As a seasoned analyst with years of experience navigating the volatile cryptocurrency markets, I have learned to read between the lines and anticipate market trends based on historical data and current developments.

Over the last seven days, the value of the cryptocurrency market has dropped substantially, falling below the $2 trillion threshold. This decrease was marked by an increase in the number of long positions being liquidated as the price of most major cryptocurrencies declined.

On the contrary, the current market trends seem to be indicative of a turnaround. Moreover, predictions for the upcoming cryptocurrency week are more optimistic than they were last week.

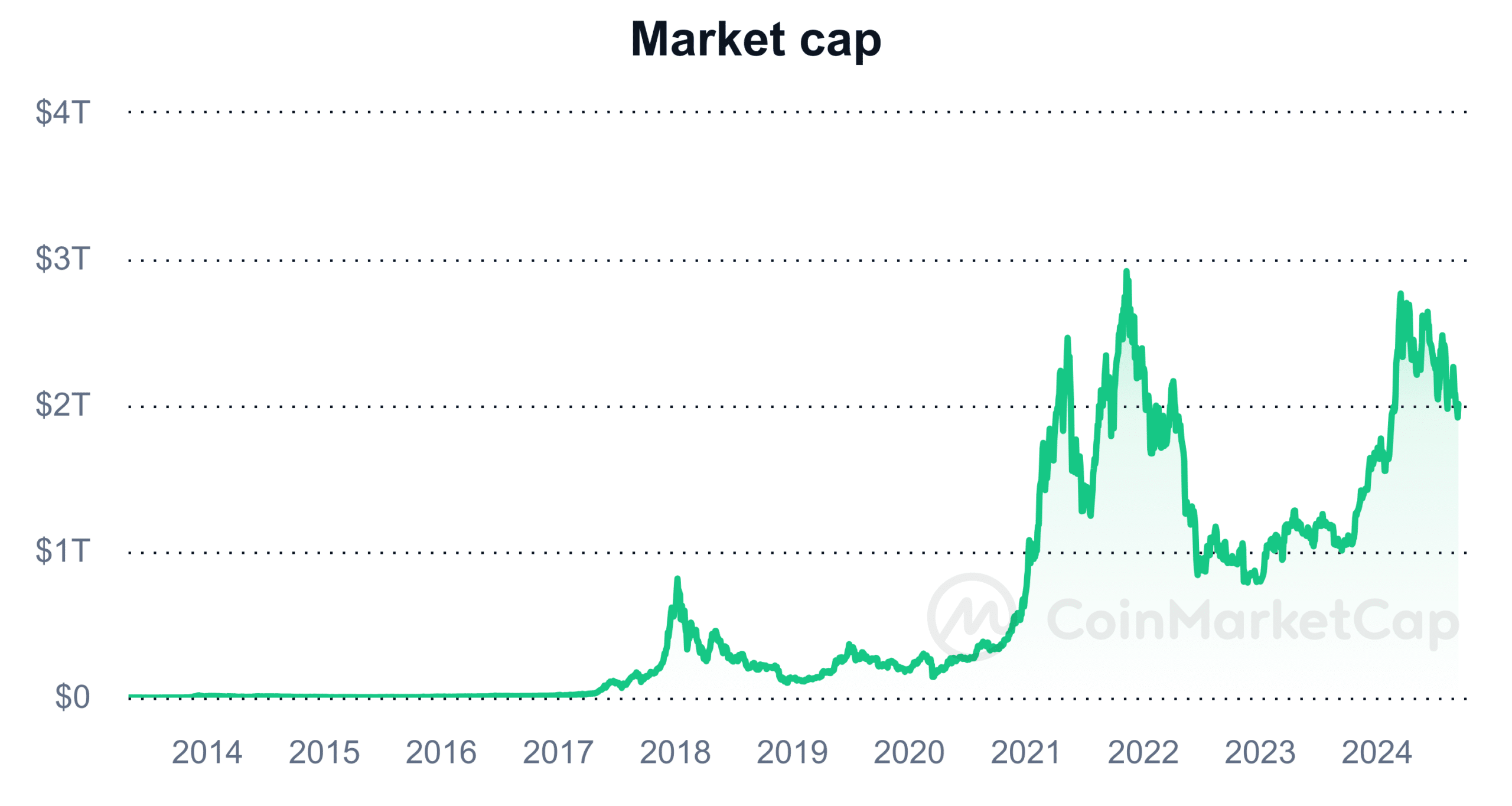

Crypto week ahead: Market capitalization

A study of the cryptocurrency market’s total value on CoinMarketCap found that it has experienced periods of decrease over the past few weeks. The steepest decline took place last week, reducing the overall market cap to approximately $1.9 trillion.

