- Bitcoin ETFs saw inflows after weeks of outflows, signaling a potential market shift.

- Wealth advisors quickly adopted Bitcoin ETFs, driving significant net flows despite limited institutional participation.

As an analyst with over two decades of experience in the financial industry, I find myself intrigued by the recent developments surrounding Bitcoin ETFs. The rapid adoption by wealth advisors is reminiscent of the early days of tech stocks, where individual investors and smaller firms often led the charge before the big players jumped on board.

Following several consecutive withdrawal periods, Bitcoin Exchange-Traded Funds (ETFs) are now exhibiting indications of a resurgence.

From August 27th through September 6th, there was a cumulative withdrawal of approximately $1,185.9 million from Bitcoin Exchange-Traded Funds (ETFs), suggesting a difficult period for this particular asset.

On the 9th of September, there was a net inflow of $28.6 million into Bitcoin ETFs, suggesting a possible change in investor attitudes towards the market.

Matt Hougan’s take on Bitcoin ETF

In response to this progression, Matt Hougan, as the Chief Investment Officer at Bitwise, observed a swift adoption of Bitcoin ETFs among wealth advisors. This rapid uptake suggests a rising trust and belief in the potential success of this digital asset.

Regarding the opposing stance on Bitcoin ETF adoption expressed by investment analyst Jim Bianco, Hougan countered with his perspective.

It seems Jim has made a mistake: Bitcoin ETFs are being embraced by investment advisors at an unprecedented rate, quicker than any other newly introduced ETF.

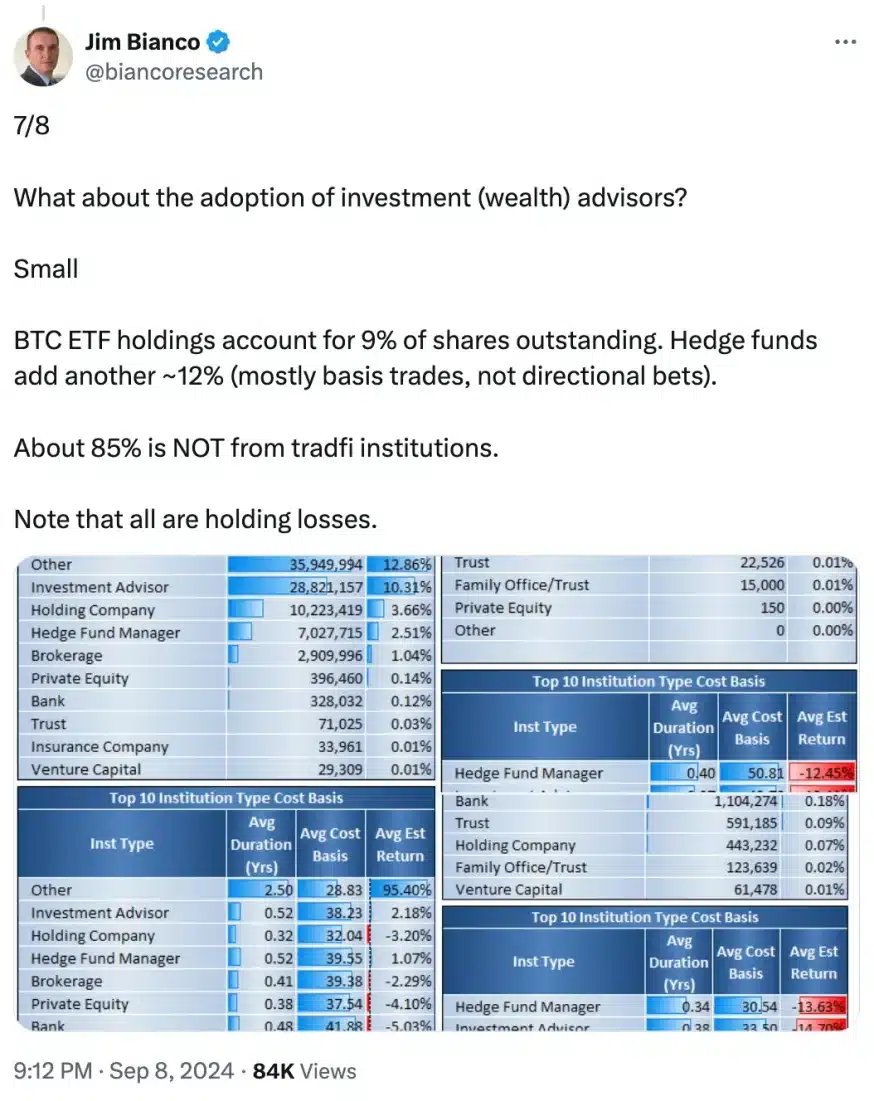

It’s been noted by Jim Bianco that it’s not primarily traditional financial institutions that are contributing the most to Bitcoin ETF investments, even though there seems to be increasing curiosity.

As a researcher, I observed that approximately 85% of the uptake for Bitcoin Exchange Traded Funds (ETFs) is originating from non-traditional finance sources. This implies that while wealth advisers are progressively incorporating Bitcoin ETFs into their strategies, institutional participation in this sector remains somewhat restricted at this point in time.

Is there more to it?

Contradicting Bianco’s point of view, Hougan noted,

According to Jim Bianco’s data, IBIT has received approximately $1.45 billion in net inflows from investment advisors, which he considers “small” compared to the $46 billion that has been invested in Bitcoin ETFs collectively.

He added,

“But if you excluded all other flows, and just looked at the $1.45 billion linked to investment advisors, IBIT would be the 2nd fastest-growing ETF launched this year (excluding other BTC ETFs). Out of 300+ launches!”

Specifically mentioning IBIT, Hougan pointed out that among all ETFs, only KLMT – a fund focusing on Environmental, Social, and Governance (ESG) factors – has a greater asset value.

Despite the fact that KLMT’s assets amount to $2 billion, this figure can be deceiving as it wasn’t accumulated from numerous investors in the market, but rather from a sole investor.

Despite this significant seeding, KLMT has very low trading activity, averaging just 250 shares per day, and no adoption from investment advisors.

IBIT’s growth rate

Instead, IBIT’s growth may be less substantial compared to others, but it’s fueled by a wider array of investment consultants. This gives its growth a more natural and impactful presence within the broader Exchange Traded Fund (ETF) market.

Adding to his explanation Hougan said,

In reality, Bitcoin ETFs are being adopted by investment advisors at an unprecedented pace compared to any other ETF ever before. However, the significant investments made by other investors have drawn more attention and overshadow these historic inflows.

Contradicting Bianco’s statement he further highlighted,

It’s correct to note that investment managers make up only a portion of the individuals buying Bitcoin ETFs, but it would be incorrect to label their purchases as minimal or insignificant in size.

Bitcoin’s price action

Over the last day, Bitcoin saw a significant rise of 3.61%, causing its value to reach $56,873, according to CoinMarketCap.

This rise is encouraging, as BTC was confined to a tight trading range over the weekend.

It seems there’s growing possibility that Bitcoin could surpass the $56K mark. Furthermore, the Moving Average Convergence Divergence (MACD) line is getting closer to the signal line, suggesting a potential bullish trend reversal.

Despite the Relative Strength Index (RSI) being at 45, which aligns with the neutral line, it suggests that a downward trend, or bearish momentum, is still in play. This means we should exercise caution and maintain a degree of optimism as we move forward.

Read More

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Quick Guide: Finding Garlic in Oblivion Remastered

2024-09-10 17:12