-

RENDER’s price trend has been bearish in recent months.

The retest of the $4.4 support zone could offer a buying opportunity.

As a seasoned crypto investor with battle-scarred eyes from the rollercoaster ride that is the blockchain market, I have learned to appreciate the subtle nuances that indicate buying opportunities. The recent bearish trend of RENDER has left many investors wary, but I see it as an opportunity disguised in the cloak of despair.

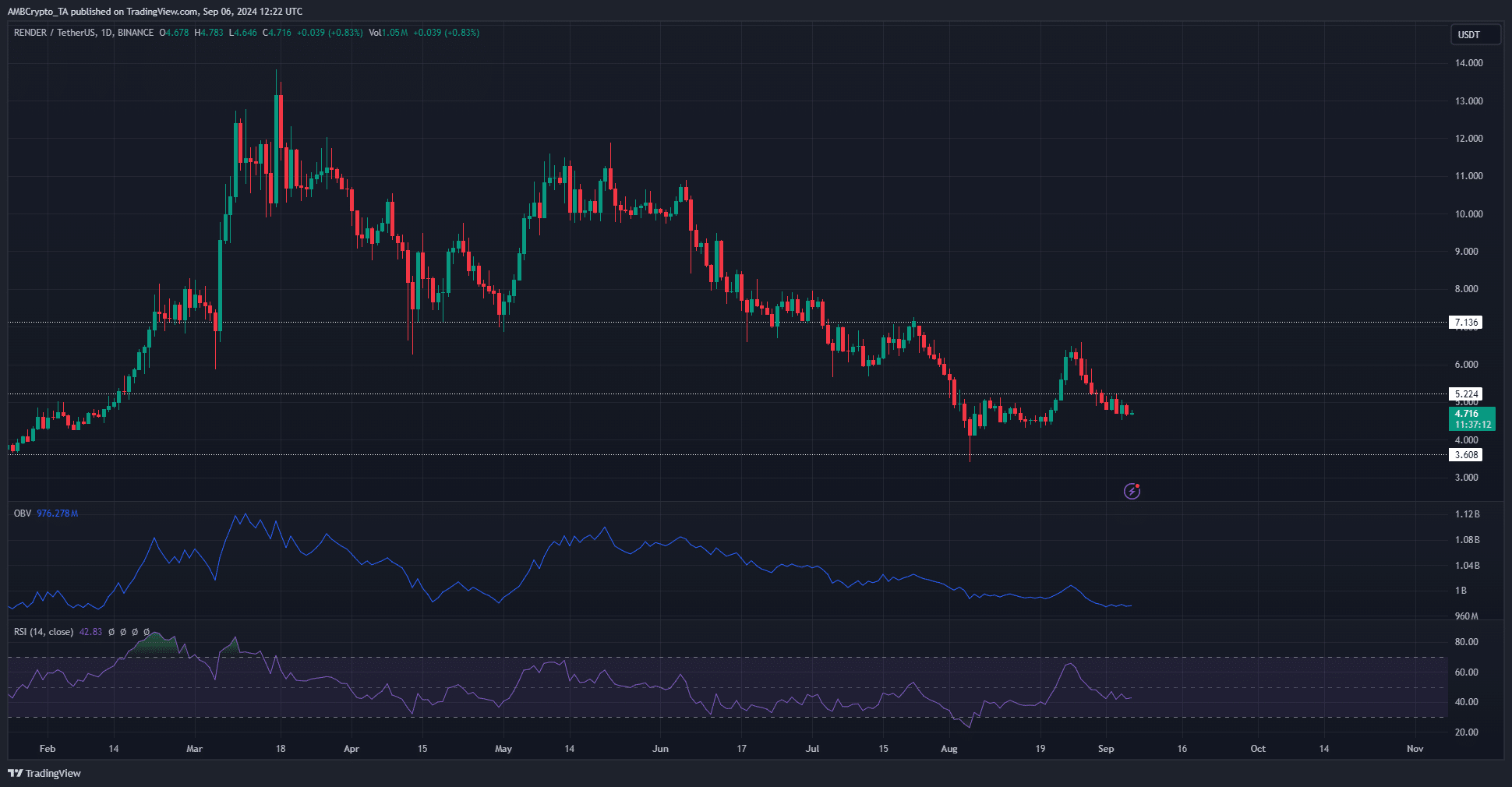

During press time, [RENDER] had essentially returned to its starting point after the price increase from August 21st to August 26th. Its current price was approximately $4.716, which is near the $4.1 to $4.4 support level.