The price drops in major assets like Bitcoin and Ethereum primarily drove this decline.

Over the last three days, it’s bounced back and exceeded the $2 trillion mark once more. This rebound has also been reflected in significant growth trends among leading cryptocurrencies, hinting that the market may experience additional upward momentum in the coming week.

If this trend holds, it could begin a more positive phase for the crypto market.

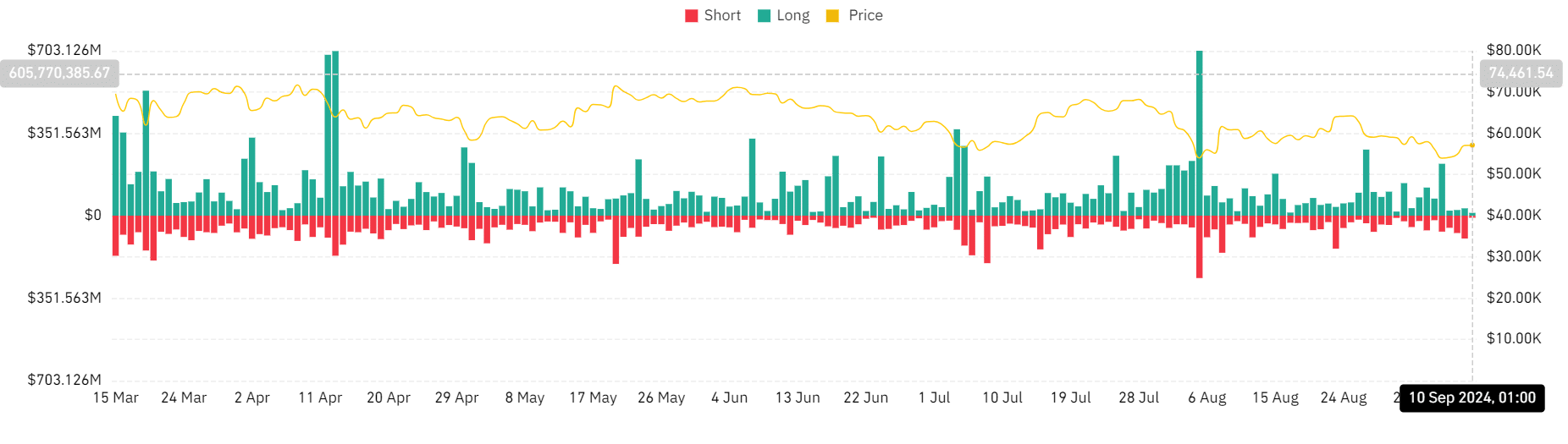

Crypto week ahead: Market liquidations

A study of the liquidation chart on Coinglass shows a significant increase in liquidations during the last week, with most being long liquidations. This trend mirrors the drop in market capitalization that has been noticed. The data further highlights that long liquidations accumulated more than $520 million, compared to approximately $223 million in short liquidations.

As the market started to bounce back, I noticed a decrease in the number of long positions being liquidated, while short positions were on the rise instead. This trend indicates that the market might be gaining bullish momentum once more, potentially making short positions vulnerable to losses.

Should the current pattern persist, next week could prove difficult for those who have taken short positions. This is because an uptrend in asset values might trigger additional short position liquidations. Given that the market seems to be recuperating, traders with short positions could encounter growing stress as optimistic views regain traction.

Bitcoin and Ethereum leads market dominance

An analysis of the last seven days showed that Bitcoin (BTC) has lost over 3% of its value while Ethereum (ETH) noted a steeper decline of over 6%. Despite these declines, however, both assets continue to dominate the cryptocurrency market.

Currently, Bitcoin’s market value totals approximately 1.13 trillion dollars, which accounts for about 56.5% of the entire cryptocurrency market. On the other hand, Ethereum’s market cap is around 282.9 billion dollars, making up roughly 14.6% of the total crypto market.

As a researcher delving into the dynamic world of cryptocurrencies, I can confidently say that these two digital assets hold immense influence. The fluctuations in their prices could substantially shape the direction of the cryptocurrency market for the upcoming week.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-09-10 21:43