-

A Solana whale has accumulated over 170,000 SOL in the last 24 hours.

At press time, SOL was trading at around $134.

As an analyst with years of experience tracking cryptocurrency markets, I’ve seen my fair share of whale activity and market trends. The recent accumulation of over 170,000 SOL by a Solana whale within the last 24 hours is a clear sign that something significant might be brewing in the Solana ecosystem.

As a crypto investor, I’ve noticed that Solana (SOL) has been making headlines lately, consistently trending in the latest trading sessions. This positive momentum hasn’t slowed down even as we speak, keeping the coin in the spotlight at this very moment.

The main factor influencing the recent trend appears to be the movement in SOL‘s price, along with noticeable large-scale purchases (whale accumulation) over the last day.

Solana enters top-trending assets

On the 9th of September, Solana was among the most talked-about assets, placing fourth in terms of popularity and discussion, according to Santiment’s data.

However, by the end of the trading session, it had moved to sixth place. The data also revealed that Solana had a positive sentiment of over 65%, reflecting strong optimism surrounding the asset.

Currently, SOL is holding its ground as it remains among the most popular assets, occupying the sixth spot. The general feeling towards it is overwhelmingly positive, exceeding 63% at this moment.

Moreover, the social activity associated with Solana surged above 3%. This signifies that Solana accounts for over 3% of all discussions happening within the cryptocurrency community.

It seems that traders and investors are keenly watching SOL, as the high optimism and heightened social interactions indicate. This interest might potentially cause more movement in SOL’s pricing.

Solana sees over 3% increase

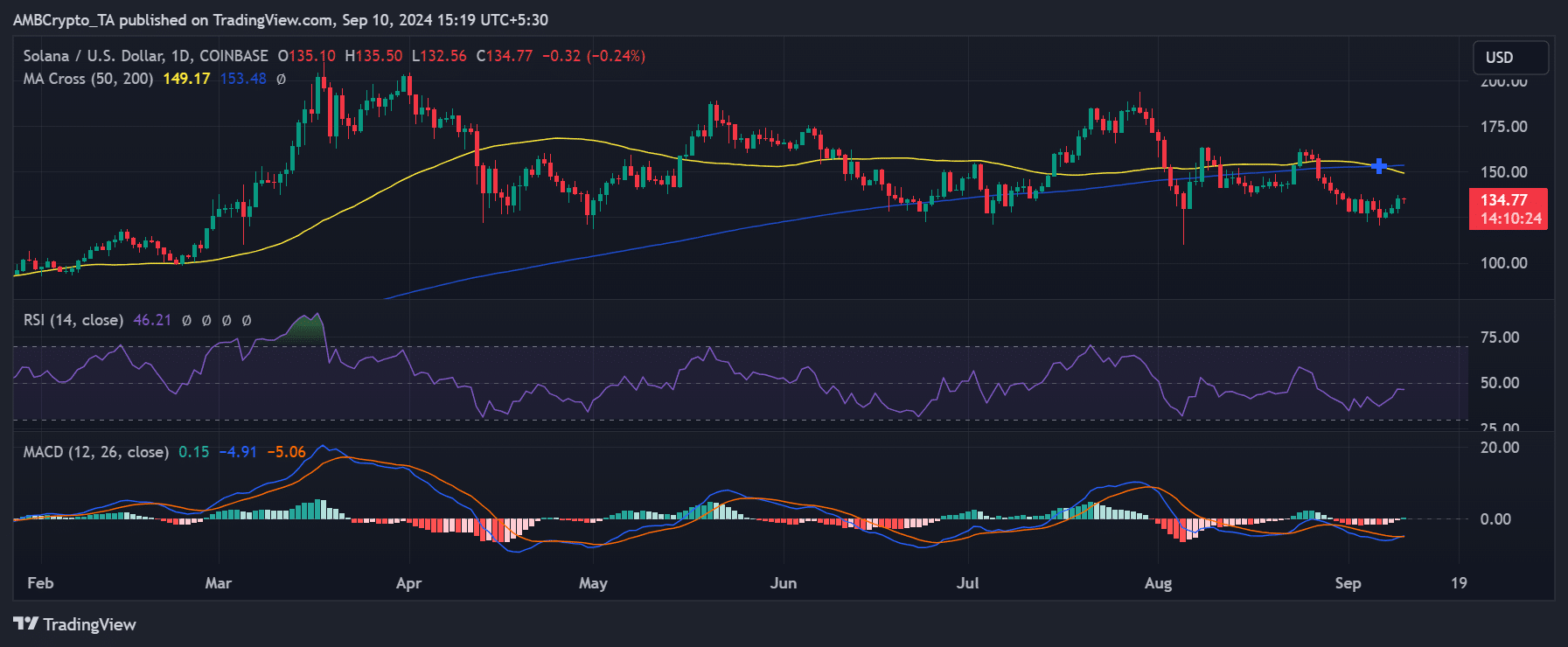

AMBCrypto’s analysis of Solana’s price trend on a daily chart revealed why it is was one of the top trending assets.

In the most recent trading period, Solana (SOL) saw a rise of 3.81%, ending the session priced at $135. As it stands now, this is the third straight day that Solana has observed an upward trend in its prices.

Currently, Solana (SOL) is being traded approximately at $134, showing a small decrease of almost 1% compared to its previous price. This minor dip is a result of the general downward correction that comes after a series of positive price movements seen in the last few days.

Although SOL experienced a slight drop, it still followed a downward trend. However, the intensity of this downtrend seemed to be lessening.

In simpler terms, an analysis using Solana’s Relative Strength Index (RSI) indicates that the asset is moving towards the neutral line, which suggests that the strong downward trend may be losing steam.

If the Relative Strength Index (RSI) keeps moving towards the neutral point, it might suggest a possible change or stabilization in the price direction.

Whale snaps up more SOL

According to information from Solscan, it’s been found that a large investor (whale) has been buying up Solana for the past day. Remarkably, this specific wallet address now holds about 170,666 Solana tokens, which equates to around $23 million.

Observing such behavior from whales (large investors) usually indicates their optimism about upcoming price changes, a factor that potentially boosted Solana’s (SOL) price surge.

I strongly believe that this strategic shift could have played a pivotal role in Solana’s surge as a popular investment choice recently. As someone who has closely followed the cryptocurrency market for years, I’ve noticed how significant developments can significantly impact a coin’s trajectory. In my experience, when a blockchain project successfully implements innovative solutions and gains traction, it often attracts more investors, boosting its value. Solana seems to have achieved just that, which is why I think this move was instrumental in its rise as a trending asset.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-11 07:04