- POL’s active addresses and total holders recorded exponential growth

- POL’s transition has attracted many users, with some analysts eyeing a flip too

As a seasoned crypto investor who has witnessed the rise and fall of numerous altcoins, I must admit that the recent transformation of Polygon from MATIC to POL has caught my attention. I was initially skeptical about the migration, but the exponential growth in active addresses and total holders has piqued my interest.

Over the last several months, there has been a great deal of excitement in the crypto world as people eagerly waited for the upgrade of Polygon‘s MATIC token to POL. As we previously mentioned at AMBCrypto, this migration became active on September 4, 2024.

In simpler terms, this change implies that MATIC has been replaced by POL as the native token for transactions within the Proof of Stake (PoS) network of Polygon. Essentially, all transactions happening on the Polygon PoS platform now utilize POL as their gas token.

Following this transition, Polygon’s token seems to be experiencing a resurgence after a prolonged decline in its price as shown on the charts. Before the migration, MATIC was heading south, with a 10.75% decrease on the weekly charts and a 7.38% drop over the monthly period.

Following the shift, the altcoin has experienced modest increases. At this very moment, Polygon (POL) is being traded at $0.3773, a 1.45% increase in the last 24 hours. Moreover, its market capitalization increased by 3.44%, reaching $2.1 billion over the same time frame.

Without a doubt, recent market trends appear advantageous for POL, suggesting the importance of its upgrade. To illustrate, Santiment’s study found an increase in network activity and a rise in the number of total holders as well.

Assessing the prevailing market sentiment

Based on Santiment’s assessment of Polygon’s system, it appears that the POL token is experiencing rapid expansion within its network. At the current moment, new daily addresses being created exceed 487, suggesting that in approximately two weeks, this altcoin could surpass MATIC‘s figures for new daily addresses created.

Furthermore, starting from August 15th, numerous MATIC wallets have emptied (or liquidated) their holdings in order to facilitate the swap. Simultaneously, approximately 1826 new POL wallets were established – marking a 64% increase on the charts.

In the past two weeks, the amount of POL held by wallets with 1 million or more has decreased from 98% to 92%. This decrease often occurs when smaller and medium-sized traders quickly invest in a new asset. The rate of decrease should eventually slow down as Binance lists its pairs for this asset. As AMBCrypto previously reported, Binance will stop supporting MATIC pairs starting on September 10th.

One factor fueling growing curiosity about altcoins is their recent price fluctuations. Lately, altcoins have experienced quite dramatic ups and downs.

Ultimately, investors find allure in POL due to its long-term advantages. For example, this token enables cross-chain staking and offers users more authority over decision-making processes.

What do POL charts indicate?

Over the past three days, I’ve noticed a shift in market sentiment towards POL following its migration. According to my analysis using Santiment’s data, it seems that the community is responding positively to this move.

