-

Metaplanet increased Bitcoin holdings to 398.8 BTC amid the price decline, boosting its share price.

Institutional investors, such as Metaplanet and MicroStrategy, maintained their Bitcoin investments despite market volatility.

As a seasoned crypto investor with a knack for identifying trends and opportunities, I find the recent moves by Metaplanet and MicroStrategy to be nothing short of inspiring. These institutional giants are not only demonstrating confidence in Bitcoin’s potential but also embodying the very essence of smart investing – buying low and selling high.

As a researcher, I’m maintaining my stance with Metaplanet, a publicly-traded investment and consulting firm based in Japan. We continue to adhere to our “buy the dip” strategy in response to Bitcoin’s [BTC] current challenges.

Currently, Bitcoin is struggling to surpass the $60,000 threshold. In fact, its value dipped to $56,497.76 within the last 24 hours, representing a slight decrease of 0.915%. This data is based on CoinMarketCap’s latest reports.

Metaplanet increases its Bitcoin holdings

In spite of the current economic dip, Metaplanet has taken advantage by significantly boosting its Bitcoin reserves, now nearing 400 Bitcoins.

As a result of this action, the stock’s value increased significantly, with a 5.9% rise observed on the Tokyo Stock Exchange.

Metaplanet’s recent BTC acquisition highlights the investment strategy known as “buying the dip.”

This method entails buying resources during price dips, anticipating they’ll increase in worth over time.

Showing faith in Bitcoin’s future value, Metaplanet seized the opportunity presented by its recent drop and increased their holdings, indicating a belief in the digital currency’s resilience amidst temporary market fluctuations.

This approach underscores faith in Bitcoin’s future worth, mirroring a pattern where individuals purchase assets when their prices are falling for potential gains later on.

What does the data highlight?

