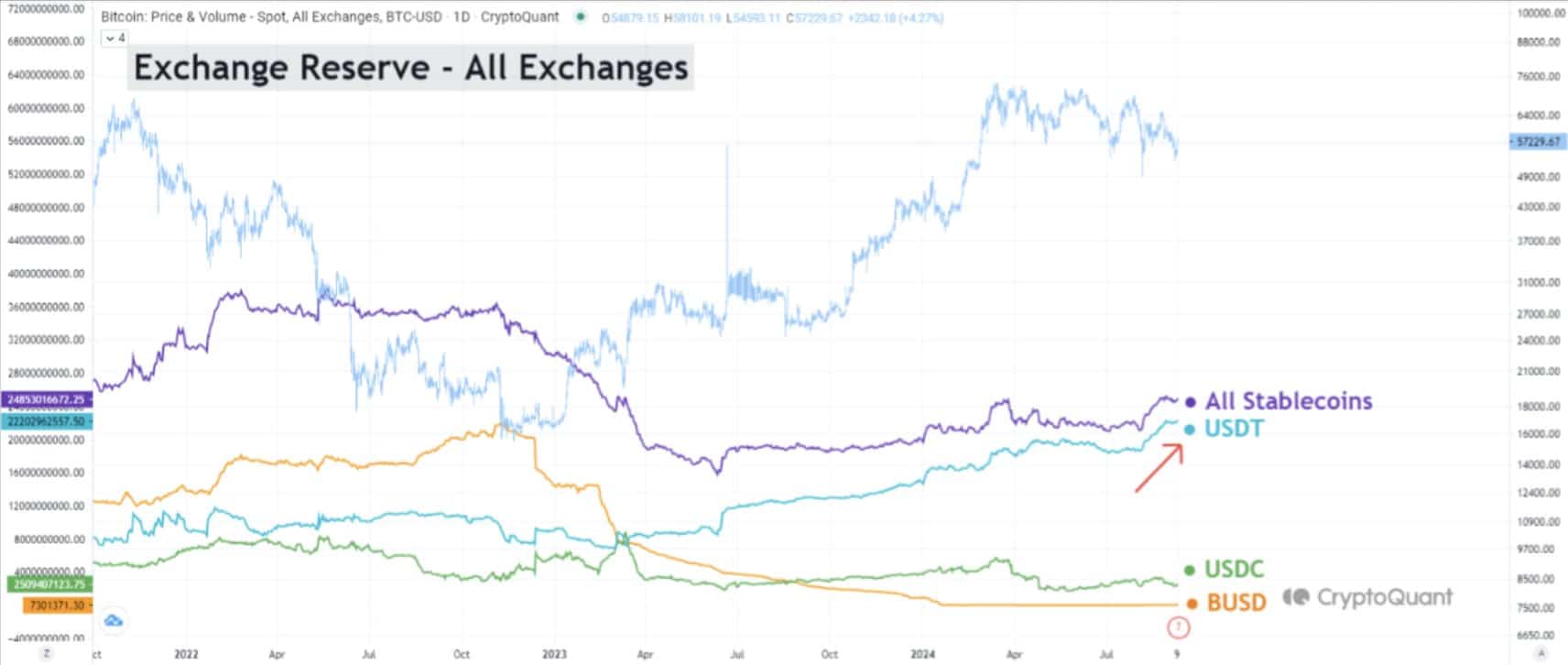

- The exchange reserves for stablecoins saw an increase.