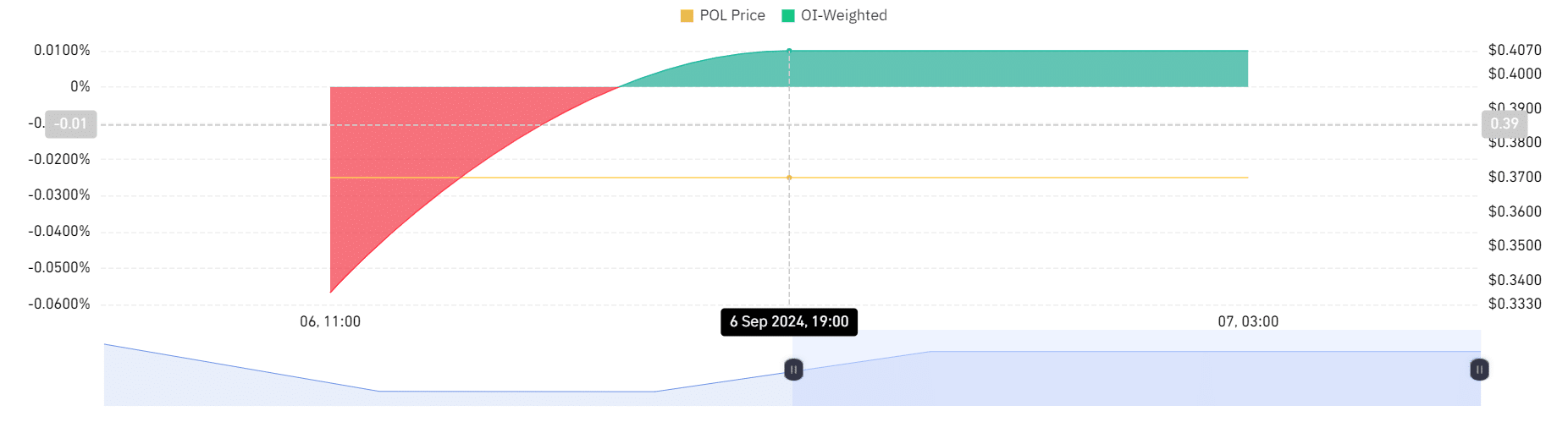

To begin with, the daily funding rate, given its OI (Open Interest) weighting, has been positive over the last two days, except for one instance where it showed a negative figure.

In this context, a higher OI-weighted funding rate indicates a higher appetite for long investments, suggesting that investors anticipate prices will continue to rise, reflecting optimistic market feelings.

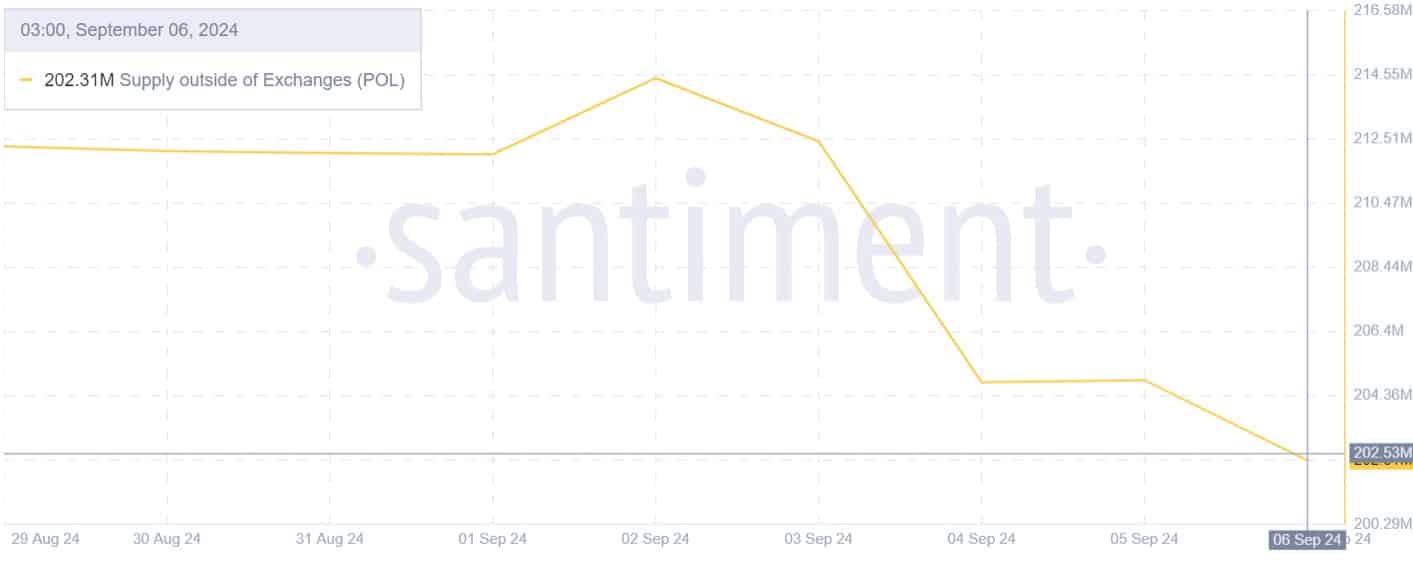

Moreover, Pol’s supply held outside of exchanges has decreased from $214 million to $202 million following the migration. This market trend indicates that investors are adopting a long-term perspective and are less inclined to sell immediately. Such a strategy demonstrates investors’ confidence in the altcoin’s future possibilities.

Given positive market trends, the altcoin appears poised to surpass the current resistance at around $0.38 and potentially reach $0.4 in the near future.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-09-07 19:04