In 2025, prediction markets finally ditched their “niche experiment” label and strutted into the financial big leagues. 🎩✨

Prediction Markets Go Mainstream (Like, Actually This Time)

Remember when prediction markets were just for betting on elections and sports? Cute. By 2025, they’d evolved into a multibillion-dollar ecosystem, cozying up to Wall Street, media giants, and even crypto infrastructure. 🌐💸

From courtroom dramas to blockbuster deals, prediction markets spent the year elbowing their way into the spotlight-and mostly winning. 🏆 But let’s be real, it wasn’t all smooth sailing. 🚢⚖️

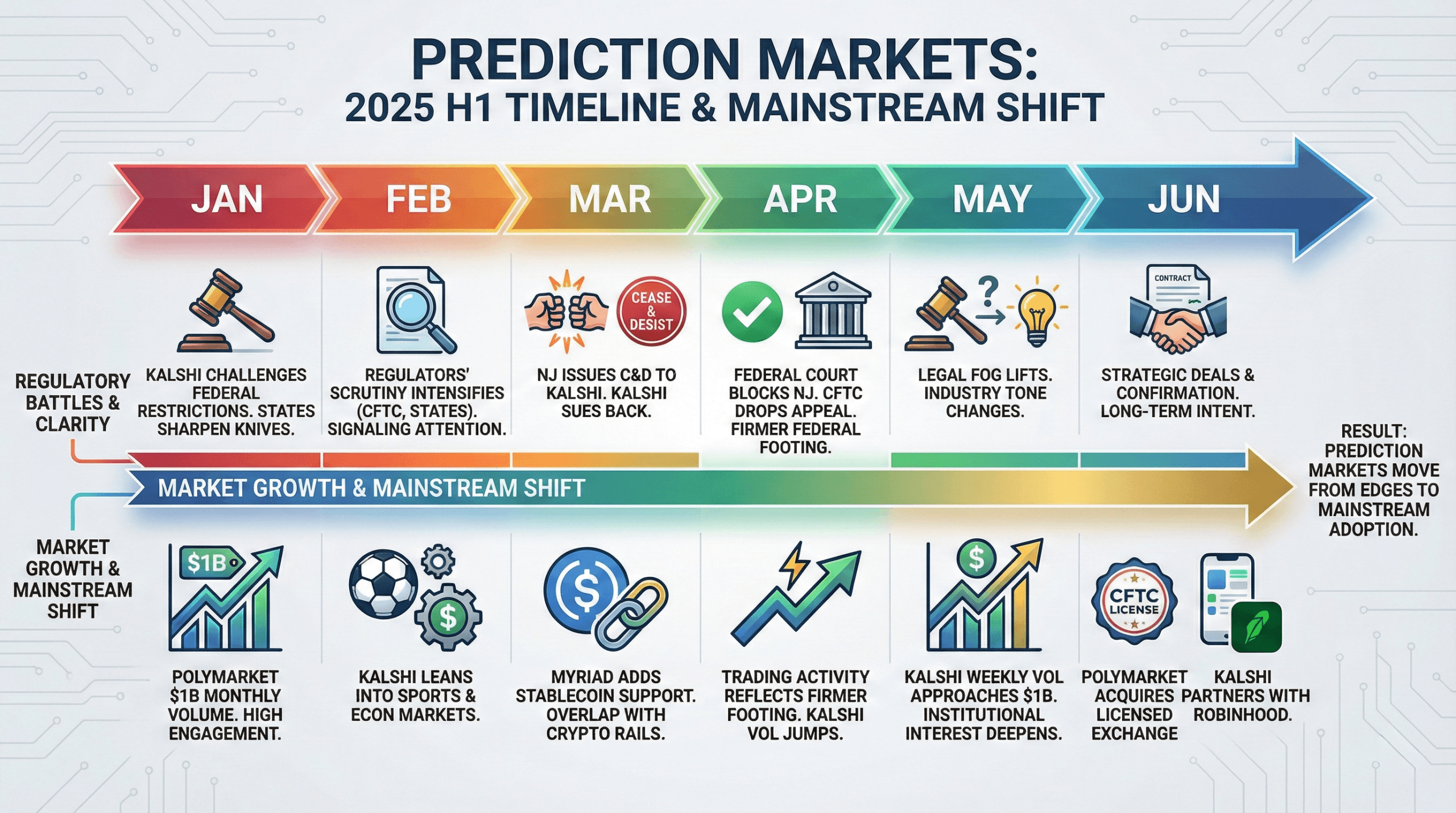

A Strong Start, With Lawyers on Speed Dial 📞⚖️

The year kicked off with Polymarket raking in over $1 billion in monthly trading volume, thanks to the 2024 election hangover. Meanwhile, Kalshi was busy betting on sports and economics-and preparing for legal battles that would make Law & Order look like a sitcom. 📉🏒

