-

Per Swan Bitcoin’s CEO, BTC could hit $100,000 by early 2025, then $1 million by 2030.

Bitcoin power law model echoed the April 2025 BTC price forecast.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of bullish and bearish predictions. However, when it comes to Bitcoin, the latest pronouncements from Swan Bitcoin’s CEO Cory Klippsten have certainly piqued my interest. His forecast of BTC hitting $100,000 by April 2025 and $1 million by 2030 is ambitious, to say the least.

Bitcoin [BTC] has been stuck in a boring price consolidation since March. However, most analysts and industry leaders remain bullish, especially from Q4 2024 to 2025.

Major financial entities, such as Standard Chartered Bank, anticipate that the value of the world’s most significant digital asset could reach an astounding $150,000 by the year 2024.

Swan Bitcoin’s CEO Cory Klippsten is the latest to make a BTC price target. During a recent interview with Kitco News, he said,

I believe that by April 2025, the price of Bitcoin could stabilize at around 100K. By the close of 2025, it’s likely that we’ll see some fluctuation, potentially dropping back down to approximately $125K.

However, the executive maintained that the largest digital asset could hit $1 million per coin by 2030, citing likely increased education about the asset.

“We’ll have Bitcoin sats to dollar parity, which means $1 million per coin by 2030.”

Klippsten’s target was slightly different from Standard Chartered. The bank projected BTC could hit $200K by the end of 2025, unlike Klippsten’s conservative $125K target.

However, do the common BTC prediction models agree with this outlook?

What does Bitcoin power law model project?

Analysts often use the Bitcoin Power Law as a predictive model. This model estimates potential future price levels by studying past price movements. It breaks down these movements into three key areas: support (areas where the price is expected to rise), resistance (areas where the price may encounter obstacles and potentially fall), and median level (the middle point between support and resistance).

By February 2024, the model forecasted a peak at around $300,000, a minimum of approximately $20,000, and a more moderate goal of $74,000. In March, Bitcoin reached its highest point at $73,000, just under the median target price of $74,000.

As a researcher, I’ve found that my model’s early 2025 targets are set at approximately $420K, $40K, and $115K. Interestingly, Klippsten’s target is remarkably close to the model’s median target. However, for the end of 2025, the model’s median target stands at a significantly lower $150K compared to the executives’ projections, which estimate around $125K.

It’s worth noting that the power law model relies on past price patterns and may be invalidated by blackswan events.

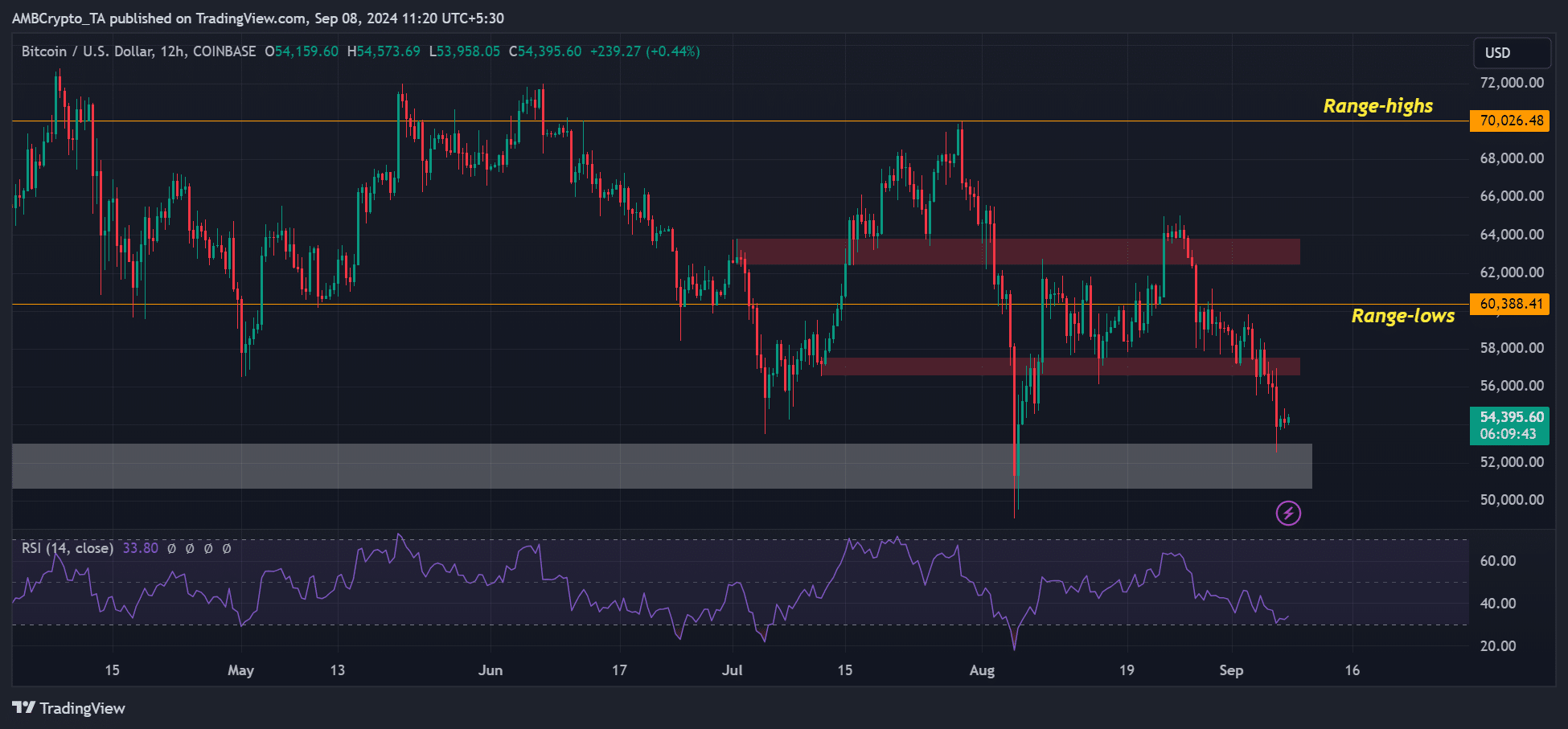

Currently, Bitcoin’s recent drop has surpassed the $52K mark, which served as a crucial support during early August’s significant decline. As suggested by Arthur Hayes, founder of BitMEX, there may be an upward trend ahead due to optimistic views from the broader economic landscape. In his words, “a rebound could be possible.

As Janet Yellen monitors the market over the weekend and potentially issues a statement, there’s a possibility that Bitcoin (*BTC*) could increase next week, should more dollar liquidity be anticipated.

For Bitcoin to continue its upward trajectory, it needs to surmount resistances at around $57,000 (which is currently above the current price), previous resistance levels at $60,000, and a supply zone located at $65,000. Currently, BTC is trading at approximately $54,300, representing a 26% drop from its peak of $73,800 recorded in March.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-09-08 14:15