- Toncoin price dropped 13% in last 7 days with a growing liquidation pool at $4.51.

- Whale activity surged 8.8%, with exchange net flows dropping by 779%.

As a seasoned researcher with years of market analysis under my belt, I find myself cautiously optimistic about Toncoin’s [TON] current situation. The 13% drop over the past week has been a stark reminder of the volatile nature of cryptocurrencies, but it’s essential to remember that these dips often present opportunities for long-term investors.

In the past day, Toncoin (TON) experienced a notable decrease, causing its value to fall approximately 3.37%, leaving it at roughly $4.69 as of this writing.

Over the past week, Toncoin saw a more substantial dip of 13%, reflecting broader bearish trends.

What the price charts show…

At the moment, Toncoin was experiencing a dip near a significant resistance point, approximately $4.88. In the past, this level has been pivotal in halting more substantial drops.

But as its bullish trend weakens following a rejection near the $4.88 significant resistance level, the overall feeling among investors seems to be becoming more negative.

If the resistance point at $4.88 maintains, there might be a possibility for a potential drop, aiming to capitalize on the liquidation pool situated at $4.51. Continued downward pressure could lead to a more significant adjustment towards the $3.66 support zone.

A break below this key support would mark a bearish continuation.

Whale activity on the rise

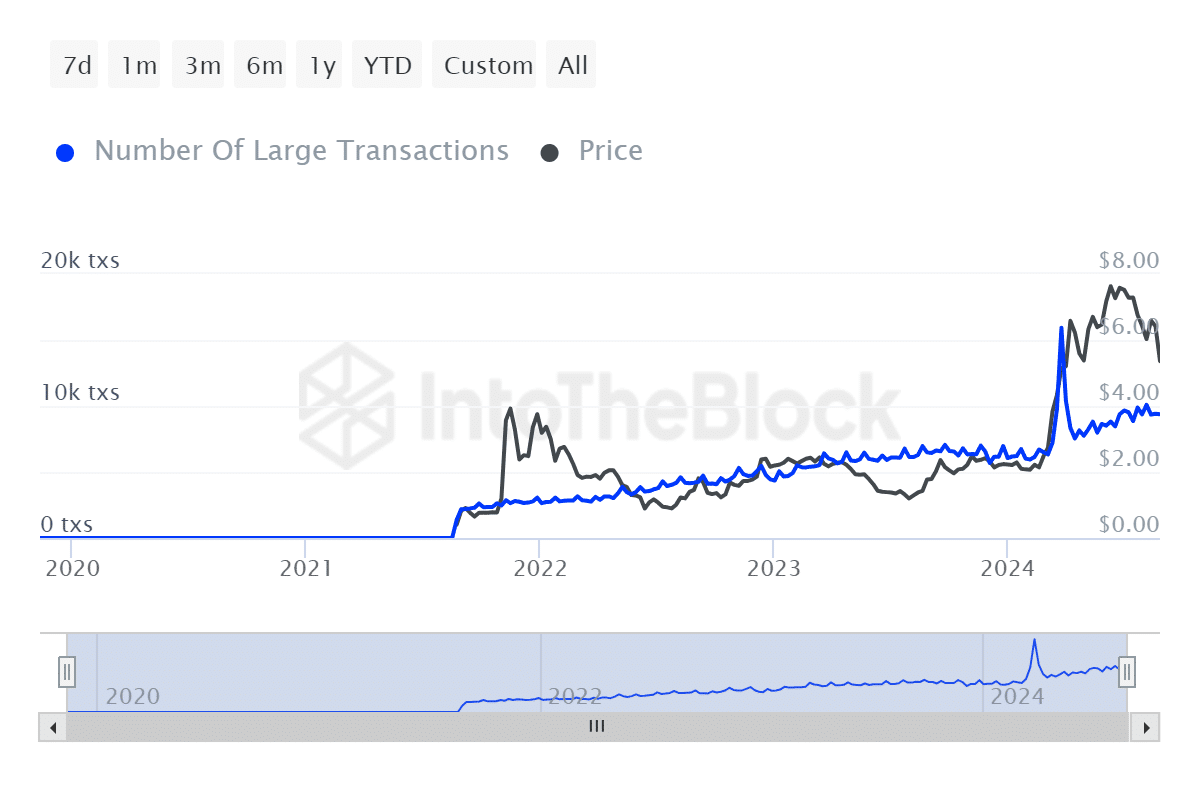

According to IntoTheBlock data, a notable uptick in whale activity is evident.

