- The United States added 142k jobs in August, falling short of expected figures of 160k

- Bitcoin dropped to a monthly low, but aggressive bets on Fed rate cuts hiked

As an experienced analyst who has weathered numerous market fluctuations, I find myself intrigued by this recent turn of events. The U.S jobs report falling short of expectations and Bitcoin’s subsequent dip are not unrelated occurrences. They both seem to be dancing to the same tune – the Fed’s monetary policy decisions.

On Friday, Bitcoin, the globe’s leading cryptocurrency, dipped to a low of $52,500, reflecting a trend similar to the decline in U.S. stocks. This downturn continued after an August Employment Report that fell short of expectations was released on Friday.

Based on data from the United States Bureau of Labor Statistics (BLS), 142,000 new jobs were added in August. However, this figure fell short of the projected 160,000 by analysts. Interestingly enough, despite the lower job creation number, the unemployment rate dipped slightly to 4.2%.

Impact on BTC and Fed rate cut’s outlook

The recently discussed U.S. Jobs Report holds significant importance for Bitcoin and other market sectors. This is particularly relevant since Federal Reserve Chair Jerome Powell previously indicated that the speed of interest rate adjustments would be influenced by labor market conditions. Consequently, there has been a lot of discussion within the community about this topic.

21Shares’ research analyst, Leena ElDeeb, stated to AMBCrypto that the recent underwhelming employment data serves as a significant test for speculative assets such as Bitcoin.

The latest U.S. job market figures have provided a significant test for speculative investments such as Bitcoin, since the health of the labor market plays a pivotal role in determining whether the Federal Reserve will lower interest rates this month.

She added,

As the unemployment rate showed signs of improvement on September 18, investors reacted optimistically, anticipating a more lenient monetary policy.

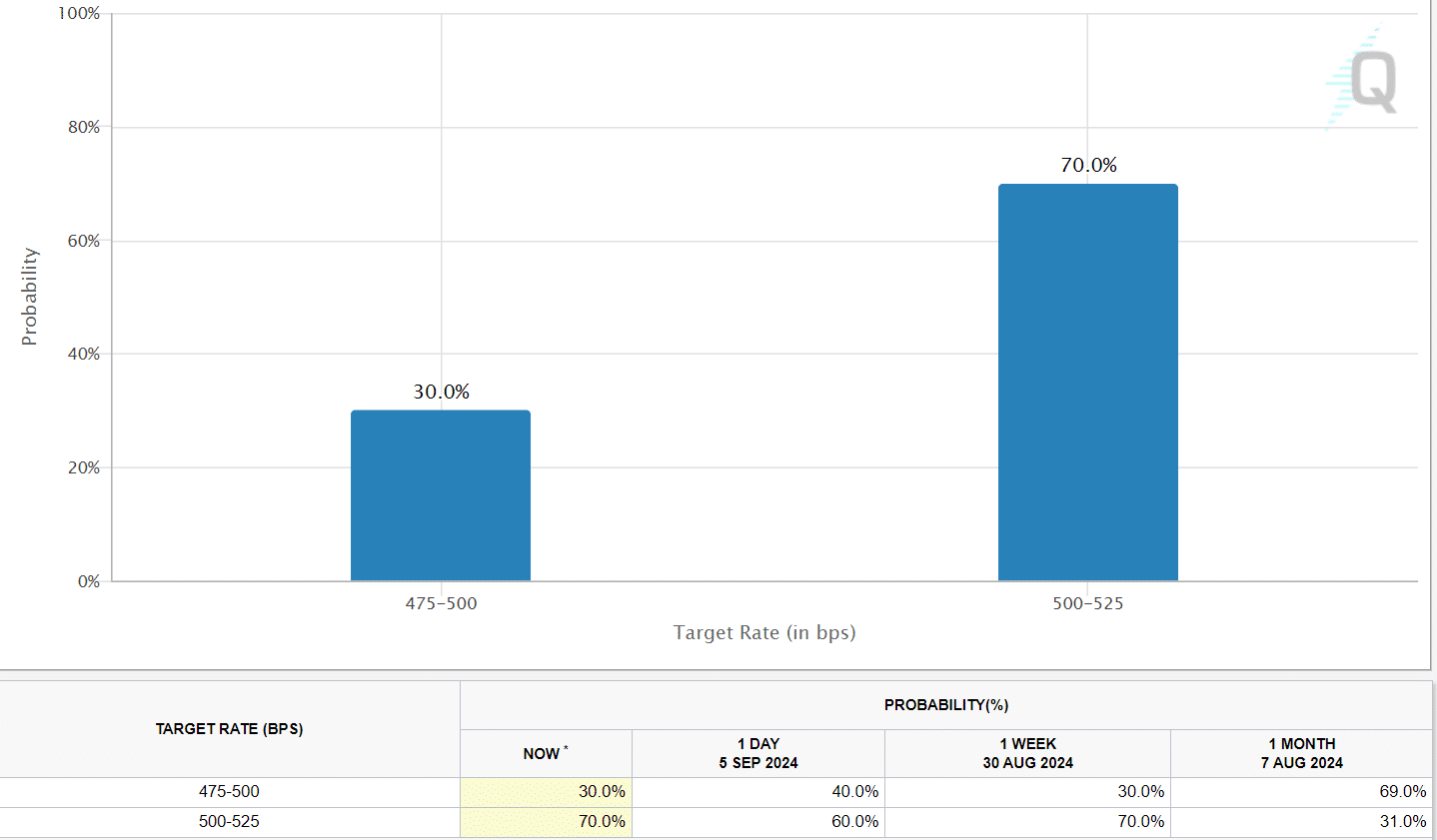

Following the publication of the report, wagers suggesting a 0.5% reduction in the Fed’s interest rate dramatically increased to more than 50%. This surpassed predictions for a 0.25% cut. After investors processed the information, the likelihood of a 0.25% rate adjustment climbed to 70% during the early hours of Saturday in the Asian market.

