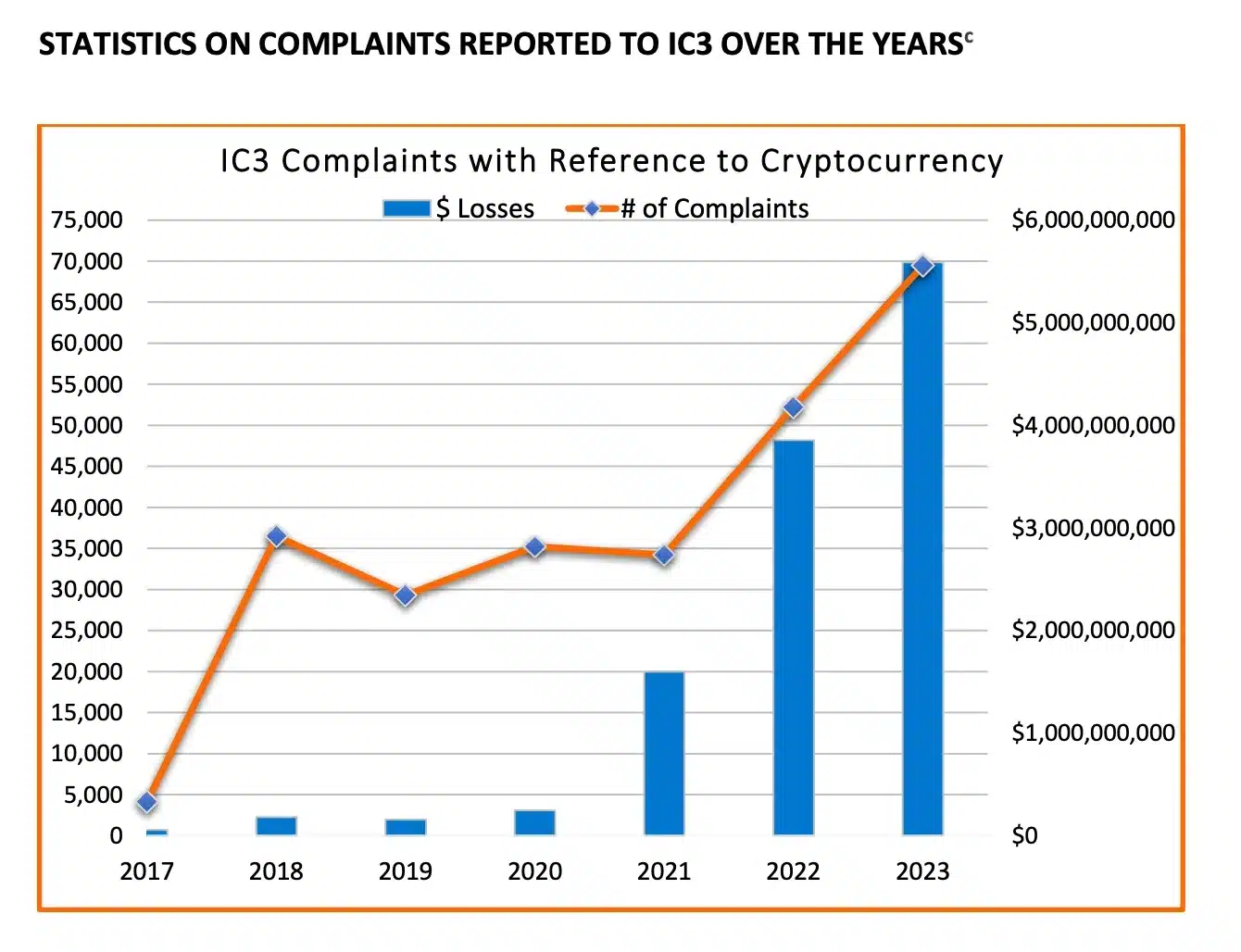

- Crypto fraud surged by 45% in 2023, resulting in over $5.6 billion in losses.

- August saw $313.86 million lost in crypto hacks, mainly due to phishing attacks.

As a seasoned analyst with over two decades of experience in the financial sector, I’ve seen my fair share of market booms and busts, scams, and frauds. The rapid rise of cryptocurrency has indeed been an exciting development, but it’s also been a fertile ground for criminal activity.

The rapid rise of cryptocurrency has come with both promise and peril.

As per a report released by the U.S. FBI on September 9, 2023, instances of cryptocurrency fraud and deception increased by approximately 45% compared to the year before, leading to financial losses over $5.6 billion.

Unscrupulous individuals are taking advantage more frequently of the swift, non-reversible character of electronic transactions for their gain.

