- Michael Saylor saw Bitcoin as a secure and stable investment.

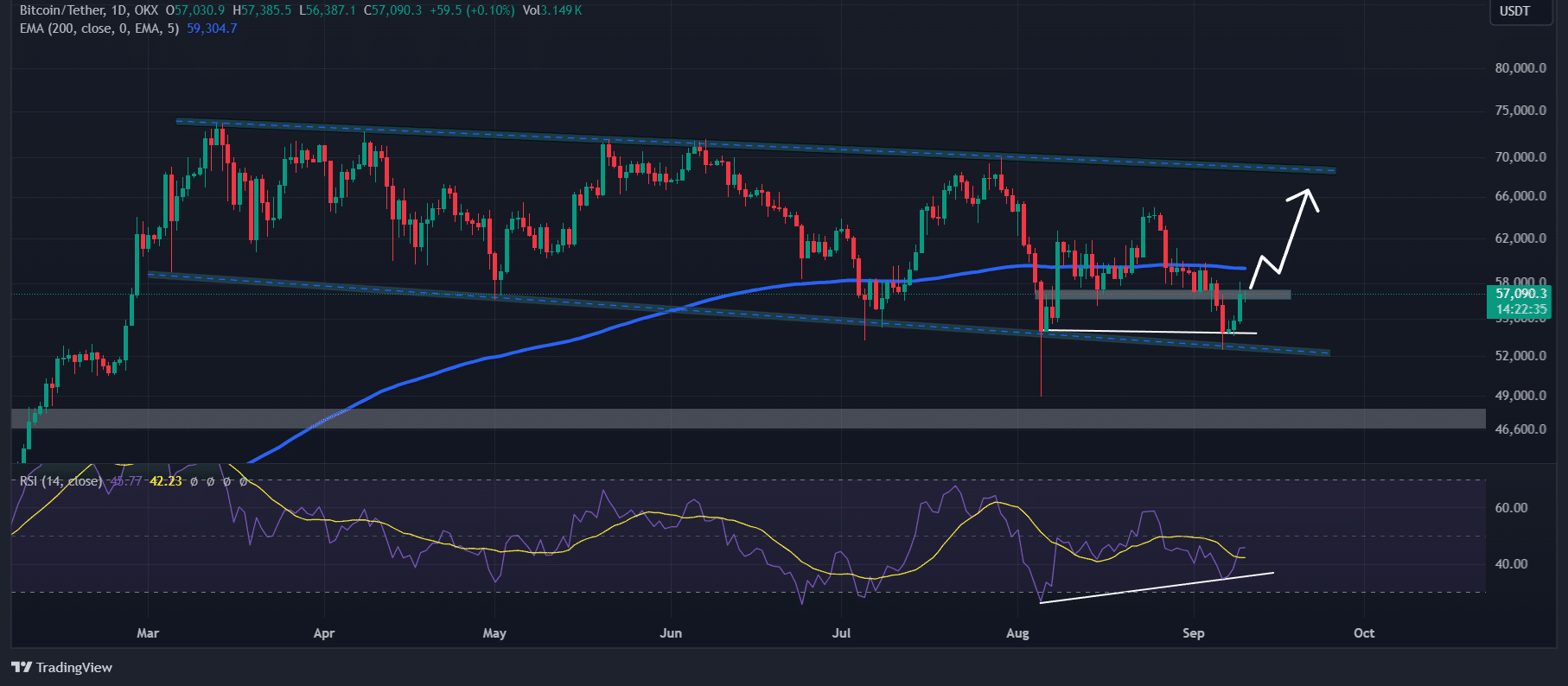

- Bitcoin’s RSI has formed a bullish divergence on a daily time frame, indicating a trend reversal.

As a seasoned researcher who has witnessed the evolution of cryptocurrencies, I can confidently say that Michael Saylor’s bold prediction for Bitcoin reaching $13 million by 2045 is nothing short of intriguing. His belief in BTC as a secure and stable investment, despite its volatility, resonates with my own observations about the unique characteristics of this digital asset.