Bitcoin’s price reaction to U.S Jobs data

Following the publication of the report, Bitcoin reached an impressive high of $56,900 on the price charts. Yet, it soon became apparent that this was merely a brief upward trend driven by speculation, often referred to as a ‘bull trap’.

The cryptocurrency soon dropped sharply to $52.5k later – A monthly low.

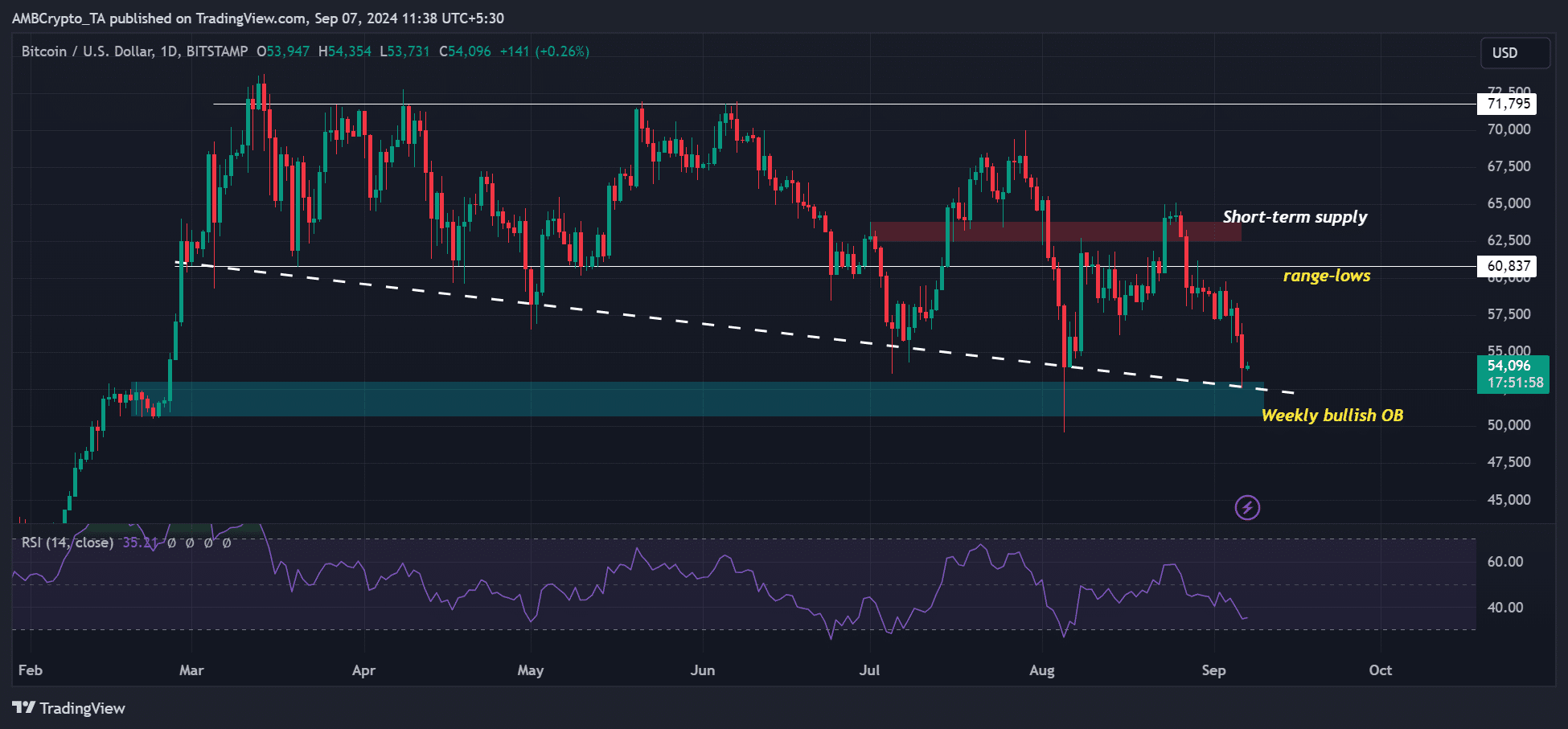

It’s important to mention that when the price dropped significantly to around $52,000, it encountered a weekly bullish order block and support level, which halted the downward trend that began in early August (indicated by the cyan mark).

Therefore, the drop in Bitcoin price to around $52k might present an excellent chance for investment, provided the support level remains strong.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-07 15:03