During the price increase, the technical indicators showed a positive trend, yet the buying force was unable to maintain the momentum. On the other hand, the On-Balance Volume (OBV) started moving downward once again, and the Relative Strength Index (RSI) dipped below the 50 mark, indicating a shift towards bearish conditions.

However, some on-chain metrics gave more positive signs.

Buying opportunity for RENDER

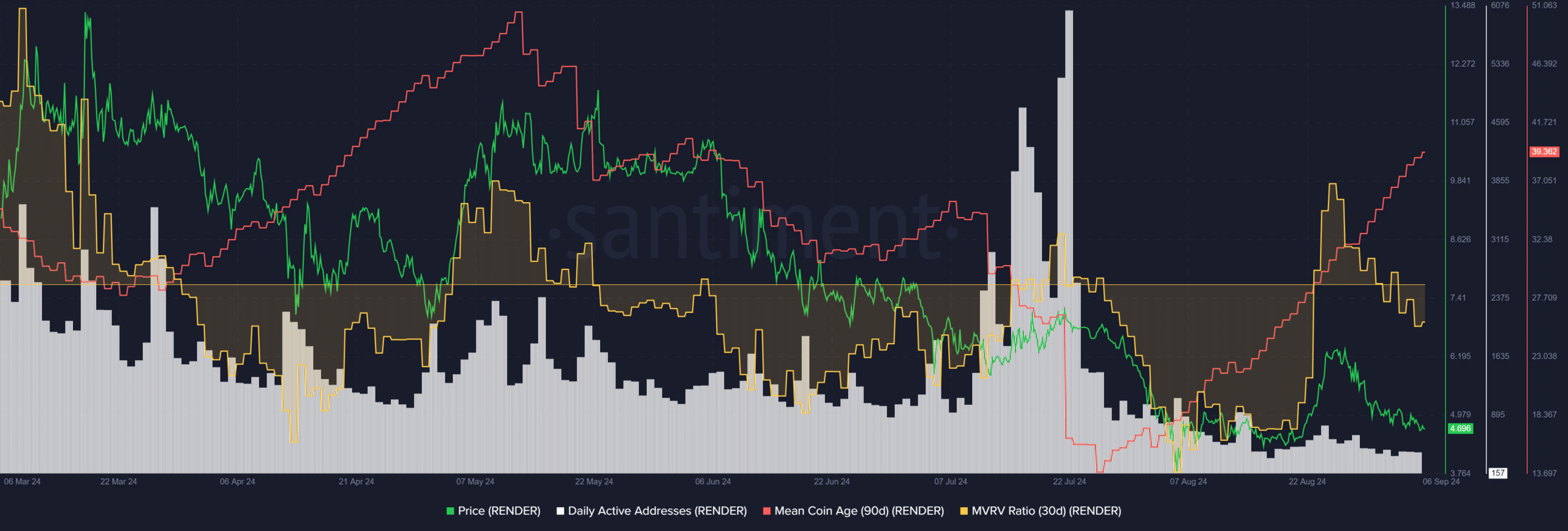

Since the spike in July, the number of daily active participants has consistently decreased, which is unfortunate because lower network engagement typically suggests lessened interest or demand.

Yet, the mean coin age has been trending upward for the past six weeks.

1) The conclusion drawn was that it was a widespread increase (or accumulation). Furthermore, the 30-day MVRV has dipped below zero, indicating that short-term investors are currently experiencing a small loss.