In January, Kalshi found itself back in court, challenging federal restrictions on political event contracts. State regulators were sharpening their knives, but did that stop anyone? Lol, no. 💼⚔️

Regulation Tightens-Then Starts to Blink 😵💫

By February, regulators were like, “Wait, these markets are actually a thing?” The CFTC scheduled public discussions, and state-level scrutiny intensified. March brought both innovation (hello, stablecoins on Myriad!) and drama: New Jersey hit Kalshi with a cease-and-desist order. Kalshi’s response? “See you in court, buddy.” 👊⚖️

Courtrooms, Clarity, and a Federal Green Light 🟢⚖️

April was the turning point. A federal judge sided with Kalshi, saying federal law trumps state gambling statutes. The CFTC dropped its appeal, and suddenly, prediction markets had a federal stamp of approval. Trading volumes soared, and Kalshi was like, “Sports bets? Name a more iconic duo.” 🏈💹

Growth Accelerates as Legal Fog Lifts 🌫️➡️🌞

By May, Kalshi was reporting weekly volumes nearing $1 billion. Sports were the star, but economics, crypto, and politics were quietly gaining traction. Venture capital started whispering sweet nothings, and institutional types stopped calling it a “novelty.” 💼💸

Deals, Integrations, and Wall Street Curiosity 🕵️♂️💼

June was all about deals. Polymarket acquired a CFTC-licensed exchange to re-enter the U.S. market, and Kalshi partnered with Robinhood, bringing prediction markets to the masses. Subtext? They were done playing small. 🌍🚀

