- Current patterns in the crypto total market capitalization chart (TOTAL), specifically an ascending triangle, suggested a major bullish trend is on the horizon.

- This sentiment is echoed in the Total 3 chart, which analysts also viewed as primed for a rally.

As a seasoned crypto investor with a decade of market experience under my belt, I’ve seen my fair share of bull runs and bear markets. The current patterns in the total crypto market capitalization chart and Total 3 chart are reminiscent of the early signs we saw before the monumental rally in late 2017. If history repeats itself, we could be on the brink of a substantial bull run.

Between January and March, the overall value of all cryptocurrencies increased by a significant amount, around 81.36%, peaking at approximately $2.721 trillion. But since then, that value has dropped by about 30.41%.

As a bullish trend appears, it seems we’re witnessing the setup for potentially significant growth in the cryptocurrency market, possibly marking the start of an extended bullish phase.

An ascending triangle can lead to a rally, but with a condition

A rising triangle is a type of chart formation in the stock market where two sloping lines converge towards each other, forming an upward-pointing triangle. This pattern frequently indicates an upcoming price increase or rally.

In simpler terms, this pattern emerges when the price fluctuates between a flat resistance level (where it tends to fall) and an ascending support level (where it tends to rise), indicating a period of holding or consolidation before potentially breaking through these levels.

If we find ourselves in an optimistic outlook, often signaled by an ascending triangle pattern, there’s a strong possibility that the price will eventually surge upwards. It could even reach or surpass its old highest point, and potentially venture into entirely new heights.

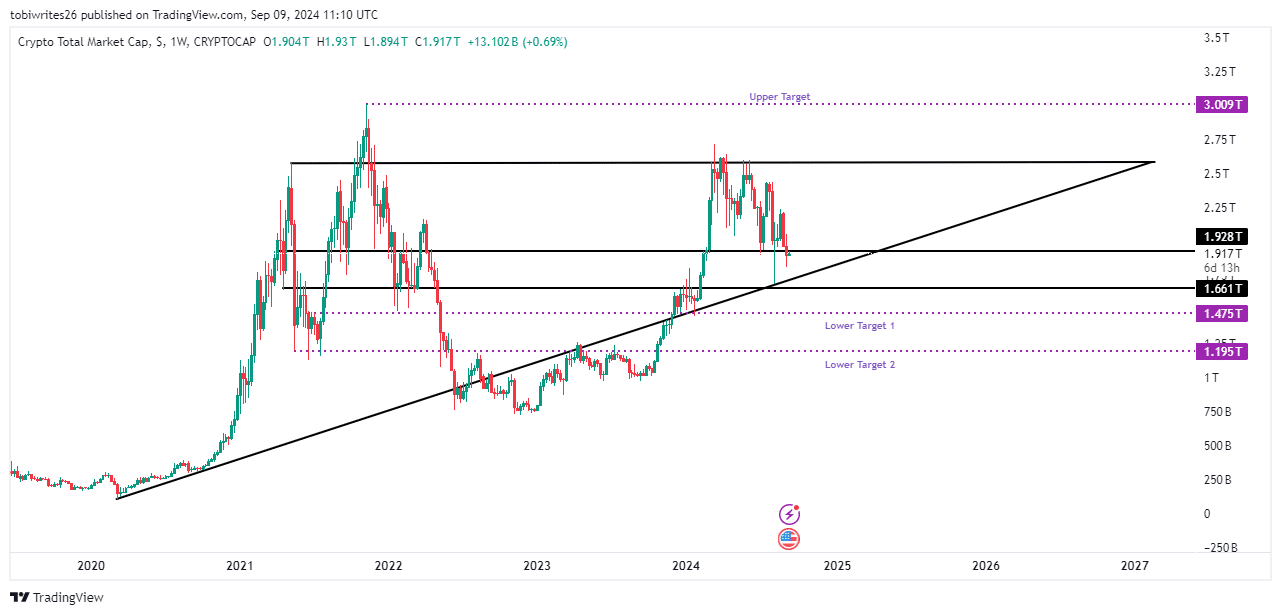

Since 2020, the TOTAL chart has exhibited recurring patterns that it’s adhering to. Currently, TOTAL is at a crucial juncture, with a significant support level set at 1.928.

If this level maintains its strength, it might generate enough demand for cryptocurrencies to reach unprecedented peaks.

Furthermore, there’s another potential support point located at 1.661 that could potentially come into play should the 1.928 level fail to hold.

At this lower level, it’s crucial because it corresponds with the base of an upward sloping trendline – a region in the past that has often sparked market uptrends.

Should the purchasing intensity sustain around 1.661, it might drive the overall crypto market capitalization towards reclaiming its yearly peak of $3.009 trillion, or possibly even surpassing it further.

If neither of these support levels fails to hold, there’s a possibility that the market might experience a downtrend. This downtrend could potentially lower the market capitalization to $1.475 trillion or even further down to $1.195 trillion.

In this situation, Bitcoin and other digital currencies could face substantial declines in value, further dampening investor confidence.

Optimism is on the rise

According to a crypto analyst known as Moustache, altcoins are likely to see a major upswing.

It appears he’s noticed that altcoins are showing promising signs so far, supported by two significant technical indicators suggesting an upward or bullish market trend.

On the Altcoin market capitalization graph, it’s been noticed that prices have recently spiked upwards after breaking free from a nine-month downward trending wedge formation. This is the initial sign suggesting an upcoming price increase.

Boosting the optimistic trend, there’s the emergence of an inverse head and shoulder structure – a pattern often considered a reliable sign of rising prices ahead.

A major surge like this implies that the value of altcoins is likely to increase, signaling the onset of what’s often called “altseason” – a time characterized by significant growth in various digital currencies other than Bitcoin.

Discussing the potential duration of this bullish phase, Moustache commented,

“I think we will have some good weeks/months ahead.”

As a crypto investor, I’ve discovered that Solana (SOL) is among the digital currencies primed for substantial growth during this market surge, according to AMBCrypto’s analysis.

Solana can lead the next crypto surge

Solana has shown remarkable resilience in the volatile cryptocurrency market.

Although there was a 15.42% drop in value this month, suggesting a decrease in demand, Solana has continued to show strength and has seen an outstanding 566.98% rise during the last year.

Based on my years of experience in the dynamic world of cryptocurrency trading, I have noticed that broader negative market trends can significantly impact even the most resilient digital assets. However, this month has shown me something truly fascinating about Solana. Despite the downward pressure exerted by the overall bearish sentiment, Solana has managed to hold its ground and avoid further losses. This is a testament to its underlying strength and potential for growth in the long term, which I believe is a promising sign for those of us who are invested in it.

Read Solana’s [SOL] Price Prediction 2024–2025

On a day-to-day and week-by-week basis, its performance exhibits a fairly steady trend, dipping slightly by 0.26% but then rising again by 0.32%.

If an altseason occurs as anticipated, Solana stands ready for a substantial price increase. It’s likely to break free from its current period of sideways movement and could even exceed its previous peak of $259.90, potentially establishing new highs.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

2024-09-10 03:04