Consequently, the token appears to be underpriced yet being amassed, making it an attractive prospect for purchasing.

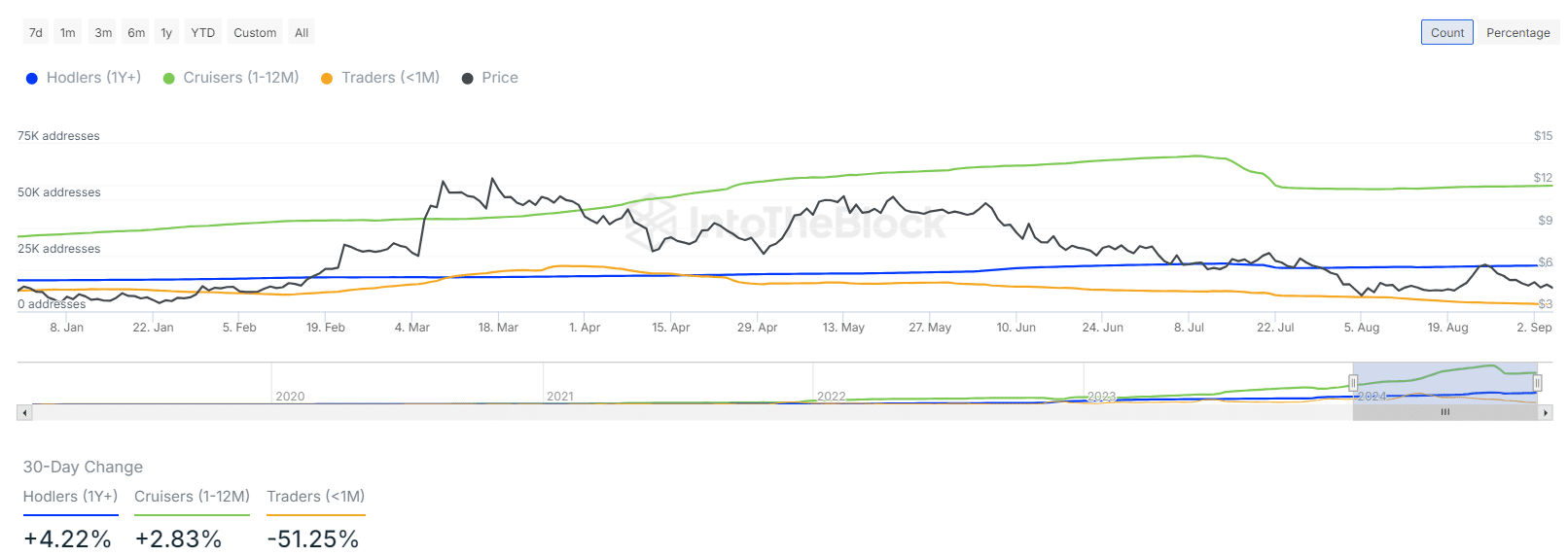

It has been noted by AMBCrypto within the past month that the number of long-term cryptocurrency holders has been on the rise. According to data from IntoTheBlock, both holders and moderate investors (cruisers) are seeing an increase, while the number of active traders is decreasing.

Implications for the price trends and market sentiment

Due to the decrease in active traders (as shown by the data), it appears that speculators and those who trade for short periods of time have significantly reduced their interest in a coin experiencing a temporary downward trend, suggesting they are less keen on keeping the coin at this time.

Lately, there’s been a decrease in the number of open contracts in the derivatives market, suggesting a temporary negative outlook among traders.

Is your portfolio green? Check the Render Profit Calculator

In simple terms, the trend for CVD at the current market has consistently declined. This decline aligns with the observations from On-Balance Volume (OBV), which indicates that buying interest is relatively low and demand is weak in this market.

In summary, while RENDER seems like a good purchase prospect currently, potential investors could consider waiting for a price dip within the range of $4.1 to $4.4 before making their move.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-09-07 08:07