- Cardano key support level at $0.3172 hold with potential for a breakout above the downward trendline.

- Exchange outflows and the long/short ratio indicate growing bullish sentiment.

As a seasoned researcher with years of experience navigating the cryptocurrency market, I find myself intrigued by the current state of Cardano [ADA]. After carefully analyzing the price movements, technical indicators, and market sentiment, I’m cautiously optimistic about its potential for a bullish breakout.

Currently, there’s been a favorable trend for Cardano [ADA], as its value has increased. At the moment, ADA is priced at $0.3409, marking a 2.68% rise over the past day and a 4.44% jump in the last week.

Key support level holds strong

Currently, ADA is building up positive energy at the notable support point of $0.3172, a level that has historically served as a strong psychological anchor over several weeks. Observing the price chart, we can see that Cardano’s prices are gathering within an ascending triangle formation.

ADA was currently approaching a downward trendline that dates back to earlier in 2024.

On multiple attempts, Cardano’s price levels have reached the resistance point, but so far, it hasn’t managed to convincingly surpass it and establish a clear uptrend.

A break above this trendline, coupled with the strong support level, may signal a bullish reversal.

The chart reveals a clear descending trendline with a series of lower highs of formation. However, the stochastic RSI indicates a bullish crossover, with the RSI moving up from oversold territory.

A bullish divergence might indicate an upcoming short-term price surge, since the trend’s momentum appears to be shifting in favor of the buyers.

Cardano exchange net flow paints a bullish picture

As per the exchange net flow data from Coinglass, more Cardano (ADA) tokens are being withdrawn from exchanges than deposited, indicating that investors are transferring their ADA tokens to cold storage.

This is typically a bullish sign, indicating a lower willingness to sell in the short term.

Liquidation pressure eases Cardano upward rally

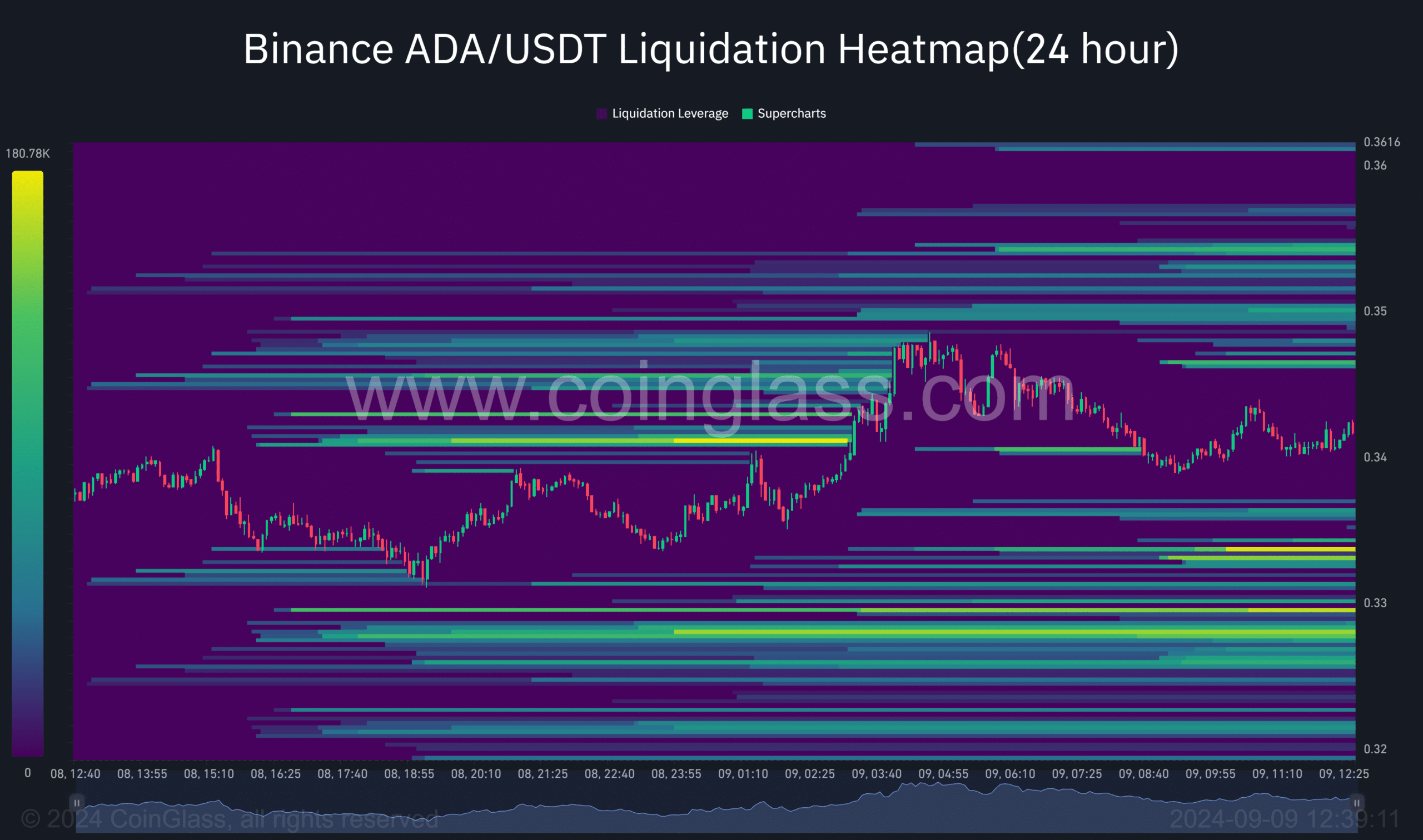

AMBCrypto analysis of liquidation heatmap data from Coinglass highlights a key zone of liquidation pressure around the $0.34–$0.36 mark.

This implies that the pressure is mounting on those who have taken short positions, possibly leading to a surge in prices because the bears are compelled to close their positions.

Realistic or not, here’s ADA’s market cap in BTC’s terms

Bears versus bulls

To expand on the previous point, the current Cardano long-short ratio indicates a bias towards buying (long positions). This ratio has experienced an increase, reaching a value of 1.31.

If Cardano manages to maintain its position above the $0.3172 support level and surpass any lingering resistance points, there’s a good chance we might witness an optimistic price surge, or a bullish breakout, according to the positive trends and benchmarks currently in place.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-10 12:07