-

ADA’s active addresses showed that one key on-chain data reacted to the upgrade.

ADA has remained in a bear trend.

As a researcher with years of experience in the crypto market, I have seen my fair share of ups and downs, bull runs, and bear trends. Recently, Cardano (ADA) has caught my attention due to its latest upgrade and subsequent activity on the network.

Lately, Cardano [ADA] has been in the spotlight following its recent update earlier this month. Yet, it seems that the upgrade didn’t lead to an immediate change in price or activity. Interestingly, there’s been a significant increase in active ADA addresses over the past three days, reaching levels not seen for several months.

Cardano gets more active addresses

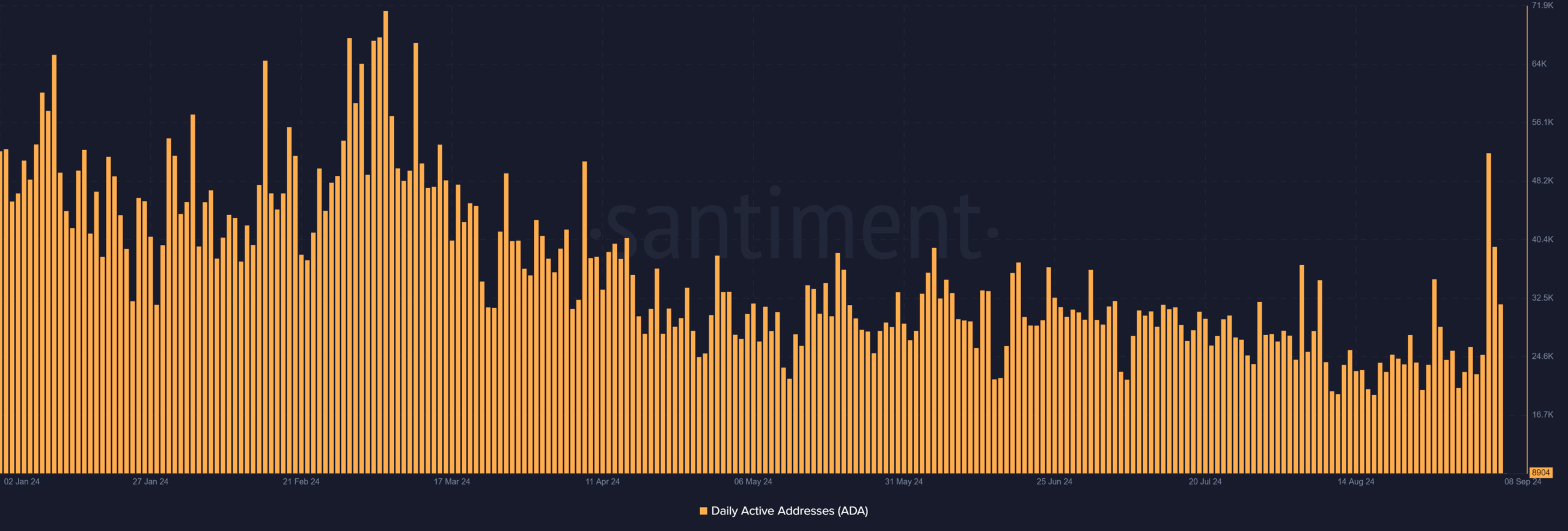

Examining the daily usage statistics of Cardano’s wallet addresses reveals a significant increase that marks a peak not seen in more than five months. According to Santiment’s data, the number of daily active ADA wallets surged past 52,000 on 5th September.

Despite decreasing to about 39,400 the next day, this figure remained the peak since May. By the close of trading on September 7th, the number of active addresses fell even more to around 31,600.

Although there have been decreases, it’s noteworthy that Cardano has experienced a notable increase in daily active address activity for the first time in months. This unexpected jump in active addresses could indicate growing curiosity and involvement within the Cardano community, potentially a belated response to the recent network upgrade.

Although the immediate effects of the update were not immediately apparent, an increase in network activity might suggest that users are slowly embracing the changes and enhancements being made.

An uptick in active addresses could potentially lead to expanded functionality and increased engagement within the Cardano network over the next few weeks, suggesting a revitalized curiosity about the platform.

ADA getting close to a reversal?