The Chairperson of MicroStrategy, Michael Saylor, has been gaining considerable focus among cryptocurrency fans due to his latest Bitcoin (BTC) forecast.

On September 10th, during an appearance on “CNBC Squawk Box,” Saylor expressed a daring forecast suggesting that the value of Bitcoin might soar to $13 million by the year 2045.

Micheal Saylor’s bold prediction

In the interview, Saylor pointed out that Bitcoin currently makes up just 0.1% of the world’s total capital, but he anticipates that it might surge as high as 7%. If such a significant change takes place, this could potentially drive Bitcoin’s value to an astonishing $13 million per coin.

Furthermore, Saylor emphasized that what sets Bitcoin apart is its independence from any external parties. This feature reduces the risk associated with it compared to many other financial investments.

Although some consider Bitcoin a risky financial venture because of its unpredictable fluctuations, Saylor believes it’s a secure and reliable choice for investors who trust in stable and dependable investments.

Bitcoin technical analysis and key levels

As a researcher, I’ve found myself intrigued by the contrast between Saylor’s long-term predictions and the latest technical analysis from AMBCrypto. While Bitcoin has been trading below the 21-year Saylor’s forecast, AMBCrypto’s current expert evaluation indicates a bullish trend for the cryptocurrency, even though it falls short of the 200 Exponential Moving Average (EMA) on the daily timeframe.

Starting from March 2024, Bitcoin has been following a downward sloping parallel channel, and on five occasions, its value has reached the lower boundary of this channel.

From past trends, when Bitcoin (BTC) dips down to its lower support line, it often triggers a substantial increase in value by more than 20%. It’s possible that we could witness a similar price hike now as well.

However, Bitcoin is currently facing strong resistance near the $57,300 level.

If it surpasses its current level and ends the daily trading session higher, there’s a strong chance Bitcoin might experience a substantial rise, possibly reaching between $65,000 and $69,000 within the near future.

Currently, the Relative Strength Index (RSI) of Bitcoin is showing signs of a bullish divergence on a day-by-day basis. This pattern suggests that the market trend may shift from a decline to an upward trajectory.