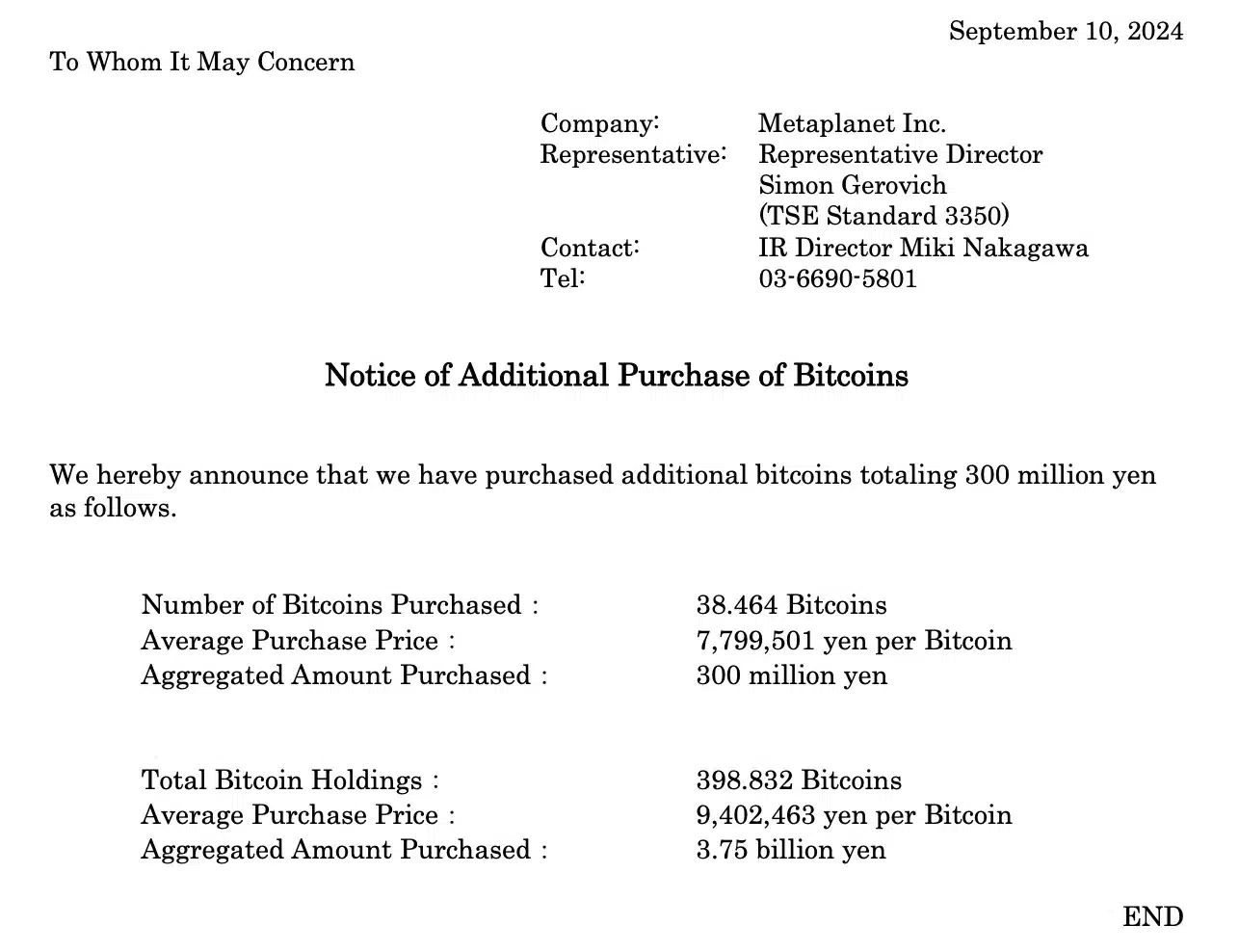

Based on a recent announcement made on September 10th, Metaplanet has purchased approximately 38.46 Bitcoins at a cost of around $2.1 million or roughly 300 million Japanese Yen.

This purchase increased their total holdings to 398.8 BTC, valued at approximately $23 million.

