-

ETH accumulation has dropped in the last few weeks.

ETH had a positive trend over the weekend.

As a seasoned researcher with years of experience in the cryptocurrency market, I find myself intrigued by the recent developments surrounding Ethereum [ETH]. While whales seem to be taking a breather from their accumulation activities, the network is experiencing a surge in new addresses – a sign of renewed interest and increased adoption.

Over the last several months, Ethereum (ETH) has shown considerable price fluctuations, and its on-chain indicators are offering conflicting messages. The data seems to suggest that some major Ethereum investors have temporarily halted their buying spree, which could mean a change in attitude among big-time holders.

Nevertheless, it’s worth noting that Ethereum has achieved a four-month peak in network expansion, which suggests an uptick in action and acceptance within the network.

Ethereum whales scale back on accumulation

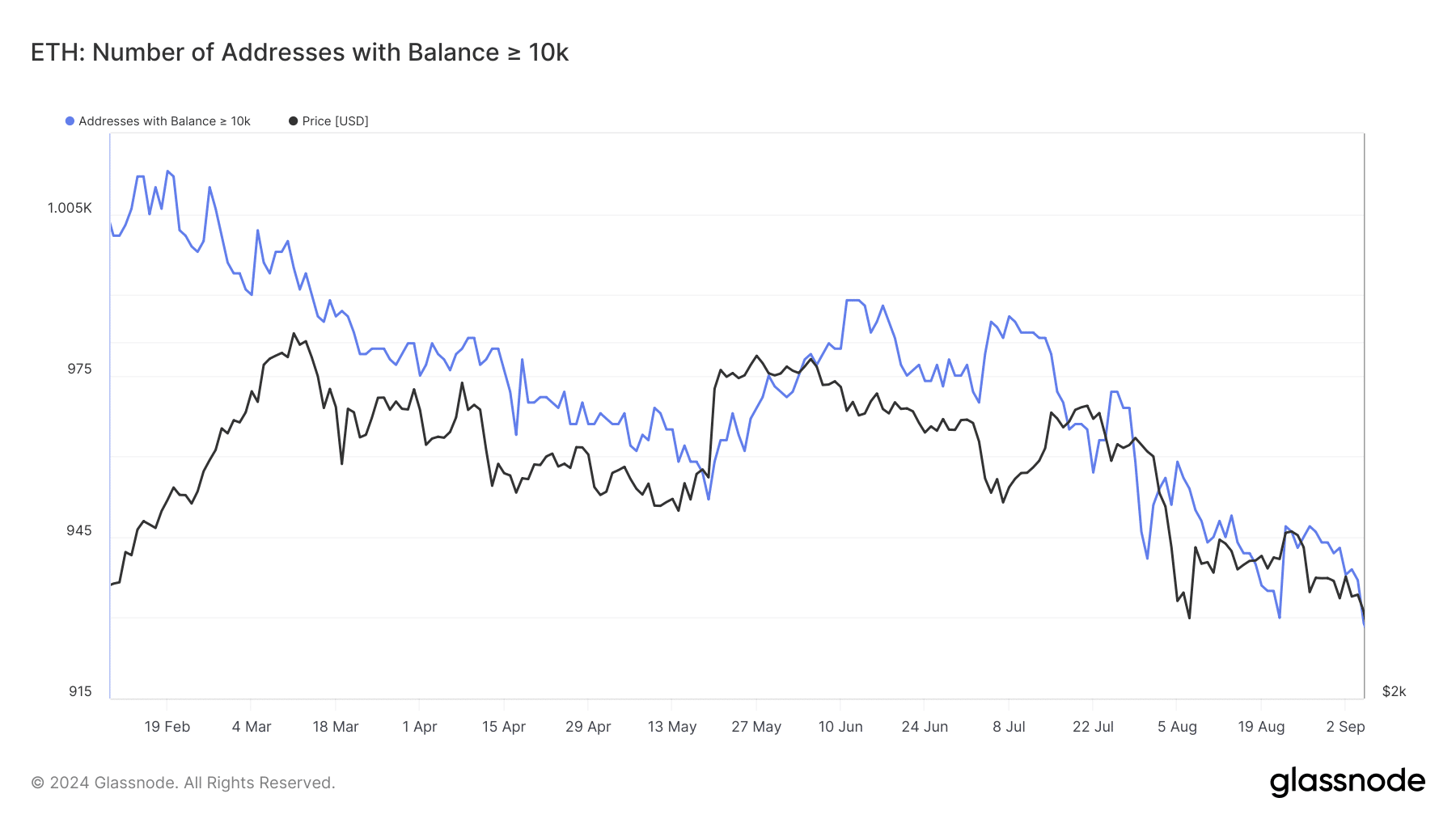

A look at Ethereum addresses via Glassnode shows that different groups of investors are responding differently to recent changes in price. Investors with between 10 and 100 ETH are showing a steady pattern, suggesting they’re neither heavily selling off their holdings nor significantly buying more.

