-

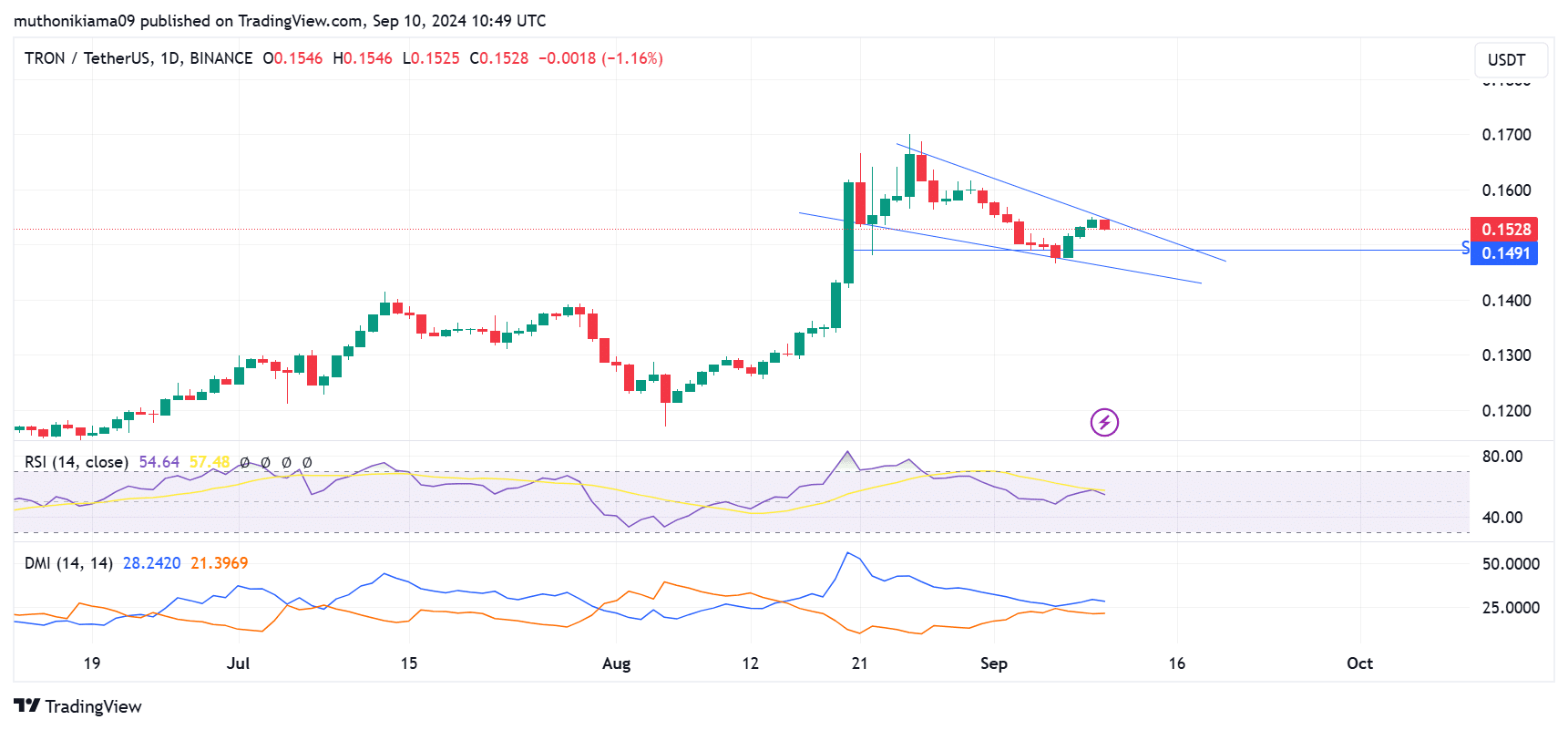

TRX stagnated at $0.15 after attempting a breakout above the upper trendline of the falling wedge pattern.

A breakout is possible if new buyers enter the market.

As a seasoned researcher with years of experience navigating the cryptocurrency market, I find myself intrigued by the current state of Tron (TRX). The broader market’s rally has left TRX standing on the sidelines, attempting to break free from a falling wedge pattern at $0.15.