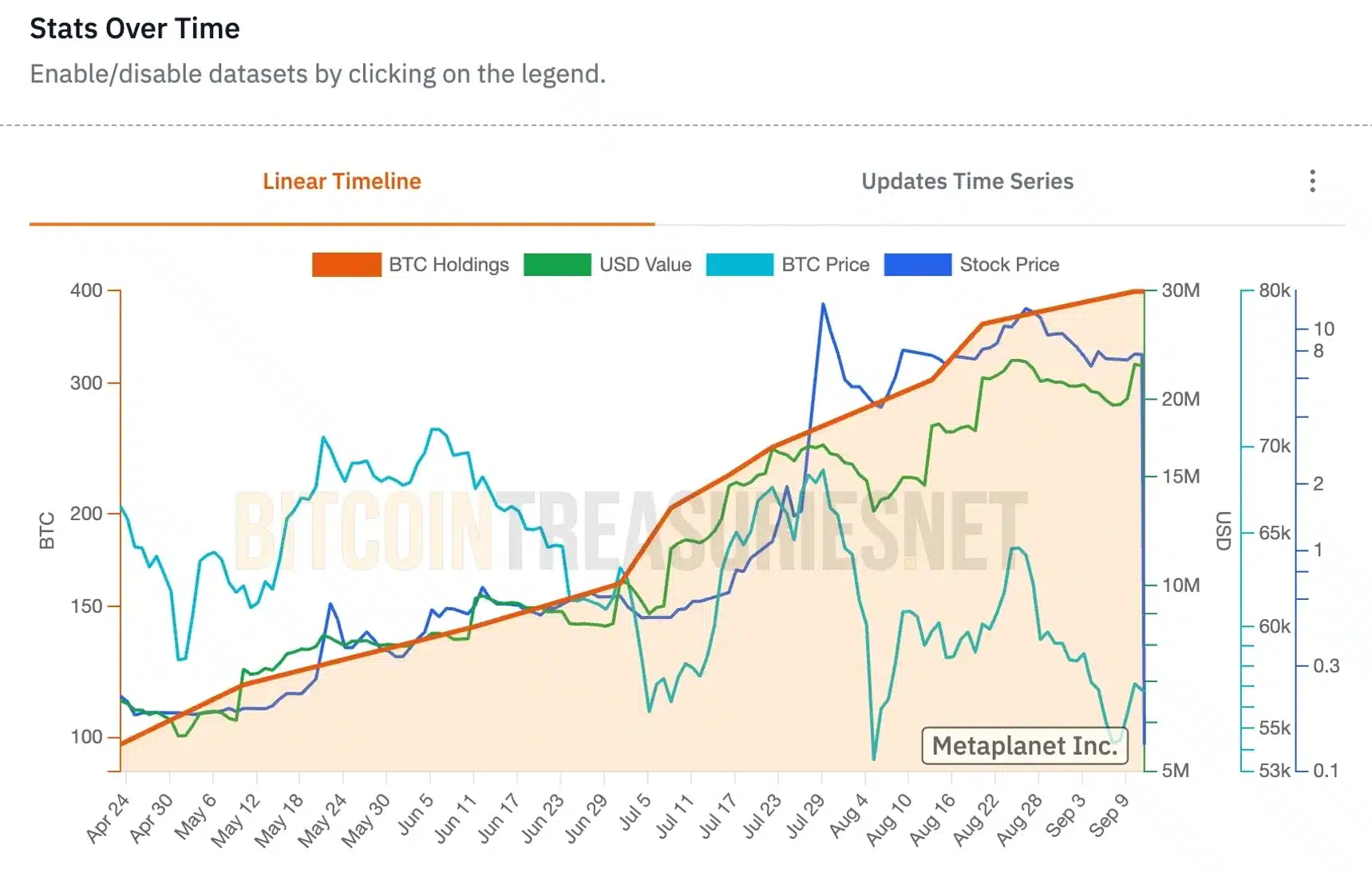

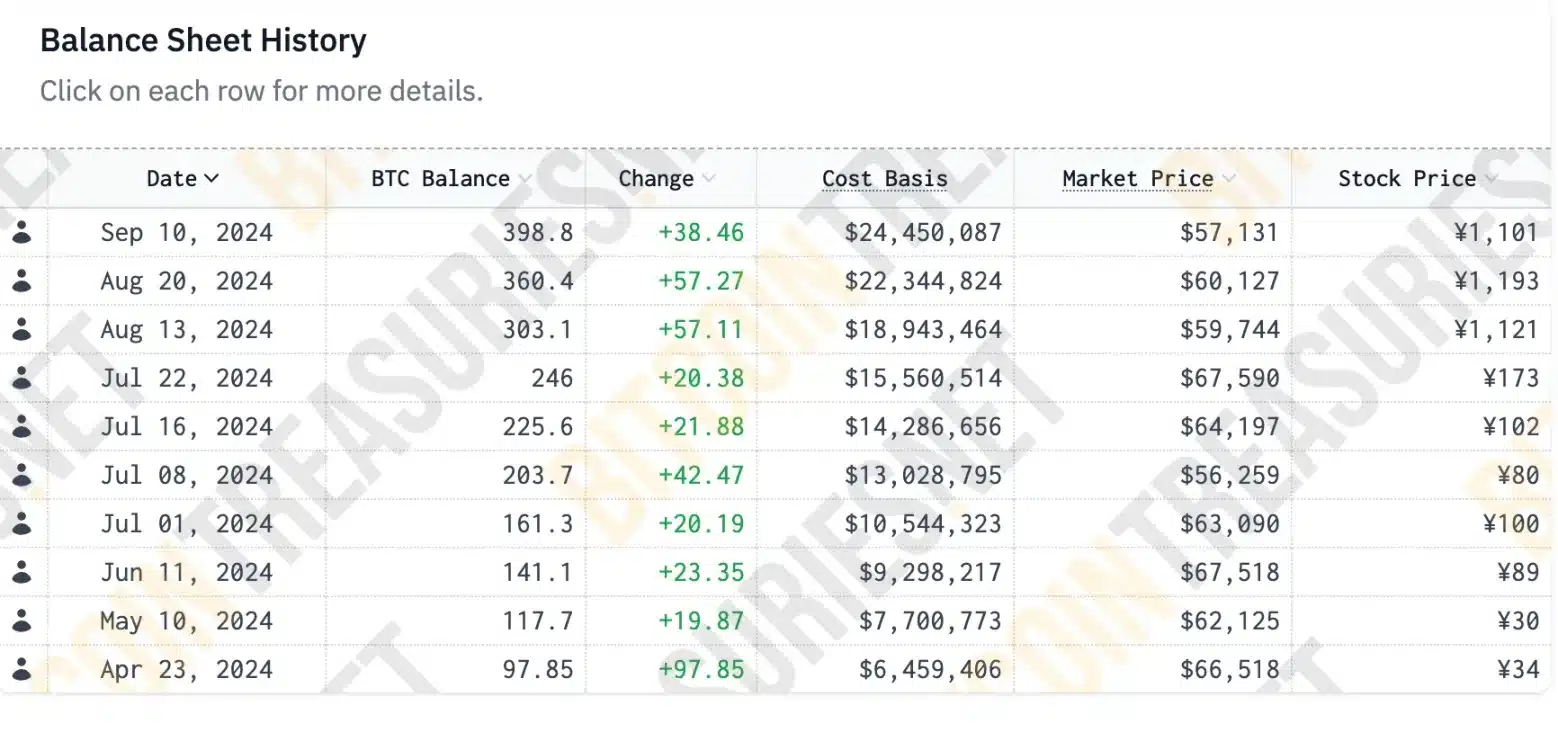

As a crypto investor, I’ve been tracking the movements of Metaplanet, and based on Bitcoin Treasuries data, they started acquiring Bitcoin on the 23rd of April and completed their tenth purchase by the 10th of September.