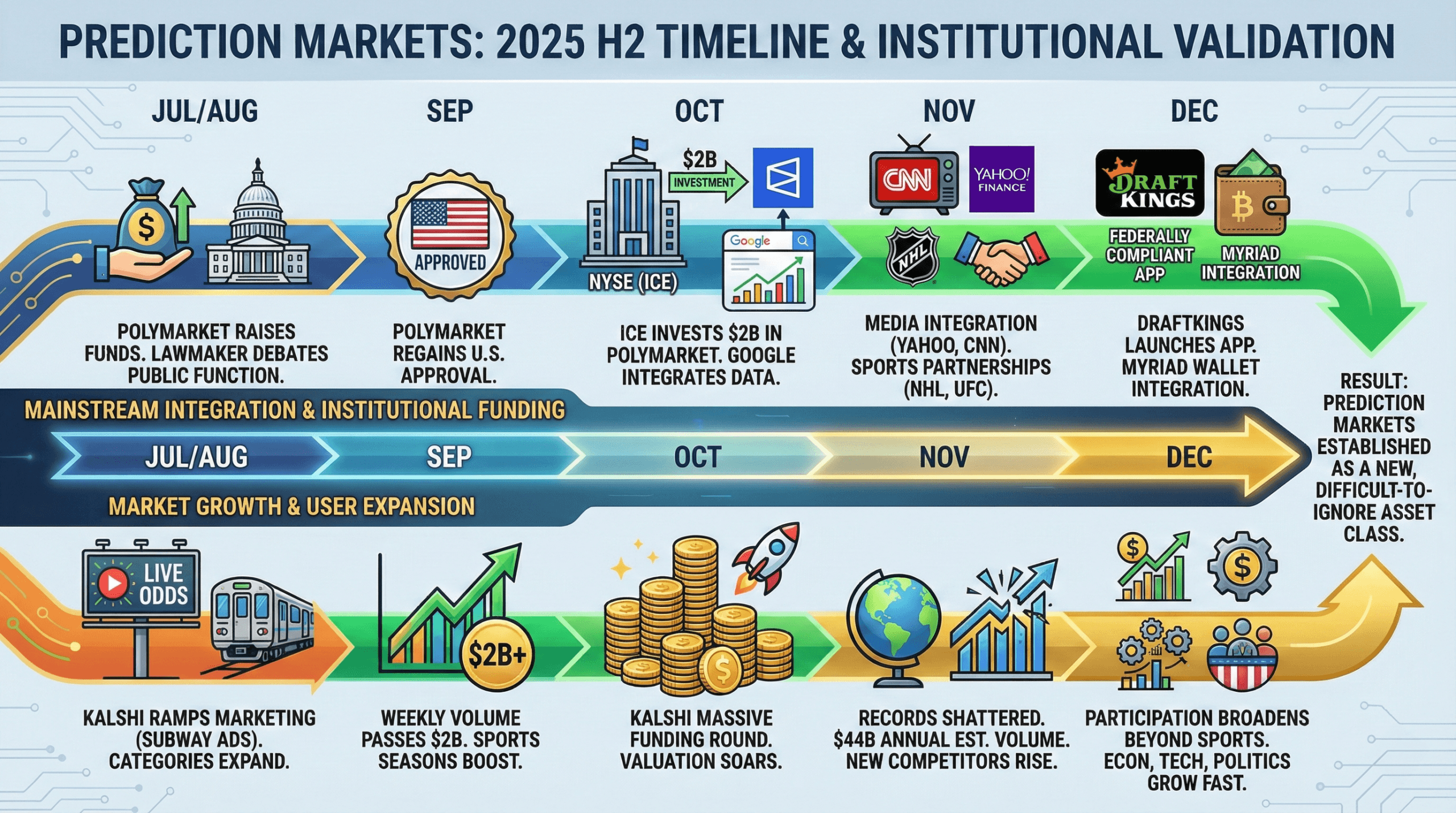

Summer Funding and the Push Toward the U.S. 🏖️💵

Summer brought capital-lots of it. Polymarket raised funds for its U.S. relaunch, and Kalshi turned live odds into subway ads. Lawmakers debated their usefulness, but no one was putting the genie back in the bottle. 🧞♂️💡

The U.S. Door Reopens 🚪🇺🇸

September was huge: Polymarket got the green light to operate in the U.S. again, just in time for sports seasons and political speculation. Weekly volumes hit $2 billion. State battles continued, but users didn’t care. 🚀📈

October’s Capital Floodgates Open 🌊💰

October was the month prediction markets went big. Intercontinental Exchange (ICE) invested $2 billion in Polymarket, and Kalshi raised $300 million, hitting a $5 billion valuation. Google started integrating their data, and suddenly, probabilistic forecasts were everywhere. 🔍📊

November Sets Records Across the Board 🏆📈

November was bonkers. Combined platform volumes hit $44 billion for the year. Kalshi and Polymarket cleared multibillion-dollar monthly totals, and media outlets like Yahoo Finance and CNN jumped on the bandwagon. Sports partnerships? NHL and UFC said yes. 🏒🥊

December Brings Expansion-and Competition 🌍⚔️

By December, prediction markets had company. DraftKings launched a federally compliant app, and Myriad integrated into a major crypto wallet. State resistance lingered, but participation broadened to economics, tech, and politics. 🌐📊

A New Asset Class Finds Its Place 🏦✨

By year’s end, prediction markets were no longer a curiosity-they were an emerging asset class. Regulated exchanges, blockchain settlement, and real-time data made them impossible to ignore. The question now? How far will they go? 🚀🤔

FAQ ❓

- What are prediction markets?

Platforms where users trade contracts tied to real-world event outcomes. 🌍📈 - Why did they grow so fast in 2025?

Regulatory clarity, major partnerships, and rising demand for probabilistic data fueled the boom. 🚀💡 - Which platforms dominated 2025?

Kalshi and Polymarket led with volume, funding, and mainstream integrations. 🏆💰 - How are they connected to crypto?

Many use blockchain, stablecoins, and decentralized tools. 🔗⛓️

Read More

- Best Controller Settings for ARC Raiders

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- James Gunn & Zack Snyder’s $102 Million Remake Arrives Soon on Netflix

- Ashes of Creation Rogue Guide for Beginners

- Jealous of the new Xbox Ally? — Here are 6 ways to give your original ROG Ally a glow-up

- Taming Fermions with Neural Networks

2025-12-25 18:58