On Tuesday, the wider cryptocurrency market bounced back, and it was Bitcoin [BTC] that spearheaded the surge, registering a 3% increase to move past $57,000 once more. Unfortunately, Tron [TRX] did not seem to be influenced by this favorable market mood.

Over the past day, I’ve observed a minor decrease of approximately 1% in TRX‘s value. Throughout this timeframe, the altcoin’s price fluctuated within a range, moving from around $0.152 to $0.155.

Despite the underperformance, a bullish falling wedge pattern has emerged on the TRX daily chart.

At present, TRX is trying to push beyond its upper trendline, an action that aligns with a period of price stabilization. This suggests that investors are holding back, preferring to observe a stronger signal before participating in the market.

Buyer hesitance can also be seen in the Relative Strength Index (RSI). After converging with the signal line, the RSI line has failed to confirm an upward move, signaling that buyers are hesitant.

When the Relative Strength Index (RSI) line crosses over the signal line, it indicates a potential buying opportunity that could reinforce TRX‘s upward surge beyond the descending triangle (falling wedge) pattern.

A bullish divergence has also emerged in the Directional Movement Indicator. The positive DI is currently above the negative DI, which suggests that while buyers remain hesitant, selling activity has eased.

If bulls push through and verify an uptrend, the upcoming goal for TRX might be around $0.17. On the flip side, if the upper trendline acts as a tough barrier and the breakout falters, TRX could potentially fall to retest support at approximately $0.149.

On-chain data shows mixed signals

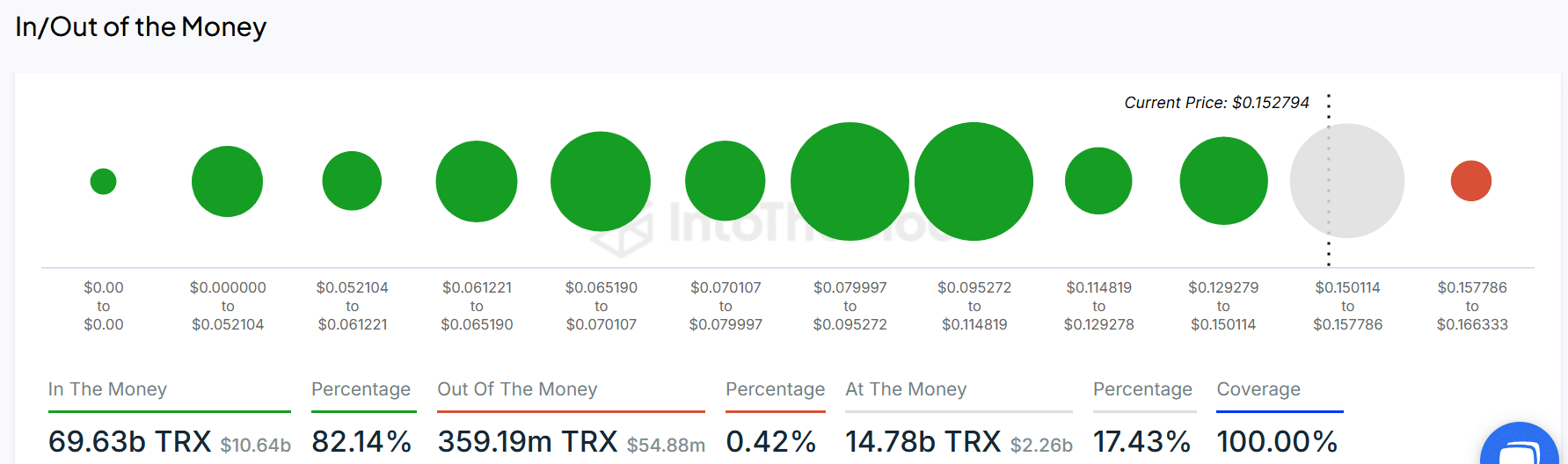

According to data from IntoTheBlock, a majority of Tron (TRX) investors were seeing profits when the current market prices were considered, with 96% being in profit, compared to just 2% who were experiencing losses.

