Ethereum will likely face difficulties in the short term.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Here’s What the Dance Moms Cast Is Up to Now

2024-09-07 04:08