Bullish on-chain metrics

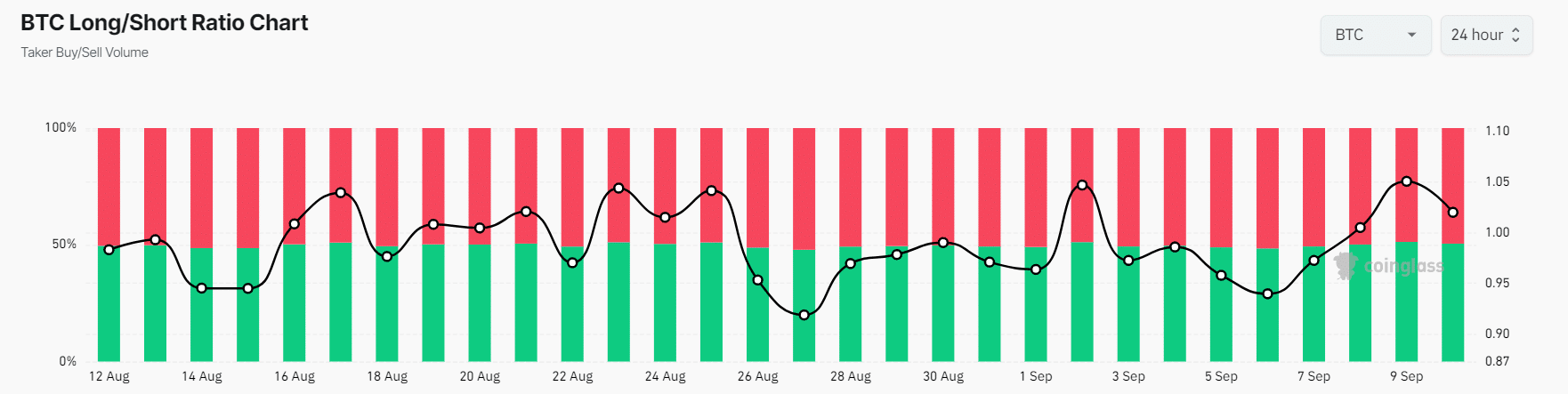

Real-world data aligns with the optimistic view as well. The balance between Bitcoin buyers and sellers, as indicated by Coinglass’s BTC Long/Short ratio, is currently at 1.039, suggesting that more traders are leaning towards buying over the past day, which is a positive sign for the market.

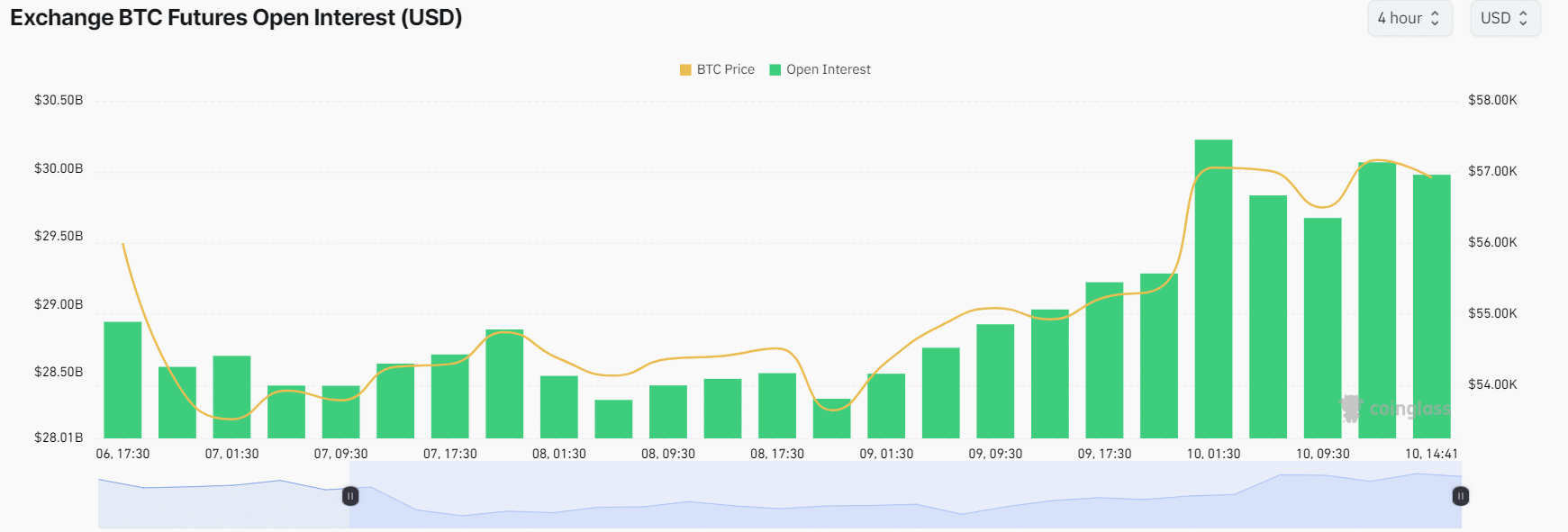

In recent times, there’s been a more than 3% surge in future contracts related to Bitcoin (BTC), and this growth trend has persisted for several days now.

A high long/short ratio and substantial Open Interest may indicate promising chances for buying, as it’s a pattern frequently utilized by traders to establish trades.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Currently, Bitcoin is being exchanged close to $57,000 per unit, with an increase of more than 3% observed within the past day.

During that timeframe, the trading activity significantly increased by 46%, suggesting a surge in interest from cryptocurrency fans as prices started to rebound.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-09-10 20:08