- Shiba Inu signalled potential pattern break with the possibility of a rally after months of sell pressure

- On-chain data indicated that whales have been adding to their balances

As a seasoned crypto investor who’s seen more than a few market cycles, I can’t help but feel a twinge of excitement as I observe Shiba Inu’s current situation. The potential pattern break and the whales’ accumulation are reminiscent of a well-timed pump-and-dump scheme… but this time, it might just be the real deal!

Shiba Inu could be on the verge of a strong bullish breakout this week.

As a crypto investor, I noticed that Shiba Inu, one of the buzzing meme coins in the market, was among the most talked-about cryptos on platform X when this statement was penned down. This trendy observation could potentially hint at an imminent breakout for Shiba Inu.

Because Shiba Inu (SHIB) has been moving along a multi-month channel or “wedge” on its price chart, with support from this year’s lows and highs.

The persistent selling of Shiba Inu has been guiding it near the boundary of a wedge formation. This indicates that a potential breakout from this pattern might occur. However, it’s still possible for the price to drop further, but the significant reduction in value hints at a greater likelihood of advantage for the bulls, particularly if there’s substantial accumulation.

Over the past 24 hours, it appears that interest in Shiba Inu has increased, as indicated by an uptick in its social sentiment. This trend might suggest that more traders are now keeping a closer eye on it due to the potential for a breakout.

At the moment of reporting, SHIB was trading at approximately 0.0000134 USD. It appears that its next significant goal might be around 0.0000161 USD, representing a potential 20% increase from its current price. Should it manage to break through this level, the next obstacle would call for a further 45% surge in value.

Is Shiba Inu building momentum?

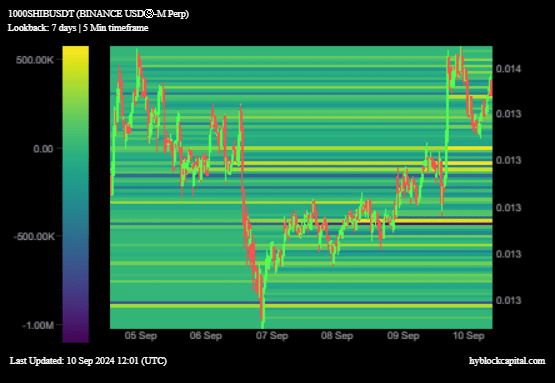

The balance between bullish (long) and bearish (short) positions in our market was intriguingly skewed, but the difference wasn’t huge. As reported by Hyblock Capital, more traders took long positions compared to short ones within the last day. Nevertheless, the number of those holding short positions was relatively small, below 300,000.

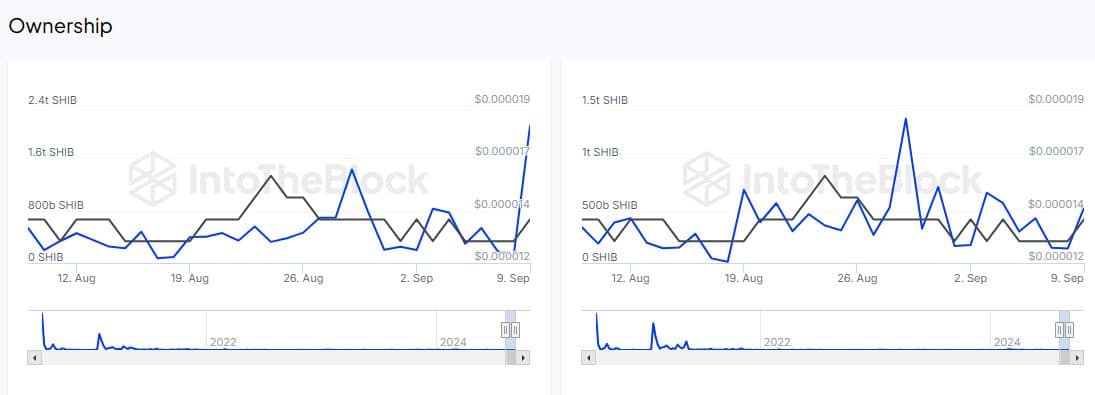

It’s been observed that the derivatives market is leaning towards the bullish side, but this doesn’t automatically mean that prices will move in the predicted direction. Instead, let’s examine the ownership statistics of Shiba Inu for a more accurate understanding.

According to IntoTheBlock’s analysis, a significant influx of around 2.09 trillion SHIB was observed in large holders over the past 24 hours. In comparison, outflows from these large holders were relatively small at approximately 527.8 billion SHIB, which is about four times less than the amount entering whale wallets.

Previously mentioned research indicated that whales (large investors) were storing substantially more than what they were selling off. In simpler terms, these large investors seem to be aligning with optimistic predictions and the potential for an upward trend or ‘breakout’ in the chart patterns.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

2024-09-11 01:43