The information indicates that Tron is unlikely to experience significant selling due to profit-taking if it recovers from its current value, since traders may prefer to keep their positions to amplify potential profits.

As a researcher delving into Tron (TRX) data, I’ve discovered that approximately 5.4 million wallets associated with this cryptocurrency are still operating at a loss. These wallets were purchased between $0.15 and $0.16. If the current uptrend falters, these investors might choose to sell their holdings to minimize their losses.

In such a situation, TRX might hold steady around $0.15 if fresh investors don’t join the market.

A further look at network activity proves a bearish thesis. Tron is the second-largest blockchain after Ethereum [ETH] by Total Value Locked (TVL).

Over the past fortnight, the total value locked (TVL) has decreased from a previous figure of $8.7 billion down to its present level of $7.9 billion, as reported by DeFiLlama.

Read Tron’s [TRX] Price Prediction 2024–2025

A drop in TVL can have a negative effect on price, as it reflected reducing utility for TRX.

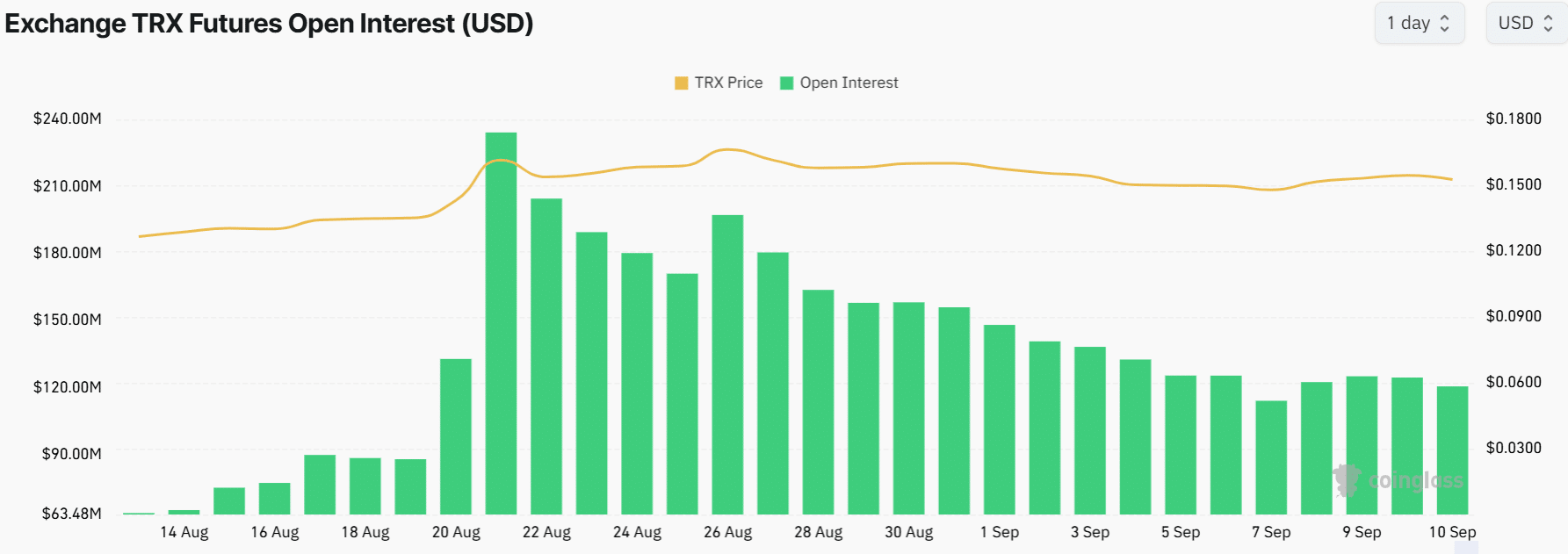

The declining trend in Open Interest indicated a decrease in enthusiasm for TRX, with its value falling approximately half to around $120 million following a peak of over $234 million in late August, as reported by Coinglass.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-09-10 23:04