-

Two market analysts have forecasted a downturn for Solana’s price action

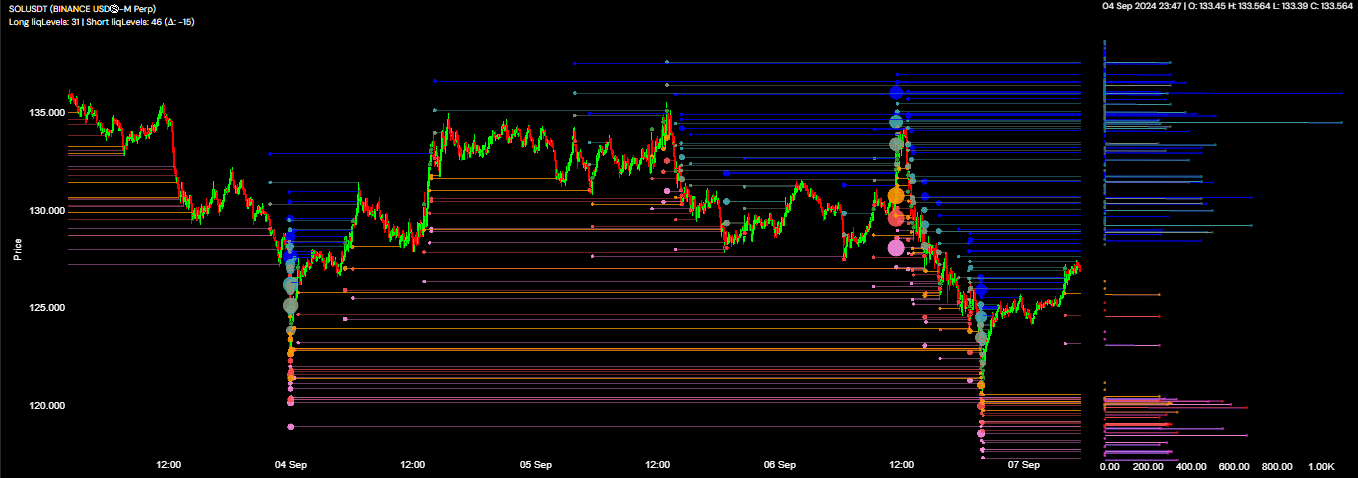

AMBCrypto is predicting a near-term descent to $120 or possibly lower for SOL’s price

As a seasoned researcher with a knack for deciphering market trends and a penchant for understanding complex financial landscapes, I find myself at a crossroads while assessing Solana’s (SOL) current price action. The recent forecasts of a potential downturn by two respected analysts – AMBCrypto and Carl Runefelt – have piqued my interest and raised some intriguing questions.

For approximately 40 days now, Solana (SOL) has been grappling with substantial hurdles in its price trend, experiencing a decrease of about 17.26%. There’s potential for this negative trend to intensify as more evidence backing the decline comes to light.

Significantly, following this dip, Solana (SOL) may likely increase in value, suggesting that the recent fall could serve as the last push for a significant upward trend.

Crossroads for SOL, potential decline anticipated

As per Carl Runefelt’s market analysis, Solana (SOL) currently stands at a critical point where it might either increase or decrease in the forthcoming days. His assessment indicates that Solana is presently trading within a descending triangle, a chart pattern that may lead to bullish or bearish results based on its development.

According to Runefelt’s analysis, if bearish sentiment prevails in the market, we might see a possible decline to around $112.5. However, he also thinks there’s a strong chance for a surge towards approximately $155, slightly surpassing the pattern’s peak, where substantial trading activity is expected.

In agreement with this viewpoint, analyst Kaleo anticipates a steeper drop in the price of SOL, predicting it could reach around $80. This level is considered crucial as it’s expected to draw sufficient liquidity to balance out the selling pressure and potentially drive prices upwards.

In his words,

“[SOL will reach a] new all-time highs.”

Previously, I had identified the $120 mark as a significant support level that could propel Solana (SOL) to fresh all-time highs. However, given the dynamic nature of the market, my attention has now been drawn towards the $80-level, as the market conditions have evolved.

AMBCrypto noticed a pattern on Coinglass where traders who had taken long positions on SOL, hoping for an increase in price, experienced losses. In reality, over $8.99 million was wiped out in the past day as the market shifted unfavorably for these traders.

Furthermore, as per Hyblock’s findings, the total liquidation level delta became negative at -15. This suggests that short selling activity has increased significantly and is now dominating the market.

Additional investigation uncovered a substantial concentration of market liquidity around or beneath the $120 price mark, implying that the value might dip towards these liquidity zones. If this happens, it could exhaust current liquidity pools and then serve as a turning point for potential price increases in the opposite direction.

AMBCrypto then went a step further to monitor Open Interest to predict SOL’s next move.

Traders are invested in SOL’s fall

As a researcher examining market dynamics, I’ve observed that the Open Interest (OI) – a tool used to quantify the number of active contracts within a given market as an indicator of both liquidity and overall market sentiment – points towards a bearish forecast for Solana (SOL).

Currently, the Open Interest has dropped by approximately 4.97%, or $1.94 billion, within a 24-hour period. This decrease indicates that traders may be expecting a potential drop in SOL‘s value, as it is currently being traded at around $127.49.

If the negative feelings about SOL continue, it’s possible that its price could drop even more from the previously mentioned point.

Read More

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

2024-09-08 03:04