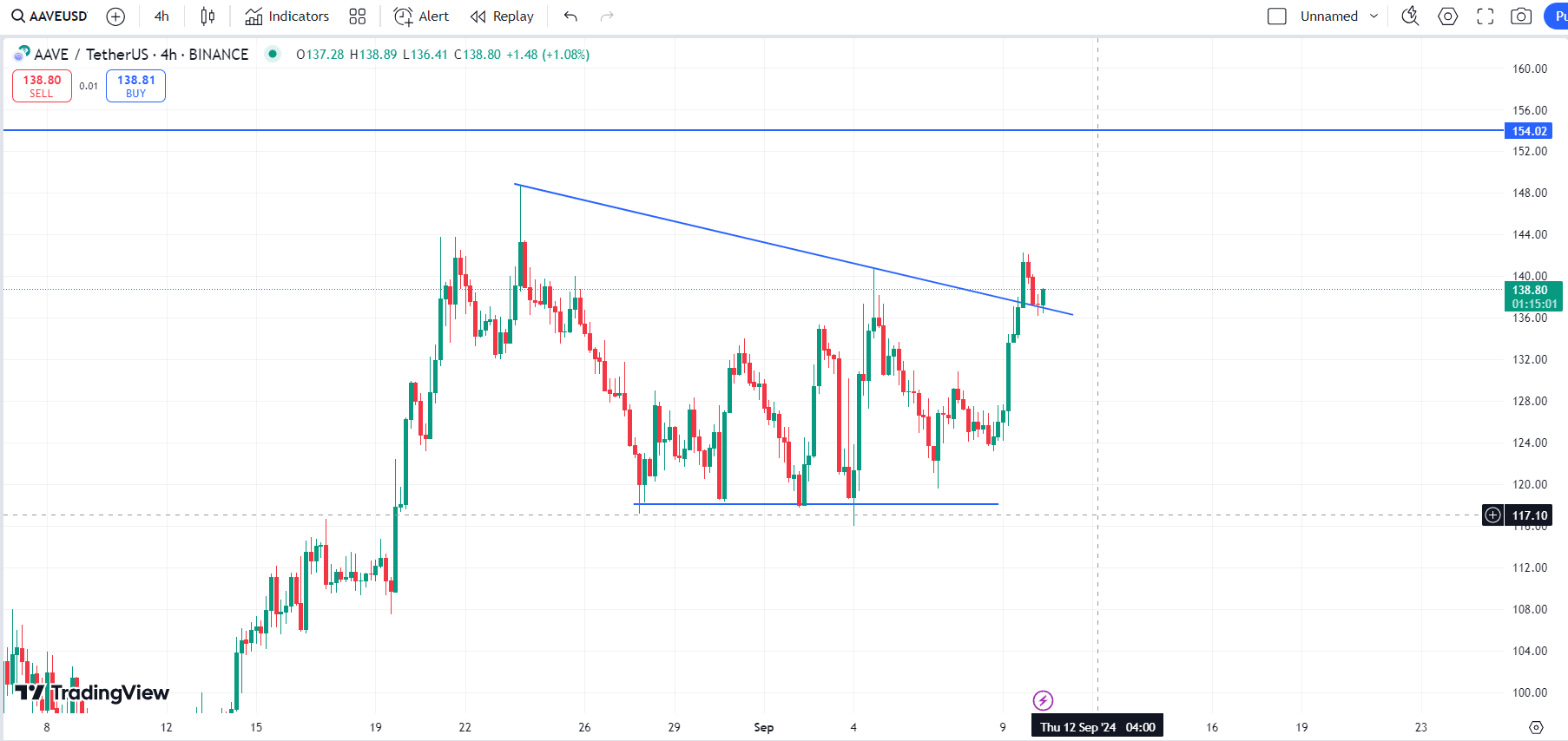

- Aave price action broke out of a 4-hour trendline.

As a seasoned crypto investor with battle-tested nerves and a knack for spotting trends, I find myself increasingly bullish on Aave [AAVE]. The recent surge in exchange reserves for stablecoins, particularly USDT, is a clear indication of pent-up buying power ready to flood the market. Add to that the resilience of Aave during the market downturns and its impressive performance in August – it’s hard not to be optimistic about its future price action.

Lately, the crypto market has seen substantial drops, but surprisingly robust is Aave [AAVE]. Unlike many other cryptos that faltered in August, Aave actually saw a rise in its value during this period.

Over the past few months, the Decentralized Finance (DeFi) platform Aave has experienced consistent expansion, not just in terms of the number of users but also in its market success.

It appears that the storage facilities holding stablecoins, like USDT, have experienced growth, implying that these resources could soon be channeled towards the market.

Generally, an increase in stablecoin ownership often signals the accumulation of purchasing power, potentially boosting Aave’s value by causing its price to go up.

Aave set for a breakout

Aave’s recent market movements indicate its increasing stature. Although the founder has offloaded some tokens, there has been substantial buying interest, hinting at possible price increases ahead.

As an analyst, I’ve noticed that on a larger timeframe, I’ve consistently encountered resistance for AAVE at approximately $140. However, on a shorter 4-hour scale, I’ve observed a break in the downward trendline and a successful retest of this line, indicating a potential shift in momentum.

Yet, the price encounters a significant hurdle as it attempts to exceed its previous cycle high of $154. Should Aave manage to surpass this threshold, price predictions for $200 and $260 become increasingly probable.

Meeting these objectives hinges on an uptrend in the altcoin market. Currently, the total altcoin market capitalization is poised at a significant upward trendline. Maintaining this support level suggests that the price will continue to climb upwards.