Rise in crypto adoption

2024 saw a remarkable surge in the cryptocurrency market, with exchange-traded funds (ETFs) playing a significant role in fueling this growth. As an analyst closely monitoring the sector, I observed that these ETFs have served as a catalyst for broader institutional investment and mainstream adoption of digital currencies.

This year’s U.S. election cycle has also featured significant involvement from the crypto space.

According to a new survey carried out by Harris Poll for Grayscale, approximately one-third of voters (32%) have become more receptive to exploring or purchasing cryptocurrencies.

However, this growth has not come without its drawbacks.

Execs weighing in…

Based on a recent study by the Federal Bureau of Investigation’s Internet Crime Complaint Center, the growing use of cryptocurrencies has coincided with an uptick in illegal activities. These cybercriminals are now increasingly leveraging digital currencies for their nefarious purposes.

Remarking on the same, the FBI said,

Although cryptocurrency transactions are openly documented on blockchains, making it simple for law enforcement to track funds, frequently money is swiftly moved across international borders, which may present difficulties for U.S. officials due to lenient anti-money laundering regulations in specific countries.

Furthermore, according to the document, India was placed fifth worldwide in terms of cryptocurrency-related grievances, reporting 840 instances and accumulating losses amounting to approximately $44 million USD.

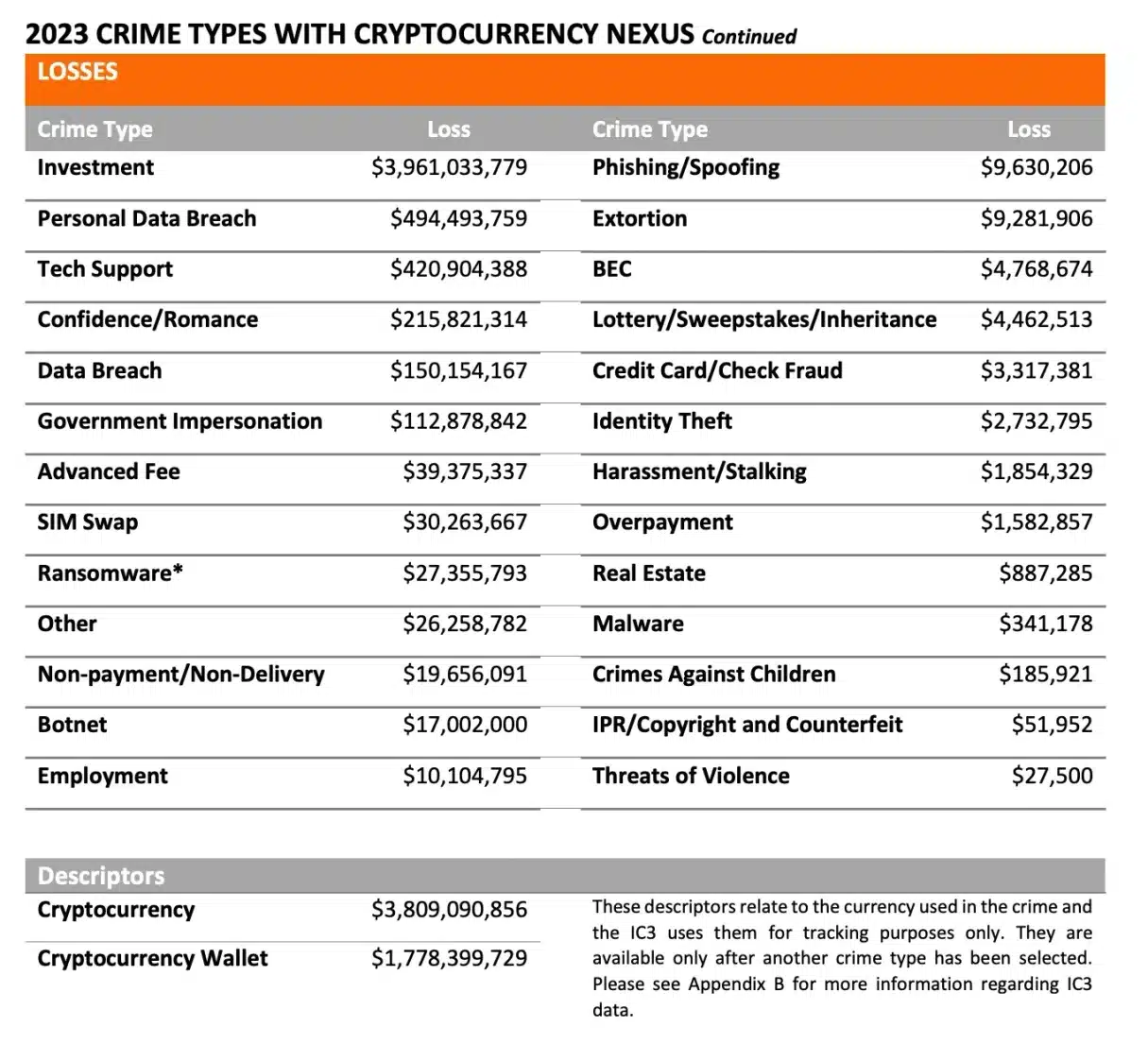

It’s worth noting that about 10% of the total losses were due to call center and government impersonation scams.

