-

AAVE targeted $180-$200 as bullish pennant forms, signaling strong market potential ahead.

Increased volume and MACD crossover hinted at bullish momentum, but traders eyed a potential pullback.

As a seasoned researcher with years of experience analyzing cryptocurrency markets, I find myself quite intrigued by the recent bullish predictions for Aave [AAVE]. With my eyes trained on the charts and technical indicators, it appears that AAVE’s price could indeed surge towards the $180-$200 range if the bullish pennant pattern holds.

According to the analysis by cryptocurrency expert World of Charts, AAVE (AAVE) appears poised for another upward price surge.

According to the analyst’s forecast, there’s a possibility that AAVE‘s value might climb within the $180 – $200 bracket, provided the bullish pennant pattern unfolds favorably.

Currently, AAVE is being exchanged for approximately $134.67 per unit. This marks an uptick of 6.30% within the last day, and a growth of 9.40% over the course of the last week.

Based on a forecast made by the same analyst on September 4th, AAVE has seen almost a 24% increase in value. Now, it’s pushing through another optimistic flag formation in the hourly chart.

World of Charts forecasted a potential 20-25% price increase if this trend continues.

Technical indicators signal bullish sentiment

According to the AAVE chart analysis, there was a significant rise in the stock’s value, breaking through the crucial barrier at $130. Additionally, the Bollinger Bands expanded, indicating increased market turbulence.

The cost was close to the top limit, indicating potential signs of an overbought market, yet the 20-day moving average offered reinforcement, suggesting continuous bullish energy.

Furthermore, the Moving Average Convergence Divergence (MACD) showed sustained bullish power, as the MACD line moved above the signaling line.

Despite the narrowing histogram bars suggesting a potential slowdown, traders are vigilantly watching for any impending bearish crossover.

Such a signal could lead to a trend reversal in the short term.

Trading volume reflects buyer interest

In simple terms, the recent rise in AAVE‘s price is fueled by higher trading activity. Over the last day, an impressive trading volume of approximately $338 million has been recorded for AAVE, indicating robust demand from buyers.

On the other hand, the rate of increase seems to be slowing down a bit, causing some worry that demand might be decreasing.

Experts are keeping a close eye out for sudden increases in volume, as these might indicate whether the current trend is set to continue rising or if it’s about to reverse course and correct itself.

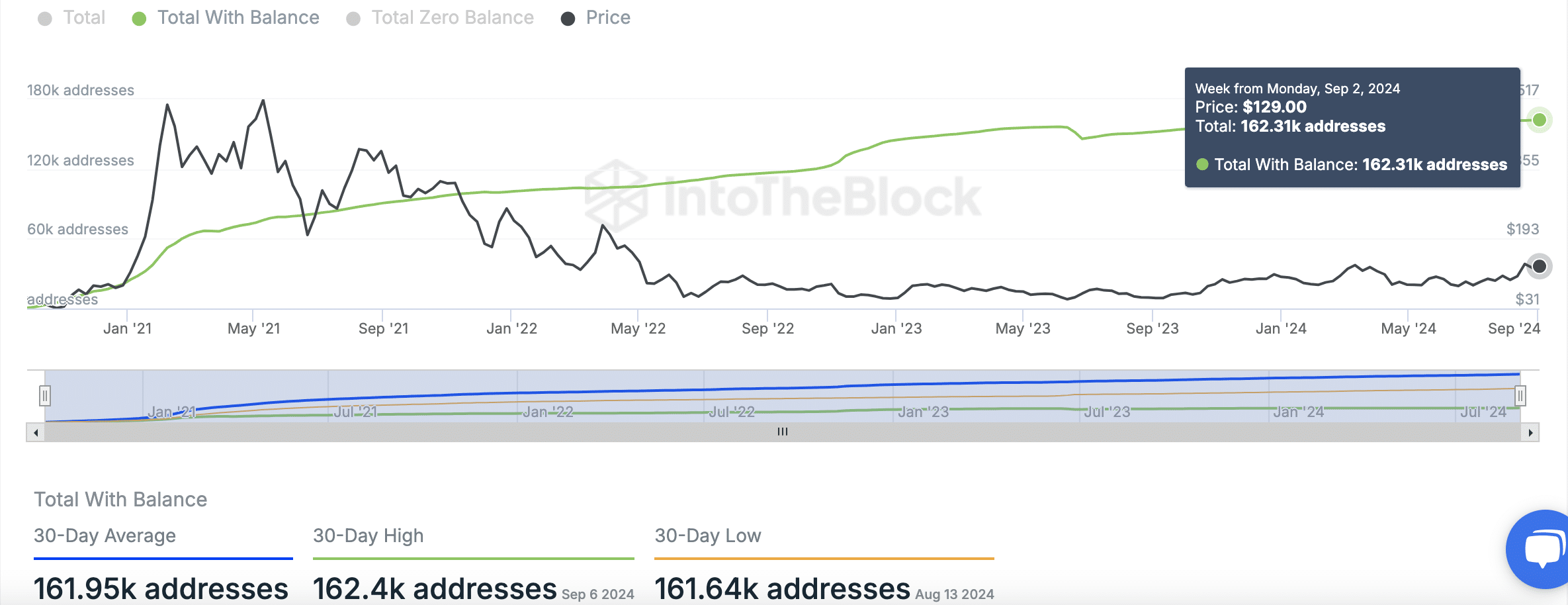

The AAVE network has consistently shown an increase in user engagement, with around 161,950 unique addresses now storing a balance as of September 2024.

As a researcher, I’ve noticed an encouraging upward trajectory that suggests robust user engagement and heightened curiosity about our protocol. Remarkably, this trend persists even amidst the volatile swings in the price of AAVE.

As per information shared by AMBCrypto, the AAVE/USDT pair has been consistently rising in price, creating an upward trend with successive peaks and troughs that are both higher than previous ones.

Read Aave’s [AAVE] Price Prediction 2024–2025

In simpler terms, the price of the weekly candle (a period on a chart representing one week) just finished higher than it had been during a prolonged period of little change, which lasted approximately 800 days.

If AAVE‘s price were to retreat, analysts believe that the $108 support level would play a crucial role in continuing its upward trajectory.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-10 06:16