Toncoin saw a 8.8% rise in larger transactions over the past day, suggesting an uptick in whale activity. Such activity might indicate growing institutional involvement or mass selling, which could affect Toncoin’s near-term price fluctuations.

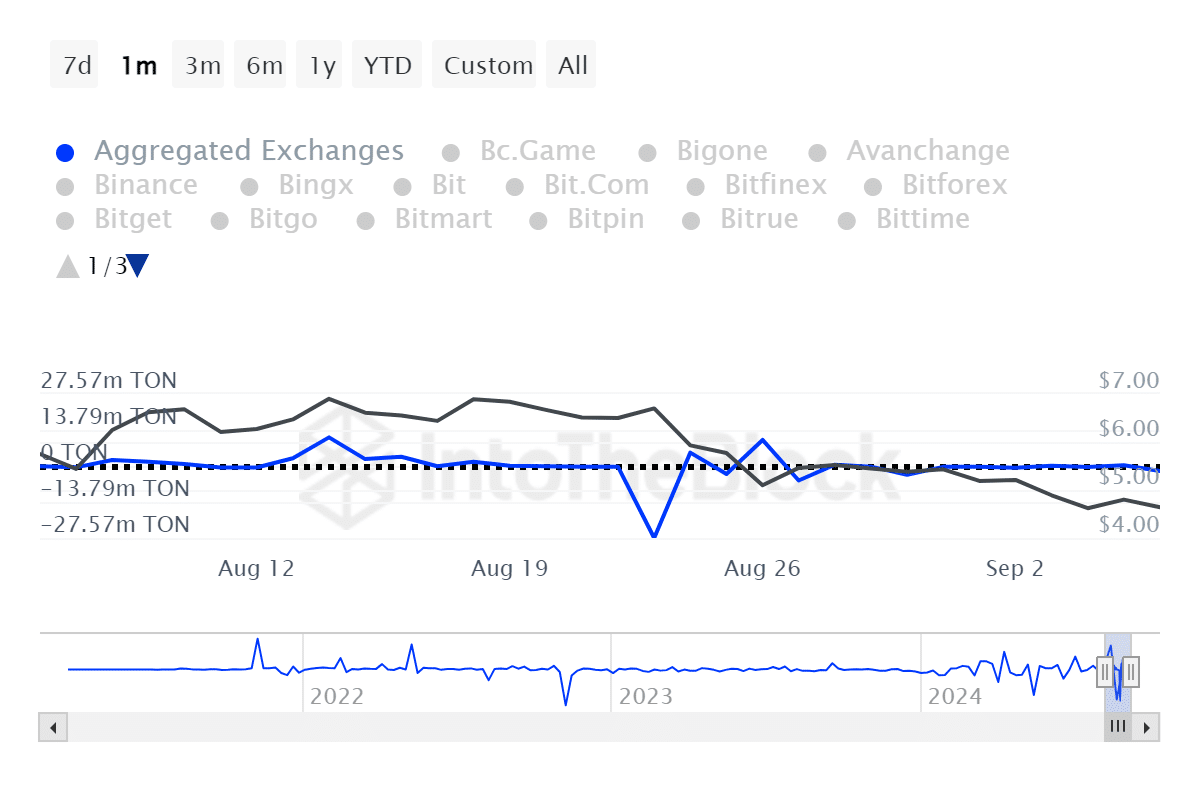

Conversely, exchange net flows showed a dramatic reduction by 779%.

This decrease suggests that there’s a large withdrawal of Toncoin from exchanges, often signaling a positive or bullish attitude among investors, as they may be transferring their coins to offline wallets, anticipating a possible price increase.

Toncoin liquidation pool grows at $4.51

As an analyst, I’ve observed a significant accumulation of potential sell-offs around the $4.51 price mark in Toncoin. Currently, roughly 322,000 tons of Toncoin are exposed to this potential selling pressure.

If Toncoin falls near this price point, there could be an increase in sell orders, possibly intensifying the downward trend.

Based on the current stochastic RSI, there might be an impending bullish turnaround as the indicator is venturing into the oversold territory.

Although a crossover event hasn’t occurred yet, investors should stay alert for a possible bullish indication that could ignite temporary buying fervor.

Recovery or further decline for Toncoin?

If Toncoin maintains its position above the critical support level in the future, it’s likely we’ll witness a steady improvement over the next few quarters. Additionally, should large investor activity persist and potential risks from liquidations be minimized, this trend could strengthen.

If the current support doesn’t keep prices from falling, there may be increased pessimism, potentially causing prices to drop even further as they approach lower levels of support.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-09-08 11:03