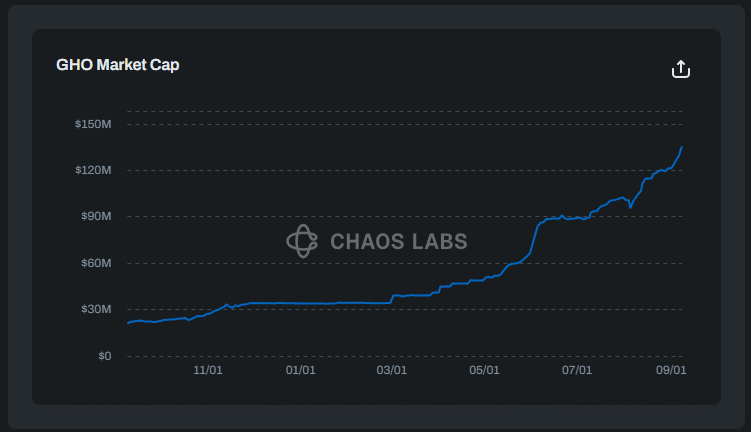

GHO swapping other crypto

The stablecoin from Aave, known as GHO, is picking up momentum as well. Following a challenging beginning in the year 2023, GHO is now demonstrating potential and optimism.

As a proud holder of Ethereum V3 assets, I’m excited to be part of the 2040-strong community that owns GHO, with a circulating supply of approximately 136.5 million tokens. Aave has broadened the reach of GHO beyond just Ethereum by launching it on the Arbitrum network as well, making it more accessible and versatile for all crypto enthusiasts like myself.

A significant number of users are utilizing the stablecoin, often by obtaining GHO loans with reduced interest rates, then exchanging it for various cryptocurrencies or alternative stablecoins such as sDAI, aiming to reap greater returns in the process.

Applying this tactic made the GHO’s parity move away from its $1 mark. Yet, their newly introduced Merit Program is designed to tackle this problem by motivating users to either hold onto or lock up GHO tokens.

As a crypto investor, I’ve found a platform that generously rewards me with returns as high as 19.32% Annual Percentage Rate (APR). This program encourages me to keep my liquidity within Aave, making it beneficial for both parties. Consequently, the stability of GHO has significantly enhanced, and its circulation is on the rise.

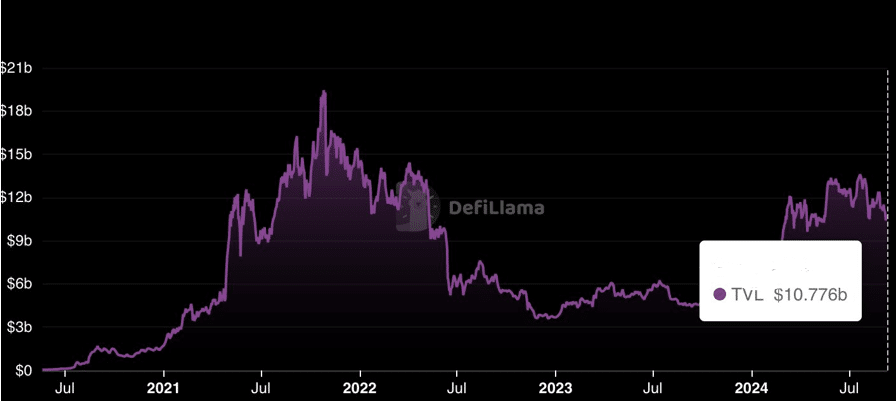

Aave DAO deploys EtherFi as TVL grows

Recently, the Aave Decentralized Autonomous Organization (DAO) introduced a specialized market called EtherFi, enabling users to secure loans using stablecoins such as USDC, PYUSD, and FRAX by using their weETH tokens from EtherFi’s liquid staking system as collateral.

Read Aave’s [AAVE] Price Prediction 2024–2025

As a researcher delving into the Decentralized Finance (DeFi) landscape, I’m consistently impressed by its unrelenting leadership role. It’s been remarkable to witness its growth into Layer 2 solutions such as ZKsync and Linea. The resilience it has shown in maintaining a bullish momentum, even when other assets were struggling, is a testament to its robustness within the DeFi sphere.

The total amount locked within it has swelled to a massive $10.7 billion, while there’s been a significant spike in user engagement, particularly from the Base platform, which has only served to enhance its standing even more.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-09-11 11:04