Nevertheless, noticeable increases were seen predominantly in larger Ethereum wallets. Specifically, those with between 1,000 and 10,000 ETH showed a pause in accumulation around late August.

Additionally, it appears there’s been a significant decrease in the amount of assets being held, which could signal either reallocation or liquidation. This trend hints at mid-level large investors scaling back their involvement.

Additionally, entities with addresses containing over 10,000 ETH reduced their acquisition at an earlier stage.

The data indicates that these particular addresses ceased amassing more around July. Just like the thousand ETH addresses, they’ve also been either transferring or disposing of their Ethereum holdings since then.

Recent Ethereum network growth flashes positive signals

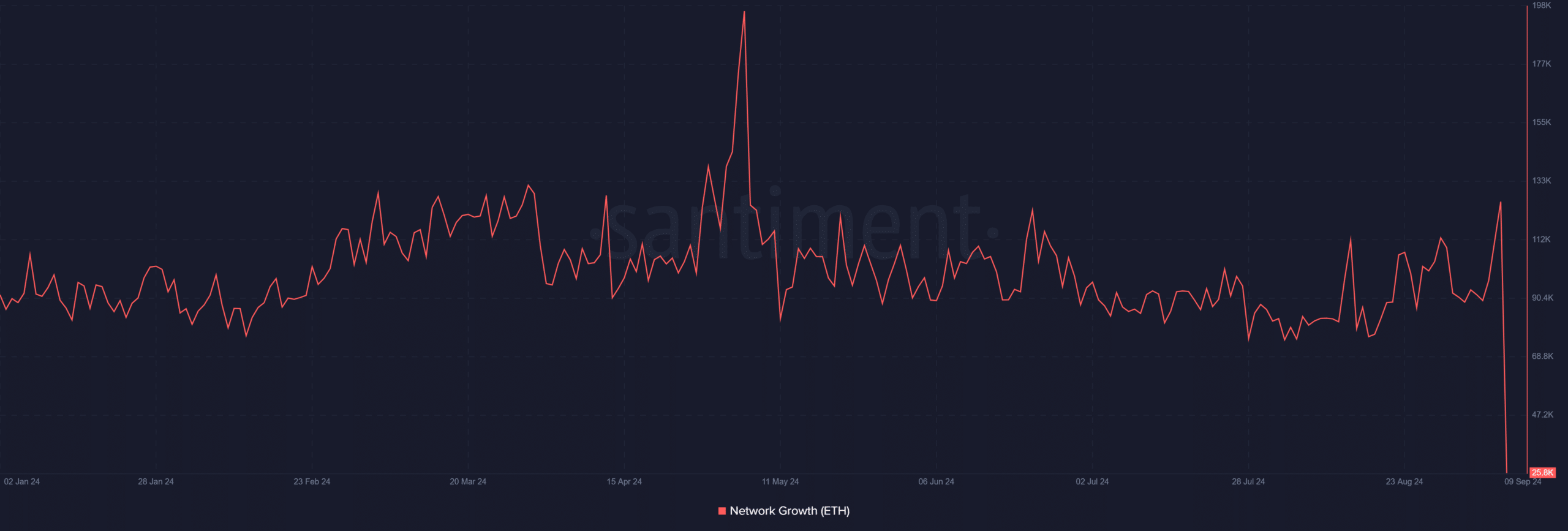

The recent decline in accumulation from whale addresses could be interpreted as a negative indicator for Ethereum, signaling caution among large holders. However, the network’s positive growth in new addresses provides a more optimistic outlook.

Data from Santiment indicates that the number of new Ethereum addresses has hit a four-month peak, surpassing 126,000. Remarkably, this significant increase took place on a Sunday, which hasn’t been seen since June.

This day typically experiences lower network activity.

ETH ends the weekend positively

An Ethereum analysis on the daily chart shows positive price movement over the weekend. At the close of trading on 8th September, ETH saw a 1% increase, trading around $2,297.

In my current analysis, I’ve observed that the Ethereum (ETH) price has surged approximately 2% in the preceding session. At the moment, it stands within the $2,300 price bracket, showing a marginal growth of less than 1%.

The increase in network expansion, evident through an uptick in newly created addresses, demonstrates a rising curiosity towards Ethereum, despite the unpredictable market conditions.

Although the rate at which whales amass assets has decreased, the growth in network involvement implies that smaller investors and newcomers are getting more engaged within the Ethereum community. This growing interest might contribute to a better equilibrium in the market’s overall dynamics.

Read Ethereum (ETH) Price Prediction 2024-25

The relationship between decreasing whale actions and increasing network expansion plays a significant role in predicting both the price fluctuations and overall robustness of Ethereum in the future.

Should smaller investors maintain their enthusiasm, it may help balance out some of the negative impact caused by less whale buying, possibly keeping Ethereum’s price stable for a while.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What You NEED to Know!

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-09-09 17:12