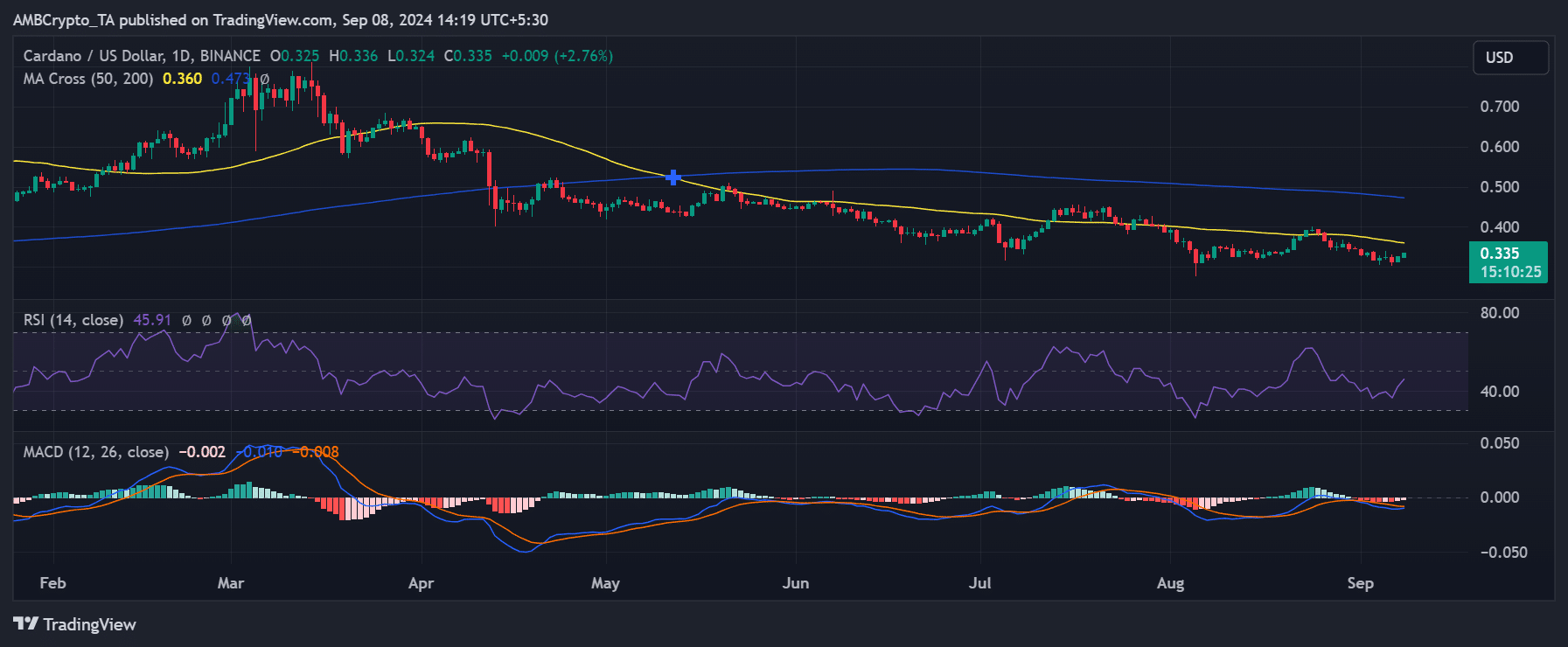

Taking a closer look at Cardano’s daily graph indicates that the asset is generally moving downwards over the long term, however, there’s been a noticeable pickup in positive movements during the past 24 hours.

Based on AMBCrypto’s assessment, Cardano (ADA) concluded the previous trading day roughly at $0.32, signifying a 3.4% rise. At present, it is being traded near $0.33, marking an additional 2.7% growth.

If Cardano (ADA) keeps up its current uptrend, it would signify the first instance in two weeks where the asset records back-to-back increases exceeding 2% each day. Persisting with this momentum could hint at a possible resurgence into a bull market for Cardano.

A look at Cardano’s RSI reveals that it continues to stay under the neutral threshold, suggesting that it hasn’t entered a bullish state yet.

In the last 24 hours, the Relative Strength Index (RSI) has drawn nearer to neutral, sitting around 46. If the RSI continues to increase, it could add more weight to the argument for a shift towards bullish energy. This suggests that Cardano might soon break free from its downtrend if its positive price trends continue.

Cardano held in the $300 million volume level

Recent analysis shows that Cardano’s (ADA) trading volume has consistently stayed in the $300 million range, with the highest volume reaching around $340 million.

For ADA to escape its present downward trend and sustain an uptrend, it may require larger transaction volumes compared to the current level.

Realistic or not, here’s ADA’s market cap in BTC’s terms

A combination of increasing prices along with higher trading volumes is essential for confirming an uptrend. As the volume increases, temporary price rises are likely to hold steady.

Cardano’s trading volume was around $160 million as of this writing.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

2024-09-09 02:15