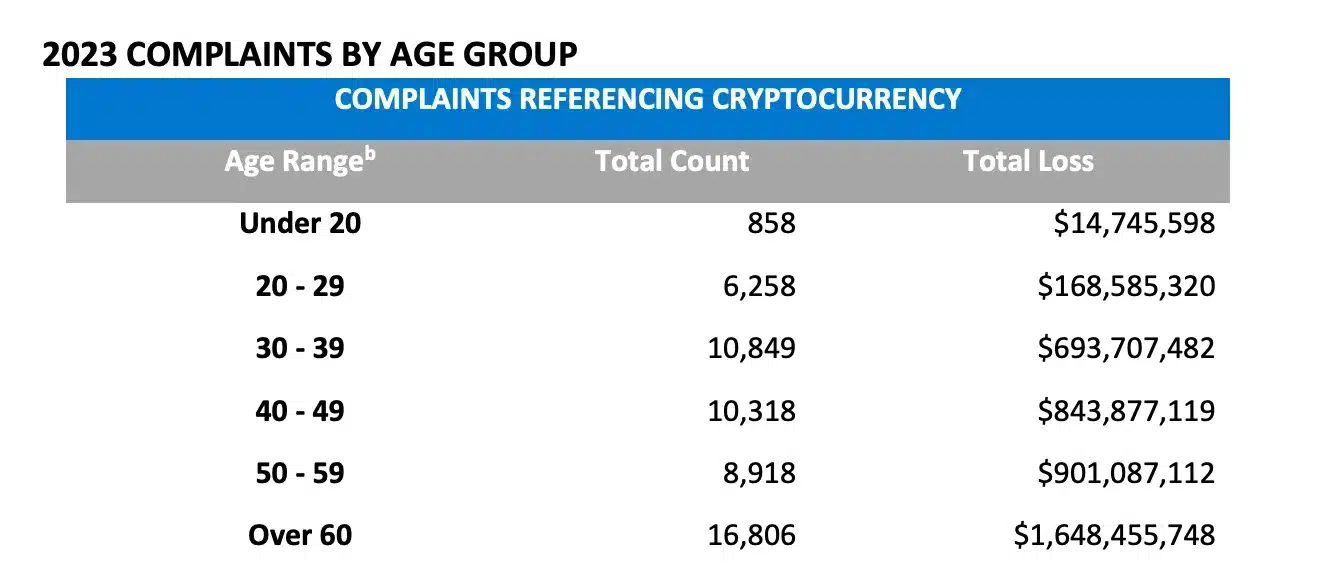

The report highlighted that individuals over the age of 60 were particularly vulnerable, with losses from this demographic totaling more than $1.6 billion.

This underscores how scammers are exploiting digital assets, preying on unsuspecting investors.

What’s more to it?

The FBI further added,

Because cryptocurrencies allow direct peer-to-peer transactions without the need for traditional financial institutions, they can unintentionally provide a platform for criminal activities like theft, fraud, and money laundering.

Providing a solution for the same, FBI Director Christopher Wray noted,

It’s crucial that people report suspicious activities related to these crimes at ic3.gov, regardless of whether they incurred a financial loss. This information helps us monitor new scams and the ways criminals employ advanced technologies, enabling us to keep the public informed and pursue those who perpetrate such crimes.

It’s worth noting that according to Peckshield, a company specializing in blockchain security, the cryptocurrency market suffered over ten substantial hacks during August, leading to total losses of approximately $313.86 million.

To clarify, the bulk of these losses were primarily due to phishing incidents, which often involved illicit transactions using Bitcoin (BTC) and the decentralized digital currency known as Dai (DAI).

Two major cyber incidents, each involving fraudulent transactions due to phishing attacks, were responsible for a staggering 93.5% of the total money stolen, equating to approximately $293.4 million.

Given the recent advancements, it’s worth considering: Might increased instances of cryptocurrency fraud and cyberattacks prompt immediate calls for enhanced security measures and tighter regulations?

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-11 09:12