Consequently, Metaplanet has secured the 27th largest Bitcoin reserves among corporations worldwide, making it the third-largest in Asia.

The Impact

Despite this significant buildup, the firm’s stock price saw a minor decline of 0.45%, trading at 1,096 JPY, and Bitcoin also experienced a downturn.

Yet, it’s worth noting that Metaplanet’s stock value has significantly increased by an astounding 480% following their announcement about adopting a Bitcoin investment approach back in April, as reported by MarketWatch.

In May, Metaplanet unveiled its plan to bolster its Bitcoin holdings using various financial tools from the capital market, following in the footsteps of MicroStrategy.

MicroStrategy accumulates BTC

In line with our anticipation, MicroStrategy – the company holding the most Bitcoin among corporations – has just released its Q2 2024 financial report.

The release highlighted MicroStrategy’s ongoing commitment to expanding its BTC holdings.

Following another prosperous quarter for our Bitcoin approach, MicroStrategy currently owns approximately 226,500 Bitcoins. This amount represents a market value that is 70% greater than our initial investment cost. We are steadfast in our pursuit of our Bitcoin development strategy and aim to consistently generate a “BTC Yield” in the future.

As a crypto investor, I’ve noticed a significant increase in institutional investors adding Bitcoin to their portfolios, even amid temporary market volatility. This trend could be indicating a possible bullish shift for Bitcoin in the near future.

What lies ahead for Bitcoin?

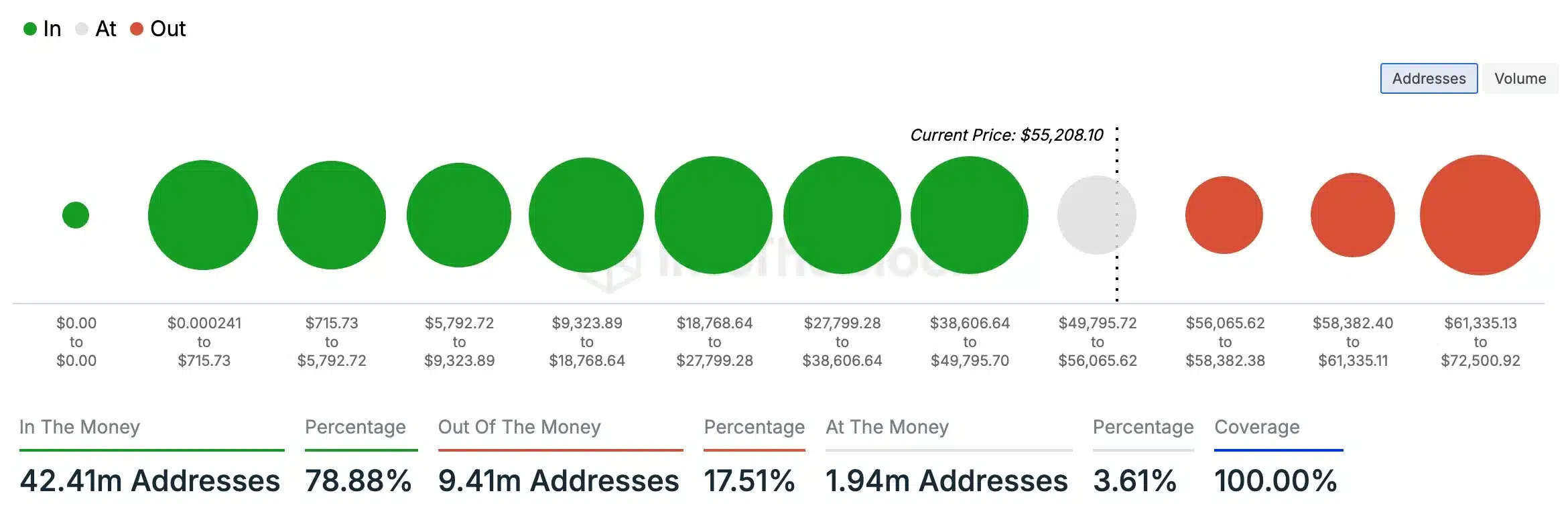

According to an analysis conducted by AMBCrypto, utilizing information from IntoTheBlock, it’s found that approximately 78.88% of Bitcoin owners presently possess cryptocurrency that is worth more than what they initially paid for it.

Instead, it’s important to note that a little over 17% of these token holders find themselves in a position where their tokens are currently valued below their original investment.

This data lends support to the belief that Bitcoin’s value could increase favorably in the near future.

Read More

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- OM PREDICTION. OM cryptocurrency

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered: The Ultimate Race Guide & Tier List

2024-09-11 18:16